Lending as a Service — What’s In It for You?

While traditional financial institutions are tightening their lending requirements, the AltFin landscape is evolving aggressively — total transaction value in the alternative financing sector is expected to reach $7,307.9 million in 2021.

And LaaS market, which is one of the newest fields in alternative financing, is projected to grow from $2,615 million in 2017 to $5,580 million in 2024.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

Alternative Finance, as the name implies, is unconventional lending that aims to address the pain of small business owners with few channels for obtaining capital. LaaS allows businesses to leverage existing technology to customize and brand as if it were their own.

It’s a relatively new trend in the financial services sector that came about around the same time as p2p lending or white label private lending.

This form of white label partnership brings about a lot of convenience, especially when it comes to lending. Several white label financial services providers are also emerging with innovative solutions for banks, other financial institutions, and those in peer lending.

What is LaaS, and why is it beneficial for your business?

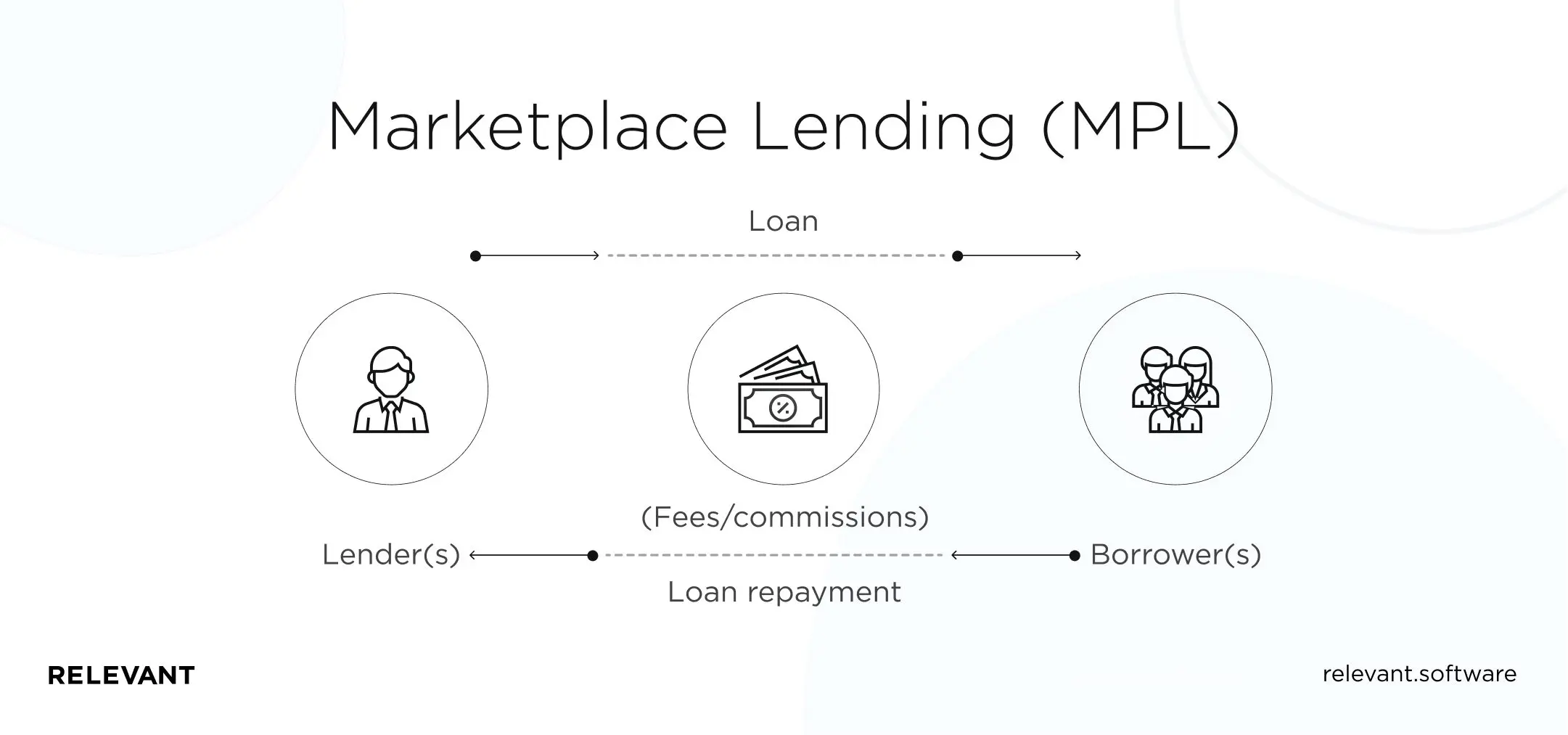

LaaS, also known as “Marketplace Lending,” is a new trend in banking and finance. With this new service, banks utilize technology to offer their services on platforms outside of their usual banking channels. LaaS is under the larger umbrella of Banking-as-a-Service (BaaS).

Banking-as-a-service involves the use of Application Programming Interfaces and cloud-based infrastructure to enable businesses to develop, set up, and maintain their financial services. This frees enterprises from old and limited traditional banking channels.

Through white label commercial lending, the future of lending will be transformed and streamlined to suit models which business executives are most comfortable with.

For instance, if a business executive prefers alerts directly through their financial platform or prefers interacting with a chatbot, it will be made possible. This will bring a lot of convenience to businesses at a previously thought level to be science fiction.

Over the next few years, there will be a significant increase in the proliferation of technology across the banking landscape. This will enable service providers to separate themselves from the distribution process.

As a result, many banks are starting to lay the necessary technological foundations and engaging fintech white-label software development service providers to create solutions that will help them remain up to speed with incoming financial services business models.

Below is a list of some current LaaS providers:

| Company | Website/LaaS URL | Lending Segments | Regional Presence |

| Ario (ZetaTango Technology) | arioplatform.com | Small Business | Canada |

| Biz2Credit | biz2credit.com | Small Business | N.America, Australia, India. In progress in Europe, Asia, S.America. |

| Cloud Lending (Q2) | cloudlendinginc.com | Small Business, Consumer | U.S. |

| Ezbob | ezbob.com | Small Business, Consumer | U.K. |

| FICO | fico.com/en/latest-thinking/ product-sheet/fico-alternativelending-platform | Small Business | Global |

| Fundation Group | fundation.com | Small Business | U.S. |

| GDS Link | gdslink.com | Small Business | U.S. |

| IDEALINVENT | idealinvent.com | Consumer | Europe, India |

| Kabbage | kabbageplatform.com | Small Business | Global |

| LendKey | lendkey.com/lend/digitallending-solutions | Consumer (student, home improvement) | U.S. |

| Mambu | mambu.com | Small Business, Consumer, Mortgage | Global |

| ODX (OnDeck) | odxsolutions.com | Small Business | N.America, Australia |

| Quotanda | quotanda.com | Student | Americas, Europe |

| Spotcap | spotcap.com | Small Business | Europe. In progress in Australia. |

| Thinking Capital | thinkingcapital.ca | Small Business | Canada |

| Upstart Network | upstart.com | Consumer | U.S. |

Source: LenditFintech

White label lending platform: Should you go for it?

The use of the white label model is a great way for businesses to avoid many technological hurdles while still meeting the expectations of their customers. White label products work well for every industry, but how are they exactly used in lending?

What is a white label lending platform?

A white label lending application is a technology that enables financial institutions to leverage a pre-existing generic lending platform to create their own branded solution. This platform makes it possible for financial institutions to deliver a cohesive user experience with minimal disruptions.

Most importantly, white label allows extensive customization. This allows you to take advantage of a refined product, brand it as your own and boosts brand reputation and visibility.

Financial institutions that employ white label solutions eliminate some unnecessary steps that can bring about friction and distrust. Therefore, customers will be at ease, enjoying a friendly and reliable experience.

Financial institutions will only be able to personalize the front end. The backend, on the other hand, will be designed to ensure best practices for the institution’s customer service. Some standard features are found in white-label lending platforms.

These include embedded data connections and user-centered designs that support customer-friendly experiences.

The benefits of a white label lending platform

White labeling for fintech brings about many advantages. Many financial institutions do not currently possess the budget, technology, and workforce to be able to develop their unique solutions that feature a fully branded and integrated application process.

A white label lending platform provides a workaround for all this. Businesses can utilize an existing platform and personalize it to make the front end their own.

When a business builds its lending solution, that will only be the beginning of the investment. The application will need to be maintained, upgraded, and updated from time to time.

This presents many challenges, especially if the business does not have the staffing and the budget for it. With a white label solution, there is no need for all this.

Another key advantage of using a white label lending platform is that every process is easy and transparent for the customer. This means customers will enjoy a fast and streamlined digital experience. This will help the financial provider to realize a lot more conversions.

What types of lending solutions can you build with the help of outsourcing companies?

Outsourcing companies can help you to develop your financial software. Their services range from ideation to white label financial development services and extend to maintenance as well.

They can also help you with recommendations and guide you through the process of selecting the proper tools and technologies to use when building your financial services software.

Outsourcing companies can also assist you in creating a white label fintech platform that you can then extend to others. These are all useful services if your business is into white label consumer financing and other related financial services.

Examples of financial services solutions you can get when you engage an outsourcing company:

SaaS lending platform

An outsourcing company that offers fintech software development services can help you build your custom fintech white label software that can service banks and borrowers. These platforms can offer services like analyzing credit scores, business loans and awarding customers the chance to compare different loan offerings.

A SaaS lending software provides everything in one solution, allowing the borrower to apply, get evaluated, and receive the funds at once.

Loan Lending App

A loan lending app eliminates the need for intermediaries such as loan brokers or banks. Both the financial services provider and the borrower can negotiate terms and repayment conditions directly.

With such an app, the borrower can issue a loan application approved through the application after a security check. The lender can then manage a list of applications and decide on which ones they want to commend. The absence of go-betweens ensures that the interest rates and terms are suitable for every user.

The prospects of Lending as a service niche

The explosion of new technologies like Lending as a service has a huge knock-on effect on the financial services industry. Figures show good numbers for technological investments, with notable growth in fintech.

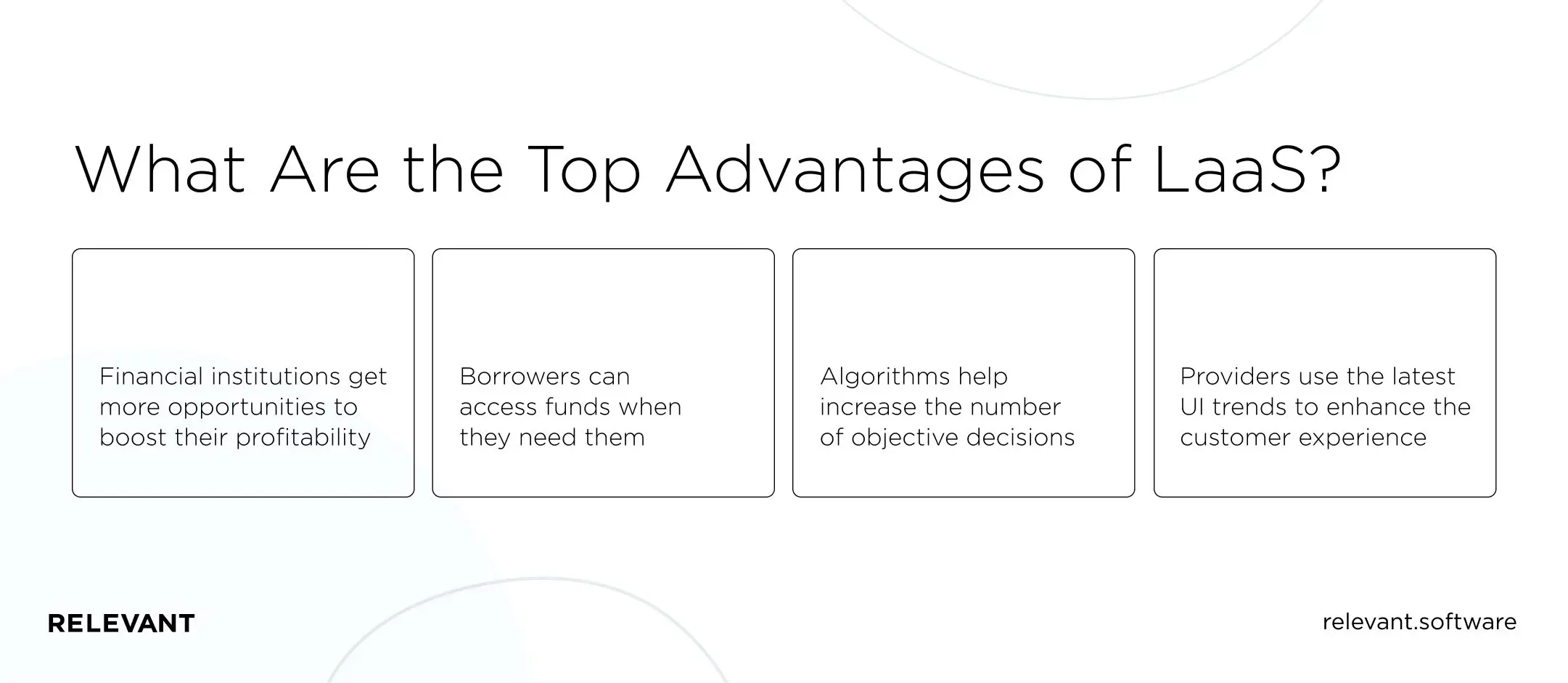

Financial services experts believe that LaaS will enjoy the same levels of success as SaaS and other similar cloud-based technologies. There are a lot of benefits that LaaS brings about, especially when coupled with fintech app security solutions.

Therefore, there is a very high chance that future financial services providers are likely to jump on the bandwagon and start utilizing it.

If you are running a financial services company, there are some solid points supporting why you might want to integrate LaaS into your business. It will help you get higher conversions, and it will help you to manage your budget better as well.

If you were to develop an app or solution of your own, there is a tremendous amount of initial investment that you would need to put forward.

LaaS eliminates the need for this and also limits the maintenance costs that you will have to endure. It, therefore, makes sense for you to consider implementing LaaS within your business.

If you are ready to take the next step, there are several Ukraine outsourcing companies that specialize in software development. This would be an excellent place to start your search.

It’s time to find a Fintech solution development partner!

One of the critical challenges you might face when you want to implement new technology into your business, like a digital lending platform, is finding the right financial solution development partner.

It would help if you had a partner like Relevant with an outstanding knowledge of the fintech industry.

Relevant also has some significant experience in formulating high-end Fintech solutions. The company has organized several dedicated development teams for projects of various complexity and size.

One of the most notable projects that Relevant has worked on is FirstHomeCoach. With this project, Relevant displayed how they are well versed with all the critical aspects of how to develop a fintech solution.

The company is skilled in bringing together effective and dedicated software development teams to ensure a smooth white-label financial product development process no matter how challenging your task is.

When selecting a partner to build a white label loan website or for financial app development, you need a team that has worked on such products before. FirstHomeCoach comes as close to LaaS solutions as possible.

It is an all-in-one platform that helps home buyers and guides them through the complicated processes of purchasing a property. Through the platform, buyers can access trusted advisors who can assist them in securing a mortgage, getting insurance, and handling all the legal paperwork.

Some of the modules that were developed by Relevant in this project are also accessible to other companies as white label offerings. You can therefore trust that Relevant will deliver if you want to build fintech white label software.

Wrapping up

Technology is bringing about new changes and innovations that might change the face of the fintech industry. Today’s financial institutions are moving towards LaaS, digital mortgage software, and other similar technologies.

The upside to integrating Lending as a service into your business model is that it not only reduces time and effort; it also adds the necessary automation and leverages on artificial intelligence to provide a better service to customers.

With Lending as a service, you can say goodbye to things like imperfect credit scoring, document errors, human mistakes, or even fraud attempts. All of this can result in severe inconveniences on both the lender’s or borrower’s end.

If you are interested in developing your fintech product from scratch, Relevant can help to assemble the most qualified and committed team who will deliver a high-quality product in record time.

Relevant can also help you seamlessly integrate a new lending solution into an existing platform bringing it up to speed with the current technological trends in the fintech industry.

If you are interested in white label loan products, we can help too. Lastly, we can also help to upgrade and enhance your existing software. So contact us if you want to build a relevant and effective fintech solution.

FAQ

What is white label lending?

A white label lending solution, i.e., white label p2p lending platform, enables financial services providers to leverage customizable pre-existing fintech lending platforms to personalize their technology solutions. Each business gets a platform that they can brand as their own. White label lending allows lenders to offer accessible, intuitive, and coherent experiences. They are also cheaper to maintain from a business view.What are the examples of white label lending solutions?

Lendiron Lendiron is a white label lending solution that enables new and established businesses to develop highly successful loan portfolios. This white label provider integrates quickly and seamlessly with credit rating agencies, external databases, and loan brokers.SBC’s Online lending solution. This is a turnkey white label solution that enables businesses to issue loans online. Borrowers can also make their repayments via the same platform. A borrower can choose to use either a website, a mobile application, IVR, or a chatbot. LendkeyThis is another white label solution that lets businesses customize and create their solutions. It lets financial services providers choose the risk criteria that are right for their businesses. It also has the added advantage of allowing them to adjust their parameters at any time.How to create a lending platform successfully?

To successfully create a customized digital lending platform, you first need to have a registered business and capital to invest in. You can then choose whether you want a white label solution or if you want to build the platform from scratch. If you are making the platform from scratch, you will need a skilled and dedicated development team to help you come up with the platform.How should you choose an outsourcing company that develops fintech solutions?

The first thing you should consider when looking for white label software development for fintech is your budget; then, you can also look at communication. You need a company that charges what you can afford and that you can also communicate effectively with. Apart from that, the company should have the technical competence to complete your project and deliver a high-quality solution. For that, you can check their portfolio and see if they have worked on and completed similar projects.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.