Everything You Need to Know About Hiring Fintech Consultants

Updated: October 30, 2024

Navigating the new and dynamic world of fintech can be a daunting task for financial institutions, large and small. Recent digital trends, changes in consumers’ expectations across all industries, and the growing number of mobile users worldwide force companies to embrace new financial technology, which often leads to the need for fintech consulting services.

Today, you can hardly find a manager or executive of a financial company who doesn’t believe that an accurate understanding of the fintech industry is essential to the future success of their business. But PwC’s Global Fintech Report showed that 42% of surveyed companies struggled to find the right specialist.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact us

In this article, we’ll discuss how to hire fintech consultants and explain the benefits they can bring to your business.

Let’s get started!

Table of Contents

The state of fintech today

The financial services industry has transformed a lot in recent years. These changes have been fueled mostly by the COVID-19 pandemic and the emergence of new technologies.

Since 2018, the number of fintech startups has more than doubled. And even global tech giants like Google, Amazon, and Alibaba are about to shake up the finance industry with their own financial solutions.

Fintech market growth predicted a CAGR of 13.7% in the next five years, and advances in technology keep the investment community interested and global fintech investment high.

Fintech is reshaping the financial services landscape, allowing companies to align with new digital trends and focus on customer experience, data privacy, and cybersecurity.

For instance, artificial intelligence (AI) and machine learning technologies, like robo-advisors and conversational tech adoption (chatbots and virtual assistants), offer improved customer experiences. Meanwhile, blockchain technology promises better cybersecurity and fraud prevention in digital payments.

It’s no wonder entrepreneurs are adopting fintech at full tilt. However, integrating emerging technologies in accordance with financial regulatory compliance requirements is a challenging task that requires hands-on experience and niche expertise. This is where fintech management consulting comes in.

How can a fintech consultant help my business?

Efforts to embrace and invest in innovation are doomed to fail without the right direction and insight. Successful navigation of this new financial jungle depends on hiring the right fintech advisor.

A fintech consultant is a technology expert (or a team of experts) with an in-depth understanding of fintech trends and financial regulations. They advise companies on fintech services and their implementation based on the company’s needs, budget, and technical capabilities.

Fintech consulting services include planning, market and risk analysis, resource optimization, technology advising, and fintech software development, maintenance, and support. Experienced consultants can help a company overcome challenges, optimize costs, and increase development and implementation efficiency.

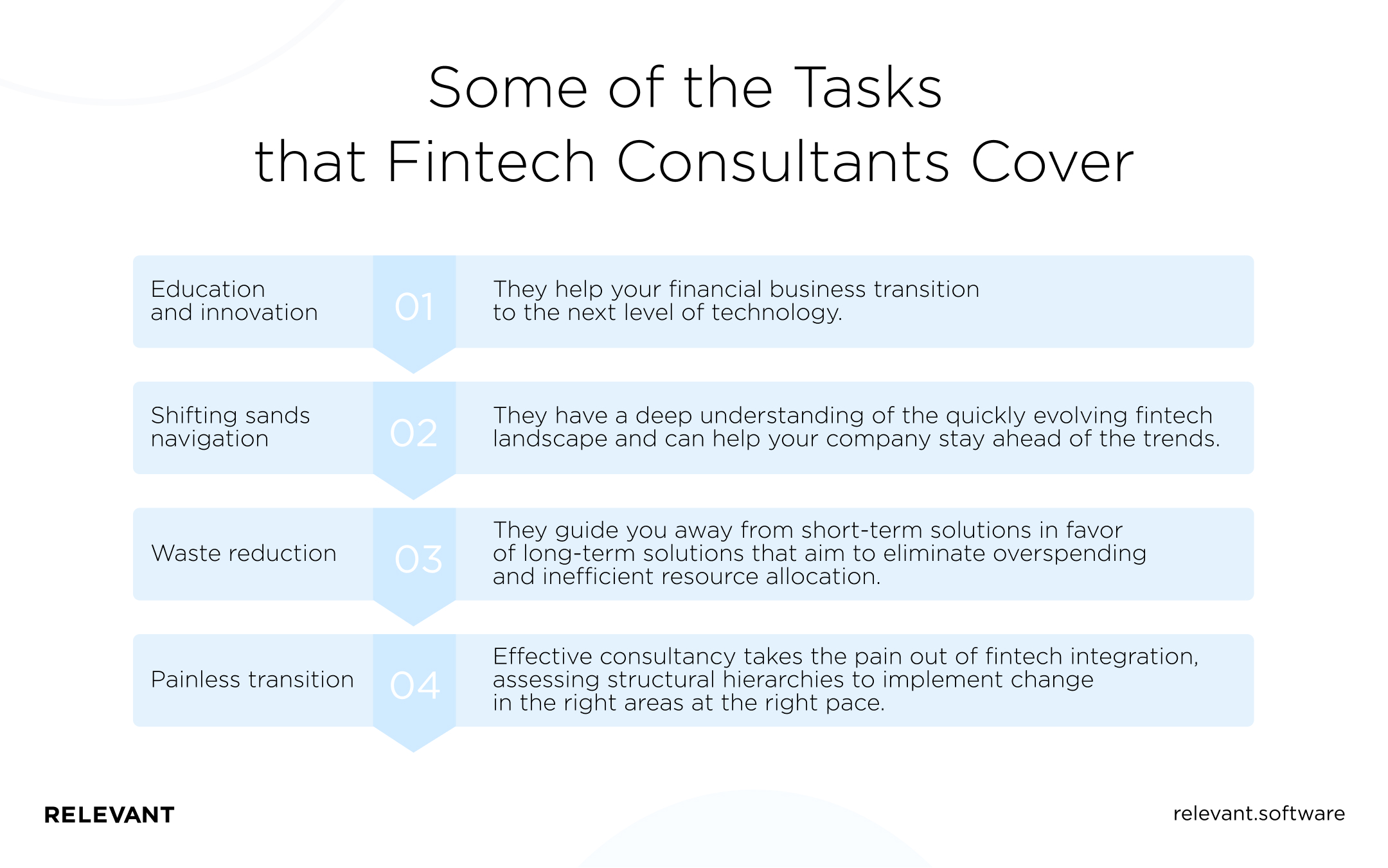

Here are some of the tasks that fintech consultants can cover:

- Education and innovation. A fintech consultant is an essential team member who helps your financial business transition to the next level of technology. A key element of this transition is educating and evangelizing internally about the benefits that new technologies offer.

- Team bonding. Businesses are composed of many subteams, which together form a cohesive whole. Effective consultation means collaborating with fintech app developers, customer management teams, and other stakeholders to ensure smooth and effective integration of new financial technologies.

- Shifting sands navigation. It’s also crucial that any fintech consultant you hire has a deep understanding of the quickly evolving fintech landscape, assessing potential technology and market shifts before they happen so that your company stays ahead of the trends. Ultimately the goal of the consultant is to provide valuable insights and actionable strategies that help your business succeed.

- Waste reduction. Companies wanting to embrace new technology often make decisions that, in the long term, can waste resources. Top fintech consultants guide companies away from short-term solutions in favor of long-term solutions that aim to eliminate overspending and inefficient resource allocation from day one.

- Painless transition. Making major changes to your day-to-day business operations can cause disruption and even spell disaster if poorly implemented. Effective consultancy takes the pain out of fintech integration, assessing structural hierarchies to implement change in the right areas at the right pace, minimizing disruption and maximizing operational efficiency.

A professional consultant can curb many of your woes, but only if chosen wisely. Luckily, we have five practical tips to help you find the perfect candidate.

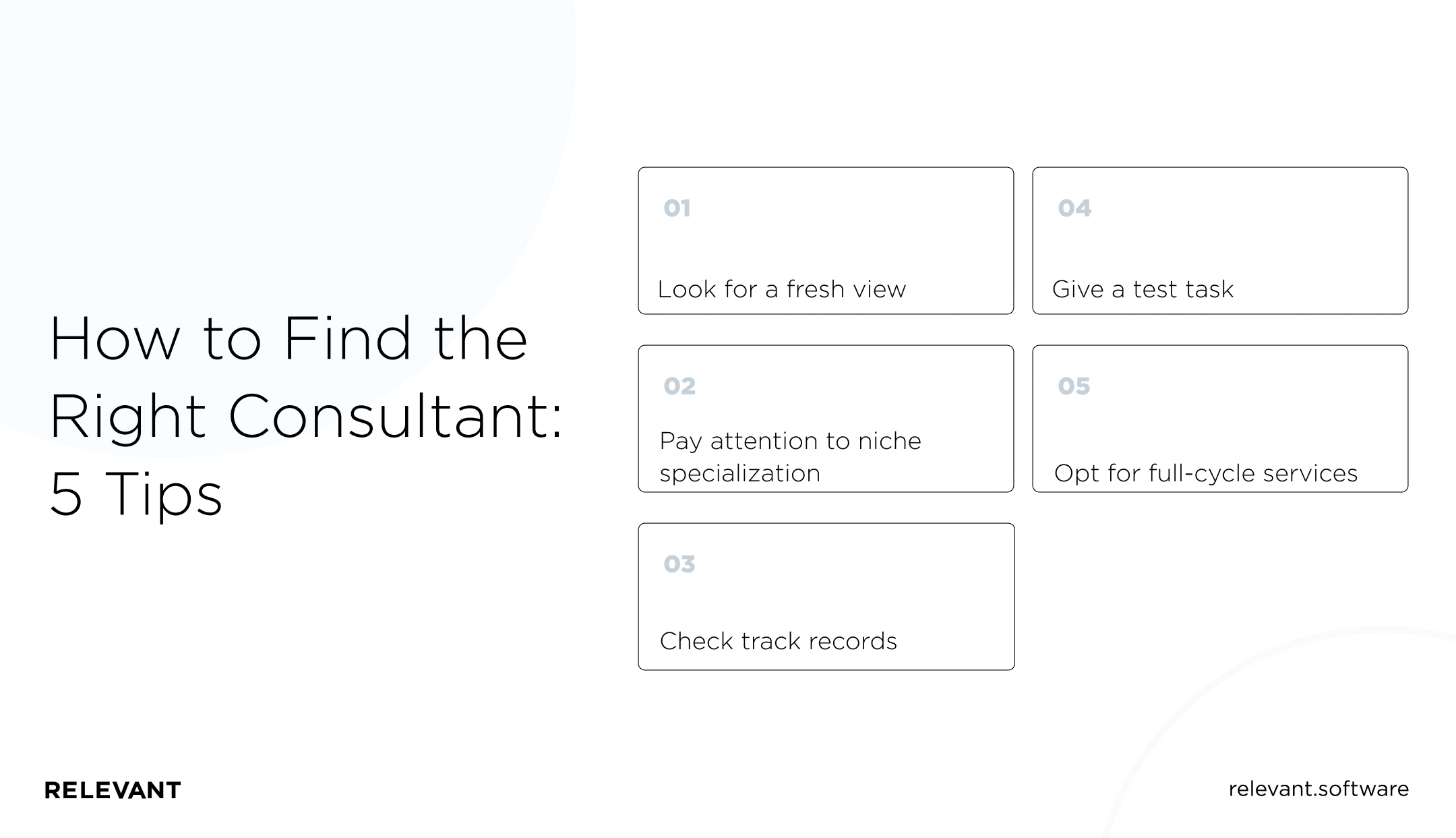

5 tips for finding the right consultant

Finding the fintech consultant who is best suited for you and your company can be a challenge. Here’s some advice that should help you find the right expert.

Look for a fresh view

It’s easy for company decision-makers to become entrenched and possibly even blind to the major issues involved in adopting new technology. Look for a consultant who can give you a fresh perspective on the challenges ahead. New ideas are best perceived as part of a holistic vision of what you want to achieve.

Pay attention to niche specialization

Hire a fintech consultant who can solve the issues specific to your company. Most companies have in-house talent equipped to deal with a variety of challenges typically encountered when integrating new tech. However, when breaking new, unchartered territory, it is vital to have an experienced specialist on the team, so list niche skills in your fintech consultant job description.

Check track records

The fintech consultancy market is growing at an extraordinary pace, with many companies, freelancers, and specialists competing for a slice of your budget. However, because it’s a relatively nascent industry, not all candidates are equally adept, which is why it’s good to seek a candidate with a proven track record of success.

Give a test task

Rushing into signing a long-term agreement with a fintech consultant could put your business at risk. Instead, first, give your candidate a small task with a clear outline and timeframe. For example, ask them to build a simple feature for a fintech investing app. If they perform well, you can feel more confident giving them the contract.

Opt for full-cycle services

While it’s tempting for many companies to grow and evolve in an ad hoc manner, a good fintech consulting strategy builds a solid foundation. So look for a fintech consultant who can build a strategy for you, not just perform tasks that you tell them to perform. As a rule of thumb, it’s always better to collaborate with a team that offers a full cycle of fintech advisory services, so you don’t need to hire separate people to solve separate pieces of the puzzle.

Now, let’s have a closer look at where you can find the right candidate.

Where can you find a fintech consultant?

Finding the right fintech consultant can be a challenge, in part because the many available options can be confusing. Here are the three most popular paths companies choose.

Freelance fintech consultants

The freelance pool is vast and deep. In general, you can go to freelance marketplaces like Upwork, Toptal, and ZipRecruiter to hire a fintech consultant with specific experience and skillsets. But, more often than not, a professional freelance consultant who would dive headfirst into your project is an extremely rare fish.

Freelancers usually cost less in the long run than hiring a company or adding a full-time employee to your team. On the other hand, freelancers may, due to the very nature of gigging, move on to another project as soon as the job is done. This inevitably means that continued maintenance and support are unrealistic.

Big consulting firms

By hiring a big, well-established consulting firm, you get access to a wealth of experienced and talented consultancy experts with a proven track record. Note that these companies are consultant firms, meaning that they offer advice based on experience, research, and data, but do not necessarily provide fintech app development services.

Here are the top five fintech consulting companies you might consider:

- Accenture, a Fortune Global 500 company that specializes in technology, business, and management consulting;

- Trianz, a strategic agency that specializes in big data consulting, cloud consulting, and IT strategy consulting;

- BCS Consulting, an employee-owned management consultancy that delivers complex “business change” projects in banking and financial markets;

- Capco, a business management consultancy firm with a focus on financial services and technology; and

- McKinsey & Company, one of the largest fintech global consultants, that offers advisory services to financial service companies.

These big firms are not cheap and will probably take longer to address your individual needs than a smaller firm because they’re less agile and less able to deal with bespoke requests on short notice. Corporate wheels move slowly, so be prepared to commit for the long haul.

Fintech development companies

Fintech development companies also can serve as financial technology consulting firms, and are the best option for businesses looking for a balanced price/performance ratio. Less expensive and more customer-oriented than big fintech consulting firms, development companies dive deep into your project and business needs to develop a solution that fully matches your expectations.

Platforms like Clutch list hundreds of development firms specializing in B2B fintech and financial service solutions—many of them offer a combination of consultancy and fintech product development expertise. However, some companies may be unreliable, so partnering with a knowledgeable and trustworthy vendor is crucial for your project’s success.

Why Relevant?

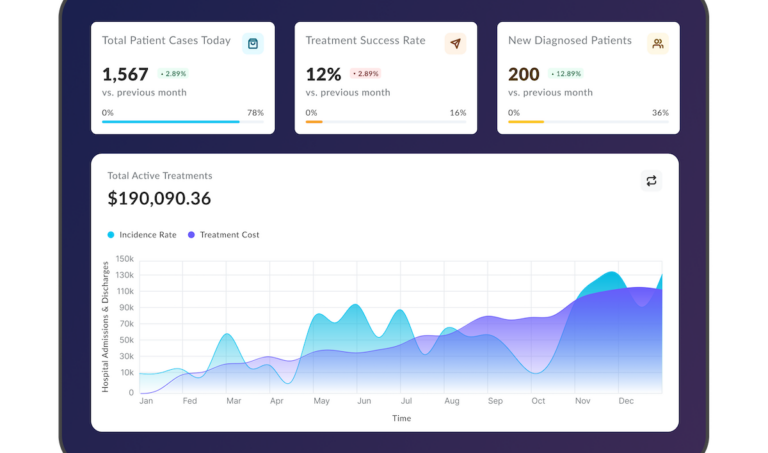

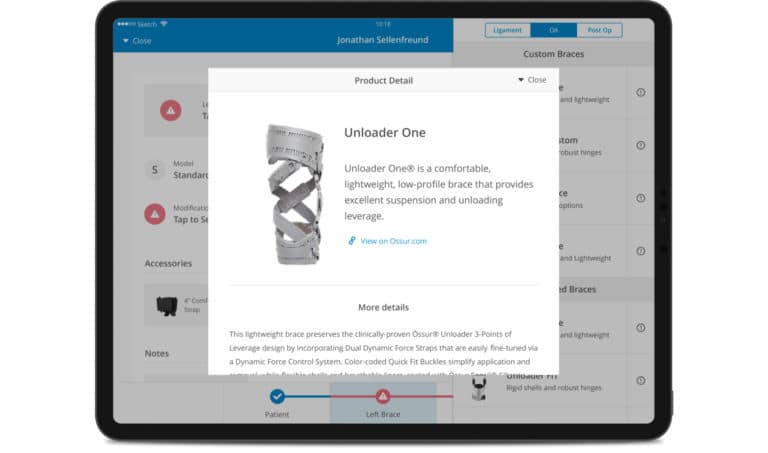

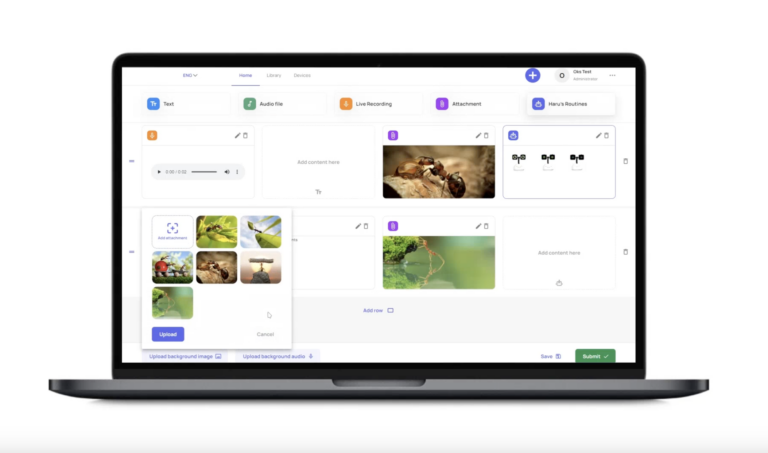

Relevant is a software development services vendor with specialists in a broad range of fintech services. These include the development of lightweight payroll and wealth management tools and scaling up to enterprise resource planning software with in-depth big data analytics.

With a wealth of experience and more than 200 success stories in web and mobile development and IT consultancy, our expertise in fintech includes:

- Fintech consulting. We understand that the needs of each client are entirely unique, and we offer crucial stewardship that will help you get ahead of the competition while complying with all financial regulations.

- Fintech product building from scratch. We don’t have a one-size-fits-all philosophy. We develop unique fintech solutions for each of our clients, ensuring that your specific needs are addressed with specific solutions.

- Dedicated teams for building fintech projects. Dedicated teams with Fintech DevOps experience. All projects are serviced by a dedicated team of senior professionals with a proven track record of creating Fintech products using the DevOps methodology

- Fintech product testing. All our fintech solutions are tested to the most rigorous standards to ensure the highest possible performance and unrivaled uptime.

Here are a couple of examples of the fintech solutions we’ve already built:

- FirstHomeCoach: We developed a highly-secured fintech SaaS platform that assists homebuyers by automatically planning the entire property buying process.

- Payroll. We automated the generation of a company’s weekly payroll reports, optimized its existing database, improved data visualization for the end-users, and added features that detect bugs and user errors.

We build solutions that help businesses thrive and excel in an increasingly competitive and quickly evolving financial marketplace. If you’re still looking for the best fintech consultant, we’re here to help.

Wrapping up

New digital trends, emerging technologies, and the impact of COVID-19 pushed companies to adopt fintech at full tilt, leading to a boom in the fintech market. But companies worldwide face difficulties in finding experts who can guide them through technology development and integration while also ensuring compliance with financial regulations and standards.

Partnering with a reliable provider like Relevant can help you transform your business by integrating industry-leading financial technology and saving a great deal of pain further down the line. Contact us and build the right product with the right team.

FAQ

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us