How to Create an Investing App: The Relevant Guide

Updated: August 9, 2022

Apps that help invest money are steadily conquering the market, prompting traditional brokerage agencies, investment companies, and fintech consulting firms to go online. Vladimir Tenev and Baiju Bhatt pioneered free trading by launching the Robinhood investment platform app back in 2013. Since then, lots of stock trading companies see a growing uptake across Europe, the USA, and Australia. All of them are trying to grab a market share by offering a brand new and accessible way to make money off existing savings.

If you’re having second thoughts about investment app development, allow us to point you in the right direction with this step-by-step guide. After all, Relevant has developed several stunning financial products: FirstHomeCoach, a SaaS platform that assists UK homebuyers, and Payroll, an application that automatically calculates payrolls for accounting departments.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usHere’s what you need to know before developing an investment app.

Table of Contents

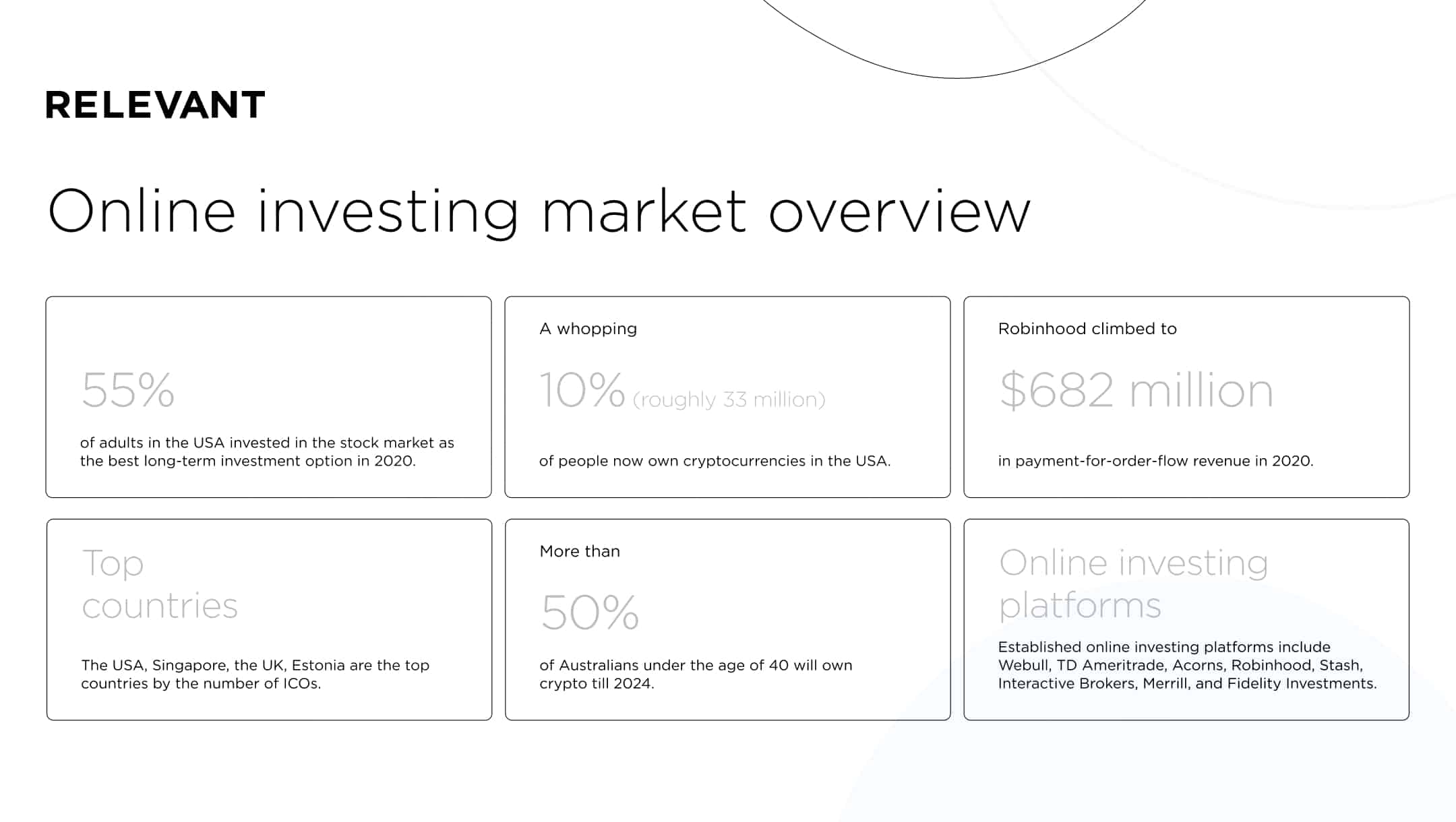

Online investing market overview

First things first. You need to know the market you’re trying to join. This is the gist:

- In 2020, 55% of adults in the USA invested in the stock market as the best long-term investment option.

- Robinhood climbed to $682 million in payment-for-order-flow revenue in 2020.

- A whopping 10% (roughly 33 million) of people now own cryptocurrencies in the USA.

- Nigerians (32%), Vietnamese (21%), Filipinos (20%), Turks (16%), Peruvians (16%), Swiss (11%), Chinese (7%), Americans (6%), Germans (5%), and Japanese (4%) said they used or owned cryptocurrency in 2020.

- The USA, Singapore, the UK, Estonia are the top countries by the number of ICOs. At that time, the USA, Singapore, the British Virgin Islands, Switzerland, and the UK are the top countries by raised funds.

- More than 50% of Australians under the age of 40 will own crypto till 2024.

- Established online investing platforms include Webull, TD Ameritrade, Acorns, Robinhood, Stash, Interactive Brokers, Merrill, and Fidelity Investments.

Are you thinking what we’re thinking? It looks like now is the perfect time to build an investment platform. But what features should it have?

Key features of online investment platforms

If you want to build an app like Acorns or Stash, сonsider some of the most common competitive investment options:

Personal accounts

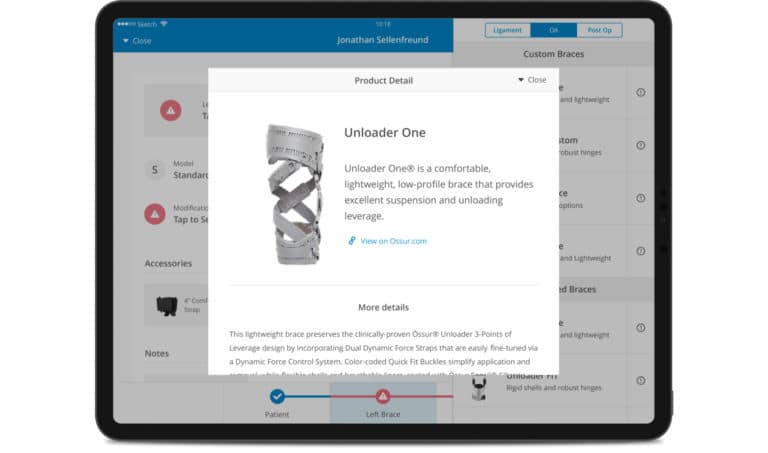

You should build an investment platform as a feature-rich piece of software where people can easily track earnings and performance, review and adjust their portfolio from time to time.

Transaction management

Your stock market investment app should allow clients to transact and invest funds using intuitive tools at their fingertips.

Multi-currency accounts

To engage even more audiences, it would be great if you offer to save and invest in multiple currencies.

Cryptocurrency trading

Provide people with the possibility to buy or sell cryptocurrency within one investment platform app, ensuring trades are happening fast and without system errors.

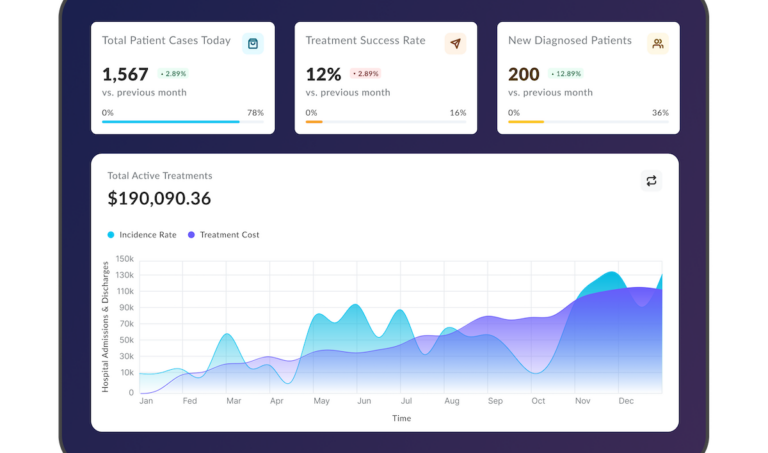

Analytics dashboards

A dashboard that will automatically present information in a user-friendly manner provides insights your clients need for making decisions.

KYC and AML integration

Apps that help invest money should meet the Know Your Customer (KYC) and Anti Money Laundering (AML) fintech security requirements without sacrificing the user experience.

Real-time alerts

Equip users with custom push notifications, reminders, and real-time alerts. This way, you can keep your clientele updated about the stock market status, returns on investments, unusual activity, special offers, and discounts.

Automated counselors

What’s more, think about integrating robo-advisors (automatic online investment assistance) into your fintech software development services.

Investment calculators

Help consumers figure out how they can meet their goals, examining a primary investment, time of deposit, frequency of contributions, and risk tolerance.

24/7 assistance

You should devise ways users can reach out to you if they have questions. So, consider implementing a chatbot, a callback option, or a support team available round-the-clock.

Micro-investing apps

Micro-investing apps are a hot trend, and you should consider taking advantage of it. They allow people to make small and irregular investments from everyday transactions. Thanks to micro-investment options, customers can round up purchases to invest their spare change further. For example, Starbucks’ Caffe Latte Grande at $3.65 will be rounded up to $4 with 35 cents to be invested.

Now that the features are settled, let’s see what else you need to consider before getting down to coding.

What you have to consider when developing the product

To build an online investment platform as smoothly as possible, you should address several challenges at the starting line.

Architecture

The architecture of an investment app shouldn’t differ much from the ones of other fintech applications. Just make sure it is robust, secure, and allows real-time data visualization. Your application should also process large data volumes and provide immediate responses, so account for that in the architecture.

APIs to develop an investment mobile app

Let’s look at some of them:

- E*TRADE allows managing user account data, retrieving option chains, searching for exchanges, getting quotes, and managing orders.

- Marketstack provides data on more than 170,000 tickers collected from 70 global exchanges, covering the Nasdaq and NYSE.

- Intrinio unlocks real-time, delayed, intraday, historical prices, and options.

- With Plaid API, developers can implement the fundamental function of connecting a bank account to your online investment app.

- Xignite can help you with the market data feed functionality.

- Ally delivers self-directed trading and managed-portfolio features.

Bank integration

Having arrangements with banks is a must to get financial information about the app users. Once a client registers and fills in the necessary forms, the information is sent to the bank branch. Then, the bank provides the user’s credit score, their reliability, which serves as grounds for further investment suggestions.

Country and time zone

Investment app development largely depends on the country the connected banks operate in. The thing is, financial laws and regulations that govern branches, along with operating hours, may vary significantly. Therefore, you should ensure the data is extracted from the most recent updates and doesn’t harm the user experience.

Code logging

Above all, third-party integration is crucial to provide proper code error logging, see the reasons that have caused errors, and decide how you can prevent them in the future.

Sandbox environment

When deciding on third-party intermediaries, make sure they all have a sandbox that isolates untested code (and then detonates suspect one) in a safe, controlled environment without risking customer data.

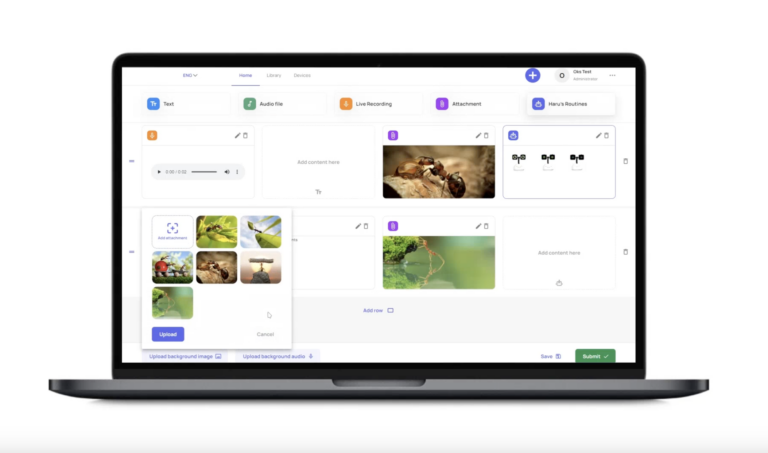

UX design

The users may not know much about investment and the meaning of specific formulas, fields, or forms. To ease their onboarding, give them enough advice, but don’t overdo it with the pop-ups. Also, don’t forget that stats and summaries are shown in large table sheets. So, make sure users can evenly scale large amounts of data and navigate them, regardless of the screen size.

Are you ready for development? Hold on. Let’s talk about the budget first.

How much does it cost to create a mobile app for an investment company?

When building an application, what exactly are you paying for? Investment app development cost depends on:

Business analysis

At Relevant, we start investment app development by analyzing business needs, revealing the goals, and gathering customer requirements.

Design process

Once the planning process is completed, we build wireframes, mockups, and a clickable prototype according to the previous stage’s findings.

Development

After approving design solutions, we get down to coding. We follow the Agile approach, which means the team works in two-week sprints and presents the client with deliverables in increments.

Testing and launch

Depending on the project requirements, we either wait for the code to be written and then test it or test the code continuously throughout the software development life cycle. We polish the app, check how it operates across multiple devices, configure the servers, and prepare it for deployment. Then, we test it again in the live environment.

Post-launch support

After the public release, we keep on tracking your online investment app performance, optimize the speed (if necessary), fix leftover bugs, and provide recommendations for improvements.

Platform management

Your software vendor takes full technical responsibility for setting up and managing the app. So you don’t have to worry about smooth performance. What you will have to do yourself is add relevant content and apply appropriate settings to meet your organization’s needs. Also, you’ll need to manage new staff training and onboarding.

Investment app development checklist

Let us wrap up with some tips to ensure the financial app development runs like clockwork.

- To get a winning online investment app, search for full-stack engineers with domain expertise.

- Don’t skimp on testing costs. A formula may work perfectly well on paper or in an Excel sheet but refuse to work in code.

- The more detailed requirements you write down, the easier it will be for the developers to understand what should be done. This also speeds up time to market.

- Third-party APIs come in handy to address technical issues while developing an online investment app.

- Remember that you are the investment expert, not the coders. It would be great if you conducted workshops from time to time to go through the business logic and the function set. Try to pick the most effective communication channel to interact with the team.

And that’s pretty much it. You’ve done your research and are now ready to start looking for a software development vendor to help you implement your online investing platform idea.

Relevant’s best practices

To provide a fast, reliable, and scalable trading experience, apps that help invest money should be developed using the newest programming languages, frameworks, and libraries.

To win the race, we recommend turning to a trusted software development partner that knows how to create an investing app to reduce your development and management burden. A partner like Relevant. We have experience in developing fintech solutions, and we’re always eager to create more. Contact us today!

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us