Let’s meet in person!

Secure your personal meeting slot today — let's connect and discuss opportunities!

29-31 July. Dublin, IE

01-02 August. london, uk

Petro Diakiv,

Delivery Manager

at RELEVANT SOFTWARE

7 Steps to Build a Robo Advisor Platform That Wins Investor Hearts

The established financial advisory model appears not exactly equipped to navigate the complexities of the modern market. Traditional financial advisors, with their often hefty fees and limited scalability, simply cannot offer the personalized, immediate, and accessible financial advice that the robo advisor platform can.

Statista reports that the worldwide assets managed by robo-advisors were estimated at $1.37 trillion and will reach $2.33 trillion by 2028. That explains why more and more financial businesses and banks are creating their own automated investment management platforms to capitalize on the performance of robo advisors.

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usAs a fintech software development company behind a couple of such platforms and with over 10 years of experience, we’ll share our expertise on the inner workings of this financial brainchild. In this guide, you’ll also find out what is robo advisor and its key features and discover essential aspects of how to create a value-added robo advisor solution.

Table of Contents

What Is a Robo-Advisor and How Does It Work?

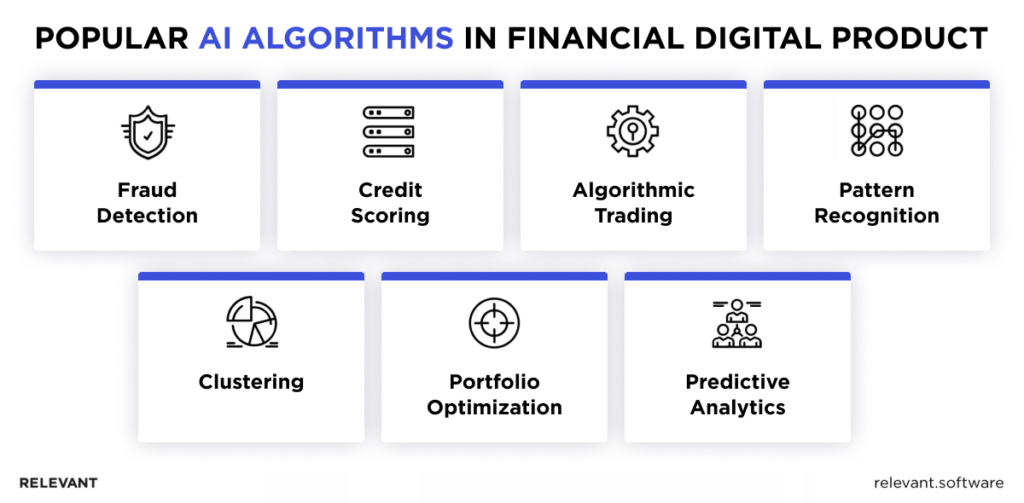

Robo advisor platform is a digital financial advisor that runs on algorithms usually powered by artificial intelligence (AI) and machine learning (ML) to build and manage investment portfolios automatically. They require little to no investment knowledge from users, which makes them ideal for anyone with an interest in growing their wealth. As long as the user recognizes the need for an investment strategy, they can rest easy and fully entrust their investment processes to this robo advisor algorithm.

So, what are robo advisors in simple terms? It’s a financial guru at your fingertips, minus the hefty price tag and the need for face-to-face meetings.

Here’s how it works: Investors input essential details such as their investment objectives, comfort level with risk, and other pertinent information. The algorithm then crafts a portfolio that aligns with those goals and adjusts it over time to keep the investments on track without you needing to lift a finger.

From this, we can distinguish the major benefits of robo advisor software over traditional financial advisors:

- Cost-Efficiency. A more affordable option for beginners or those with smaller portfolios.

- Accessibility. Anyone with an internet connection can access and use a virtual financial advisor.

- Convenience. The day-to-day portfolio management is handled for you.

- Time efficiency. A perfect option for people who don’t have time to manage their investments.

- Scalability. Can manage a larger client base with lower costs.

- Transparency. Provide clear and consistent communication about your investment strategy and performance.

Core Functionalities of Robo-Advisors

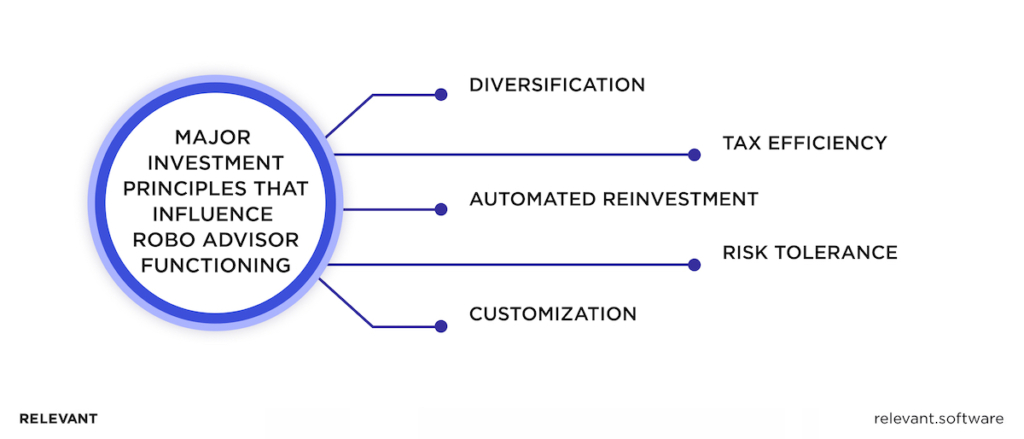

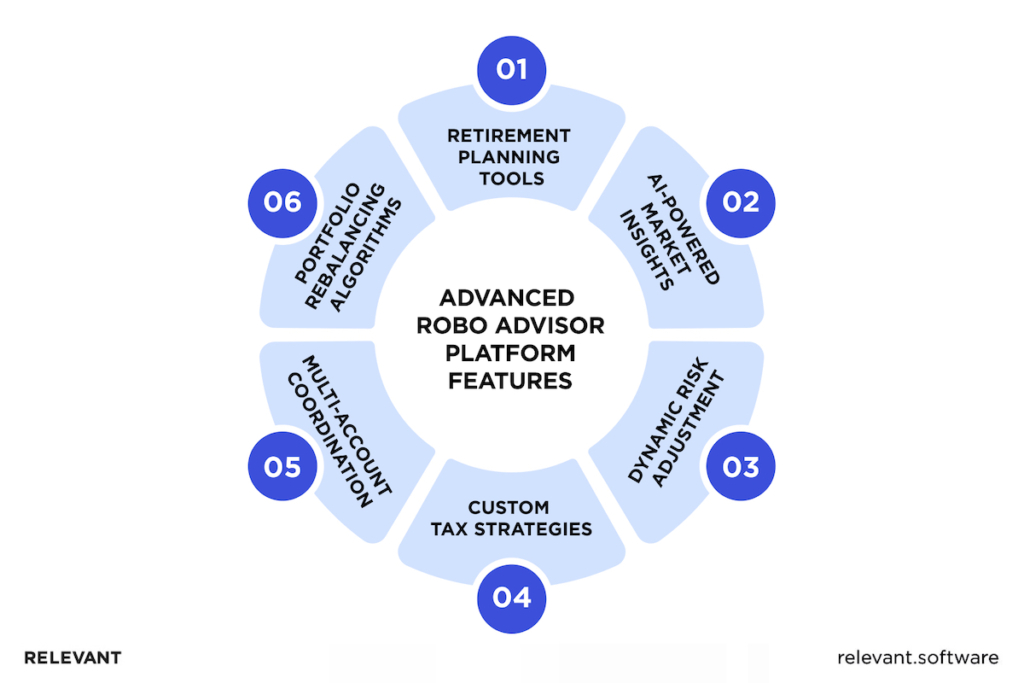

A white label robo advisor platform should incorporate certain features that make all the wonders of machine-driven investment management. Let’s delve into the core functionalities that make these automated investment platforms tick:

- Portfolio management

Robo advisors build personalized portfolios taking into account your risk tolerance and financial goals. To spread your risk and maximize your potential returns, they fall back on low-cost exchange-traded funds (ETFs) and automatically manage diversified portfolios.

- Tax optimization

Robo advisor software is tax-savvy and employs tax-loss harvesting and other strategies to minimize your tax burden. It finds investments that underperform and strategically sells them to offset capital gains, which keeps more money in your pocket.

- Rebalancing

With digital advisors that monitor your portfolio 24/7, your finances are on reliable autopilot. If your asset allocation drifts from your target due to market movements, they automatically rebalance and exchange assets to take your portfolio back into alignment with your goals.

- User onboarding and risk assessment

To assess your risk tolerance, financial advising tools ask a series of questions about an investor’s financial goals, investment experience, and comfort level with risk. Based on these details, they craft an investment strategy that aligns with your risk profile.

- Integrations with third-party data providers

Robo-advisors aren’t afraid to collaborate. They often integrate with third-party data providers to get access to a wider range of financial information, which improves their ability to make investment decisions and helps them stay ahead of market trends.

Steps to Develop a Robo Advisor Platform

The world of automated investing is booming, and the creation of a robo advisor platform is an exciting prospect. Here at Relevant, our software development team has extensive experience in the development of these financial assistants. Below, we outline the key steps we followed to successfully build robo advisor fintech products and share some tips from our experience.

Planning Your Robo Advisor Platform

Robo-advisors take the financial world by storm largely due to the fact they let everyday people manage their money with no need for a financial advisor cape. However, building an AI robo advisor worthy of this title requires careful preparation. Here’s what it’s usually involves:

Regulatory Considerations

All kinds of financial software and robo advisors as well must follow various financial regulations. Therefore, it’s important to be aware of and consider the legislation in the jurisdictions you plan to operate in early on. Some of the most common laws and requirements applicable to fintech solutions are:

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations require institutions to monitor their clients’ transactions and report suspicious activity.

- The General Data Protection Regulation (GDPR) in the European Union, or similar data protection laws in other regions, mandate the secure management of personal data.

- Know Your Customer (KYC) standards necessitate the identity verification of clients to prevent fraud.

- Securities and Exchange Commission (SEC) regulations require platforms that operate within or target investors from the United States to adhere to fair practices in investment advice.

- Payment Card Industry Data Security Standard (PCI DSS) compliance for platforms that handle credit card transactions aims to protect against data breaches.

- Financial Industry Regulatory Authority (FINRA) for platforms that offer brokerage services aimed to maintain the integrity of the market.

- Consumer Financial Protection Bureau (CFPB) protects consumers from unfair, deceptive, or abusive practices in financial services.

When you launch a fintech solution, such as a robo advisor, embedding compliance into your platform’s DNA from day one is crucial. Factor in relevant regulations like AML/KYC and data privacy laws early to save you time and headaches down the road.

Vadim Struk

Product Manager at Relevant Software

Technology Stack Selection

We believe that there is no need to emphasize how crucial it is to choose the proper tech stack for a robo advisor platform that supports its needs in terms of data analysis, security, and interface design. We compiled a list of the most popular technology options that developers at Relevant favor for their simplicity and the outcomes they deliver.

| Component | Tech choices | Description |

| Frontend Technologies | React, Angular, Vue.js | These JavaScript frameworks and libraries allow you to build user-friendly, interactive, and responsive interfaces for platforms. |

| Backend Technologies | Python (Django, Flask), Java (Spring Boot, Node.js) | These programming languages form the backbone of your platform for server-side logic, processing financial data, and integration with external services. |

| Database Management | PostgreSQL, MySQL, MongoDB | These database solutions store and manage all the data for your platform and its users. |

| Security Protocols | OAuth 2.0, JWT (JSON web tokens), HTTPS (SSL/TL) | These tools protect user data and ensure safe communication within the platform. |

| Cloud Infrastructure | AWS, Google Cloud Platform, Microsoft Azure | These cloud solutions offer scalable and reliable computing power, storage solutions, and other services needed to run your robo advisor. |

| Data Analytics | Apache Spark, TensorFlow, PyTorch | These frameworks allow for more advanced data processing, pattern recognition, and, ultimately, more sophisticated investment strategies. |

Discovery Phase and Prototyping

First-stage discovery in robo-advisory software development necessitates extensive research on your target audience and the identification of your product type (robo advisor for retirement income, wealth accumulation, or tax-efficient investment) and strategy. You should also decide on the investing approach, risk management techniques, and asset classes to be employed in your platform.

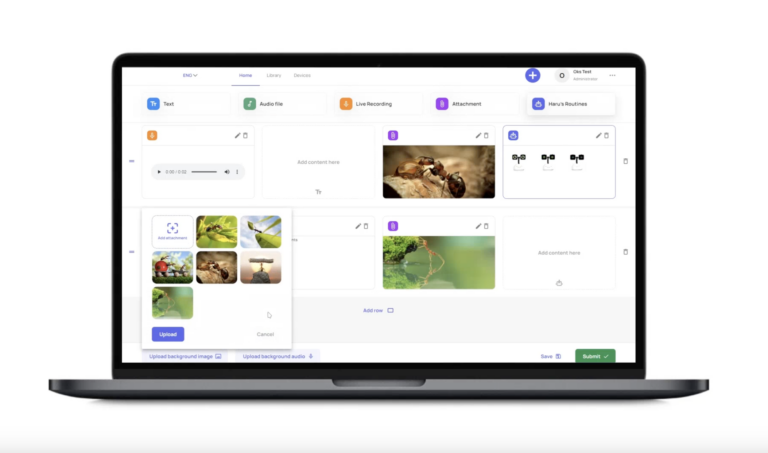

Once you have a roadmap, it’s time to bring your vision to life and create a prototype. In simple terms, it’s a digital sketch of your future platform that features only core functionalities and user flows to get rapid feedback and early testing. Typically, at this stage, UI/UX designers create the visual and interactive elements of your platform and then work together with development teams to specify user stories and paths, perform UX research, and create mockups.

The creation of a prototype will help you save time and resources. It allows for rapid feedback and iteration so you can refine your product without burning through your budget. By the time you start full-scale development, your product will already be fine-tuned and user-tested, so the chances for costly post-launch modifications are very low.

Vadim Struk

Product Manager at Relevant Software

Designing Your Robo-Advisor Platform

A successful white label robo advisor platform depends not only on its ability to automate investment management. A well-thought-out design that prioritizes user experience and lets them navigate and engage with the platform with ease is equally essential.

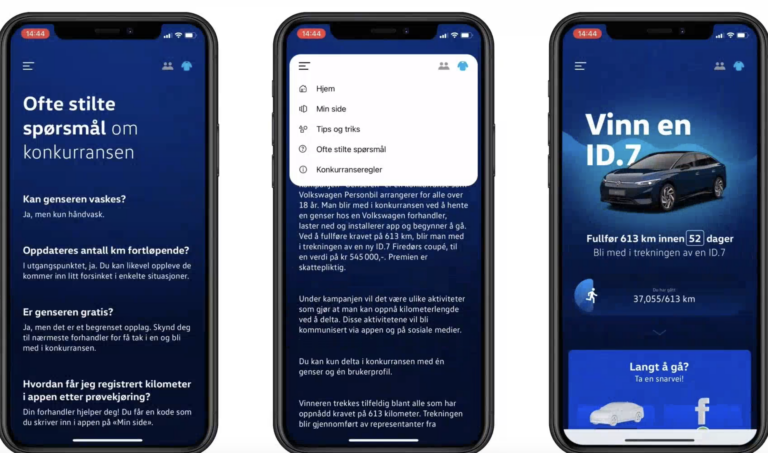

Simplifying the Onboarding Process

The onboarding process is the first engagement customers have with your robo advisor app, and therefore, it’s critical to make a positive first impression. This means clear instructions, streamlined data collection, and easy account setup. Don’t forget the power of education! Offer investors access to educational resources that explain investment basics and answer their questions. A well-informed and confident user is more likely to become a long-term investor on your platform.

Creating an Intuitive User Interface (UI)

What you need is to develop a UI that feels like a trusted financial advisor, not a complex investing maze. That’s why we recommend you stick to well-established design principles (clear information hierarchy, uncluttered layouts, intuitive navigation, and easy-to-understand data visualizations). What’s important is to structure the platform in a way that clients can easily find investment details and other essential information they need without fuss. Also, consider that users might access your platform on both desktop and mobile devices so optimize the UI for each screen size.

The golden rule of our design team is this: keep it clear, keep it simple. Don’t overwhelm your users with financial jargon or complex layouts. Clarity and user-friendliness help build trust and keep your investors engaged on their wealth-creation journey.

Vadim Struk

Product Manager at Relevant Software

Developing Core Functionalities

Now that you’ve designed a user experience that inspires confidence, it’s time to build the brains behind the beauty. At this stage, your development team or a tech partner will develop the core functionalities of your robo advisor software, as well as the algorithms and features that will power your platform’s investment logic.

Algorithm Development for Portfolio Management

Your robo advisor’s core is an algorithmic engine that offers personalized investment recommendations and manages user portfolios. The development of this engine includes algorithm creation guided by modern portfolio theory (think diversification for maximum returns) and risk assessment models. If you want to make the engine even more powerful and responsive and improve your robo-advisor performance, add AI and ML technologies. They will let your platform customize investment strategies and better adapt to market shifts.

Modern portfolio theory and risk assessment are great building blocks, but to truly stand out, consider a hybrid approach that combines these models with the power of AI and ML. Thus, you’ll create a more dynamic and adaptable engine.

Vadim Struk

Product Manager at Relevant Software

Integrating Third-party Services

In our practice, virtually any fintech solution requires third-party APIs to connect with external services and functionalities that enhance its capabilities. Many platforms find it beneficial to integrate with financial data providers or trading platforms to offer their clients real-time market data. You might also need to add payment gateways to streamline the user experience for deposits and withdrawals, while APIs for KYC/AML will simplify your platform’s compliance with regulations and keep your platform secure.

Security Measures

Implementation of strong security measures is a non-negotiable step for fintech software since it deals with sensitive customer information. At the bare minimum, you should adopt end-to-end encryption for data at rest and in transit and firewalls, along with multi-factor authentication to protect user accounts. Compliance with all those industry standards (e.g., GDPR, SEC) is similarly crucial and more about the creation of a safer environment rather than a burden.

Testing Your Platform

The foundation is built, and the engine works – now it’s time to put your robo advisor platform through its paces! You should thoroughly test the platform to confirm it functions flawlessly and delivers a secure, user-friendly experience for your investors.

Unit Testing and Integration Testing

To avoid costly mistakes in software development, one must conduct testing and quality assurance. Unlike other tests that are broader in scope, unit and integration testing allows you to check the performance of core functionalities and individual components and how they work together. We would suggest you use JUnit or Selenium tools that could help streamline the testing process and give you peace of mind that your platform delivers accurate results and operates flawlessly.

User Acceptance Testing (UAT)

The true test of your solution will come from your potential users. UAT involves beta testers—actual users—getting their hands on the platform and using it under real conditions. Their feedback will give you insights on usability issues or areas for improvement that directly impact robo investing performance and effectiveness. Thanks to UAT, your team will be able to make changes and polish the platform’s user experience to better meet client expectations before full public release.

Launching Your Robo-Advisor Platform

Now that everything is finalized, deployment is underway. Your fintech platform promotion is a major part of the launch equation. To spread the word about your robo advisor and attract potential clients, you need a targeted marketing strategy that combines digital and content marketing, public relations, and strategic partnerships.

Post-Launch: Maintenance and Scaling

After the launch, the long-term success of your robo advisor will depend on two factors: continuous maintenance and efforts to scale. Such simple yet critical things like bug fixes, security updates, and performance optimizations will keep your robo advisor platform running smoothly and secure against threats. As for scalability, at some point, your user base will grow, and your platform will need to scale to accommodate increased traffic and data. The most obvious solution would be the use of cloud platforms or dedicated server resources to ensure your robo advisor continues to deliver a reliable and secure experience for all your investors.

Future Trends in Robo-Advisory

The financial industry already relies heavily on technology, and as new fintech products like robo advisors and blockchain-based platforms appear at warp speed, we can conclude that the sector’s dependence on tech solutions will only deepen. That said, we have listed a few trends in robo advisory development our experts believe will shape the future of automated investing:

- The AI’s impact on algorithmic decision-making

We have no doubt that the future of robo advisors is closely tied to AI technology, mainly thanks to AI’s capacity to process huge amounts of data quickly, which is particularly valuable for algorithmic decision-making. Deeper and faster insights will power the algorithm to identify even nuanced investment opportunities or reveal hidden correlations between seemingly disparate financial data. In practice, it means better service personalization for clients and incredible responsiveness to subtle market shifts that potentially will amplify returns and reduce risk for investors. In essence, AI can turn a robo advisor from a rule-based engine into a dynamic investment strategist.

- Potential impacts of blockchain technology on robo-advisors

Blockchain technology, with its secure and transparent ledger system, is another advancement that can bring a few innovations to robo advisor development. Firstly, it could completely change the way fractional share ownership is handled. Instead of a high minimum investment to buy a whole share of a traditional asset, blockchain allows for the secure fractionalization of those assets. It lets clients invest in a piece of real estate or a high-priced stock through a robo advisor, all facilitated by blockchain capabilities. Secondly, the transparency of blockchain transactions reduces administrative burdens for platforms and investors, while regulatory bodies can benefit from easier compliance checks and reporting.

- Anticipated changes in financial regulations

The robo advisor industry progresses, and regulations are likely to adapt as well. We can expect to see a focus on white label robo advisor platform’s standardization and transparency to increase investor protection. We suggest that one of the changes in financial regulations might be the implementation of stricter auditing and reporting requirements for robo advisors. For example, it may revolve around the disclosure of the algorithms and decision-making processes of robo-advisor engines so that users have a better idea of how their investment portfolios are managed.

How Much Does It Cost to Make a Robo Advisor?

The dream of an automated financial advisor might seem complex, but the cost of a robo advisor app development can be surprisingly affordable. While the price tag can vary significantly, estimates typically range from $25,000 to well over $250,000. So, what exactly influences the final cost? Here are some key factors:

- A solution from scratch vs. white label robo advisor platform components

- How many and how complex features do you want to build

- Will you build it in-house or outsource robo advisory software development to an agency

- Integration with current infrastructure

- Compliance with financial regulations

Now, let’s have a detailed look at the development cost breakdown.

| Development task | Approximate cost range | Details |

| Market research | $5000 – $16000 | Research to learn about your target audience’s needs, competitors, and the market through industry studies, surveys, and focus groups. |

| UI/UX design | $2000 – $12000 | Creation of prototypes and wireframes that feature UI and UX. |

| Backend development | $7000 – $90000 | Server-side logic development, database management, the algorithmic engine creation, and API integration. |

| Frontend development | $7000 – $90000 | Development of the user-facing application. |

| Security & compliance | $2000 – $17000 | Security protocols and data encryption implementation, adherence to regulations. |

| Testing & QA | $2000 – $25000 | Unit and integration testing and user acceptance testing to ensure good performance and reliability. |

| Ongoing maintenance | $2000 – $15000 | Constant upkeep – bug fixes, security updates, and performance optimizations to keep your platform running smoothly and securely. |

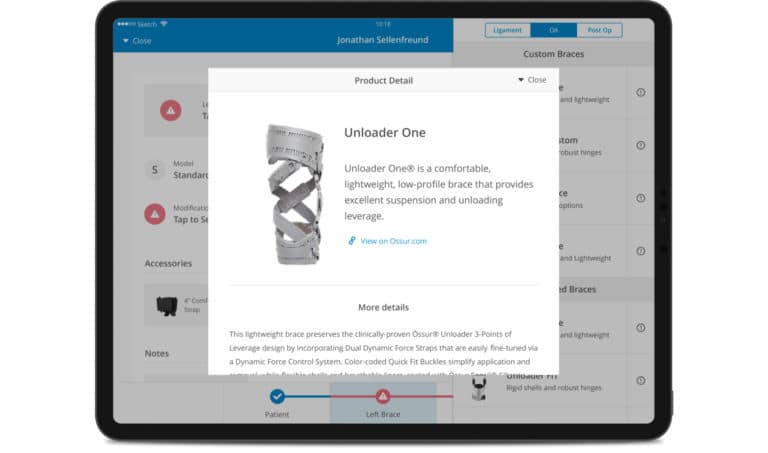

Our Case Studies

We want to share our two case studies, which don’t feature robo advisor functionality as such but are related to financial planning and serve as a bridge between financial advisors and users.

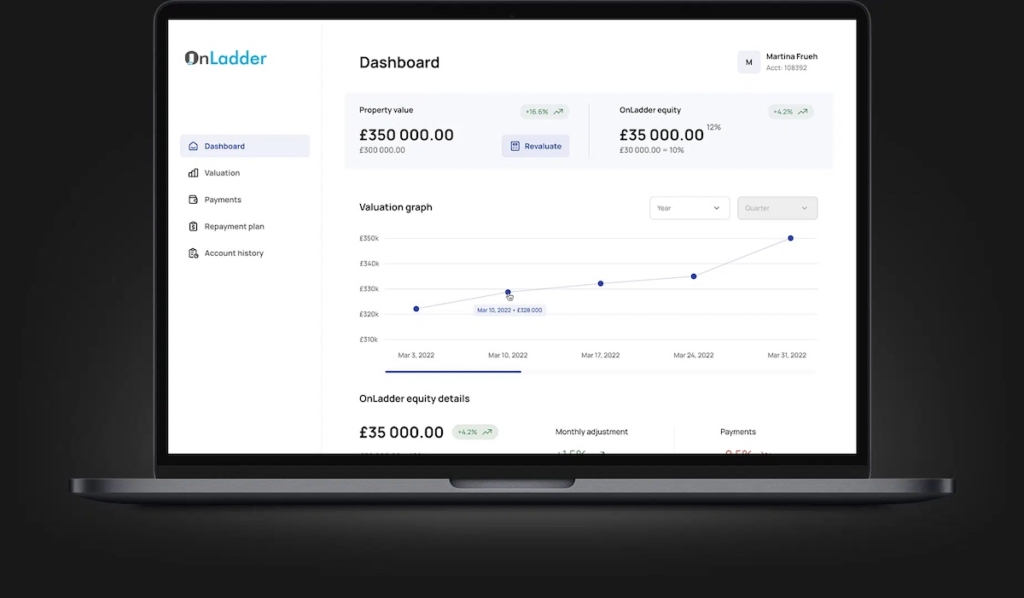

OnLadder

OnLadder, a UK fintech company, offers equity loans to bridge the home deposit gap and make homeownership more accessible. They needed a customer loan data portal with an admin panel for user management and integration with third-party payment and calculation systems.

We designed and built the project from scratch, including UI/UX design and GoCardless payment system integration, to launch a fully functional MVP within a short timeframe. Packed with features like client dashboards, real-time loan information, and staff/admin management, the platform offers all the necessary tools to track and manage equity loans easily.

First Home Coach

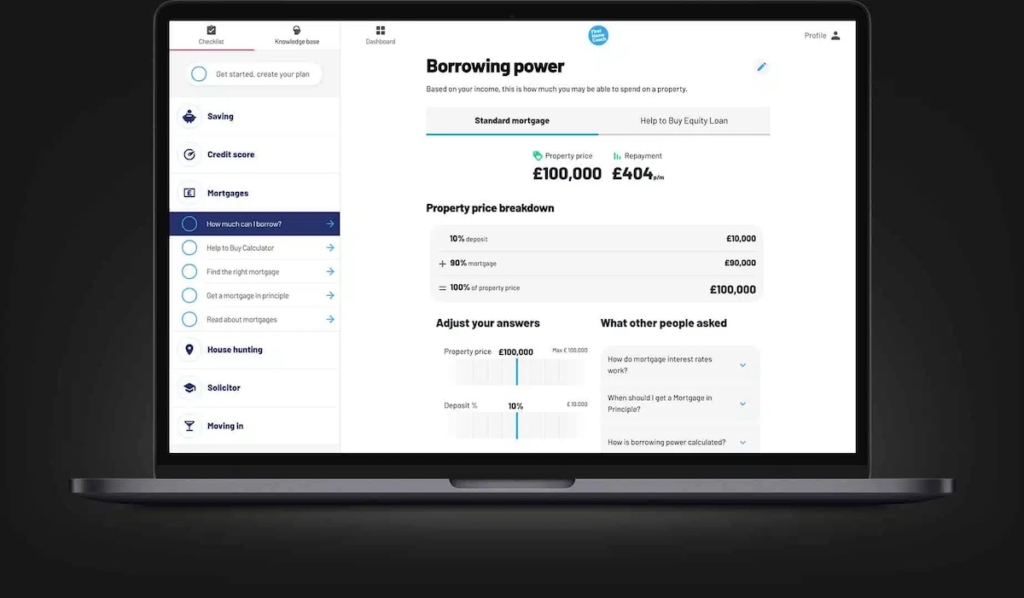

Another software solution we’re excited to highlight in our portfolio is FirstHomeCoach. This UK-based fintech firm helps first-time homebuyers overcome the complexities of purchasing a property (mortgage acquisition, legal documentation, etc.). They needed to build a recommendation engine and algorithm that would make the home-buying process more personalized and smooth while highly secure.

We chose the tech stack and designed the architecture (microservices, clustering, and static typing) and security (security assessment and static code security analysis). This app, built from scratch, offers a property buying plan and deposit savings planner features along with a mortgage calculator. So, we delivered a good-looking and easy-to-use application with a recommendation engine for customized property buying experiences for each user.

Build a Robo Advisor Platform with Relevant

The bespoke robo advisor app will boost the financial performance of banks and any financial institutions. More efficient budgets, accelerated returns, and generally improved clients’ investment management thanks to the automation of routine operations are just some of the major gains.

If you decide to develop a custom robo advisor platform to reap the full benefits, rely on the professional team at Relevant Software. Tell us about your project. We’ll help you develop the requirements and estimate costs to create a Fintech product that improves customer satisfaction and increases your company’s sales.

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us