Your Definitive Guide to White Label Solutions for Fintech and Banking Services

Updated: June 4, 2025

Developing fintech applications or software from scratch can be complex and overwhelming, especially for a company getting into the financial market for the first time. To get these sophisticated solutions without breaking the bank, most financial institutions consider white-label software development.

As you know, white label software basically refers to software a fintech company purchases from a service provider and then rebrands as its own. White labeling is a simple solution to an expensive problem. It enables fintech companies to outsource financial application development to get into the market faster, save time, & resources and stay relevant in a highly competitive market.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usTable of Contents

How we built a white-label fintech product

Recently, Relevant helped FirstHomeCoach, a UK-based Fintech company, develop an application that helps home buyers navigate the complex process of buying real estate quickly and efficiently. Our team designed the app’s security & structure and set up the system and its algorithms from scratch to help the fintech company provide a reliable product to potential homebuyers. FirstHomeCoach also sells its products as a white label to companies like Virgin Money. Read the case study

A glimpse into white labeling and fintech today

Looking at the e-commerce and banking sectors today, it’s right to say white label solutions (also referred to as private label financial service solutions) are on the rise. As these industries become more open to partnerships with third parties, it has become easier to save both time and resources when deploying new solutions.

A white label partnership shifts the technical aspects of development, UX/UI design, analytic algorithms, and cybersecurity off a company’s plate. With that, the firm can focus on other administrative and strategic tasks.

White label development is especially relevant for fintech startups and banking service providers. While the first usually has a limited budget using a white-label solution with one to two outstanding features would be enough to launch a validatable MVP. The set of features mobile banking users need is also pretty standard, so here, there is no need to reinvent the wheel, and white labeling becomes a smart strategy to tap into a mobile banking trend.

What is a white-label platform?

So, what is white label software? A white-label platform is a software provided by a white label provider unbranded to a reseller. The resellers then integrate their branding and sell access to the application as if they developed it. White labeling allows fintech companies to configure and rebrand existing financial applications by outsourcing them from a white label provider specializing in fintech software development services. In this case, the fintech company allows the selling company to integrate the final service or product into their company and make it look like they created the final application themself. How does that apply to the financial industry?

In the modern world, banking as a service and open banking is increasingly becoming popular. White label banking enables fintech companies to provide online financial services using products from white label providers. For instance, a fintech company can adopt existing APIs (application programming interface) from a white label provider or a bank as the foundation for selling their financial services. To put it simply, instead of building a financial product from scratch, the fintech company can use existing applications to put together its final branded financial product.

So what problem does white labeling solve? Well, not everyone starts off their fintech project with a big budget for product development. To save on costs & resources and cut the time to launch, a white-label product will be a quick and painless solution.

How does white labeling differ from other partnerships?

White labeling for fintech is only one of the different options you have when looking for a strategic partnership. Other options include:

- Affiliate relationships (also known as an introducer) are when related brands recommend your company. For instance, as a fintech company, you can enter into affiliate relationships with accountants, solicitors, or IFAs, who then introduce your product to the end user. Introducers help your company access a new market easily, but they can also leave your company vulnerable due to their demands. You may end up constantly trying to please your introducers rather than your end users/customers.

- Co-branding creates a marketing and advertising relationship between two brands. For example, Apple and Master Pay co-branded to make Apple Pay. One brand’s success positively impacts the other, and they work collaboratively to ensure the final product’s success.

- Outsourcing. Within this partnership, one company delegates a white-label finance project and its development tasks to another. In simple words, your organization hires another company to implement the functions of your business. It mainly works for short-term projects. Opting for Ukraine outsourcing, a popular and globally recognized white-label outsourcing destination, is a smart move in this case.

White label banking services

Buying ready-made software for rebranding has become a viable strategy for many startup newbies in finance. Even traditional banks are going down this route as they enter the digital age, where operations become paperless and online. Here’s a rundown of banking services white label providers commonly cater to in financial app development:

- Client onboarding. When clients sign up for your services, they go through an onboarding process, finding out how to create an account and use the app’s features in the most effective way.

- Savings and checking accounts. White label partnerships can help you offer services of managing clients’ checking and savings accounts.

- Virtual card issuance. With a private label banking integration, you can issue debit and credit cards to users virtually.

- Simplified bill payments. White label banking can help you deliver easy and convenient bill payment processes.

- Online payments bill transfer systems. A user can transfer the money owed to the biller in a seamless transaction.

- Personal loans. This offers several features to help users manage their money and access personal loans in a less complicated way than traditional banking implies.

- Deposits and withdrawals. You can build a fintech white-label software that facilitates funds depositing and withdrawal.

- Mortgages. If you want to provide functional digital mortgage software for users, whether it is a mortgage calculator or online mortgage application form, a custom fintech white label software can help you deliver a user-friendly product.

- Insurance. A white label banking solution can help you provide users with insurance quotes. The application takes the user’s information and gives quotes to help determine a suitable insurance policy.

- Bank statements with transaction details. Users can access their bank statements with withdrawals, deposit charge details, and balance details for a specific period.

- Balance notifications. A user can request notification alerts for bank balances to avoid overspending.

What makes white label fintech projects successful?

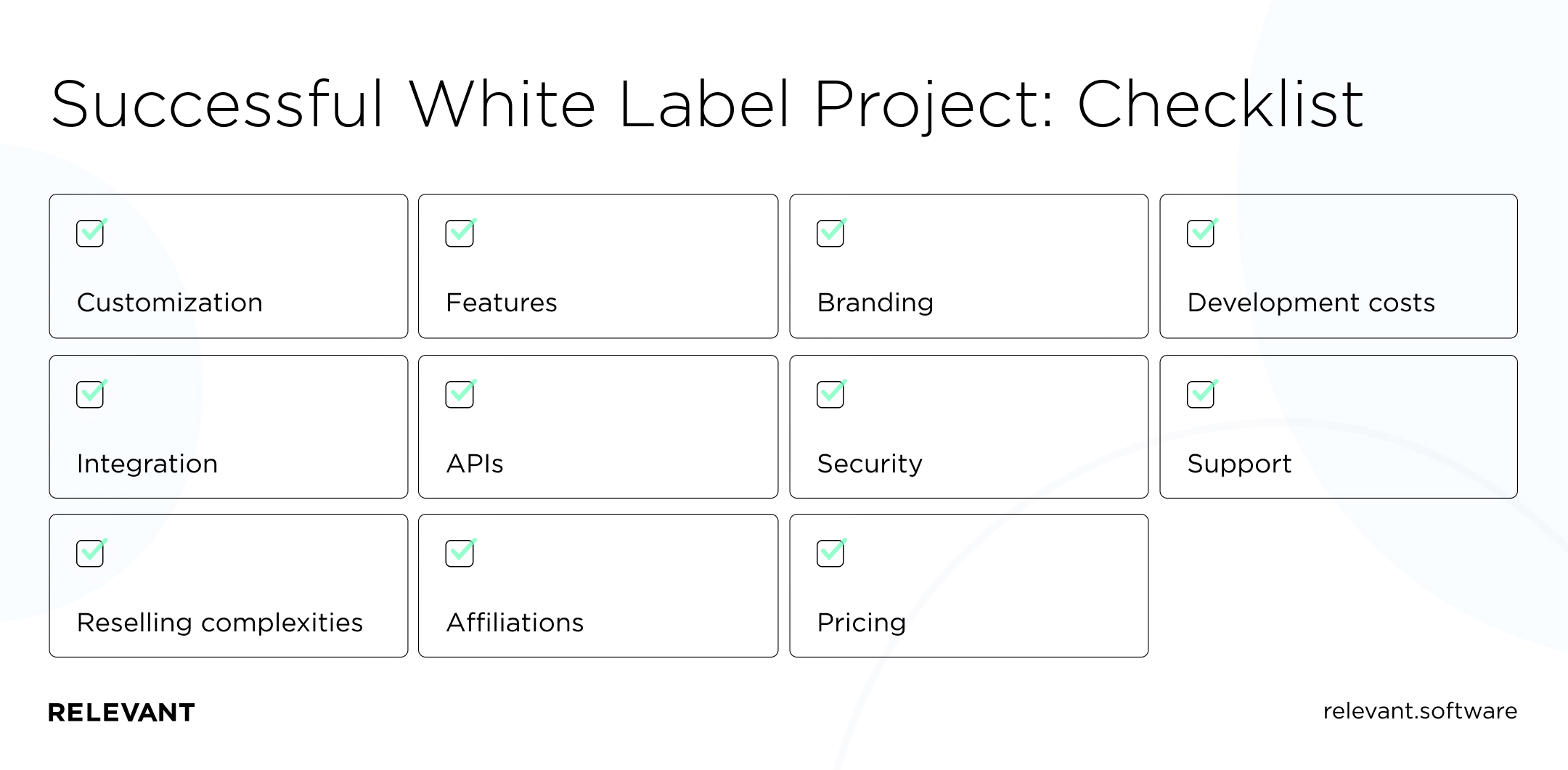

Following in the footsteps of other fintech giants requires a great deal of planning. To create a successful white-label project, follow the next checklist for white-label mobile banking app development:

Customization

Ensure that your developer can build a white label app architecture in such a way that you can add brand identity by yourself. Every element of the app should be easy to modify to fit your brand.

Features

Coming up with the right set of features is essential for both white label app and custom software development processes. That’s why you have to pick the best solutions in your niche, outline the most necessary, effective, and outstanding features, shortlist the ones that your users need and implement them using the latest technologies for financial solutions development.

Branding

Branding is just what makes your white label app stand out. Make sure to follow your brand style and keep your app easily recognizable among the competitors.

Development costs

Planning your white label development budget in advance is also essential for creating a solution in a pitfall-free way. Fortunately, white label apps come with a pretty standard set of features. That’s why your development vendor will be able to make an accurate estimate of the upcoming costs.

APIs and integration

When you are ready to build a white label fintech platform, make a list of the necessary integrations in advance. Depending on the goal of the solution, you can integrate it with various payment systems, online calculators, digital signatures, and so on.

Security

Security comes first for any software solution, and you should never underestimate its importance. Take a deep look at the possible security issues associated with using the software and research the best security practices for fintech industries. You can also apply for fintech app security solutions consulting services.

Support

Usually, the developer can set up a support system that users can apply to highlight issues. They should show you how to look into the admin’s dashboard and troubleshoot any problems. The support program can be renewed, allowing you to help solve client problems continually.

Reselling complexities

Discuss the options of reselling or sharing the royalties of the product with your developer. Determine the best choice between selling the product or sharing on a subscription basis.

Affiliations

Have a clear plan on who will license the software and sell it. You have the option to hire a company to sell the product on a commission or compensation basis.

Pricing

Also, make sure to develop a clear pricing system, keeping market trends and competition in mind. You have to wisely balance your income expectations with your users’ solvency and align your pricing policy with a market-established one.

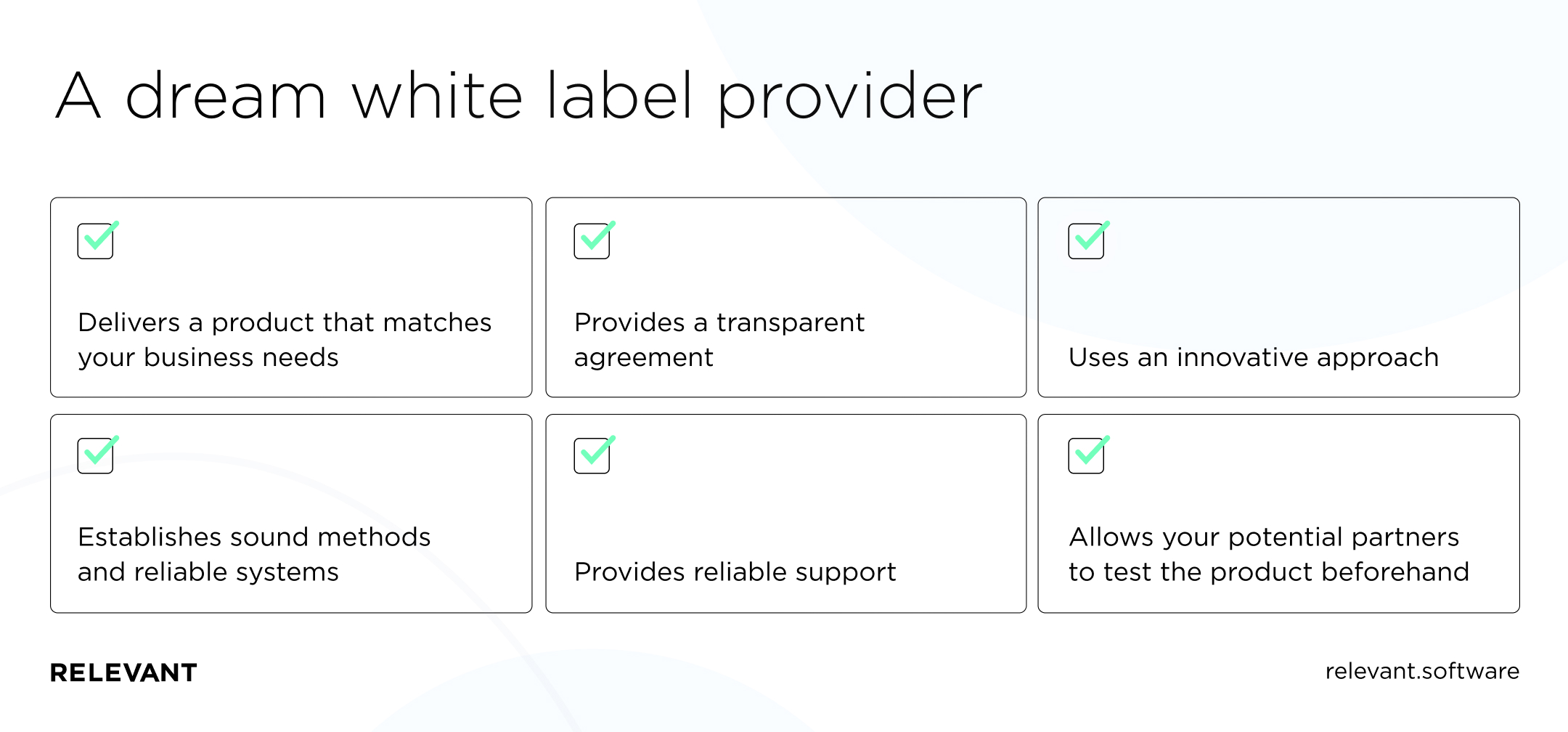

As a trusted white label provider, you need to:

- Deliver a reliable product that matches your partner’s needs.

- Use an innovative approach and look into ways you can enhance your partner’s product.

- Establish sound methods and reliable systems to create a good reputation and trading history.

- Provide reliable support for your partner to help them monitor the client’s issues and troubleshoot problems.

- Provide a transparent agreement with a minimum lock-in timeline that stipulates the standard fees.

- Come up with a demo version of your app so your potential partners can try it before buying and discover how it works for their business.

Top 6 white label platform providers

Modern Fintech is a highly competitive industry. Therefore, there are enough white label financial services with various technological capabilities on the market.

As a Fintech software development company, we value splendid solutions. Therefore, we have selected top providers representing a professional approach to white-labeling among hundreds of brands.

Plaid

Plaid’s product is a technological platform that provides all the tools needed to develop a modern digital financial system. Plaid API is essentially a link between banks and Fintech, allowing apps to sync with users’ bank accounts to manage their budgets and transfer funds. The platform services are used by such popular fintech brands as TransferWise, Charity Water, Gusto, and Robinhood.

Bankable

Bankable is an international architect of innovative payment solutions for corporations, banks, and retailers. These include e-wallets, mobile wallets, money transfer services, P2P money transfers, and prepaid card programs, which are available as self-service platforms with a white label and through the API.

Tink

This cloud-based open banking platform provides infrastructure and additional products for data processing in financial services. Tink’s suite includes initiating payments, aggregating accounts, enriching data, and managing personal finances, which you can use to develop individual services or integrate into existing banking applications. Among Tink’s partners are such well-known brands as BNP Paribas Fortis, Nordea, ABN AMRO, Klarna, and SEB.

ETNA

ETNA offers a complete software solution with white label technology for online brokerage or digital capital management businesses. It includes web and mobile trading applications, middle and back-office, and trading APIs. Turnkey stock trading technology easily integrates through APIs with execution venues, clearing, and market data providers of choice.

Hydrogen

This global SaaS platform offers a range of features, widgets, and applications that are part of the codeless platform. And this is also one of the best white label personal finance software examples. With a ready-made white label solution from Hydrogen, you can integrate personal finance management, asset management, and other components of financial products. In addition, Hydrogen offers reliable authentication, algorithms, KYC (Know Your Customer), and customer support for Fintech businesses.

White Label in Fintech Examples

Many fintech neobanks that have emerged over the past few years, notably N26, Chime, Revolut, and Monzo, use solutions created by well-known white label providers.

As an example, consider the partnership between ABN Amro and Tink, whose open banking platform forms the basis of ABN Amro’s new banking app, Grip. An essential feature of Grip is accessing and tracking five different bank accounts simultaneously. It means that non-ABN Amro customers can use the technology and still benefit greatly from it.

But not only banks leverage the advantages of white-branded fintech services. Accounting and payroll companies (e.g., BDO, Grant Thornton, PwC) and financial software vendors (Quickbooks, Visma, and Sage) also use white-labeling as an effective tool to scale their solutions.

Before diving into the fintech white label space, consider that even off-the-shelf infrastructure needs to be configured. That is, you can choose the most suitable end-user platform for effective financial management and realize its capabilities with the help of a reliable development partner.

Why Relevant?

As you have already understood, white-label fintech development is a largely customizable service. It can meet the needs of any fintech business, be it a large neobank or a small payroll startup. Therefore, if you are looking for a technology partner who can ensure the smooth implementation of your white label project, we are here to help.

As a top-rated IT outsourcing services company with 9 years of experience, Relevant offers you the following fintech development services:

- Development of white label functionality from scratch

- Configuration and personalization of ready-made fintech white label software

- Integration of white label software with existing solutions

- Professional technical support, maintenance, and updates on-demand.

Want to know more about how white-label software development services can benefit your business? Ready to launch your project? Contact us, hire a dedicated software development team, and get started today!

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us