How is Open Banking Changing the Lending Industry? [Loan Solutions Overview]

![How is Open Banking Changing the Lending Industry? [Loan Solutions Overview]](/media-webp/Open-Banking-Changing-the-Lending-Industry-_Cover.jpeg.webp)

Remember the decision process for approving loans that Jim Carrey’s character used in “Yes man”? Personal, intuitive, and… pure fiction. In reality, lending money usually doesn’t involve looking the applicant in the eyes or listening to one’s heart. It’s a science based on math and data, and open banking loan solutions are here to make life easier for both borrowers and lenders.

Analysts expect the global digital lending platform market, valued at $5.8 billion in 2021, to grow at a CAGR of 24.0% from 2021 to 2028. This growth rate is largely attributed to the digital initiatives that financial institutions are introducing to improve the lending experience for their customers.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

Our article will focus on the real benefits of open banking that can help your lending business move forward and expand. We’ll provide some use cases, look at solutions from the current market leaders, and try to get a glimpse of the industry’s future.

As the open banking ecosystem develops, we’re witnessing a change in the paradigm. Let us explain what we mean by this.

How is open banking transforming the financial services industry?

Banks have been collecting customer data since day one and mainly keeping it to themselves, for that matter. The introduction of open banking sets a precedent for creating a more competitive environment. Smaller fintechs and even non-financial companies can now drink from the pools of data to create new products and revenue streams.

But before we get to that, a proper definition is in order.

What is open banking?

The idea behind open banking is to grant access to customer data aggregated by banks to accredited third parties. The customer needs to give their consent and can control who the data is shared with and for how long. The exchange takes place over APIs (application programming interfaces)—software intermediaries that both sides must support.

This approach simplifies the task of fintech software development by providing a convenient source of raw financial data. Having a full and current account of the customers’ demographics and financial standing can help match them with more relevant products and make instant eligibility decisions. No wonder the popularity of open banking solutions is growing by the minute.

Open banking is on the rise

From $17,256 million in 2019 to $171,933 million in 2025: almost a tenfold increase in revenue over six years—that’s what experts predict for the open banking market based on today’s fintech trends and data. Another research projects a 50% yearly increase in the open banking user base.

In the US, the advent of open banking is driven by consumer demand, while in the EU, it’s pushed forward through legislative efforts. Australia, another vast territory and market, has also been introducing regulatory changes to drive the adoption of open banking. Countries such as Japan, Singapore, and South Korea have opted for a market-driven approach, just like the US.

But when it comes to open banking adoption, Europe remains the undisputed leader. The main reason for that favorable position is the legislative support for open banking in the EU. PSD2, or Revised Directive on Payment Services, became effective in July 2018 and is the second version of the original set of rules.

These rules define a competitive financial system based on an exchange of customer data with high standards of security and privacy. All regulated banks that operate in the EU jurisdiction must comply with PSD2, only sharing their customers’ data with TPPs (trusted third-party providers).

With a fresh supply of data to analyze, fintechs, neobanks, and other businesses are jumping at the opportunity to learn more about their customers and extend their financial services. Let’s look at the typical use cases that promise immediate benefits for the industry.

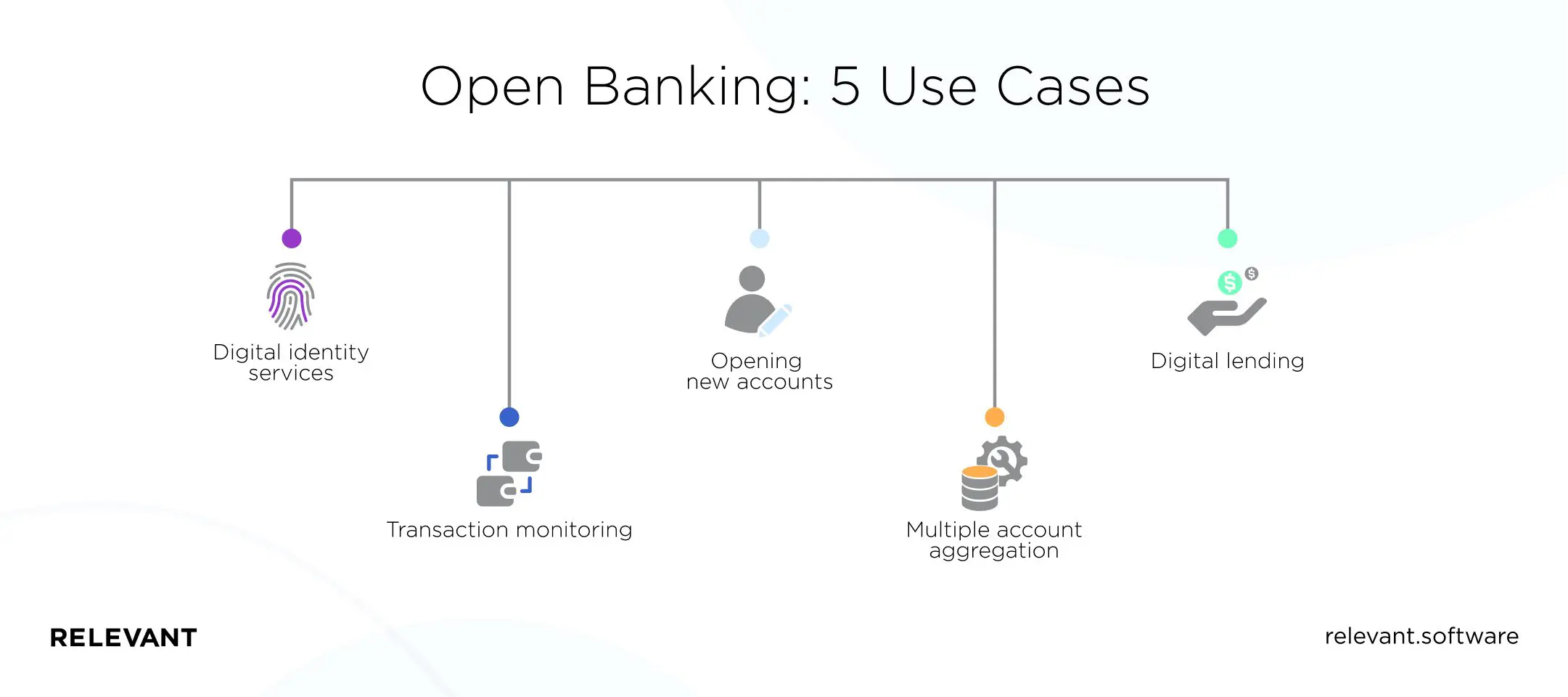

Open banking use cases

Open banking APIs are the cornerstone of the ecosystem. By building new software that can communicate with the banks’ databases through these APIs, market players can attract new customers by offering better financial products. Here are some key areas of finance where the use of open banking can make a difference:

Digital identity services

A digital identity provided by a bank can be used to log in to other financial and even government services. Luckily, secure data storage and transfer are the strong suits of open banking. The APIs enable quick and reliable authentication for all trusted third-party solutions.

Transaction monitoring

Payment providers are required to constantly check transactions for fraudulent activity. Automated analysis of customer data helps identify abnormal behavior in the account by comparing it to the typical profile.

Opening new accounts

It’s usually the customer’s first encounter with a new financial service provider, and first impressions matter. The use of open banking standards allows for an instant transfer of relevant data (upon receiving consent). Registering an account with a new bank or another financial institution becomes a quick and simple task.

Multiple account aggregation

With data readily available across several sources, fintechs can gather valuable insights into their customers’ financial situation and create personalized finance solutions. Before open banking, most of this information was stored in silos, so neither the customer nor the institution could see the whole picture.

Digital lending

Thanks to the open banking APIs, the lender can consolidate the borrower’s data and assess the applicant from virtually every angle. The history of previous loans, credit scoring, current outstanding debt—all of these factors need to be taken into account. The use of open banking can speed up the decision process and help find an affordable loan solution custom-tailored to the client’s needs.

Actually, the lending sector can benefit from adopting open banking in so many ways we’ve dedicated a whole section to it.

How does open banking impact the lending sector?

The lending landscape is quickly changing, and open banking is one of the notable actors reshaping it. If we were to pick one major positive influence, it would have to be the fact that open banking brings lenders and borrowers closer together.

Open banking enables lenders to create products with a pin-sharp focus on the changing needs of today’s businesses and individuals. In return, financial institutions get better chances of repayment and can tap into previously unexplored niches. Borrowers, on the other hand, get a more diverse market with more customized options to choose from. They can also expect less bureaucracy and quicker approvals.

Let’s elaborate. Here’s our quick rundown of the main advantages of open banking for the lending industry.

Healthier competition

Innovation always shifts the balance, and it’s about time it was shifted for incumbent banks. Armed with access to their customers’ data, fintech solution companies can capitalize on this commodity to aggressively compete with the market’s behemoths. This will force traditional banks to regroup and innovate as well, resulting in much-needed improvements in areas like SME loans and student loan solutions.

Just think about it: all your fintech startup needs to enter the market is a strategy, a well-built open banking app, some investment, and a little bit of luck.

Looking for a team of professionals to build an open banking solution for your business? Contact us, and we’ll discuss your idea!

Better tailored financial products

Only those institutions able to offer well-designed products that address the customers’ pain points will thrive. For example, we’ll have to wait and see if the phenomenon of marketplace loans withstands the test of time. MPLs (marketplace lenders) are platforms that directly connect investors with borrowers, charging a fee on transactions.

Open banking loan solutions have every chance of becoming the high-precision, low-maintenance tools today’s lending industry needs.

Improved data security

Personal information is a valuable asset and is rigorously protected by law. Even though many traditional banks are reluctant to adopt open banking, fearing for the safety of their data, they might have misjudged it. Open banking APIs adhere to the highest security standards when it comes to collecting and exchanging data. In reality, most of these banks would be in a better position in terms of security had they implemented those APIs and procedures.

Digitalization

You’d be surprised to know how much time paperwork can eat. When using open banking, the amount of time spent on filling out paper applications or sending and signing documents is reduced to a bare minimum. A paperless solution is a divine gift for any lending business since it immediately cuts down costs and allows the processing of more applications per hour.

Moreover, such a seemingly minor change would signify a massive shift towards innovative practices, likely attracting a younger demographic.

These are just a few of the top advantages—there are so many benefits of open banking for lending, we’d bore you to death by listing each and every one. Which brings us to the next question.

Are open banking loans better than traditional ones?

Yes, open banking loan solutions can improve the borrowing/lending process for both sides, as opposed to the traditional model. Here’s what they offer.

A streamlined application procedure

Instead of filling in basic information every time they apply for a loan, a person or an SBE can simply permit their bank(s) to share data with the new provider. This saves time for both parties involved and gives the lender more input for the initial assessment. It’s especially relevant for smaller consumer loans, where shorter wait times mean a better experience for the customer and more volume for the retailer.

Quicker income verification and affordability checks

A modern open banking loan application can evaluate the borrower’s transaction history and assets immediately after receiving the necessary info through APIs. The process takes minutes and doesn’t require exchanging papers and signatures. Besides getting a better customer experience, borrowers also have a much lower chance of credit denials, which can be very disappointing.

When it comes to making decisions on personal loans, open banking lenders often find the information obtained from banks to be sufficient. It’s a nice alternative to doing a hard pull—an in-depth inquiry with credit bureaus that leaves a trace on a person’s credit score.

More informed decisions

Being able to obtain transaction histories in real-time, lending companies can do a better job of servicing those borrowers with a below-average credit score. The traditional classification puts them in the “near-prime” category.

Also, some individuals or businesses may have had too few interactions with the banking system for regular lenders to deem them creditworthy. Both these groups are more likely to be eligible for open banking credit due to a more precise assessment of loan risks.

As we get into the heavyweight division, there is good news for those looking to use mortgage loan solutions as well. Digital mortgage software connected to open banking allows the lender to see a full picture of the borrower’s financial status.

If recent transactions are in order, this data can amend the credit bureaus’ record, which will result in a higher chance of approval. The same goes for home loans. Financial services like CreditLadder in the UK, for instance, can update a tenant’s credit score by adding data on stable rent payments.

Top 5 open banking loan solutions to check out

Since we’ve started to name names, let’s get you acquainted with some of the best open banking loan solutions. Below are five lending products that represent different segments of the industry.

Koyo

Founded in 2018, the same year that open banking started full-scale in the UK, Koyo is considered to be the first open banking lender in the country. The company focuses on personal loans, promising to complete the approval and payment process in under 48 hours. It’s made possible by the use of open banking APIs. The solution is 100% online, but there’s no mobile app to use on the go.

Fintern

From the moment Fintern’s website loads, you can tell that this lending solution is based on a mobile application. The only way to apply for a loan is by downloading the Fintern app from AppStore or Google Play.

The app offers a set of essential features and a very intuitive interface. By granting Fintern access to their open banking data, the user enables the app’s full functionality. The software will tell the customer how big of a loan they can afford, how long it will take to pay back, and how their data is being used.

Pixieloans

Open banking payday loans, as well as other quick loan solutions, are what Pixieloans specializes in. The company is actually a loan broker, offering to connect the customer with the best loan options for their particular needs. It’s able to do so by leveraging the power of open banking APIs and aggregating loads of user data.

Trussle

Trussle is a mortgage broker with a mission. Namely, “to bring an end to bad mortgages.” The company’s website offers a myriad of options, mostly related to getting a mortgage or remortgaging. All services are free, and one of the main perks Trussle offers is saving big on mortgage payments by shopping around for better deals.

Atom

Atom is a neobank with a focus on lending, and it has fully embraced open banking. Its financial services cover personal savings, mortgages, and business loans. All of this is nicely wrapped in a mobile app that uses face and voice recognition instead of regular passwords.

How will open banking affect future lending solutions?

Looking at the immense variety of online lending solutions, it’s hard to resist making predictions. We can’t say with complete certainty where those fintech trends will take the lending industry, but we do have a few suggestions.

Moving from a monolithic architecture to microservices

This is already happening, and the tendency will only become more widespread. Legacy apps need to be replaced by new ones that are based on microservices—to ensure a longer life cycle, better compatibility, and to allow room for scaling up. There’s a growing demand for reworking software products for the cloud or making them cloud-oriented from the start. Lending solutions won’t be an exception.

Lending as a service

We’ve already mentioned lending as a service (LaaS), only last time it went by the alias of marketplace loans. As you might have guessed, it has to do with the cloud as well. A subcategory of open banking as a service solutions, LaaS is a way for traditional incumbent banks to play a bigger role in the lending game.

Essentially, LaaS is all about creating whole ecosystems, platforms where banks can extend their services via APIs and make them available to a wider audience. This way, customers don’t need to directly interact with banks through traditional channels. But they can have the luxury of using the same, if not better designed, services on the platform.

On a final note

The API-based data sharing ecosystem is coming to every region’s financial market sooner or later, so wherever your business is, it’s best to be prepared.

Investing in open banking loan solutions like a lending app could be a smart move and pay good dividends. The team at Relevant has just the right skills and experience for developing fintech apps, so we’ll gladly offer our help.

We’ve already created a SaaS platform for UK homebuyers and successfully delivered a number of other fintech-related projects. Feel free to browse through our portfolio and check out the range of services we provide: from forming dedicated teams to full-cycle product development, be it for web or mobile. Get in touch, and we’ll discuss your future loan solution.

FAQ

What is open banking?

It’s a practice where banks share their customer data with trusted third-party providers over secure and standardized open banking APIs.Is open banking beneficial for lenders?

Absolutely yes. The information about the potential customer’s financial transactions can help build more accurate client profiles, facilitate credit decisions, cut costs, and ensure better chances of repayment.Do mortgage lenders use open banking?

They do, and if they don’t, they really should. Getting a mortgage involves significant risks and sums of money, so mortgage lenders are first in line to benefit from open banking’s data.What does open banking mean for borrowers?

It means a lot of benefits, including a better overall customer experience, a wider gamut of options, as well as the availability of financial products fine-tuned to their needs.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.