Building Digital Mortgage Software: Actionable Tips and Case Study

Updated: September 3, 2021

The old ways of doing business are a part of history, being drastically changed in favor of an on-demand economy. Automotive, hospitality, healthcare, finance, staffing, almost anything, really—today, you can have it at the swipe of a finger.

Thanks to advancing technology and consumers pushing for a better experience, building a mortgage app is becoming the new lending norm as well.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usMillennials — the largest adult population group in the U.S. — are starting to enter the housing market and spurring industry changes. As the National Association of Realtors reports, millennials made up the largest share of homebuyers in the past year (38%), being most likely to find online offerings during their home search. Younger millennials (22 to 29 years) and older millennials (30 to 39 years), 86% and 52% respectively, were first-time home buyers, more so than other age groups.

Once millennials have decided, they want the result right now, deeming unacceptable anything later than overnight delivery. In response, fintech companies should offer easy and sometimes one-button applications. In this article, we will uncover six takeaways that bear a crucial message: adapt today or risk disruption tomorrow. There are no shortcuts, trust us. We know all actionable tips on creating a custom loan origination software, as we have already done it.

Table of Contents

Why Mortgage Business Digitalization Is Rising Dramatically

As it goes in the Accenture report, lenders who prefer traditional banking to mobile banking risk losing up to 35% of the market share to online service providers. Meanwhile, Energias Market Research projects the global lending software market to reach the 11.6% annual growth mark till 2024. The industry as a whole is to surpass $5.5 billion in revenue.

The bulk of the niche’s value goes to digital mortgage software, residential mortgage loans, and the U.S. Being one of the world’s largest, the U.S. mortgage industry is experiencing historically low mortgage rates. Such a drop makes real estate a tidbit to mortgage applicants: many Americans became homeowners despite the pandemic in 2020, resulting in the third quarter’s 67.4% homeownership rate.

Features of the Best Loan Origination Software

To build a mortgage LOS platform that users will fall in love with, you should consider its fundamental feature set. Let’s take a look at some basic features that help you digitalize mortgage business.

- Registration

The best registration is the one that represents the easiest and friendliest way for the consumer. To encourage more users to register in your app, let them choose between social sign-in, log in with an email address, or authentication via phone number. - User Profiles

Ensure your customers can add personal information, photos, item descriptions, edit, and delete data. - Loan Application Form

The personal loan application form is an online application’s underlying option. Applicants will appreciate your assistance in this issue. It would be great if you could split the process into specific steps, guide consumers throughout the loan processing, and show progress throughout the application. - Mortgage Calculator

The mortgage calculator helps customers find out whether they can get approved for personal loans. Based on their salary or other sources of income, the feature roughly estimates how much applicants can borrow as a mortgage, including what type of loan, which loan programs to choose from, at what rate, and for what period. Also, the option displays an equated monthly installment (EMI) breakup. - Mortgage Tracker

The option helps applicants keep track of mortgage application status in real time: disbursements, outstanding principal balance, EMI, payments, bounced check, cash, or cheque receipts. - Open Banking Integrations

Open banking makes the whole process of commercial mortgages more transparent for lenders by disclosing applicants’ financial data provided by financial institutions on taxes, monthly income, expenses, loans, and bankruptcy filings. - KYC Compliance

To ensure the highest degree of data protection, anti-fraud, and anti-money laundering measures, you need to integrate know your customer (KYC) identity verification when creating a custom loan origination software. The KYC check function inspects a customer’s mortgage history, captures and verifies information from IDs, and even identifies facial biometrics. - Payment Gateway

Once a mortgage has been approved, users should have a place to track all their records from. Let consumers choose how they want to pay: by PayPal, credit card, direct bank transfer, or cash on delivery. - Push-Notifications

Push notifications come in handy as they remind applicants about upcoming payments a couple of days prior. Also, notifications inform users about new features, system updates, and other significant info. - Support Module

When it comes to compliance management, live chat software is a handy option to satisfy customers. Let users call, chat, or email the care service in case of loan enquiries and suggestions. - Chatbot

When live chat support isn’t available, a chatbot can answer repetitive questions while re-routing the complex queries to live chat agents. - Geolocation

The ATM locator feature allows users to find the closest spots to withdraw money at. - Credit Rating Service

The credit score option allows predicting a borrower’s creditworthiness and their likelihood of defaulting on debt. - Filters

Filters help customers browsing your app by easily sorting out data by lenders, loan type, location preferences, etc. - Document Management

Ensure your users can securely store, share, and manage all their documents online within one place: tax filings, list of assets, property information, and personal data. - Property Evaluation

This feature helps homeowners know their property’s market value in a competitive market based on that property’s features and advantages. The market value is generally used for reporting both lenders and users.

We’ve covered the common options, but there may be more, depending on a mortgage app’s specifics. Now, let’s take a closer look at the benefits mortgage automation software development can offer the mortgage industry leaders.

Building a Custom Mortgage LOS Platform vs. Using Ready-Made

Before building a mortgage app, you should decide on a suitable method and sum up its pros and cons. After all, if well-chosen, all of these pieces result in greater efficiency and a shorter loan cycle, saving time and money on business processes.

- The Big Picture

Creating a custom loan origination software offers a broader solution to the homebuying journey, covering loan processing as a whole. This includes automatic data verification, application prefilling using data previously provided by the mortgage borrower, providing continuous human assistance to first-time home buyers. - Upgrades and Maintenance

Custom mortgage apps make maintenance and system upgrades efficient and simple to implement. At the same time, ready-made solutions demand $100k to millions of dollars annually on support and updates, and six months to two years to implement and integrate new software. - App Focus

Ready-made mortgage app development services commonly focus on the start of loan processing, streamlining, and automating paper-based document management. Usually, they help home-buyers up to the pre-approval letter and disclosure package, stopping before underwriting, approving, clear to close, and funding. - Extensibility

Unified solutions often lack the extensibility to apply innovative ways of business running, capability reuse, the ability to respond to future needs, and meet novel challenges. - User Experience

Numerous mortgage lenders’ business models result in a disjointed user experience depending upon customer touchpoints. Home-buyers are often forced to engage with loan companies via call centers or emails to collaborate and participate in loan processing.

As you can see, mortgage automation software development offers multiple benefits. But the options prevailing on the market these days — ready-made apps — are more limited than custom software solutions, take custom real estate management software as another example.

Features That People Seek in Mortgage App Development Services

To develop a mortgage app that covers all user groups, you should clearly define features depending on who uses it. Hence, every online mortgage platform should ensure both lenders’ and customers’ high-quality experience.

From lenders’ perspective, an app should:

Speed up online application

To streamline document management, the mortgage LOS platform should utilize automated digital recognition (ADR) and optical character recognition (OCR) to distinguish and read texts, as well as catch errors.

Enhance loan officers’ productivity

Mortgage app development should boost productivity by relying on the power of automation with minimum to zero errors in the process.

Address customer anxiety

Most home-buyers experience stress when obtaining a mortgage, so financial technology should substantially ease the level of anxiety.

From consumers’ perspective, a mortgage app should ensure

Smooth and seamless user experience

Mortgage automation software development should ease loan processing by taking consumers through a clear and logical process and allowing them to apply for a loan over their preferred iOS and Android devices.

One-stop loan process

Mortgage app development services should be applied to create a one-stop portal with a possibility to upload files, sign documents, and track mortgage progress in real time.

Things to Consider Before Starting Mortgage App Development

Before developing a lending business management system, your team should be aware of some fundamental market issues. Let’s explore the basic necessities.

Market Research

Finding out as much as you can about your target audience is the very first thing you need to consider when developing a lending business management system. An in-depth understanding of your end-users’ needs and pain points makes building a mortgage app easier and results in a better final product.

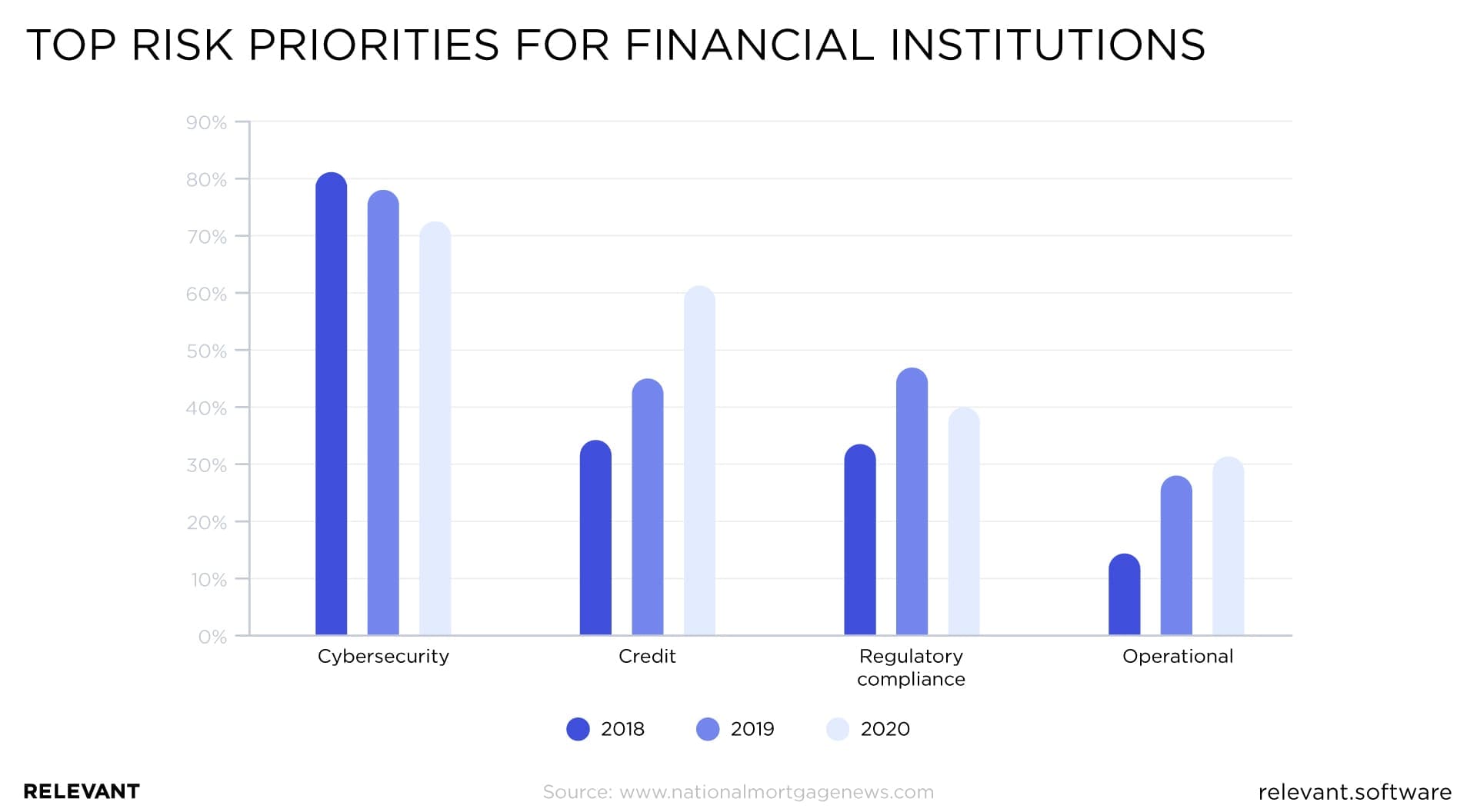

Regulatory Compliance

Mortgage compliance is one of the top concerns of banks these days.

Consumer Financial Protection Bureau (CFPB), Office of the Comptroller of the Currency (OCC), Federal Reserve System (FRB), National Credit Union Administration (NCUA), the Home Mortgage Disclosure Act (HMDA), the Equal Credit Opportunity Act (ECOA), and other regulators have initiated requirements for lending and servicing to ensure customer and investor protection. To digitalize mortgage business, you should comply with local laws, policies, and regulations.

User Experience

How a mortgage lender delivers on user experience tends to prevail over what it delivers. According to the White House Office of Consumer Affairs’s survey, 80% of American consumers will pay more for a better experience.

Monetization Model

Now that you’ve disclosed end-users’ needs, you can uncover what they are willing to pay for. Lenders typically make money from commission on the loan price, charging lender fees, commission on the monthly mortgage payment, and selling loans to end-investors.

For instance, intermediary mortgage firms engaged in peer-to-peer software solutions earn from home-buyers’ fixed payments or by taking a small fee from both the borrower and the lender based on the total loan amount.

App Development Team

The entire mortgage service success depends on the software vendor you are going to partner with. First, they will conduct business analysis, write a technical specification, estimate software development cost, then plan the project as a whole. Second, you both should clarify a mortgage app development workflow, define the feature set, and design an application concept. After setting up project milestones, the development team will start building the minimum viable product (MVP).

Mortgage Platform MVP

Building a mortgage app is a challenging task, therefore, it would be best if you roll out an MVP first to test software and business performance. After gathering feedback, you can improve your service before its public release. Here’s how we did it at Relevant.

How We Built a Custom Mortgage App for the UK Fintech Company

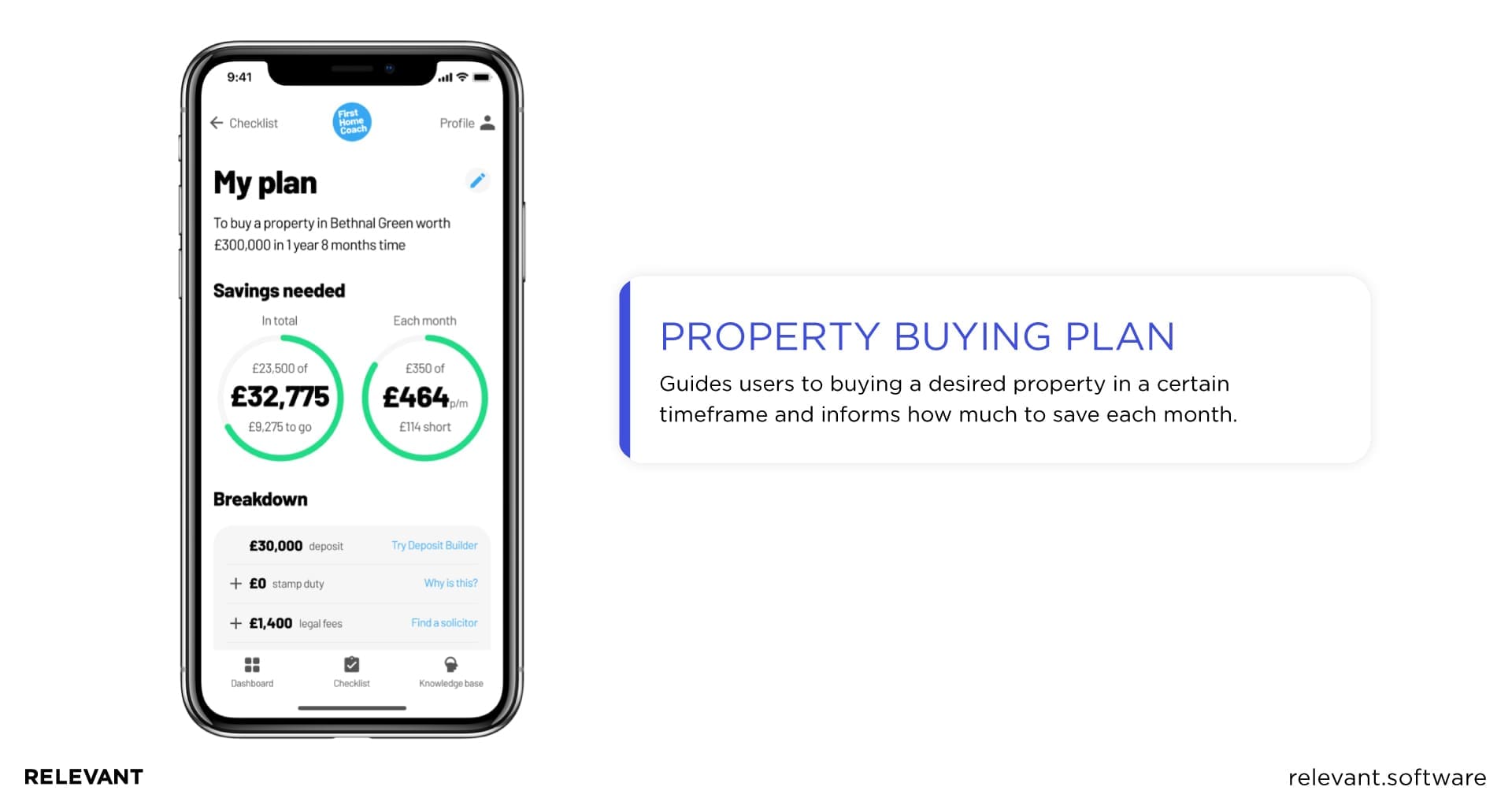

Relevant is a software development company that helped FirstHomeCoach build a custom mortgage app to provide its customers with a seamless end-to-end home buying journey. We delivered software that assists borrowers in creating a personalized plan, analyzing costs, and tracking every stage of the property buying process.

FirstHomeCoach features:

- property buying plan

A purchase plan helps consumers buy a desired property in a particular timeframe and alerts on how much they should save each month.

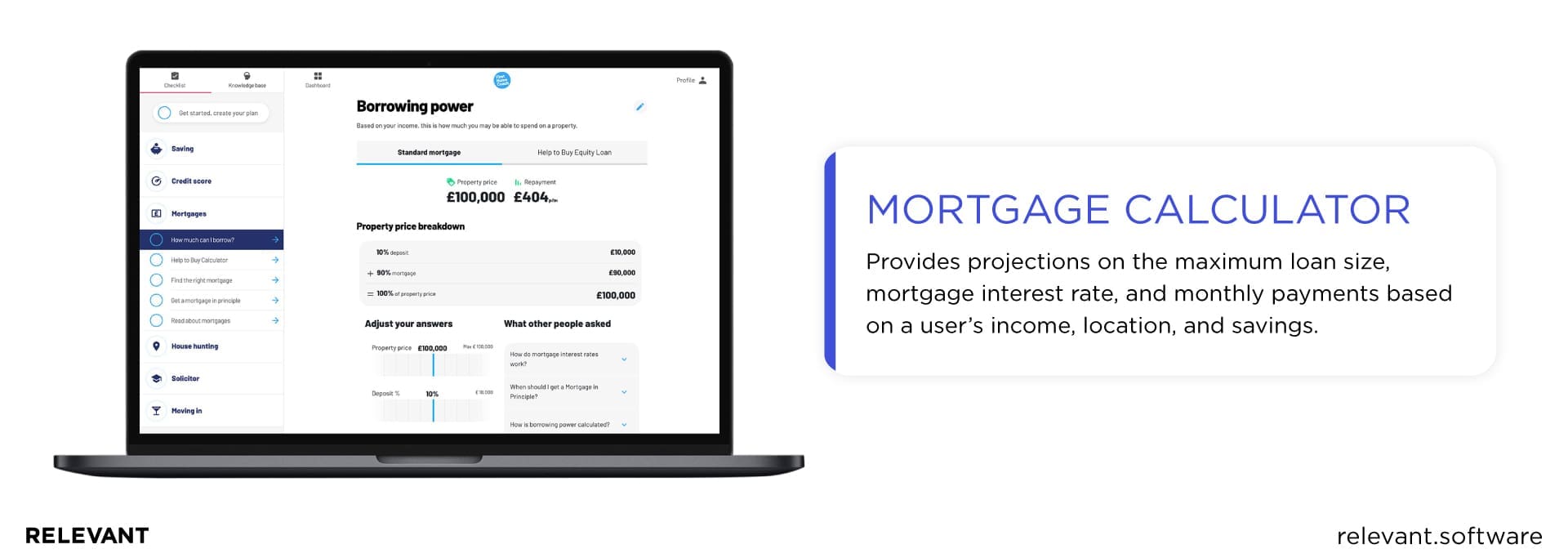

- mortgage calculator

The calculator unlocks the maximum loan amount, interest rate, and EMI based on the borrower’s salary, other income, and location.

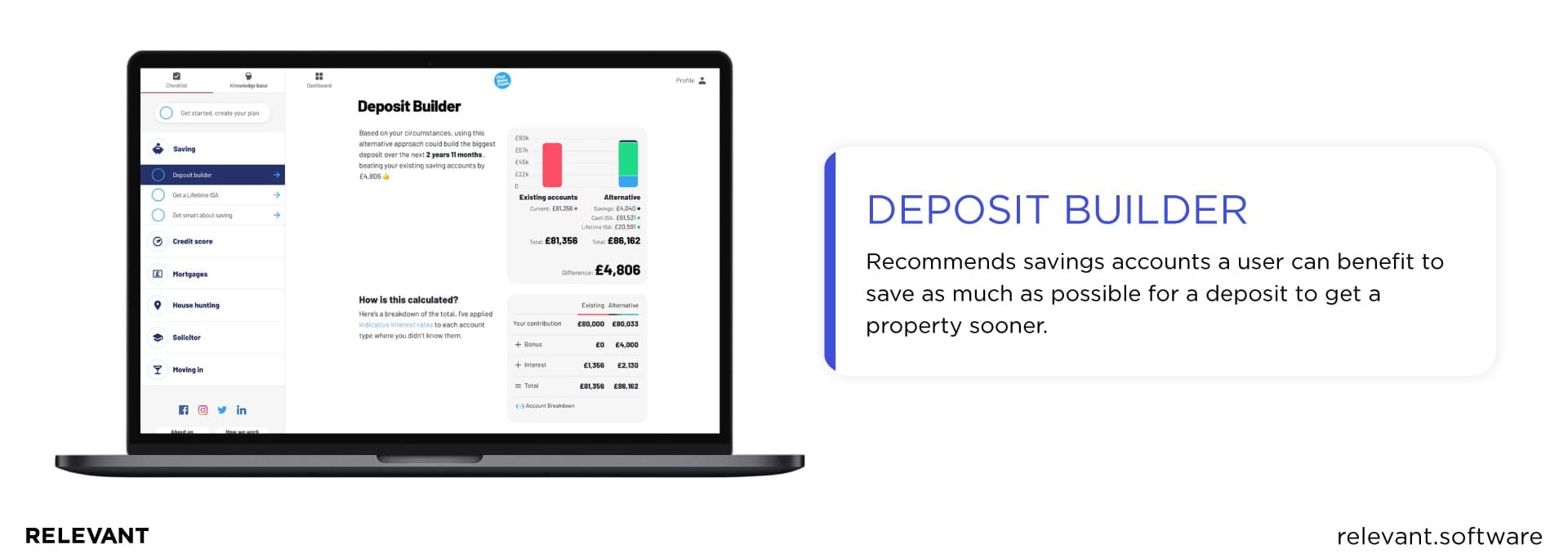

- deposit builder

Deposit builder provides users with calculations on savings to fund their deposits and get a property sooner.

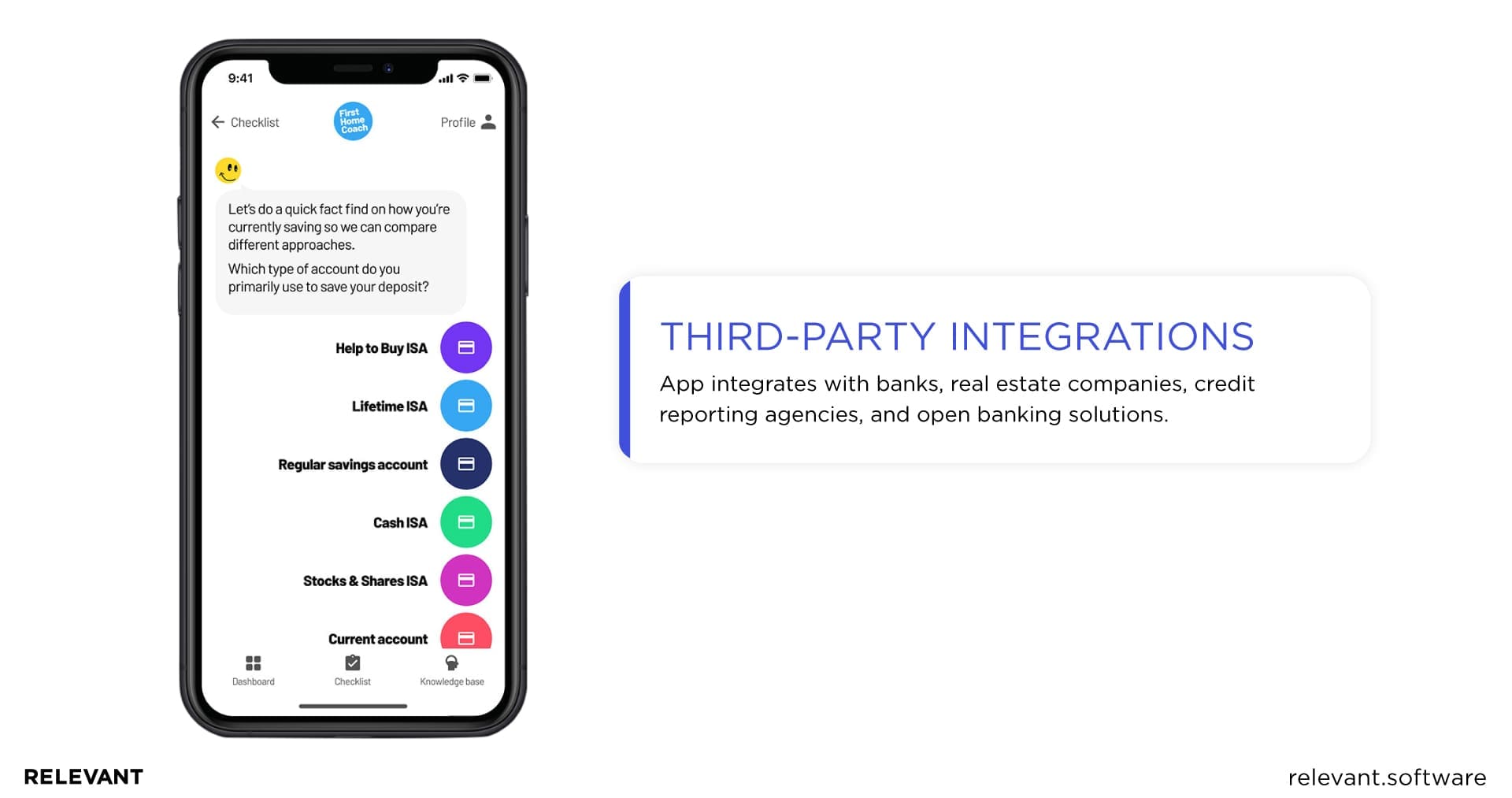

- third-party integrations

A mortgage app integrates with third-party facilities like banks, real estate companies, credit reporting agencies, and open banking solutions to ensure an easy and fast buying process..

Technologies we used:

- server-side development

We applied microservices to enable the necessary isolation between the app server and business processes. We used TypeScript to speed up development and make the system more stable. To leverage the full power of the CPU, we used a cluster module based on Node.js. - security measures

We performed functional, integration, confirmation, and regression testing to gain a cloud perimeter and assess IT infrastructure security. What’s more, we applied grey-box penetration testing to define possible security bottlenecks missed during a manual examination and automated source code scanning. To prevent data leaks and backdoors, we automatically detected and located security flaws in the source code.

Enter the Next Level of Home Buying Journey

Mortgage app development services are on the rise. An increasing number of loan firms evolve by using advanced software solutions and running world-class operations. If you’re (still) pondering whether it’s a good choice to build a custom solution to digitize the mortgage business, you better start moving. Now.

We at Relevant provide one of the mortgage industry’s best digital solutions. Don’t hesitate to contact us. We have all services at our disposal to craft a custom mortgage LOS platform that will meet your particular business needs.

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us