ESG Investing: The Ultimate Guide for Startups

Traditionally, the investment decision was based primarily on financial returns. But as the world continues to evolve, with investors setting up new standards, more criteria appear in the decision-making process.

Today, companies’ performance evaluation is measured based on the people around them, their environment, and their responsibilities. These standards, known as ESG, have become essential factors in financial analysis.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

Given the impact of COVID-19 on global economies, investors detected a need to consider ESG strategies as a more sustainable investing approach. Startups have also caught on to the trend – 68% are already applying ESG policies in their company structures, with the rest planning to apply them as soon as possible.

In this article, we will examine ESG investing and why it is crucial for all startups, regardless of their industry. To reveal all the ins and outs, we have invited Bruce B. Simpson, a senior advisor to McKinsey, Tomorrow.io, and Quadfi, as a guest speaker.

What is ESG, and why does it matter?

ESG (Environmental, Social, Governance) refers to the three essential criteria for evaluating the sustainability of an investment. In other words, it’s the yardstick that investors, particularly Venture Capitalists (VCs), utilize to screen the companies for their social or environmental responsibility. ESG investing examines investment principles that produce higher financial returns while creating or maintaining a positive environmental, societal, and governance impact.

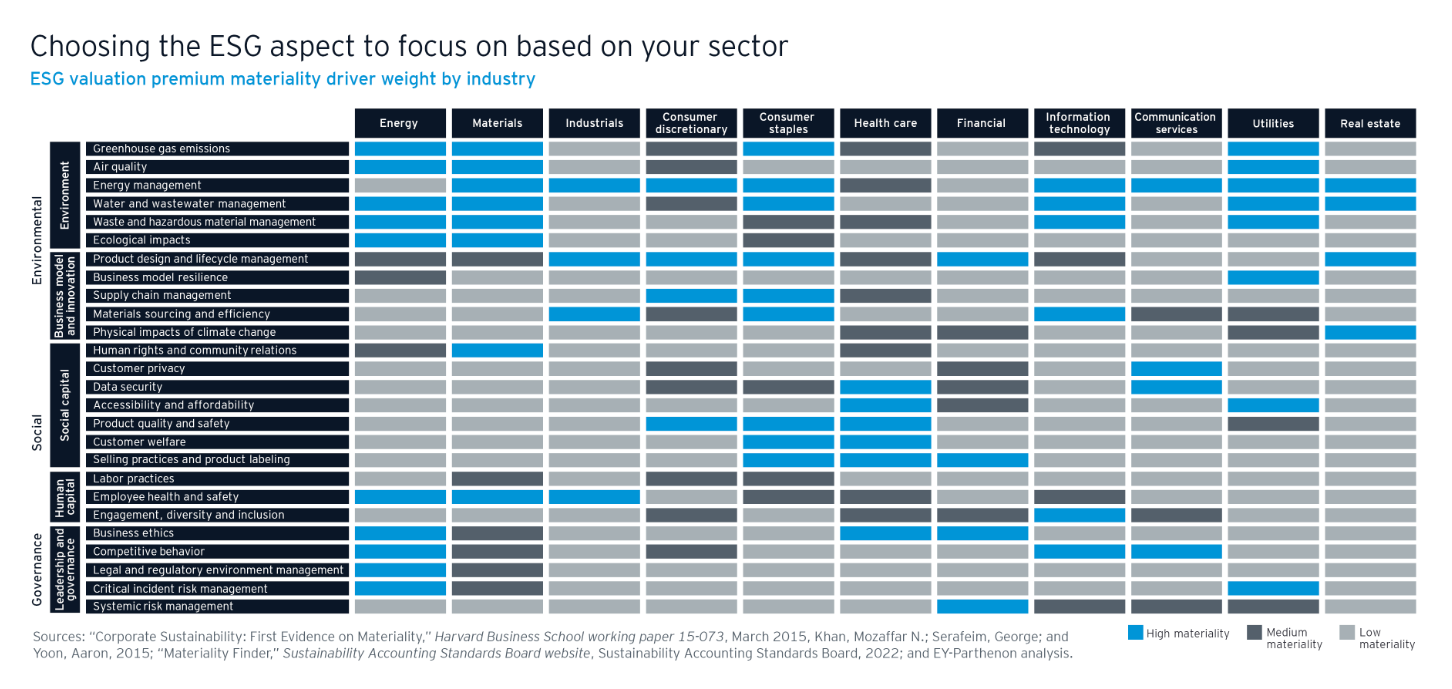

So, how does ESG investing work? ESG investing companies focus on sustainability and its impact on society, so these standards will inform their decision-making. Let’s look at the three ESG investing areas of focus:

- Environmental Issues. With the global depletion of resources and the threat of climate change, investors are adopting the ESG framework for a sustainable future. ESG investing focuses on preventing pollution, combating climate change, and creating sustainable energy.

- Social Issues. The social criteria consider how a company manages relationships with customers, suppliers, employees, and its community. Here it investigates challenges such as working conditions, racial diversity, and health measures at the workplace. It will also look at the company’s ability to stand for social good beyond its area of operation. ESG investing improves brand awareness, the productivity of staff members, and customer loyalty.

- Governance Issues. ESG investing seeks to evaluate and direct investment into well-governed companies and use transparent and accurate accounting methods. It examines the audit committee structure, board composition, executive compensation, political contributions, bribery, and corruption. Fund managers are implementing these ESG strategies into their asset selection to ensure that the companies they invest in uphold these standards.

“It’s useful to marry the concept of purpose and ESG. Where are our greatest strengths? What would the world lose if we disappeared as a startup? Where do our strengths overlap with society’s needs? Ask yourself that question and then develop a strategy to build on those strengths.” Bruce B. Simpson – McKinsey Senior Advisor

How can ESG ratings impact your business?

There are several benefits to having robust ESG policies and credentials. A high ESG score correlates with higher profits, greater consumer demand, and improved resilience and productivity during demanding times. The MSCI World Index survey reported that the average capital value for the highest ESG-scored quintile was 6.16%, compared with 6.55% for the lowest ESG-scored quintile.

A Marsh & McLennan report states that Millennials and Gen Z will make up 72% of the world’s workforce by 2029. These generations set the highest value on environmental and social concerns and expect employers to share a similar philosophy. Businesses with high-achieving ESG scores are better positioned to attract adequate human capital and have more motivated and engaged employees.

“Generation Z doesn’t engage as much in community activities outside work as previous generations, but they have the same societal aspirations and bring those to work. They expect the workplace to provide meaning and purpose linked to a strong ESG delivery”. Bruce B. Simpson – McKinsey Senior Advisor

According to the Environmental Defense Fund, 93% of customers will seek to hold businesses accountable for their environmental impact. A statement by PWC found that 48% of customers want companies to demonstrate more progress on social issues and 54% on governance cases. Additionally, 75% of respondents said it was worth sacrificing short-term profitability to address ESG issues.

High ESG scores show that your firm is doing its part to reduce environmental impact, address community issues, and foster an inclusive and diverse workforce. In investors’ opinion, companies with good ESG scores are better prepared to deal with future tasks, foresee beneficial opportunities, and make strong long-term decisions.

Conversely, a company with a poor ESG score or that does not implement an ESG policy can experience significant financial and reputational impacts. It will ultimately erode, or even lose, consumer and investor trust, which may then lead to reduced sales, funding, and investment.

What are the benefits of ESG investing for startups?

Implementing and promoting ESG is critical for startups that want to thrive. The amount of work is large, but there are objective reasons it’s necessary.

1. More investments

Investors find ESG to be an essential factor when vetting candidates. Startups with a strong ESG focus are thought to be more steadfast. They have a reduced risk of social counteraction, civil litigation, or state fines, making funding for “green” ESG startups easy.

2. Top talent acquisition

When attracting top talent globally, ESG policies are topping the charts! Anthesis found that 53% of workers believe a company’s sustainability and good employment practices are important when choosing a company. Creating an open and inclusive workplace culture is beneficial and can attract customers and employees.

3. Better reputation

The next advantage of ESG investing is that it is the best way for a startup to generate good press and positive PR. At such an early stage, any significant coverage can boost brand awareness and put your company’s name in front of many potential customers. Additionally, ESG investing is useful for establishing trust in your brand and increasing its appeal to your target audience.

4. Higher profits

The introduction of ESG factors can boost brand awareness and capture the attention of consumers. In the same way that investors are using ESG to screen startups, so are the customers that increasingly opt to choose brands that respect social and environmental issues.

“If you want to sell a product, you need to be sure that the consumers understand your social stance and that a nice uptick can come if those consumers are also recommending that same product to others”. Bruce B. Simpson – McKinsey Senior Advisor

5. Risk mitigation

Given the current state of the business and socio-economic field, businesses that are not ESG-compliant are at great risk. Bad PR or a government sanction can be especially hazardous for new companies that do not have the capital or brand strength to recover. Also, implementing ESG policies is way easier while your organization is still relatively small.

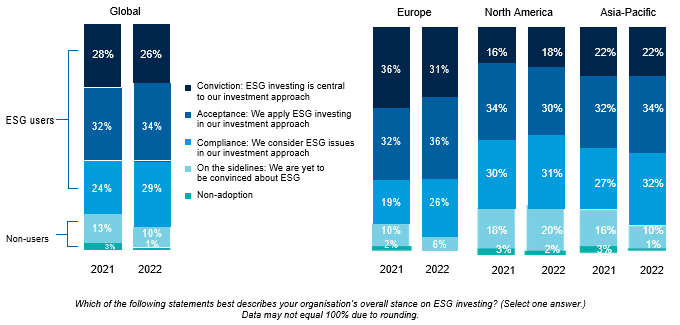

Demand led by investors

Sustainable investing maintains momentum because investors continue to allocate capital to strategies that align with climate, governance, and long-term resilience goals, even when headlines grow noisy.

Morningstar reports that global sustainable fund assets reached $3.7 trillion as of September 2025, despite net outflows in Q3, which shows the category has already moved into mainstream portfolio construction. Looking ahead, PwC projects ESG-related assets under management will reach $33.9 trillion in 2026, up from $18.4 trillion in 2021, and could represent 21.5% of total global AUM. PwC’s survey data also signals that demand comes from the buy side: 72% of investors say they set ESG-related goals for their asset managers at a portfolio level, and 78% say they would pay higher fees for ESG funds.

New technologies help fund managers keep pace with this demand. The internet changed how information is captured and shared, which gave investors more data than ever. Now AI makes it possible to analyze that volume at scale, combine alternative data with disclosures, and spot inconsistencies faster. The result is stronger transparency, because investors can assess how companies operate from an ESG perspective with more evidence and less guesswork.

We’re seeing a much more educated consumer base today with much more technology access. That has democratized people’s ability to understand what’s happening in companies because there’s so much data available. They can make their own decision and then decide whether a company is delivering as it should. Bruce B. Simpson, McKinsey Senior Advisor

RBC also notes that ESG investing no longer carries the same “expensive and lower return” stigma. In its analysis, RBC argues that high-ESG portfolios can align with long-term goals while supporting stronger financial performance, which gives investors another reason to keep capital flowing into sustainable strategies.

ESG vs. Thematic vs. Impact investing

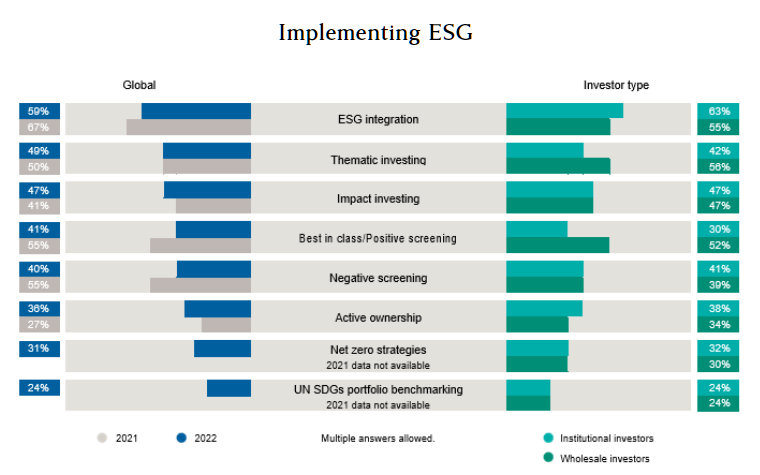

ESG integration incorporates essential ESG factors into investment decision-making to recognize possible risks and opportunities and improve long-term risk-adjusted returns. When checking and excluding ESG, investors apply positive and negative filters to attract or exclude assets. For example, they may be against investing in tobacco companies.

ESG integration, mentioned by 59% of global investors, remains the most commonly used implementation strategy. It represents an approach to embedding ESG comprehensively into the investment process. Institutional investors will probably deploy ESG integration (63% vs. 55% wholesale).

With ESG-thematic investments (49%), investors are looking for a specific ESG-related topic (such as climate, water, clean energy, or gender equality) or trying to solve a particular social or environmental issue.

Regarding impact investing (47%), impact investors focus less on returns and more on intent. However, they may be willing to bear losses until there is a tangible return on investment.

What is the current state of ESG among startups?

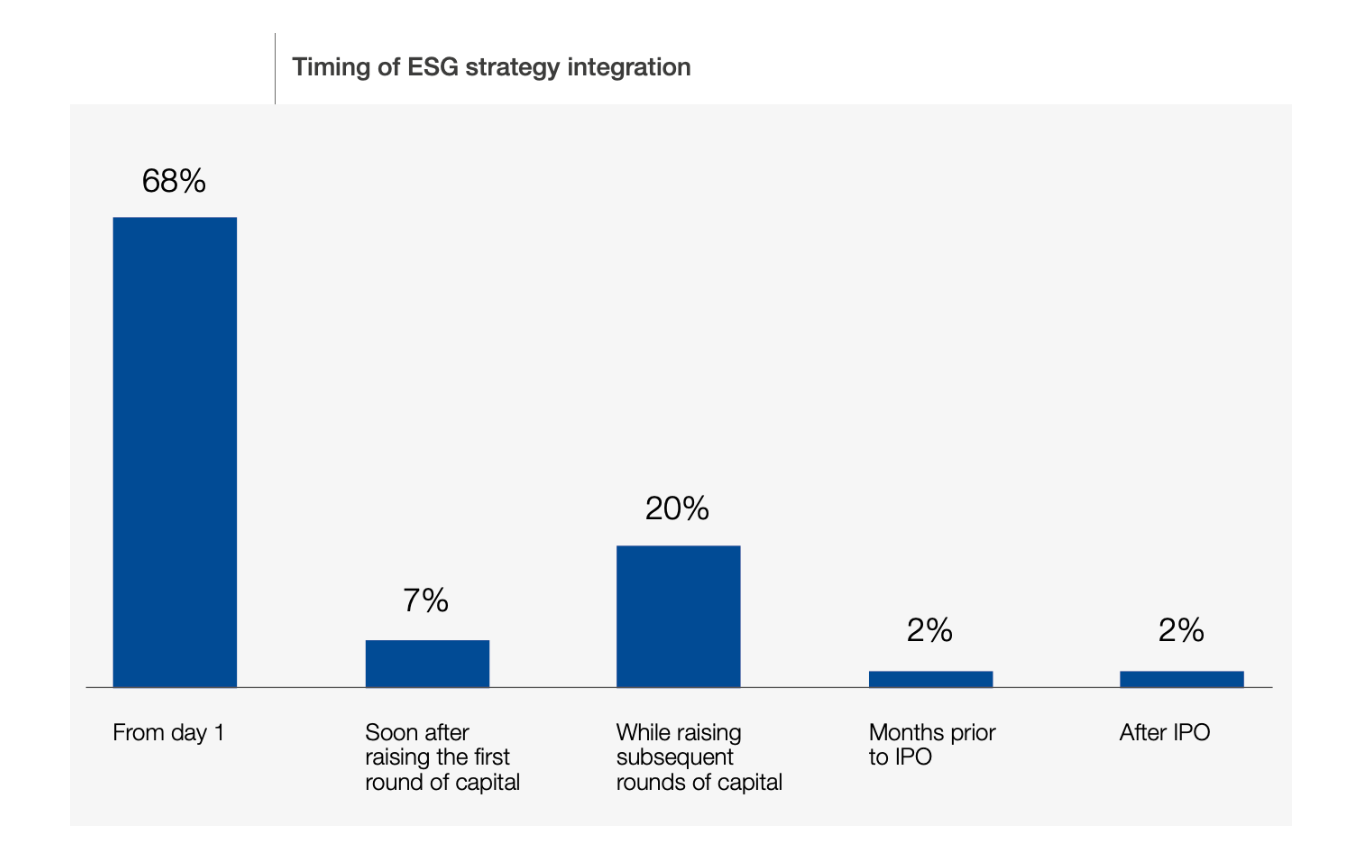

The World Economic Forum conducted a survey and interviewed startup founders from the Forum’s Global Innovators and Technology Pioneers communities. The overwhelming majority of surveyed startups (68%) integrated ESG into their business strategy before most even had a viable product, complete C-suite, or office space.

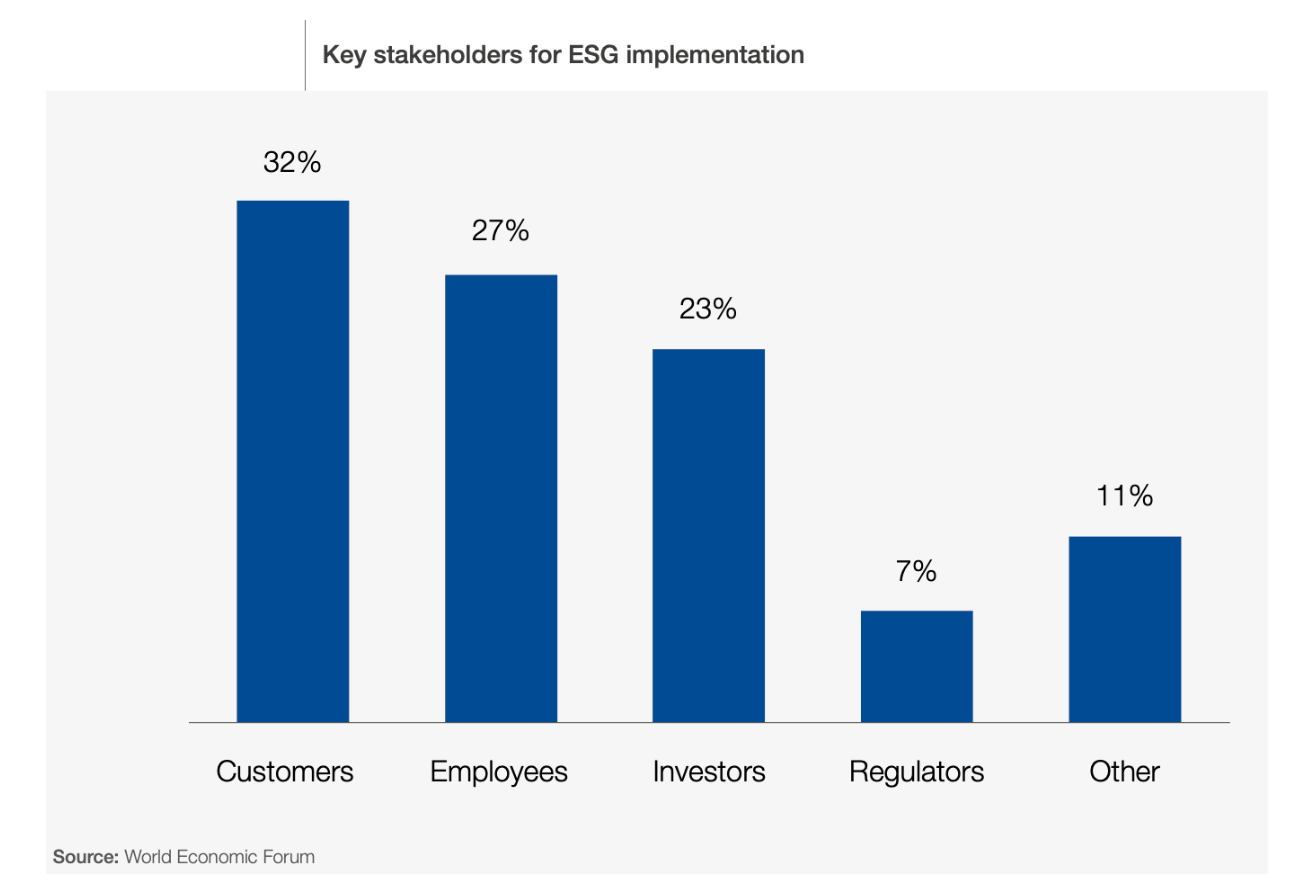

Most startups that participated in the survey expressed the increasing importance of two key stakeholder groups when implementing their ESG strategies: customers (32%) and employees (27%). In addition, pressure from investors (23%) seems to be a forthcoming driver, with possibilities to collaborate closely on crafting the direction.

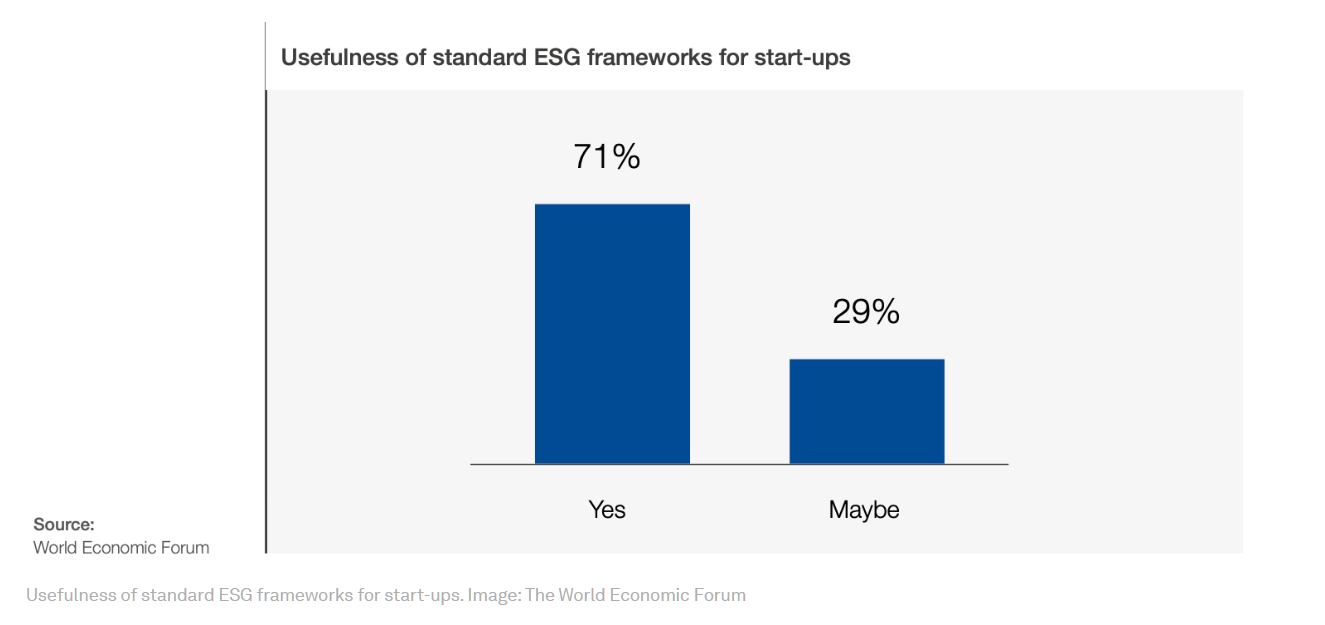

As far as the specific measurement of ESG performance is concerned, there still needs to be methodologies for how startups could practically approach ESG. The current market standards (such as GRI, SASB, etc.) mainly focus on corporations that can dedicate resources to comprehensively tracking all required metrics.

Startup founders have responded positively to the standard ESG framework specifically for venture capital-backed companies, which is currently being developed by some industry communities such as VentureESG and ESG_VC. This makes it easier to track, measure, and implement such metrics, but they need to be more practical.

“Startups bringing revolutionary new solutions to the societal space are growing very fast because of their focus on ESG. Bruce B. Simpson – McKinsey Senior Advisor

Here are some examples of ESG investing in startups with promising business ideas:

- Facedrive – provides a green alternative to car aggregator services like Uber. Their customers can call a taxi, order food delivery, and rent a car that uses environmentally friendly fuel — electricity. The project raised 4.7 million Canadian dollars in 2021.

- Zenyum – a startup, got $13.6m in a series of funding. The company’s product is 3D-printed invisible braces for mild and moderate orthodontic issues. The startup’s treatment process – from diagnosis to treatment conclusion – is digitized and uses 3D visualization technology. The patient’s progress can also be checked by startup doctor partners who passed Zenyum’s training.

- R-Zero – a startup, raised $170 million to develop affordable UV-based hardware, software, and sensors that gauge certain risks to air quality and a dashboard to provide analytics.

- Emitwise – a platform that helps to reduce carbon emissions at all stages of production in an automated manner, raised a total of $6.6 million in 3 funding rounds.

- Greyparrot – a UK-based startup that has created a range of computer vision solutions to help companies in the waste management sector with their next-generation robots and smart systems, has raised a total of $4.8 million.

- Tomorrow.io – a startup that focuses on innovation across climate adaptation, sustainability, and resilient operations, raised a total of $183.9 million in funding over 6 rounds.

- QuadFi – a fintech startup that empowers newcomers with access to products based on their future potential, has raised $112 million.

Sustainability-Focused VCs

Many VCs are interested in investments in social startups, environmental startups, and those under the governance category. This is due to increased awareness of diversity and sustainable and environmentally friendly solutions, such as carbon footprint calculators. Here are some global VCs that support purpose-driven young companies:

- Alter Global – connects Silicon Valley to the best high-growth ventures led by high-character founders in emerging tech cities worldwide.

- Icos Capital – this Rotterdam-based cleantech collaborative venture capital firm is working at the intersection of digital and sustainable industry. Icos Capital is focused 100% on early-stage startups.

- DBL Partners – this is one of the most successful smart green VCs that invested in Tesla, Advanced Microgrid, SpaceX, and Zola Electric.

- Insight Venture Partners – a global venture capital and private equity firm investing in fast-growing technology and software businesses that are driving transformative change in their industries.

- Statkraft Ventures – a VC that seeks fast-growing smart energy startups in Europe. Their portfolio includes DEPsys, Tado, and Parkbee.

Tips on how a startup can embrace ESG from Bruce B. Simpson – McKinsey senior advisor

The faster your startup adopts an effective ESG policy, the more you will get in the long run. Therefore, the key message is to take on ESG from the start. You can also avoid some pitfalls by listening to our guest expert Bruce B. Simpson, who has revised our ESG investing guide with his startup strategy tips.

ESG as an integral part of business

“There is a belief that startups should build a business first and then worry about ESG. But ESG can’t be separated – it is an integral part of the business. And startups have a huge advantage over established companies if they ask purpose and ESG questions very early. That means they can avoid creating assets and supply chains that large companies already have but need to be canceled or reformed, as they must align with the ESG philosophy. By asking ESG questions upfront, good startups can get things right. And they can build an ESG-compliant company from the start.

Security and privacy first

Next, you need to identify the material risks associated, in particular, with the sector in which you operate. So there are, for example, one of the biggest risks for startups is data governance and privacy, or you can lose trust quickly. But you need that trust to build your startup successfully. On the governance dimension of ESG, you should also ensure a diverse board. That’s important because startup investors, institutional investors, or private equity firms commit themselves to various committees on their investments.

Build strong social contracts with employees

In addition, startups must build strong social agreements with their employees. That includes an inclusive, diverse culture and key support for mental health. The way you track whether people burn out matters a lot, as does the level of salaries. I know that all startups pay the minimum wage to survive. But this money should be enough so that the founders, team members, and startups do not look for additional income elsewhere; they have to get enough to stay.

Measure and reduce your carbon emissions

You need to measure your carbon footprint on the environmental side. Again, the carbon footprint is the first area after board diversity that investors have already committed to. Thus, measuring your carbon footprint will help investors decide on giving you funds.

And that’s quite easy because monitoring your utilities and electricity consumption gives you some good data on your carbon footprint. Having a net zero plan, which starts with measuring your carbon footprint, is a big deal. Only 7% of startups have a net zero plan. But your investors are under very strong regulatory pressure in that space. So they’re going to be asking those questions of you. You have to get those critical few right and avoid those mistakes.

“We are consuming the resources at almost twice the rate the planet can regenerate. So if we think about turning off the lights and the computer and using less energy, then that in and of itself would be very helpful for the planet.” Bruce B. Simpson – McKinsey Senior Advisor

Where to find funding?

The source of funding for startups is to choose depending on what sector you are in. If you are in the telecommunications sector, look for a large telecommunications company with a venture capital fund. If you are a fintech, consider banks. But I suggest starting with global incubators because they can provide better access to experts and supporters at the earliest funding stage.

Many of the mentors at the startup incubator have gone through several exits themselves, they’ve run several startups, so they know what it’s like to be in the shoes of a startup entrepreneur. They want to be helpful and also looking to invest. So it’s a good source of expertise and funding without giving away the farm.

If you get ESG right, you can tap into major sources of value, lower risk, and lower cost of capital. In the environmental space, for example, new products and services that have an ESG philosophy are growing three to four times faster than traditional products. And you can also develop a competitive advantage by building ESG relative to companies that are much more established.

Final Thoughts

Startups can have a particularly strong impact on the global challenges we face. Just as they are leading the way to digitalization, they must innovate in the ideas, technologies, and products needed to find the solutions we need.

Venture capitalists who support startups in this transformation will also benefit from the significant commercial value that sustainability investments create, including lower investment risks, higher expected returns, and business models poised to thrive in the long term.

Technologies are crucial in driving business models, products, and services transformations. And we at Relevant are ready to help you. Our global outsourcing company with dedicated software development teams has implemented hundreds of successful projects for big companies and small but ambitious startups.

No matter your current task – digitizing your business, building an MVP, creating a website or mobile app, or testing your fantastic product – we are doing it all perfectly! Interesting? Then contact us!

FAQ

Why is ESG investing important?

According to Forbes, ESG investing is when investors prefer fund companies with high environmental, social, and governance ratings. Independent companies and research groups compile these ratings. Investors are increasingly relying on ESG ratings because of the clarity they provide about companies’ financial and operational performance and how these companies manage a wide range of risks. Global ESG assets are estimated to exceed $41 trillion by 2022 and $50 trillion by 2025. According to a report by Bloomberg Intelligence, this amounts to one-third of projected total assets under management globally.How to get into ESG investing?

Let’s say you’re ready to invest your money in an ESG strategy. Various agencies publish lists of top ESG-rated stocks for investors looking for individual stocks each year. You can start with these lists to identify potential investments that might fit your goals and then build an asset allocation strategy in a diversified portfolio that suits your investment field of vision. However, you can hunt for more than individual ESG stocks. You can also choose funds, just like when investing without ESG. It saves you the hassle of selecting individual companies, allowing the fund or index manager to choose for you. Finding ESG ETFs and mutual funds can also be easier online.What is a Fintech role in ESG?

In business, the innovations in the most progressive companies, ranging from open-plan offices to four-day work weeks, tend to trickle down into the rest of the economy. ESG will likely be the same, and FinTech is an industry perfectly positioned to lead that transformation. The companies working in the Fintech sector are extremely diverse and young. Some of these startups, who resorted to Ukraine outsourcing for product development services, are regarded as the ideal companies for investment by most VC firms interested in fintech ESG. And each one has the potential to become the next Klarna or Revolut and, from there, influence thousands of other companies. It is a mind-blowing time to be part of the FinTech community as it continues to become a force for good in the world.What are the three ESG trends for FinTech?

The biggest ESG trends will influence how FinTech evolves and positions itself within the sector u003cbru003e1. Shifting customer expectations, FinTech companies’ consumers increasingly demand financial products that consider personal values on social and environmental issues. u003cbru003e2. Climate pledgesFinTech is well-positioned to support global climate change efforts, given that many FinTechs offer fully online products with no physical affiliates and can leverage existing business models to innovate and swiftly transform the financial sector. u003cbru003e3. Greenwashing and social laundering risks, like traditional banking and finance, fintech is also faced with the risk of green money and social laundering. Greenwashing is when a company positions itself as green but does not solve environmental problems. The same can be said for social money laundering. Fintech companies must be prepared for ESG to become a subject of stakeholder interest, but must try to avoid greenwashing and social washing.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.