Remittance & Money Transfer Software: Trends, Types, Core Features, and the Development Process

Updated: August 15, 2024

Digital payments have been here for a while. But COVID-19 has sent their popularity through the roof. Nearly 50% of global shoppers are now using digital payments more than they used to before the pandemic.

Yet, the coronavirus isn’t the only one to blame. Modern users increasingly prefer quick and easy solutions with a minimal ecological footprint over paper checks, long queues, and “three-to-five business days.” No wonder the market is brimming with apps like Azimo and PayPal. But not all of them win the hearts of customers.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usIn this article, we’ll explore the latest money transfer trends, types of online payment solutions, their core features, what it takes to build a money transfer application, and how you can start money transfer app development right away.

Table of Contents

Money Transferring Trends

The tech industry doesn’t stand still. If you are looking to enter the market with your custom solution, you should stay updated on the latest trends. Below are a few of them.

Payments via Smart Speakers

Among other things (like booking a cab or getting traffic updates), smart speakers perform well as money transfer platforms: instead of taking the time to log into your banking platform to make a payment, the only thing you need to do to complete a purchase is make a couple of voice commands.

No wonder that smart speakers are booming. The only thing that prevents their popularity from increasing faster is security concerns. So, if you are looking to join Amazon and other giants by building a payment solution based on smart speaker technology, first of all, you should take care of security.

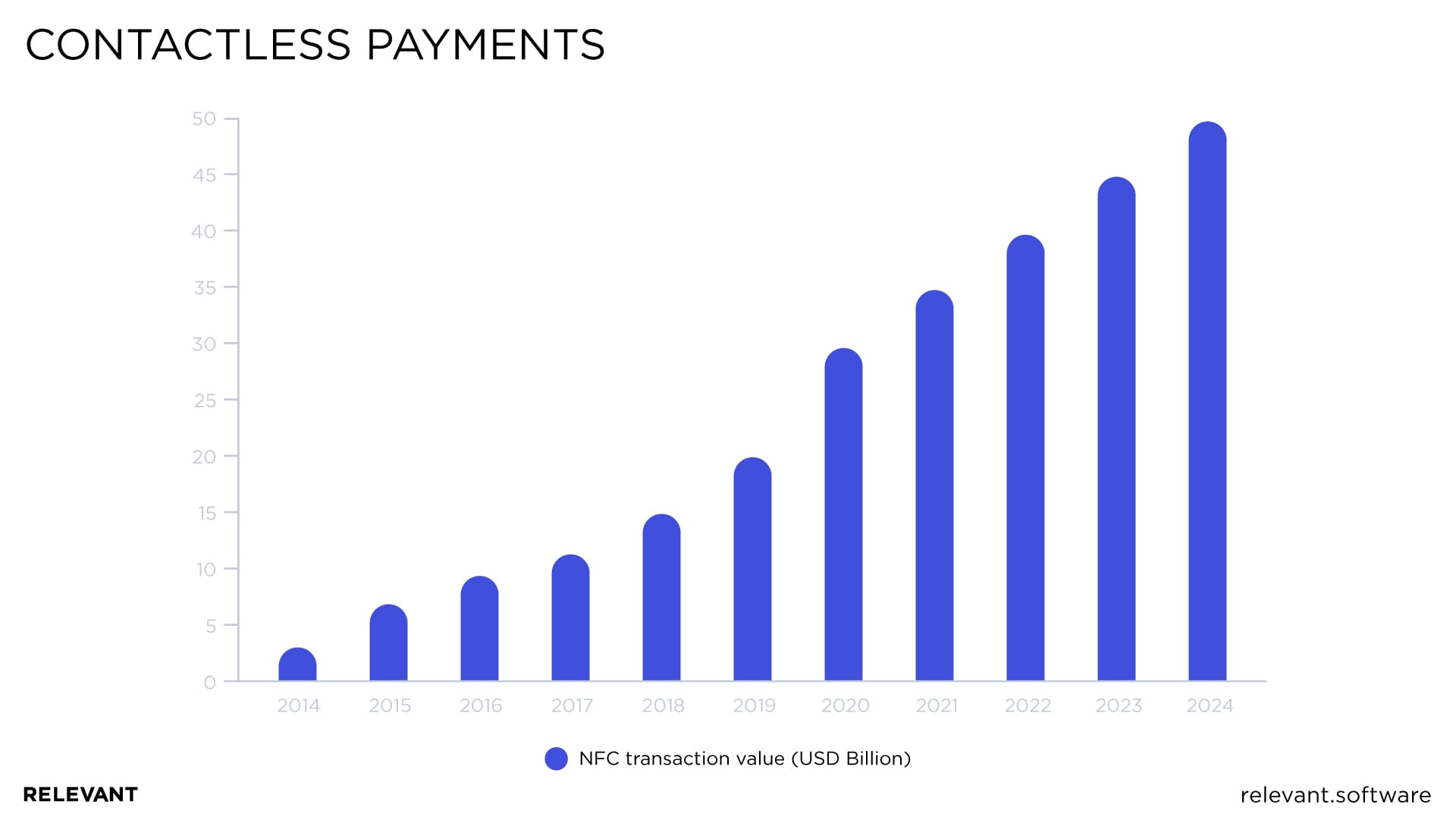

Contactless Payments

During the coronavirus pandemic, contactless payments have soared in popularity as they allow avoiding any contact with surfaces. Based on the near-field technology (NFC), this payment method allows making transactions by simply waving your device over the reader when both are activated.

NFC technology allows making payments through almost any smart device: a smartphone, tablet, smartwatch, and beyond. Besides, NFC payments exclude entering a PIN (the encrypted data is sent to the reading device instantaneously), making it more secure than card-based transactions.

Payments in Messengers

It’s no secret that some messengers are about more than just texting, calling, and sharing media. With varying success, they are also becoming a convenient option for sending and receiving payments. For example, here is how you can send funds to your friend via Facebook Messenger:

- Start a conversation with a person whom you need to send money to.

- Tap the “$” button and enter the amount you want to send.

- Tap “Next” and voila — the money is on its way to your friend.

Yes, that’s right, it takes only three steps to make a transaction via Facebook. And speed is not the only advantage of messenger banking. It is also free and allows (in the Facebook case) sending money to anyone in the world.

Despite the potential of P2P payments in messengers, the competition in the market is not very tough. While WeChat banking is available only to Chinese citizens, Facebook Pay has become available in countries other than the U.S. only in 2020. For this reason, if you have a viable messenger banking solution in mind, it’s a good time to bring it to life.

Mobile Wallets

While we are just testing the waters with in-messenger payments, the number of mobile wallet users grows by 140 million per year.

A mobile wallet solution mimics its real-world counterpart. It allows you to manage all your credit cards, coupons, memberships, and beyond. Big players like Apple, Google, and Samsung already have their own mobile wallets. As the use of this technology steadily grows, more and more companies will have their own mobile wallets in years to come.

What Type of Money Transfer Software Do You Need?

Though staying in the know about the latest industry trends is important for building a custom money transfer software, it is, of course, only the first step. The second step is to decide on the type of software you need. Below, we’ve cherry-picked the most common money transfer app types.

P2P Payment Systems

Peer-to-peer (P2P) payments exclude the participation of third-party financial intermediaries. P2P payments are different from traditional online banking, which implies entering a lot of details to complete a transaction. With P2P payments, it’s enough to know the recipient’s card number or phone number. Known for little to no fees, global coverage, and 24/7 accessibility, P2P payments are ideal for sending money to your friends, paying for goods and services, fundraising, and beyond. PayPal is an iconic example of a free P2P payment system.

B2B Money Transfer Software

Business-to-business (B2B) payments are transactions carried out between two merchants. Unlike business-to-customer (B2C) payments, these are large in volume and much more standardized.

While B2C payments increasingly go online, B2B customers are more “conservative,” with the majority of businesses still relying on paper checks. However, due to the growth of e-commerce, more and more B2B payment solutions with varying sets of features crop up. For example, according to Merchant Maverick, National Processing, Dharma Merchant Services, and Payment Depot are some of the most efficient B2B payment methods for small businesses.

Digital Remittance Services

Digital remittance is a payment sent from a person living abroad. As the name suggests, it’s performed online and doesn’t require a bank account or other electronic wallet. Unlike traditional money transfers, most digital remittance services offer same-day transfers and lower transaction fees while allowing you to track where your money is with an app. Besides, due to the latest electronic ID verification and more convenient sending methods, digital remittance is far easier to use than their traditional counterparts.

Mobile Top-Up Apps

A mobile top-up application is a recharging service that allows you to top up prepaid mobile phones without going to the store and purchasing a top-up voucher. TopUp.com and Ding Top-Up are two of the most popular top-up solutions. Both connect you with over 400 mobile operators worldwide, allow you to recharge your own phone or that of your loved one, and store your payment details to streamline the top-up process.

Electronic Bill Payment Services

True to its name, an electronic bills payment service is a software program, an app, or a website designed to make paying bills fast and easy. While varying in price, convenience, and reliability, such applications allow users to pay all their bills from one place. Other functions may include set-it-and-forget-it automation, same-day payments, or juggling bills. Prism, Quicken Bill Pay, MyCheckFree, and Paytrust are some of the most common examples of bill payment solutions.

Money Transfer Software Essential Features

As shown above, money transfer solutions fall into different types based on their primary purpose. Yet, there is a list of features most of them have in common:

- Sign up/sign in. Keep it as simple as possible while providing all the vital information about the platform.

- Two-factor authentication. Security is the primary concern of online banking users. Show them that their data and finances will be strictly protected with two-factor authentication. Include biometric authentication (Face ID/Touch ID).

- Send/request money (generate invoice/pay a bill — for B2B solutions). This is the main function of your application. Make sure it performs properly.

- Templates. The ability to create customized templates based on previous transactions will facilitate instant payments and improve customer experience.

- Payment status/history. Make sure that your users have all pending and completed transactions at their fingertips.

- Notifications. Keep your customers updated on any information related to transactions with push notifications and SMS alerts.

- Money transfer to/from a bank account. Your users should be able to replenish their digital wallets whenever they want.

- Data protection. Two-factor authentication is essential, but it’s not enough. Provide your users with the highest data protection level by complying with legal requirements. You can offer additional authentication layers, build your product based on blockchain, or leverage artificial intelligence.

- 24/7 support. Make sure that your users are able to reach you whenever they need help.

No money transfer solution (with some exceptions, of course) can succeed without these features. Yet, when it comes to developing money transfer software that stands out from the rest of the pack, these functionalities alone won’t suffice. Your next task will be to compile a list of additional features that will depend on your app type and its business tasks.

Money Transfer Software Development Stages

As you can see, money transfer applications vary in types and features. Yet, the top-up service and peer-to-peer money transfer software development processes are, more or less, the same with the following stages:

- Regional market and target audience research

- An enjoyable user journey

- Money transfer portal development

- Building CRM and user management modules

- Working on reporting and accounting

- Building a user-friendly UX

- Ensuring compliance and security

Let’s discuss each of them in detail.

Regional market and target audience research

Customer satisfaction is paramount for any product’s success, be it a corporate remittance solution or an app like Azimo. Given that, first and foremost, you should find as much information about your users and competitors as possible with the help of regional market and target audience research, which might include the following steps:

- Define and analyze your potential competitors

- Define your target user group

- Explore its behavior with respect to your subject of research (Why do they transfer money? When and through which channels? And so on) with the help of surveys, focus groups, and questionnaires

- Create user personas

Without the knowledge acquired during this research, it may be that your product never reaches the intended customers.

An Enjoyable User Journey

The user journey is a timeline of how a user interacts with a product to achieve a certain purpose. A detailed user journey map allows designers to see a product from a user’s standpoint. Building such a map, you will most probably do the following:

- Define what expectations each user persona has about each interaction with your product

- Define channels for each expectation (for example, “send money to a relative abroad” is an expectation while “a bank or a digital money transfer app” is a channel)

- Define what motivates users to use your product

- Sketch a scenario for every expectation

- Consider a user’s emotional state during each step of a scenario, identify emotional ups and downs (this will reveal areas that require refinement)

- Check the probability of the scenarios with usability testing involving real-life representatives of your personas

Make sure that all your team members have seen the user journeys and develop the product based on them.

Money Transfer Portal Development

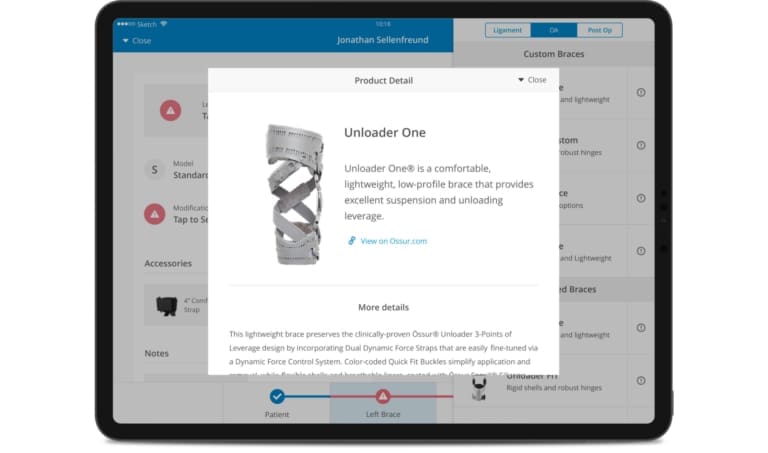

During this stage, your experts will work on the core part of your product. The money transfer app development process will include building the key money transfer functionalities (described in the previous section) and features specific to your product. The latter might include the ability to pay bills, top-up phones, earn bonuses in referral programs, artificial intelligence frills, and a lot more.

Whatever set of features you choose, keep in mind that your tech stack will vary depending on the app type, whether web or mobile.

Building CRM and User Management Modules

Any money transfer app consists of different user interfaces based on user roles. The latter vary from product to product and may include: Admin, Cashier, Auditor, Customer, and so on. Thus, you will be able to monitor user activity and if needed, activate or deactivate accounts.

Besides, you should be able to manage all interactions with all your current and potential customers. That’s why building a CRM for your needs is also necessary. A robust system will allow you to see your product’s weak points and run your marketing activities more efficiently.

Working on Reporting and Accounting

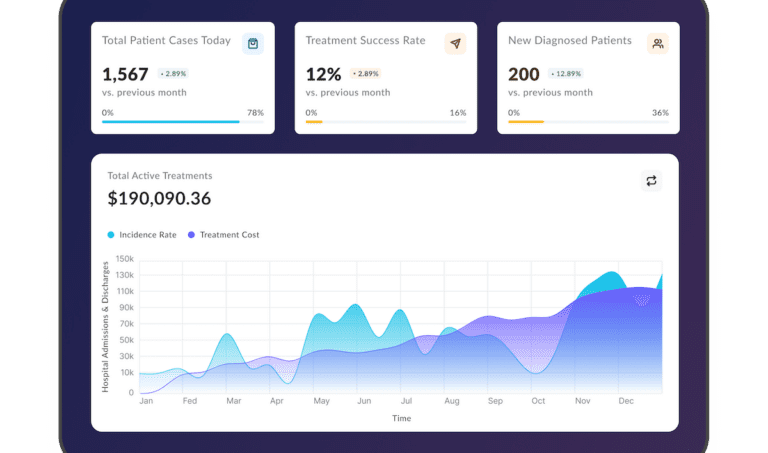

Real-time tracking and historical data availability are must-have features for every money transfer application. Ensure that your users can monitor their transactions and generate advanced reports and balance sheets.

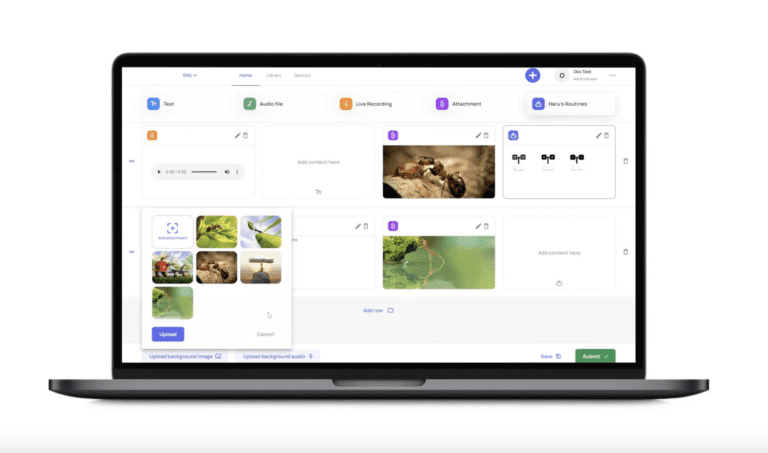

Building a User-Friendly Interface

One of the main reasons users abandon traditional banking and opt for digital alternatives is that the former is slow and complex. So, make sure that your solution doesn’t have such attributes. Here’s what we recommend paying attention to:

- Flawless access through all intended devices

- Multilingual access for all user roles (for global solutions)

- Intuitive UI

- The ability to work in areas of limited connectivity

- All features work without a glitch

Ensuring Compliance and Security

Digital banking solutions are, without doubt, increasingly attractive targets for hackers. That’s why security should be your primary concern. Make sure your product is KYC and AML compliant, all sensitive data is encrypted, introduce two-factor authentication, restrict access to the vulnerable parts of your system, and set up session time limits.

Let’s Build a Money Transfer Application for You

Needless to say, building custom remittance software or a money transfer app requires a lot of time and effort. Before the first line of code is written, you should:

- Analyze market trends while keeping in mind all the essential features of a money transfer application

- Decide on the type of your custom solution

- Study your target audience and create user journeys based on it

Fortunately, with a team of online banking experts (you’ll need at least 15 professionals), you’ll be able to build a solution that complies with the criteria enumerated above. But what if you don’t have the needed in-house talent? Well, there are at least three options at your disposal:

- Hire the missing talent.

- Find a suitable remittance and money transfer software development services provider (both processes can take a while).

- Outsource this task to Relevant Software (us).

We are an offshore software development vendor. Among other services, we specialize in developing remittance software, building P2P transfer apps, developing custom B2B transfer systems, and other world-class fintech solutions. Our financial products stand out due to their focus on customer satisfaction, swift centralized data collection and processing, as well as the application of the best-performing cybersecurity and compliance practices.

With that being said, if you are still looking to outsource money transfer software development — just drop us a line!

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us