Buy Now Pay Later BNPL App Development: Quick Guide

ECommerce is on the rise. The adoption of its technologies has surpassed levels not expected until 2025. One of the trends now is Buy Now, Pay Later (BNPL) solutions. As the world sank into an unprecedented economic situation, BNPL saved the day, enabling millions of people worldwide to afford products they dearly needed amid the lockdowns and financial difficulty.

As experienced fintech consultants, we will tell you about BNPL app development from scratch, but first, let us briefly explain how BNPL works.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

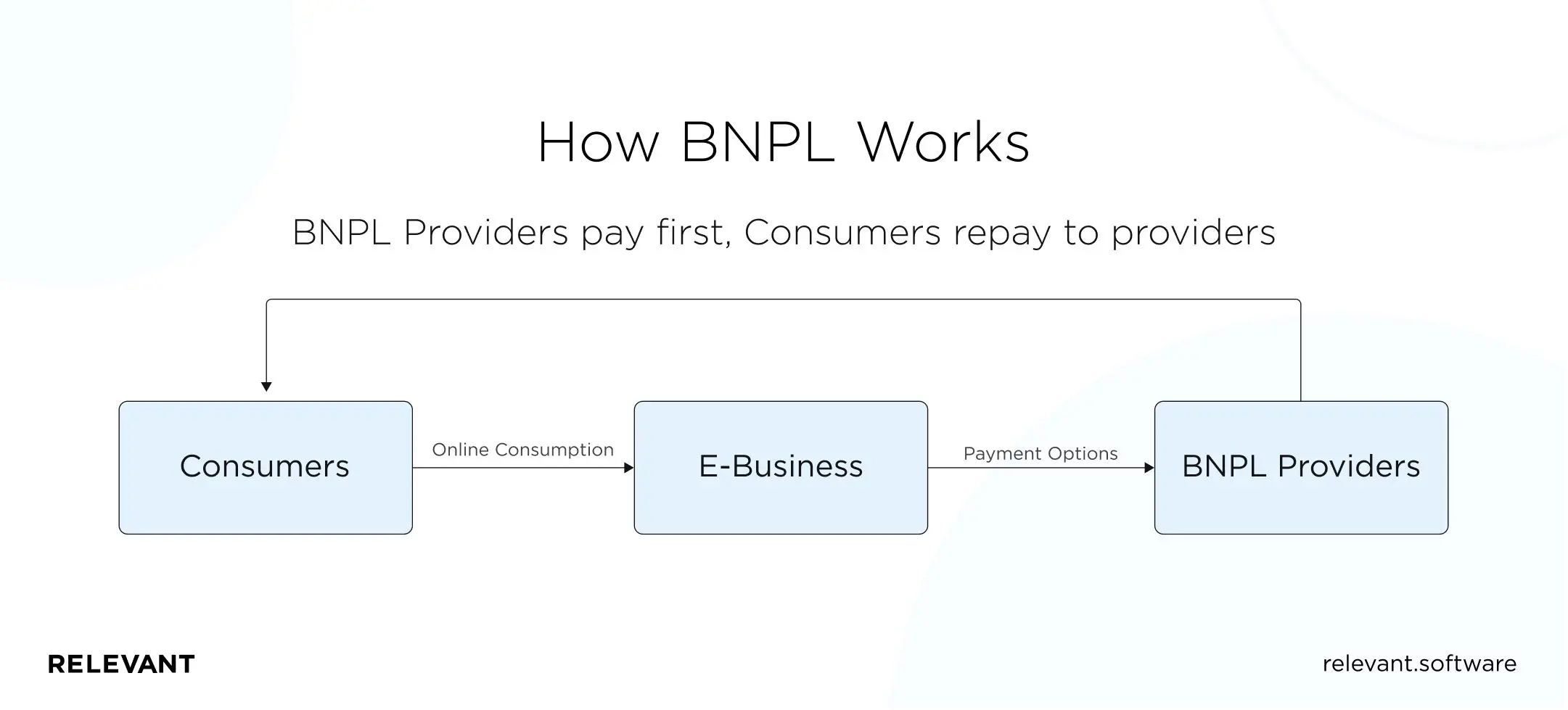

Buy Now Pay Later: how it works

In its simple form, Buy now pay later service is similar to using a credit card or getting a soft loan. Pay later shopping enables you to buy products online and pay back in installments over a certain period, such as a few months.

This is a more convenient pay later shopping method in which customers make online purchases without paying the bill at checkout. The process is significantly simplified to ensure that customers get the loan quickly and easily. The loan should be paid back on time to avoid late payment fees and affecting your credit score.

Considering today’s consumers are looking for flexible financing options, especially interest-free, because of the financial hardships brought on by COVID-19, BNPL is the favorite for many.

The challenge of Buy Now Pay Later for business

The online share of total retail sales rose from 16% in 2019 to 19% in 2020 across major economies, reflecting the pandemic-driven shift toward e-commerce. But, in the same period, online fraud cases also grew by 30%. With the growth in fraud, governments around the world implemented strict cyber measures to ensure that e-commerce platforms and BNPL services providers are in full compliance with the law.

Software development companies like Relevant have stepped up their effort to guarantee data security among fintech services providers. We provide software and product development services to companies in various sectors, including the fintech space. Recently, Relevant developed a SaaS platform to help UK homebuyers get mortgages, find insurance providers without going through a lot of paperwork.

Relevant guarantees a high-security level and full compliance with the regulations. Our clients have the option to develop a custom Buy now pay later platform to manage their business their own way, which means they have more control of the processes involved in BNPL app development services.

Typical features of a Buy Now Pay Later app

Below are the key features of Buy now, pay later services that you should include as you work on financial app development projects:

Loan terms – depending on the BNPL service provider you use, some offer soft loan options that are repayable after a couple of weeks to a few months. Some high-value purchases may have a repayment period of more than two years.

Convenience – the process of applying for a loan and getting approved takes a few minutes. This is done so quickly that the process can be initiated while the customer is at the point of sale or about to checkout (if it’s online).

Purchasing power – different BNPL providers have different caps on loans they extend to customers. Some may offer up to a $20 000 loan.

Repayment frequency – the loan offered to customers is repaid periodically. Customers may be required to pay back in weekly or monthly installments. However, usually, merchants are paid in full.

Paperless – the process of applying for a loan and getting approved is fully digital. Customers do not need to print or sign any documents.

5 current trends in mobile payments

The recent global pandemic pushed the growth even higher due to increased online sales. This sector will continue to not only grow but also change the way of conducting business. Below are some of the trends on the future of mobile payments. Read also: Developing a Palm Scanner Solution for Payments Like Amazon One

Digital wallet user base increase – the analysts predict that the amount of digital wallets globally will grow from 2.3 billion users in 2019 to 4 billion users in 2024.

The disappearance of physical payment cards – it comes with no surprise that the increase in mobile wallets has resulted in a decline in the usage of bank cards for payment.

High demand for mPOS solutions – mobile point of sale is a decentralized checkout system that allows customers to complete payments from anywhere.

The rise of social shopping – most of the popular social media platforms can support e-commerce. It is believed that customers will utilize those platforms to shop online if they come across their choice of products.

The growth of biometric authentication – customers will increasingly use dual authentication methods to ensure that their mobile wallets are safe. That makes fintech app security solutions crucial for guaranteeing the safety of transactions and access to data.

How to develop a Klarna-like mobile payment app for your business?

The success of the Klarna mobile payment app has drawn the attention of many developers. Most of them have started brainstorming how to develop an Affirm-like mobile app, or simply a Klarna related app. Below are the steps to take if you want to build a custom pay later app:

- Project scoping – if you want to build an Afterpay-like mobile payment solution, Klarna, or Affirm, have a bigger picture of the project. You should precisely know which features to include and understand the platform which you’re building for.

- Select the SDLC model – choose the right SDLC methodology for your project that will make the development process productive and time-efficient.

- Determine the ideal approach in developing the application – ask yourself whether you want to use PaaS, SDKs, or APIs in your project.

- Build a team – having dedicated software development teams affects the project’s success. The team often comprises the project manager and the developers with relevant skill sets for working on the project.

- Choose the right cloud provider – cloud-based solutions are the best alternative for fintech startups to access great IT infrastructure without developing one for themselves.

- Get an online payment solution – you can use an API or SDK for implementing the important features of online payment.

- Buy an ID verification system – the ID verification system is a regulatory requirement for online payment services providers. ID.me has become the standard of the finance industry.

- Developing the application – instead of acquiring the required technologies for the project, you may consider outsourcing the software development task. This will save you the time and financial resources needed to acquire the right technology and skill set for working on your project.

Many businesses consider Ukraine outsourcing strategy as suitable for eCommerce companies that want to build fintech apps at affordable costs. This will help you start quickly start the project and shorten the application launch cycle. - Testing and deploying phase – conduct many tests before launching your application to ensure that all areas which need improvement are fixed. This mitigates poor performance, bad reviews, and uninstalls.

How to implement BNPL in your store

As consumers are turning to BNPL services as a preferred way of shopping online, eCommerce companies should consider the ‘buy now pay later for business’ model as a way to maximize their revenue. Below are some of the ways to successfully implement a BNPL app development project for your online store:

- Point of sale integration – you need to use a provider that provides a BNPL service that is easily integrated into your checkout process to ensure a smooth buying experience.

The merchant will eliminate the need for a manual process of data entry, and the client will quickly understand the checkout process. That makes the buying process easy for both the customer and the merchant. - Fees – different BNPL service providers have different rates for processing payments. It would help if you chose a provider that offers affordable rates for transaction fees. Also, check the late repayment fees because they will affect your credit score, as well as add to your bill.

- Consider the user base – with the rise in online fraud, you need to use a trusted BNPL service provider, preferably with more users. This will help you tap into a wider pool of customers. Also, you will benefit from advertising done by a popular BNPL service provider.

Tips to consider during Buy Now Pay Later app development

To develop a sound application, account for the following:

Maintain secure transactions

There has been a 30% increase in e-commerce fraudulent activities, compared to a 16% in e-commerce sales. Such a significant increase in fraud cases compared to actual sales leads to developers seriously considering ways to maintain secure transactions.

Experienced fintech software development services providers will ensure that they develop an app that is reliable for handling and processing transactions. Below are ways to ensure a secure Buy now pay later BNPL app development process:

- Incorporate security at all stages of the development process – during the Pay later app development process, programmers should consider building several security layers so that the app’s data is always kept secure. This helps to control and possibly limit access to sensitive information.

- Data encryption – encrypting data can help to reduce the risk of a successful cyberattack. It should be noted that data stored on the internet is not so secure. It needs to be encrypted to minimize the damage of such an attack. This is why the Paylater app development process should include the integration of reliable encryption features. The platform should encrypt data at every stage of data handling and processing.

- Two-factor authentication – two-factor authentication has become the standard for online transactions. You need to ensure that customers fully trust your app to handle sensitive information, e.g., any linked credit cards. Having two-factor authentication built into your app can double your app security and help customers perceive your application as very secure.

- PCI DSS and other regulations compliance – the rise in internet fraud had seen regulatory bodies tightening laws regarding data privacy and security. It is crucial, especially for the banking sector and businesses that handle credit card information. Developers must ensure that their data collection and information handling methods comply with the set policies.

Provide convenience to users

With so many apps being developed each day, developers should ask themselves whether their application solves a particular problem. You need to ensure that your customers need your app, and eCommerce website UX must be well-thought-out and easy to use. Below are some of the things to consider in building a user-friendly, convenient app:

- Conduct a product discovery phase and develop an MVP to check the convenience to users – the product discovery phase helps ensure that you create the right product for the right audience (target market).

Some of the steps you can take include identifying the needs of users. Identifying such needs involves striking a balance between product and risk management during the development phase.

Developers need to assess the following:

- Value risk – whether customers find your product valuable and want to use it.

- Usability risk – understanding whether customers can quickly know how to use your product. (Is it user-friendly?)

- Feasibility risk – determining whether you have the required resources and skill set for building the product.

- Business viability risk – understanding if your application works for your business or what it takes to make it fit.

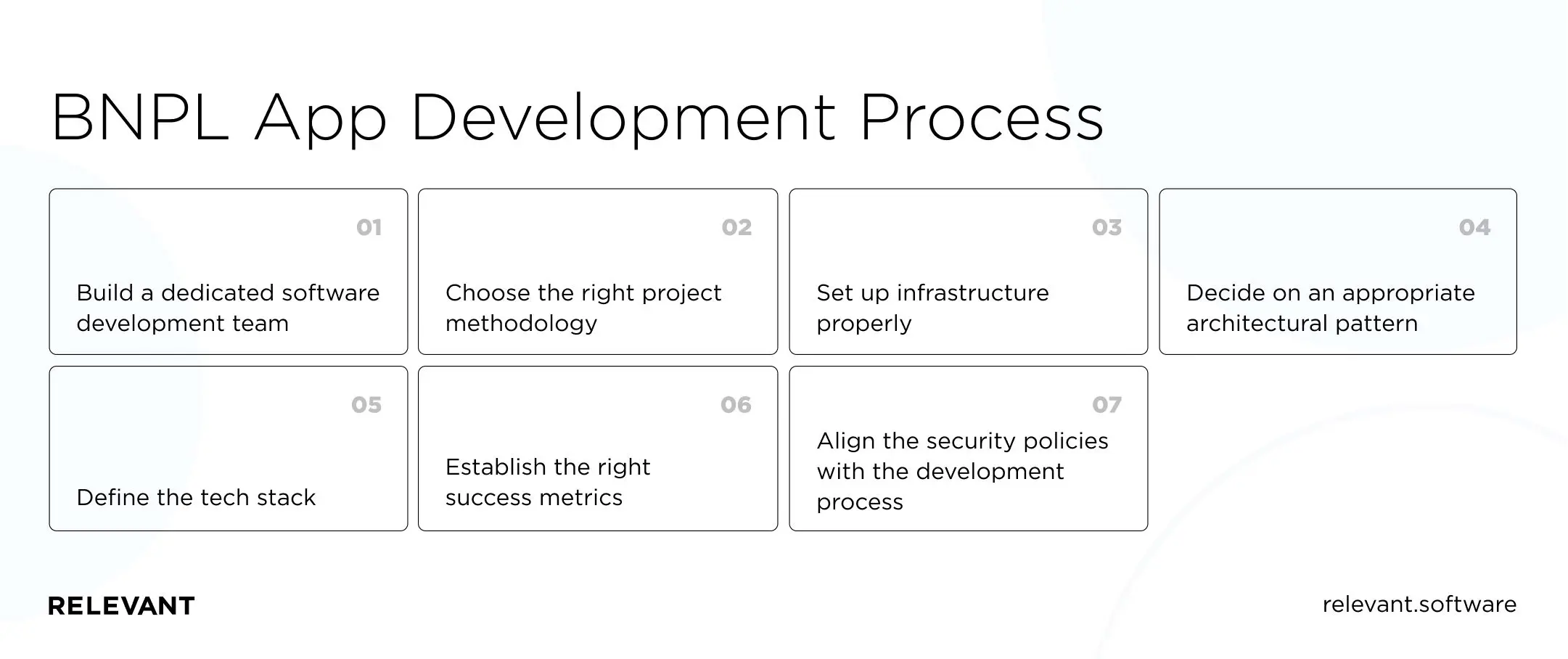

Set up the effective engineering process

Having an effective engineering process is a crucial part of developing a shop now pay later software solution for eCommerce. With the rapid advancement in fintech app development technology, it is quite common for fintech app development projects to fail after they have passed the ideation phase.

[e-book id=”8445″]

Your engineering process or development model will determine whether you will have a competitive edge and short product release cycles. Here are some of the things to consider:

- Build a dedicated software development team – this can make or break your project. Ensure that your team has crucial skillsets for rolling out projects much faster. The expertise to consider having may include DevOps, cloud, Java, React, Native, Swift, Node.JS, UX/UI, QA & testing, etc. This will help develop the best product for the customer without being limited by the lack of adequate skillsets.

- Choose the proper project methodology – a suitable product methodology or framework will help you structure and undertake the development process. It also makes project management easy, which could improve the efficiency of your team.

- Set up infrastructure properly – you should ensure that your infrastructure is set up correctly to avoid technical challenges that may affect the project’s overall progress. It is better if your infrastructure is scalable and easy to deploy.

- Decide on an appropriate architectural pattern – you need to have the right architectural plan for your application development so that you build a product that is extendable, easy to maintain, and has low fault tolerance. Developers use different architectural patterns that are aimed at meeting the business needs of the target market. These patterns include:

- Layered pattern – this is built around a database approach and may help customers tabulate and store data. The pattern is easy to maintain, test as well as assigning separate roles. It also supports short application launch cycles.

- Broker pattern – enables unlinked computers on different systems to communicate without needing to be directly connected. The broker coordinates the flow of information among various elements.

- Define the tech stack – have a clear picture of your company because how you build a tech stack will affect your company’s future development products and its efficiency.

- Establish the right success metrics – clearly define your success metrics to collect relevant data to measure your success and make any necessary improvements. Some developers measure the number of users, total sales revenue, and average order value (AOV). These metrics will also help your merchant to measure the impact of the BNPL option.

- Check and review the security policies and align them with fintech mobile app development – even as fintech app development companies continue to drive positive change in the e-commerce sector, policy regulations remain critical to ensure that the drive for innovation does not pose a threat to consumers’ data. Policies are updated regularly, which is why you should check and review security policies to ensure that your application is still in compliance with the standing regulations.

BNLP payments regulations updates

The recent surge in the use of BNPL services due to COVID-19 drew the attention of many governments. A lot of complaints were raised by payment authorities regarding the state of regulations of this industry. Special rules are needed to govern the BNPL commerce.

In response to the complaints, the European Commission produced an update of the consumer credit agreements that accommodate BNPL service providers. The Financial Conduct Authority of the UK will announce new BNPL stipulations as well.

Also, Australia will not be left out, its Reserve Bank is deliberating fresh rules for the BNPL industry.

The main issues that concern regulators include:

- Overspending by consumers;

- The unclearness of the conditions of the BNPL services.

For example, in the USA a handful of users have missed at least a single payment. Over 50% of the users were close to the limits of their credit cards when they started using BNPL services.

Summary

As the e-commerce wave sweeps across nations, due to the increase in smartphones and the global pandemic, consumers have shifted the interest towards online shopping. Slowly, the future of businesses appears to be online, with models built around mobile solutions and experience.

Most eCommerce companies are outsourcing to fintech development companies for building fintech apps. This is helping them to stay competitive by offering pay later shopping solutions to customers.

Ukraine is one excellent country to outsource your development project. You can hire competitive firms, like Relevant Software for your BNPL software development project to start a buy now pay later business. Relevant also provides digital mortgage software development, among other fintech IT services.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.