How to Build a Personal Finance App like Mint in 2025

Updated: February 8, 2024

As consumers continue to grapple with financial uncertainty caused by the coming recession, budgeting apps have become a popular way to track expenses and save money. According to the study, the top 10 finance planning apps saw an average 56% increase in downloads over the past five years. It has made personal finance app development highly profitable.

Probably, the best example is Mint – an app that has become the de facto standard in the fintech industry. In the beginning, it was just an investment tracker with a few options, and now it has transformed into an AI-enabled financial counseling platform with 25 million users.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usSo if you’ve to break into fintech, developing a Mint-like app could be a perfect choice to reach customers who want to control their budgeting and spontaneous spending. And we at Relevant will guide you through this process. We’ll cover the latest trends, must-have features, pricing structure, and technology stack based on our experience building an app like Mint. So let us begin!

Table of Contents

Personal Finance App Market Review

Whether budgeting, planning to pay off debt or keeping track of your credit, your financial life needs ongoing control. And what could be more convenient for this purpose than a mobile application that anyone can install on a smartphone or tablet? This accessibility has determined that mobile applications, not web versions, have become the most promising segment in the finance industry. Today, almost every user has installed at least one banking or financial application on their mobile device.

Although money management techniques are quite complex, modern finance applications make them much easier and clearer. Unsurprisingly, the personal finance app market is growing at a CAGR of 5.7% and will reach almost $1.49 billion by 2026. These predictions generate high demand for personal finance app development in the coming years.

Budget App Market Trends And Major Players

Creating a personal finance app is challenging if you don’t know your users and why they need such software. But things get even more tricky if your budgeting app can’t keep up with the tough competition. Therefore, before developing an application like Mint, let’s get acquainted with some of the direct competitors of its product in the financial market:

- Mint. The budget planner app allows connecting bank accounts and credit cards to keep track of your income and expenses. It provides spending-based budget targets, including an overview of the daily budget. These goals may be changed and expanded in the future.

- Mvelopes. It is another alternative to the Mint that uses digital envelopes to help users control and manage their capital. The app helps handle your finances and save a part of your income (approximately 10%) from otherwise being spent.

- EveryDollar. The app lets users visualize their income and expenses to quickly analyze and manage their finances. They can also add budget-appropriate categories and see where they go over or under budget.

- PocketGuard. Using PocketGuard, users can link all their bank accounts in one place and keep track of their income and expenses. This Mint alternative will highlight how much money they have for spending and notify them if they go over budget.

- You Need a Budget (YNAB). It is an individual finance and spending tracker application that can save up to $600 in the first two months and over $6000 in the first year.

Banking apps are also in the game

Traditional banks are also actively developing the segment of personal finance management. Today, almost any banking software has budgeting features, such as Alliant Mobile Banking or Ally Mobile. And yes, they can compete with your future product. The good side is that you can also sell the application to the bank.

Chatbots and virtual assistants treading on heels

Besides banking apps, your competitors will be FinTech chatbots working in the same segment. They can be added-on components on platforms such as banking or standalone apps. They keep track of spending, offer budgeting options, and provide personal finance advice conversationally. Cleo, Plum, and Digit are just a few FinTech chatbots on the market to observe.

The audience is getting younger

About 25% of the world’s population is under the age of 15; this number increases yearly. Therefore, many personal finance management apps target a younger audience. For this reason, apps that teach kids and teens how to manage their personal finances have become popular—check out Greenlight, Plan’it Prom, and BusyKid, for example.

Cryptocurrencies are not going anywhere

The ability to connect crypto-wallets the same way as you do bank accounts is lively for an app. Allowing users to track and manage their crypto expenses has become a competitive advantage. Apps like Mint allows managing Bitcoin balances. Other solutions, such as OSOM and Coinbase, are focused primarily on managing crypto wallets and trading cryptocurrencies.

Multifunctionality is on-demand

A personal finance app should track income and expenses, give users financial literacy, help streamline their budgets, and thus facilitate personal wealth management. All this requires rich functionality, as evidenced by the most popular personal finance apps.

What Do Customers Expect From Personal Finance Apps?

When figuring out how to build a personal finance app and launch it, you must consider the minimum set of features required by the market. However, to make it onto the FinTech software leaderboard, you must meet users’ needs slightly more than they expected. How exactly? Let’s discuss the nice-to-have features that might motivate customers to choose your finance solution over your competitors.

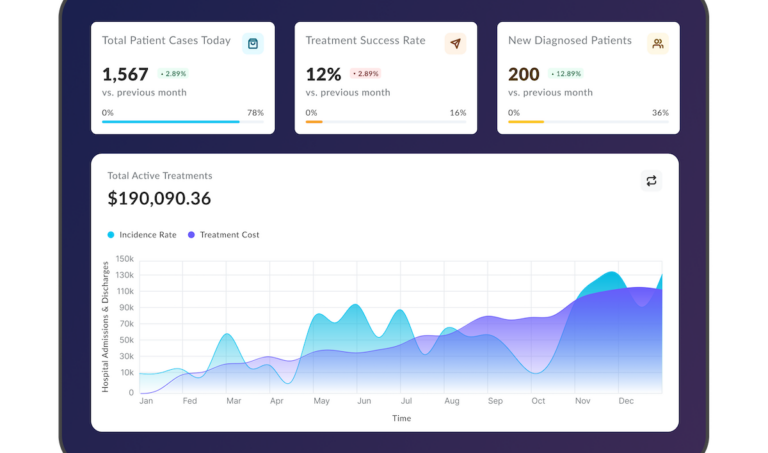

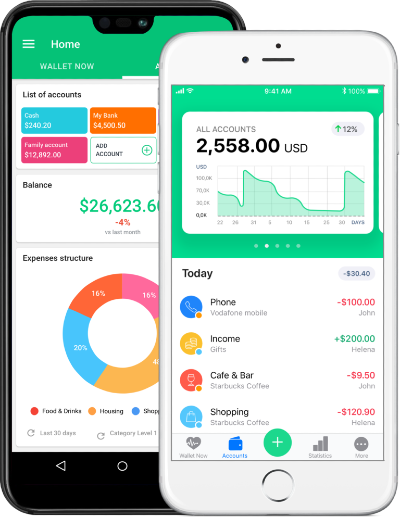

Data visualization

Infographics, charts, and dashboards are necessary for a budgeting app because they attract attention and impress users. Also, displaying data in charts and infographics makes the information understandable and manageable. Check out the functional dashboard in Airthings, where Relevant’s engineers helped the Norwegian tech company to visualize air quality data in a user-friendly interactive format.

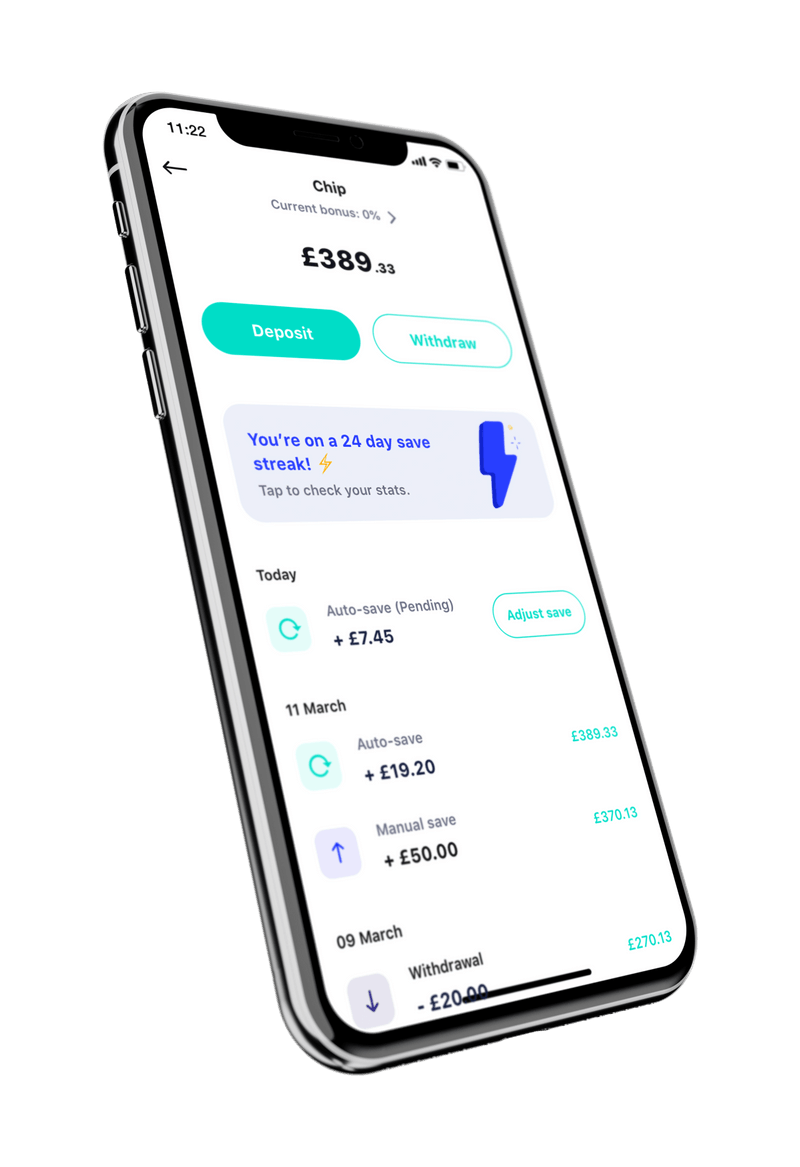

Gamification

A personal finance mobile app like Mint is not meant to be fun. But it doesn’t have to be boring. Gamification involves game-like elements in a budgeting app to encourage engagement. You can add features such as a points system, rewards, and achievements to keep users interested and stimulate cost savings or something else.

Look at our case, where Relevant’s team gamify Kaizo’s management platform for support teams. Our engineers established a scalable and maintainable solution with stunning UI/UX. The gamification of customer support led to increased user motivation and improved engagement.

Strong security and standards compliance

In any kind of app, sensitive data has to be secured. But security is especially vital in a budgeting app since it has direct access to a user’s financial accounts. According to this survey, financial/banking data is the kind of data people fear losing control over the most. That is why high security is a must for a budgeting application.

Moreover, a personal finance management app must adhere to modern data processing and management standards, such as GDPR and ISO 270001. For that matter, always build apps with secure cloud infrastructure, and conduct penetration testing and security audits. And if you don’t know how to comply with the standards, ask Relevant’s consultants.

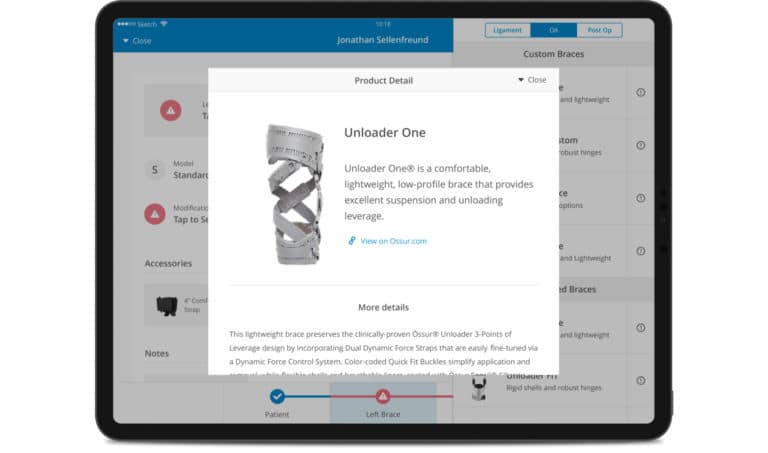

Integration with banks and payment systems

The obvious advantage of a budgeting app is the ability to link all your accounts together. Thanks to this convenience, an app can cover and monitor all user finances in one place. However, the budgeting application must support integration with various banks and payment systems to make this happen.

AI-powered financial assistance

Using AI, you can deliver deep insights into financial coaching with suggestions and recommendations to effectively regulate their expenses to reach goals. Furthermore, AI technology can automatically categorize expenses and show a holistic picture of which category users spent more money on. It allows you to significantly personalize your finance app and be ahead of the competition.

Customer support and consultation

We hope your budget tracker & planner app will run like clockwork and users don’t have any questions or complaints…but anything can happen. Therefore, 24/7 support, consultations, and prompt customer service won’t hurt either.

What Features The Personal Finance App Must Have in 2024?

In this section, we introduce the features of personal finance apps that are fundamental to apps of this type and will help you learn how to build a personal finance app, a budget app like Mint. What features will be in high demand in 2024?

Analytics and reports

Using this feature, users can keep track of their financial activities to manage and save their money properly. Due to well-organized data, users can get daily, weekly, monthly, and yearly reports to see income, expenses by category, summaries of payees, forecasts, etc.

Synchronization

Users of a budgeting app will want all their money to be easily accessible on the same digital platform to view information and data about their financial situation. Your application must sync all user accounts, debit and credit cards, etc., to get the relevant information. This allows consumers to view info and data from all accounts in one digital environment and better manage their budget.

Registration and account creation

Any app starts with registering and creating an account. But when it comes to finances, authorization and security require special attention. The best practices for protecting sensitive user data are two-factor authentication, fingerprint or voice recognition, and the generation of a unique security code.

Budgeting and expense categorization

You should provide a budgeting option for users to plan their spending for a week, a month, or several months. Let your users set spending limits, and the app will notify them before overspending. Another awesome feature is to show your users exactly what they spend their money on. A budgeting app can provide categories for expenses and automatically categorize users’ transactions to track their spending effectively.

Investment tracking

The feature lets users track where costs go and where to invest their money. An investment tracker can help users stay on top of market benchmarks and monitor all their asset allocations, such as brokerage accounts, real estate investments, mutual funds, IRA investments, etc.

Notifications and alerts

This feature is required for the financial application, so we recommend adding it to the functionality. But make sure the reminders are timely and non-intrusive. You can also consider other push notification scenarios, for example, notifying your users when their goals are met or reminding them to stay on budget.

A Brief Mint Overview

Mint is a fantastic example for businesses looking to gain market share with a personal finance management solution because it offers a variety of key benefits, such as automation and robust security. There are, however, certain disadvantages. Let’s take a closer look at Mint.

| Mint’s Functionality | Pros | Cons |

| Accounts aggregation Categorization and budgeting Setting financial goals Bill payment tracker Savings tipsInvestments analysis Reports Refinancing Multi-factor authentication Notifications and alerts MintSightsPersonalized offers Help and support | User-friendliness All user finances overview Amazing UI/UXHigh-security Actionable saving tips and financial advice Maintaining credit score Live updates on any financial activity | No support for multiple currencies No support for users from outside the US and Canada Categorization issues No separation between a user’s income and budget Only personal accounts |

How Apps Like Mint Make Money

Mint is free to use. The question is, how does the app generate profit? Well, Mint has a very clever monetization model.

- Freemium. This prevalent monetization method offers a basic set of personal finance app features for free, while extra features are for sale.

- Credit monitoring service. Mint offers basic credit reporting for free. Still, it provides users with the premium reporting service Mint Credit Monitor for $16.99 per month.

- In-app ads. The core idea of this monetization method is to receive payments by showing users third-party ads based on their transaction history. The ad can be in various formats, such as banners, native ads, full-screen ads, or videos. Plus, users can pay to stop seeing any ads.

- Subscriptions. Applying this monetization strategy means your users will pay a monthly fee to use all app’s features.

- Selling aggregated financial data. You can generate revenue by aggregating financial data relating to consumer trends and then selling it to third parties for promotional, research, and marketing purposes. Many apps employ this strategy, including Mint.

- Paid app. This monetization method implies purchasing your app just once and providing users with all its features.

- Referral fees. You make money when users buy the financial items your app promotes. For example, Mint offers services and products like credit cards, insurance, loans, and many more. Anytime customers take Mint’s advice, the app receives a referral payment.

How to Build a Personal Finance App Like Mint: A Step-by-Step Guide

Now that you’re familiar with all the features and monetizing strategies of your personal finance app, it’s time to take a step-by-step guide to develop it.

Step 1. Conduct a preliminary analysis

A preliminary analysis begins with a plan and research into the market and commercial viability of your product. At this stage, the strengths and weaknesses of your project, as well as possible risks, are also assessed. The result of the activity should be evidence of a decision to continue or abandon the project.

Tip from our experts: The study must have a clear and complete scope to ensure essential factors that influence the decision-making process are not omitted.

Step 2. Define your audience

You decided to continue the project, and that’s great. Now it’s time to define your target audience in order to understand your users’ pain points and the problems they want to solve. Only by getting to know your user will you be able to define the feature set and develop an effective marketing plan.

Tip from our experts: Target markets with low entry barriers to having a better chance of success (e.g., students, families, or seniors)

Step 3. Create a list of the requirements

Make a list of requirements for functionality, design, size, number of features, and so on. When the set of features is defined, the next step is to range them by importance. This strategy helps you to determine the most valuable qualities you need to include in the app.

Tip from our experts: We recommend you describe the requirements in as much detail as possible. It will make it easier and clearer for your future team to build a finance app.

Step 4. Choose a tech stack

Once you’ve decided on the features of your personal finance app, you can choose the tools and technologies you’ll need to make this solution a reality. You can choose either a native or cross-platform budgeting app development. If you go with the native approach, you will have to build two separate apps using different technologies, which means hiring two development teams.

Tip from our experts: For an IOS application, developers can use Swift or Objective-C. For an Android app, the team’s tech stack might include Java or Kotlin. To create a cross-platform application for personal finance, these can be Flutter and React Native development frameworks.

Step 5. Assemble a team

Striving to build the “next Mint” amongst personal finance apps, remember that its development will require technical skills and a deep understanding of the market you’re getting into. So you need to find professionals that can build a successful fintech product. One team for building a custom money management app will consist of:

- A project manager

- A UI/UX designer

- At least 2 mobile developers (or more, depending on the project’s complexity and time frames)

- At least 2 backend engineers

- 2 QA engineers

Tip from our experts: By outsourcing app development, you can hire professionals at a considerably lower rate. Outsourcing developers can build an app end-to-end or just be a temporary reinforcement to your company’s capacities.

Step 6. Develop an MVP

A minimum viable product (MVP) allows a team to collect the maximum amount of validated learning about customers with the least effort. Technically, it is the product with the highest ROI divided by risk.

Tip from our experts: You must be strategic in deciding which limited functionality to include in your MVP. Once the customer retention rate for the MVP is satisfactory, your developers can scale up the app by introducing more customer-centric features.

Step 7. Select a monetization strategy

How will your financial application generate income? Think about a monetization strategy based on the desires of your specific user base and the strengths of your app.

Tip from our experts: Return to the section on How apps like Mint make money and choose what suits you. You can combine several app monetization methods or develop a unique approach.

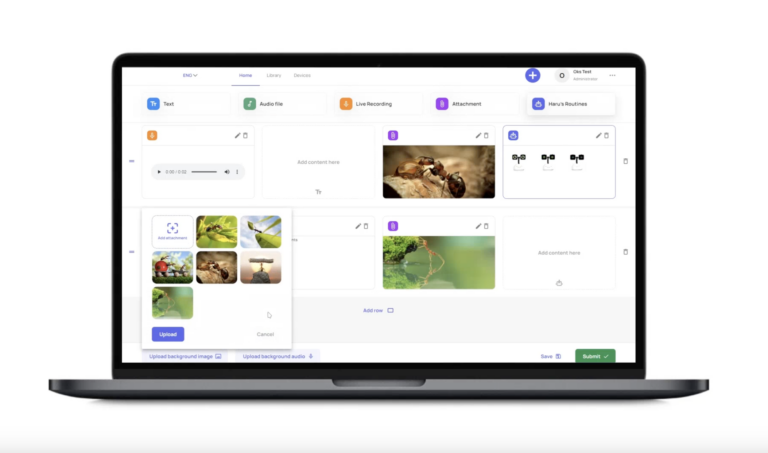

Step 8. Proceed to the UX/UI design phase

When it comes to financial services, UI/UX design must be well-organized, clean, and easy to manage for the users. You must ensure that any option in the personal finance app is within a 3-step accessibility maximum.

Tip from our experts: We recommend balancing minimalism with attractive elements, using simple language, and don’t overwhelm customers. Try to replace the long block of text with visuals such as enticing images or animations to avoid to-read information.

Step 9. Start development stage

The development requires qualified specialists and expertise to implement all the finance app features correctly. When the scope of work is approved, the developers begin to implement the features of the financial application step by step based on the chosen tech stack.

Tip from our experts: At Relevant, we usually assign two experienced front-end and back-end developers to this stage.

Step 10. Test your app

Employ manual and automated testing to check functional and non-functional parts of your finance app. Through manual testing, QAs can discover bugs during the earliest stages of the software development cycle, while automated testing helps achieve immediate product feedback and increase test coverage.

Tip from our experts: Involve testers in the core development cycle to ensure risks are mitigated timely.

Step 11. Launch your personal finance app and keep maintenance

Once everything has been verified, launch your financial application in production. Provide follow-up application support to resolve product inconsistencies, fix bugs, and continue updating.

Tip from our experts: Don’t forget to promote your app through social media, SEO-optimized content, paid ads, etc. Also, to avoid publishing issues, make sure you deploy your product as recommended by the Apple Store or Google Play.

Personal Finance App Development Cost

In essence, developing a personal finance management app, such as Mint, takes 2000-2500 hours. Now, let’s calculate the overall cost of development using average engineers’ rates:

- UI/UX Design: 375 hours x $40 = $15 000.

- Application development (iOS): 780 hours x $36 = $28 080.

- Server-side app development: 920 hours x $36 = $33 120.

- Client-side app development: 270 hours x $36 =$9 720.

- Approximate total cost: $85 920.

Why Relevant?

Collaboration with an experienced team will provide you with a mature development process and a highly qualified team to complete all critical work on time. This way, you can avoid the burden of development and management, ensuring that the solution complies with the fintech industry rules and your business goals.

At Relevant, we provide our clients with the best technologies, tools, and practices to get the idea right. From developing a unique value proposition, we support development through final deployment and post-release support. And it is not just words!

FAQ

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us