The Top 15 UK Venture Capital Investment Funds That Invest in Fintech Companies

Updated: June 12, 2024

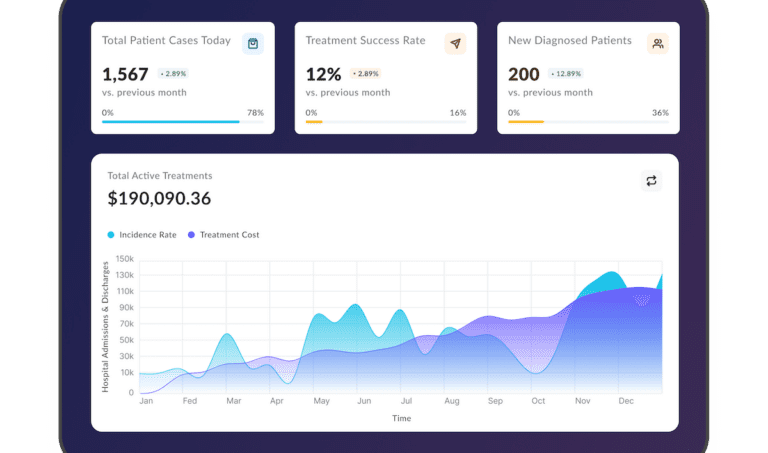

In 2022, global investment in fintech was $92 billion, down 30% from the previous year. However, the UK fintech sector experienced a smaller drop in investment, amounting to approximately $12.5 billion, which is only 8% lower than its 2021 peak. Thus, despite economic challenges, the UK remains the top destination for fintech investment in Europe and second in the world, trailing only the United States with $39 billion.

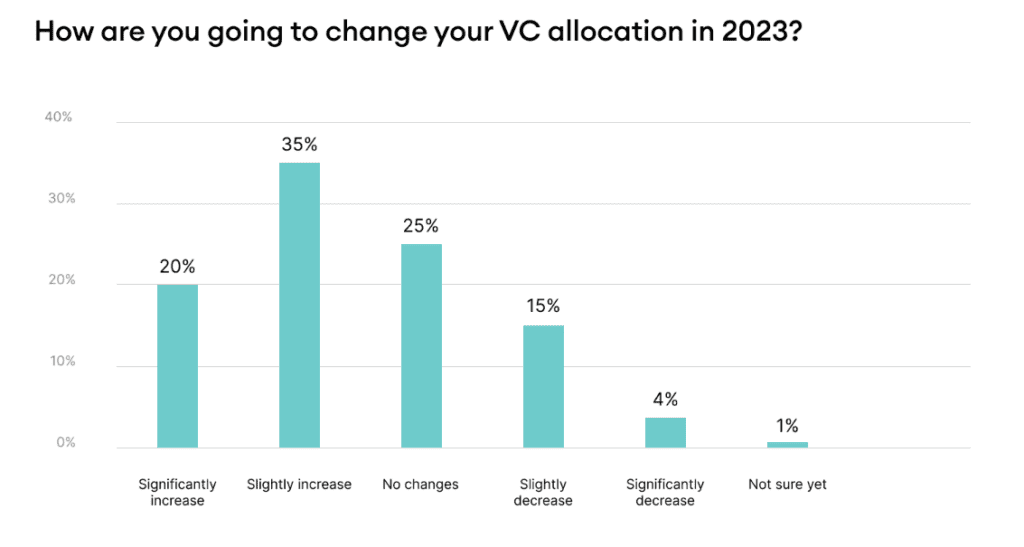

Due to the slowdown in growth, “dry powder” — money raised by venture capitalists that have not yet been deployed — surged to record levels. Investors are understandably cautious but remain optimistic – one in five firms plans a “significant” investment in 2023. This money will mainly go to companies that can prove relevant through turbulent times. If anything, the recession will shake out the weaker players and force those with real potential to step up and show their worth.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usIf you are an early-stage Fintech founder and need data on the most active fintech investors in the UK, read on. Here is a list of the top 15 venture capital funds actively investing in new fintech businesses in the United Kingdom. To assist you in creating a strategy for your company, we provide a brief overview of each fund.

Source: Digital Horizon

Table of Contents

15 Most Active Venture Capital Firms To Finance Your Startup

Venture capital funds play a vital role in developing the vast FinTech ecosystem helping startups and entrepreneurs with a grand vision enter new markets and grow faster. Scroll down to see profiles on the 15 most active fintech funds, including investment criteria and some of the businesses they’ve backed.

1. Seedcamp

| Location | London, England, United Kingdom |

| Founded | 2007 |

| Focus | Fintech, Marketplaces, SaaS, Analytics, Mobile |

| Website | https://seedcamp.com/ |

| Notable Investments | Wise, Revolut, UiPath |

| Past 12 months | 58 investments |

Based in London, Seedcamp kickstarted its journey in 2007 and is one of the most popular venture capital investment firms, especially in the UK. Led by Carlos Espinal & Reshma Sohoni, the firm invests around €100k – €2 million in only startups in their early stages.

The fund has an excellent track record, backing 400 companies, including such unicorns as Revolut, Wise (formerly TransferWise), and the virtual events platform Hopin.

2. Anthemis Group

| Location | London, England, United Kingdom |

| Founded | 2010 |

| Focus | Insurtech, Fintech, Data Technology |

| Website | https://www.anthemis.com/ |

| Notable Investments | Trov, Flock, Matic, Hokodo |

| Past 12 months | 33 investments |

Launched in 2010, Anthemis Group was founded by Amy Nauiokas, Sean Park, and Nadeem Shaikh, who operated as bankers focusing on angel investing. With four offices spread worldwide, three located in Europe, the firm has been actively investing in small and medium-sized Fintech companies, especially those in their early stages in the US & UK.

One of the reasons they have been investing heavily in the Fintech Sector is their keen interest in exploring how financial technology impacts various other sectors, including mobility, agriculture, and energy.

3. Force Over Mass Capital

| Location | London, England, United Kingdom |

| Founded | 2013 |

| Focus | Blockchain, Artificial Intelligence, Cloud computing, Fintech, B2B technology |

| Website | https://www.fomcap.com/ |

| Notable Investment | MobieTrain, Koyo, Snap It Limited |

| Past 12 months | 12 investments |

Force Over Mass Capital is an FCA-regulated venture capital firm focused on early-stage technology investments across the UK and Europe. FOM cap operates seed and scale-up funds to support early-stage businesses through their growth journey. They invest in B2B innovation across four verticals, i.e., Fintech, Artificial Intelligence, SaaS, and Industry 4.0.

In their program of investments, the firm prioritizes businesses having a strong model and secure technology, backing 10 to 15 startups each year.

4. Passion Capital

| Location | London, England, United Kingdom |

| Founded | 2011 |

| Focus | Fintech, Financial Services, Telecommunications, Internet of Things, Software, Mobile |

| Website | https://www.passioncapital.com/ |

| Notable Fintech Investments | Monzo, GoCardless |

| Past 12 months | 7 investments |

Passion Capital is a London-based Venture Capital Investment Firm that has funded more than 70 early-stage tech startups, of which about half were Fintechs. The investors have eyes on the European market and have claimed they have huge plans for the future.

They have been identified as one of the fintech venture capital firms, with a high success rate in converting seed investments to Series A funding.

5. Octopus Ventures

| Location | London, England, United Kingdom |

| Founded | 2008 |

| Focus | Health, Fintech, Deep tech, consumer and B2B Software |

| Website | https://octopusventures.com |

| Notable Investments | BondAval, Visible, Cazoo |

| Past 12 months | 44 investments |

London-based Octopus Ventures is one of Europe’s largest and most active venture capital investors. Investments typically start at £1m for seed rounds and £10m for venture rounds, and the fund aims to continue supporting its portfolio companies before the IPO. The fund also provides companies with a network of trainers, operational consultants, and venture partners.

We can highlight the thriving areas of fund investing, such as the Internet and artificial intelligence. In addition, a startup must be 4-5 years old to receive investment from the fund.

6. Global Founders Capital

| Location | Berlin, Germany |

| Founded | 2013 |

| Focus | Financial services, information technology, mobile, IoT, software, media, telecommunication, e-commerce, big data |

| Website | http://www.globalfounderscapital.com/ |

| Notable Investments | Oyster SilkChart Flash |

| Past 12 months | 173 investments |

Global Founders Capital, founded in 2013 by Oliver Samwer, is a venture capital company headquartered in Berlin, Germany. The firm prefers to invest in early-stage companies in different parts of the world. Over the past two decades, GFC has supported over five hundred entrepreneurs worldwide, such as Facebook, LinkedIn, Slack, and Away Travel.

7. Index Ventures

| Location | San Francisco, London |

| Founded | 1996 |

| Focus | AI/ML, Business Applications, Data, Fintech, Entertainment, Future of Work, Healthcare, Media, Mobility, Open Source, Retail, Security, Talent |

| Website | https://www.indexventures.com/ |

| Notable Investments | Adyen, Aurora, Deliveroo, Funding Circle, Intercom, Robinhood, Alan |

| Past 12 months | 77 investments |

One of the oldest United Kingdom Venture Capital Investment firms, Index Ventures has been in the game for over two decades. With so many years of experience, the company that raised more than €6.14 billion works with founders in any sector at any stage. Still, its portfolio shows a particular interest in seed and venture-stage startups in fintech, software-as-a-service (SaaS), and eHealth or health tech.

8. Speedinvest

| Location | Vienna, Wien, Austria |

| Founded | 2011 |

| Focus | Fintech, Deep Tech, Marketplaces, Industrial Tech, Healthcare, Consumer Tech (Generalist Venture Capital Firm) |

| Website | https://speedinvest.com/ |

| Notable Investments | Coachhub, Billie, TWAICE, Tourradar, Inkitt & Luko |

| Past 12 months | 77 investments |

Founded in 2011, Speedinvest is a generalist firm and has successfully managed to build an impressive portfolio in the Fintech sector. Co-founded by Erik Bovee, Oliver Holle, Michael Schuster, Daniel Keiper-Knorr, and Werner Zahnt, the investors have climbed the ladder in the past five years. The firm has offices across Europe, heavily invested in debt collection, insurance, elder tech, and innovative debit schemes.

9. LocalGlobe

| Location | London, England, United Kingdom |

| Founded | 1999 |

| Focus | Generalist Venture Capital Fund |

| Website | https://localglobe.vc/ |

| Notable Investments | Monzo, Yapily, Zego, Tide |

| Past 12 months | 45 investments |

Although LocalGlobe is a generalist firm, it has shown significant interest in the Fintech Sector. One of the reasons behind this is that London is Fintech’s global capital. Also, the firm is interested in open banking, insurtech, and small and medium-sized enterprise services.

LocalGlobe was founded in 1999, and its founding partners, Robin & Saul Klein (father and son duo), have managed to turn it into one of the best early-stage Venture Capital Investment firms.

Saul Klein, the co-founder of LocalGlobe, has an outstanding track record in investment, as he was a co-founder of Seedcamp and LoveFilm and was a former partner at Index Ventures.

10. Par Equity

| Location | Edinburgh, United Kingdom |

| Founded | 2008 |

| Focus | Fintech, Cleantech, Media, & Communications. |

| Website | https://www.parequity.com/ |

| Notable Fintech Investments | Swipii, miiCard, Greengage Lighting |

| Past 12 months | 11 investments |

Par Equity, founded in 2008, has an exceptional reputation and invests heavily in UK & Scottish businesses focusing on Fintech, cleantech, media, and communications.

When it comes to choosing the companies they would like to invest in, they filter out companies in terms of the ones with outstanding growth potential and clear global application.

11. Point Nine Capital

| Location | Edinburgh, United Kingdom |

| Founded | 2009 |

| Focus | Fintech, Education, Health SaaS, Marketplaces, and Opportunistic Consumer-Facing Ventures |

| Website | http://pointnine.com/ |

| Notable Fintech Investments | Revolut, Kreditech |

| Past 12 months | 32 investments |

One of the key highlights of Point Nine Capital is that it backed Revolut during its seed-stage. Moving forward, up until now, it has backed several Fintech companies across all of Europe, especially in the United Kingdom.

Point Nine Capital, with a sole focus on fintech, also allocates its resources to early-stage education and health-based companies. The firm has an outstanding track record of investing in B2B companies highly focused on SaaS, marketplaces, and opportunistic consumer-facing ventures.

12. Maven Capital Partners

| Location | Glasgow, Glasgow City, United Kingdom |

| Founded | 2008 |

| Focus | Generalist |

| Website | https://www.mavencp.com/ |

| Notable Fintech Investments | Growth Capital Ventures, Fissara, NorthRow |

| Past 12 months | 17 investments |

Maven Capital Partners, founded in 2008, is one of the leading venture capital investment companies that closely follows the Fintech sector and has built a fantastic portfolio. The average investment of this company ranges from 0.85 to 12.71 million euros, mainly in small and medium-sized businesses at an early stage.

Before making the investment move, the experts at Maven Capital Partners ensure that the companies they are considering investing in have a credible marketing strategy and a strong marketing position.

13. Finch Capital

| Location | Amsterdam, Noord-Holland, Netherlands |

| Founded | 2013 |

| Focus | Fintech, Financial Services, Insurance, Real Estate, Deeptech, Internet of Things, Security & Artificial Intelligence |

| Website | https://www.finchcapital.com/ |

| Notable Investments | Zopa, Webio, symmetrical.ai |

| Past 12 months | 7 investments |

Finch Capital, launched in 2013, has been making substantial investments in various sections of the Fintech sector.

From insurtech to payments and banking services, the company has built an impressive portfolio with the Fintech companies in Europe, especially the United Kingdom, at the top of their list. Apart from this, they have also invested in Fintech companies located in Southeast Asia.

As stated, they have been closely observing the B2C Fintech companies disrupting the traditional banks and other financial services. Mark their words, “We believe that the companies should be building and applying the software in the financial services sector. Now’s the time to make a move.”

14. HV Holtzbrinck Ventures

| Location | Munich, Bayern, Germany |

| Founded | 2000 |

| Focus | Consumer, Education, Digital Companies, Enterprise, Healthcare, Fintech, Mobility, & Retail |

| Website | https://www.hvventures.com/ |

| Notable Fintech Investments | Penta, SumUp |

| Past 12 months | 17 investments |

HV Holtzbrinck Ventures was founded in 2000. Back then, it started its journey as a publishing group Holtzbrinck’s corporate venture arm, only to become an independent firm in 2010. With nearly 20 years of experience, they have invested heavily in Fintech companies, with a maximum limit of €42.35 million per company. And that’s what makes them unique, helping the entrepreneurs realize their vision.

15. Ascension

| Location | London, England, United Kingdom |

| Founded | 2010 |

| Focus | Consumer products and services, digital health, life sciences, financial technology, sustainability, commerce, deep technology, information technology, and financial services |

| Website | http://www.ascension.vc/ |

| Notable Investment | Docbot Labs |

| Past 12 months | 21 investments |

Ascension operates a collection of early-stage VC funds built by exited entrepreneurs to back the next generation of technology and impact founders. With a visibility of over 3k investment opportunities a year, Ascension invests through several funds.

Whilst Ascension doesn’t publish its investment range, Beauhurst research indicates that it typically invests between £300k and £1.2m.

Conclusion

The current recession is not the end of FinTech but a market correction because in 2020 and 2021, it experienced unusually fast growth.

Will it be harder to raise capital this year? Probably, yes. While financing opportunities of fintech venture capital firms are not diminishing, we’ll see a much more cautious funding environment. But this could be a great time to start a FinTech company. If you are small and capital-efficient, broader market turmoil will have little effect on your long-term prospects.

By the way, we at Relevant possess a wealth of experience in the Fintech sector, including creating software products for startups. For example, we partnered with FirstHomeCoach to build, release and continually improve their product. Contact us if you need professional support in the technology industry.

FAQ

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us