What Is RegTech? A Comprehensive Guide to Regulatory Technology

No one dreams of studying regulatory documents all day. Yet, for financial institutions, that’s exactly what compliance can feel like—a never-ending nightmare of forms, checks, and updates. Meet RegTech, capable of turning that headache into a streamlined, automated, and even dare-we-say-it… painless process. What is RegTech, what connection does it have with fintech development services, and how does it help you keep up with the unceasing pace of regulations without losing your mind—or your competitive edge?

As complex as it may seem, this concept was born in response to the exponentially growing complexity of regulations. In 2018, a new regulatory update was implemented approximately every 7 minutes, and this year, nearly 73% of compliance professionals anticipate an even greater surge in regulatory activity. If you’re curious about how regulatory technology can help you maneuver this complex terrain with less stress and more speed, stick around—we’re diving into exactly that.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

What is RegTech?

We’ve briefly mentioned how RegTech originated, but what is RegTech exactly, and how does it help financial businesses comply with regulations.

RegTech (short for regulatory technology) is any technology that automates the tedious bits of fintech regulatory compliance – tracking rules, monitoring risks, filling out reports, flagging issues—so you don’t have to. Considering there’s a new regulation to follow every time you blink, the existence of tools that take the tedious tasks of updating your systems as soon as rules change is a godsend.

Today, you have to comply with anti-money laundering; the next day, it’s data protection, and let’s be honest—keeping up can feel like chasing a moving target. Frankly speaking, manual compliance is a total headache. It’s slow, prone to mistakes, and, let’s face it, boring.

RegTech tools are built to monitor regulatory changes, analyze risks, and automatically update systems to ensure the company’s processes are in line with the latest rules. They cut down on human errors and save your team valuable time, which also means the avoidance of costly fines that come with non-compliance. And here’s something to think about—34% of companies have reported losing business opportunities simply because they lacked a crucial certification.

Reg tech helps prevent that by ensuring you’re always up to date, meaning fewer lost deals and more peace of mind. In essence, it takes care of the regulatory mess practically without human oversight, so you can sleep soundly at night.

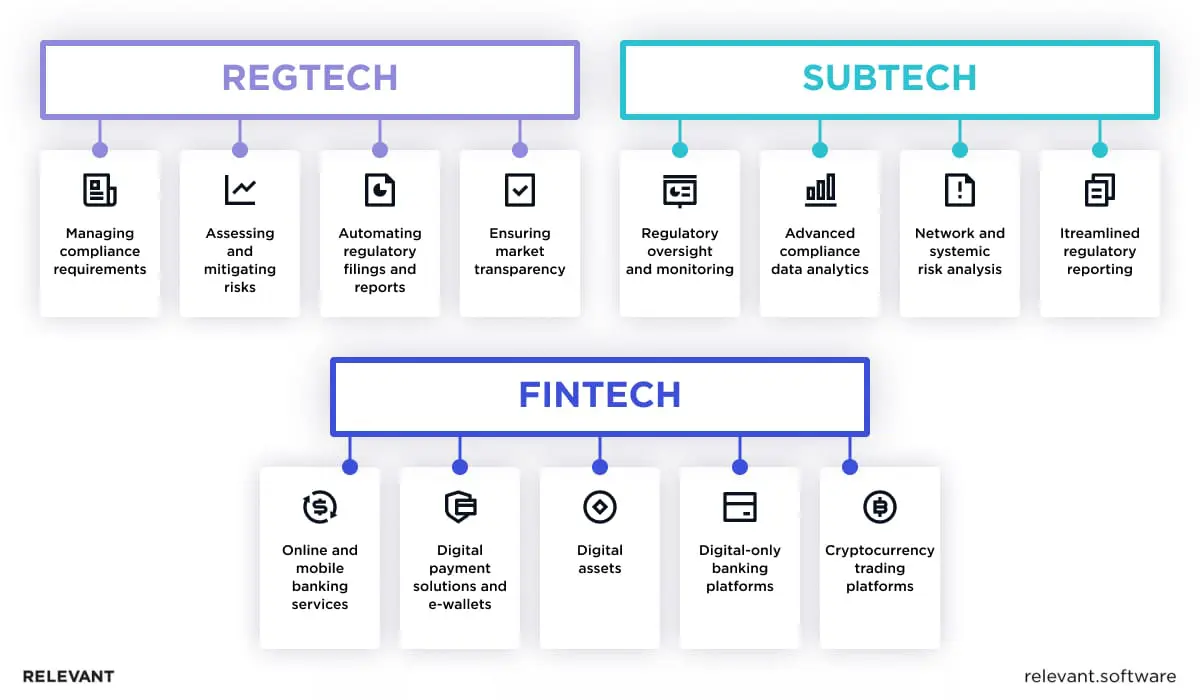

RegTech vs. FinTech vs. SupTech

While FinTech, RegTech, and SupTech all fall under the financial services umbrella and work hand-in-hand, it’s important to acknowledge that they each serve distinct purposes. They complement each other and are tightly connected, but they aren’t the same thing. Let’s see how they differ and when to use each.

We’ve already clarified the RegTech meaning, and know that it makes life easier for businesses, predominantly financial organizations, that deal with regulations. It automates all those annoying compliance tasks, like tracking rule changes, monitoring risks, and filling out reports, so you don’t have to spend hours doing it manually.

How is that different from FinTech?

FinTech, or financial technology, is a bigger umbrella applied to any kind of technology (AI, blockchain, mobile apps, you name it) that makes financial services cheaper, faster, or more accessible. The relationship between FinTech and RegTech is close. As FinTech companies disrupt traditional financial services, they face new regulatory challenges that require FinTech RegTech solutions to be able to cope with. For example, if a financial startup develops a peer-to-peer lending app, it will need RegTech tools to ensure it complies with anti-money laundering (AML) laws or data protection regulations.

What’s SupTech?

SupTech (Supervisory Technology) is the lesser-known cousin in this tech family and refers to the use of technology by financial regulators to enhance their supervisory functions. Just like RegTech automates and gives organizations the necessary tools to simplify compliance, SupTech is meant to simplify the oversight process for regulatory bodies. Data analytics, which we believe is an essential instrument in any sector, financial market monitoring, risk identification, and management are some of the capabilities SupTech offers.

Here’s a quick look at how SupTech, FinTech, and RegTech compare:

| FinTech | RegTech | SupTech | |

| What It Does | Improves and modernizes financial services with technology | Simplifies compliance tasks for financial institutions | Gives regulators the tools to oversee financial systems |

| Who Uses It | Financial companies, consumers | Financial institutions, compliance teams | Regulatory bodies (e.g., central banks) |

| Key Benefit | Easier, faster financial services | Automates compliance, reduces errors | Helps regulators monitor and reduce financial risks |

| Examples | PayPal, Revolut, Robinhood | ComplyAdvantage, Actico, AxiomSL | European Central Bank, Financial Conduct Authority (FCA) |

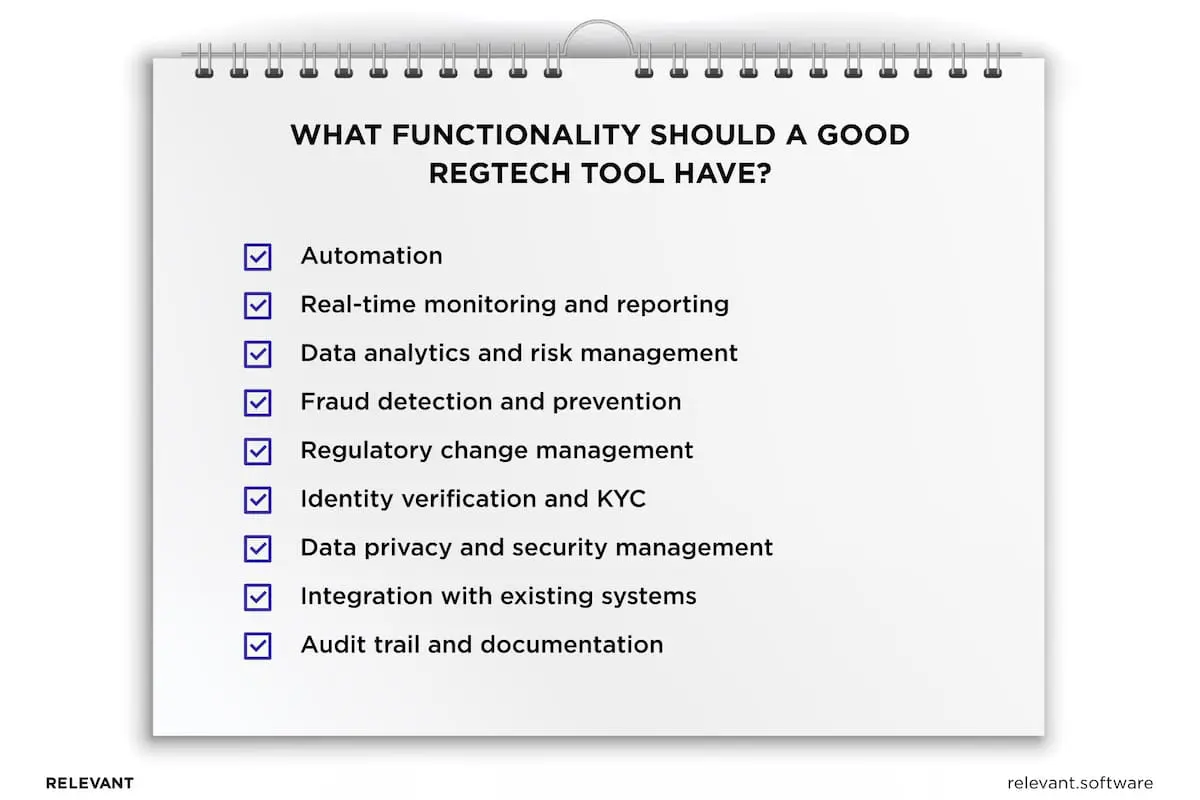

Key Features of RegTech

What makes RegTech so special and indispensable for fintech product development and modern financial institutions? Well, that’s mostly due to a set of features that help you handle regulatory obligations smarter, faster, and more securely. But what exactly does regulatory technology have to offer?

Automation and Efficiency

No one likes spending hours manually inputting data or triple-checking forms. That’s one of the main reasons companies adopt RegTech solutions – to automate those time-consuming and tedious tasks.

Let’s take anti-money laundering (AML) compliance as an example. In the past, compliance officers would have to manually review transactions and flag anything that seemed suspicious, which is slow and also prone to human error. With RegTech solutions, those same processes are automated. They continuously monitor transactions and automatically mark any unusual activity guided by predefined criteria.

Real-Time Monitoring and Reporting

Instead of waiting weeks or even months to assess compliance, you can access live data and make real-time adjustments as necessary—saving both time and potential fines. RegTech tracks all regulatory updates, so you know exactly what’s going on at any given moment. Got a new regulation popping up? RegTech will highlight it immediately. Need to file a report? It’s ready at the push of a button. For you, that’s fewer surprises and faster responses to regulatory changes, which is a big deal when it comes to avoiding fines.

Data Analytics and Risk Management Tools

RegTech solutions usually come with data analytics tools. That’s why they are so effective at spotting, assessing, and managing regulatory risks. Some of the tasks they help fintech companies with are fraud detection, compliance risks, or tracking patterns in transactions. For instance, if a sudden spike in suspicious transactions occurs, RegTech tools instantly flag this as a potential compliance issue so the company can respond promptly and prevent further risks.

Fraud Detection and Prevention

Fraud can wreak havoc on a business while staying on top of security threats, which is a constant battle. RegTech uses smart algorithms and machine learning to recognize the slightest signs of irregular behavior that happen at a given moment and takes immediate action to prevent fraud before it does damage. Such a system blocks suspicious activities, alerts compliance teams, and initiates further investigation—all within seconds.

Regulatory Change Management

One of the biggest challenges businesses face is keeping up with constant regulatory changes. RegTech tools handle regulatory change management by continuously monitoring updates from regulatory bodies and automatically adjusting company processes to stay compliant. This means that your systems are always up-to-date without the need for constant manual intervention.

Identity Verification and KYC (Know Your Customer)

With the rise of digital banking and remote services, verifying customer identities has never been such an in-demand priority. How does RegTech cope with it? Thanks to the use of AI, biometrics, and other RegTech trends, financial companies can simplify and strengthen the identity verification and KYC process by using modern identity verification software that helps meet compliance requirements more efficiently.

Data Privacy and Security Management

With data privacy laws tightening globally, organizations need to ensure that customer data is secure and handled properly. RegTech helps you manage and safeguard sensitive information more easily and effectively. For instance, RegTech solutions can automatically track how customer data is being stored and accessed with regard to GDPR compliance. If there’s any unauthorized access or a potential data breach, the system will immediately alert the compliance team to minimize damage.

Integration with Existing Systems

You don’t have to overhaul your entire tech stack to implement RegTech. Most solutions integrate seamlessly with the systems you’re already using—whether it’s your CRM, cloud platform, or accounting software. For this reason, the adoption of RegTech solutions is painless and cost-effective. Complete sync with your systems means smooth operations while your data remains compliant with the latest regulations.

Audit Trail and Documentation

Regulatory audits are nerve-wracking in any case, but especially if you don’t have everything in order. Thanks to RegTech solutions, you’ll have a detailed audit trail that logs every compliance-related action. Need to show proof of compliance? The system has you covered with automatic documentation that’s ready for review, making audits a lot less stressful.

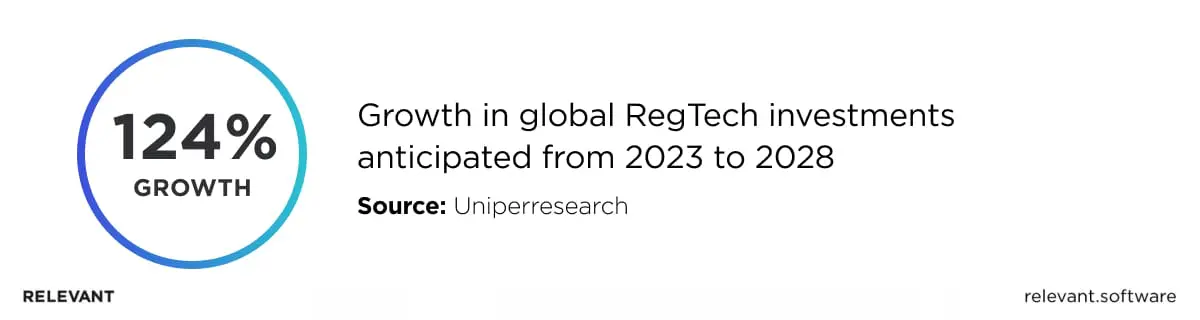

Why is RegTech Important for Businesses?

The need for regulation compliance will only increase with time because our reliance on financial technology is unluckily to slow down. We can already see it with dozens of new rules emerging every day. Despite this fact, businesses must stay updated on the latest requirements to avoid hefty penalties or, worse, potential criminal liability for failing to comply. We’ve outlined in more detail why RegTech matters so much.

Enhancing Compliance Efficiency

RegTech automates the tedious, repetitive tasks that come with compliance. Think about all those hours spent gathering, validating, and reporting data. RegTech solutions can handle it all automatically, cutting down the time it takes to stay compliant and saving companies a lot of money in the process. Instead of manually updating systems whenever a new regulation rolls in, RegTech tools can instantly track changes and adjust processes, making compliance more efficient and cost-effective.

Minimizing Risks and Errors

Good risk management is your defense against financial loss or damage to an organization’s reputation in case of an incident. Thanks to RegTech, which uses smart algorithms, you can detect anomalies and fraudulent activity much earlier than manually, so you’ll have time to prevent a compliance gap from becoming a disaster. The technology shields organizations against different types of risk, including data mishandling, security breaches, compliance gaps, fraud prevention, and more.

Regulatory Complexity and Global Compliance

If your business operates in more than one country, you’re likely to deal with regulations across different jurisdictions, where those rules may differ. With RegTech, you can forget what it’s like to struggle with manual updates and fragmented compliance checks. The tools automatically adapt compliance processes to meet local requirements and update on regulatory changes worldwide as soon as they occur. For global companies, this means staying compliant everywhere without the constant manual effort.

Cost Savings

Let’s be real—compliance is expensive. Whether it’s the costs of maintaining professional compliance teams or the financial hit from fines, it all adds up. RegTech solutions help cut these costs through the automation of labor-intensive tasks and fewer human errors. Thus, you avoid pricy fixies and, at the same time, improve productivity for faster time to market and better service delivery.

Key Technologies Powering RegTech Solutions

Although there is no concrete technology or solution RegTech is associated with, there are several key innovations driving its success. As a company closely collaborating with FinTech companies to help them build industry-compliant software systems, we know a lot about RegTech trends and have compiled a list of the most impactful.

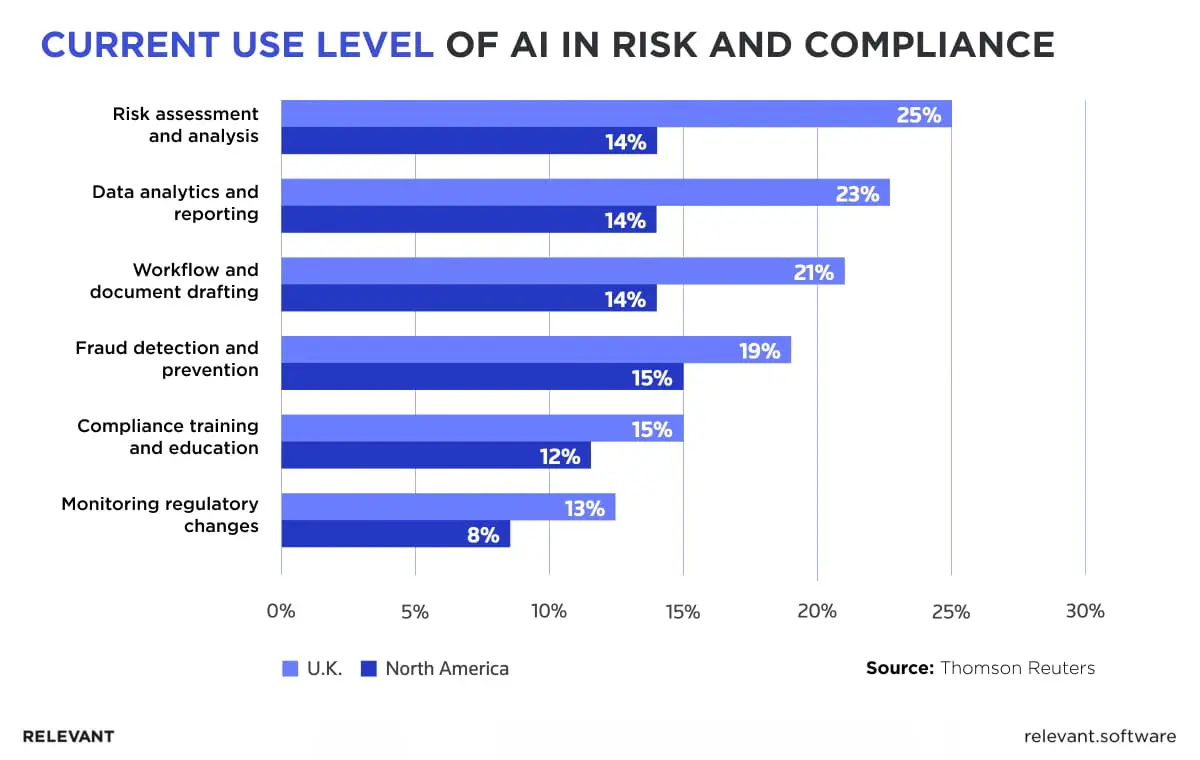

Artificial Intelligence and Machine Learning

We’ve mentioned several times already that RegTech heavily employs AI and ML technologies to perform complex tasks. Around 48% of the risk and compliance teams surveyed believe that AI has the potential to drive internal efficiency within their organizations, and 35% see it as a tool that can help keep abreast of legislative developments.

AI and ML help companies analyze massive sets of data, automate workflows, and detect risks with laser precision. AI algorithms effortlessly monitor every transaction in real-time, and if they spot something out of the ordinary—a spike in unusual payments or a deviation from normal behavior—they’ll flag it instantly.

Blockchain for Secure and Transparent Records

Blockchain has gained popularity due to cryptocurrencies, but now it’s a separate technology and one of the RegTech trends. In a nutshell, it’s a digital ledger that locks in every compliance-related activity and makes it almost impossible to tamper with. It creates a clear and permanent audit trail that companies can rely on for proof of compliance. And because every change is tracked and verified, it offers a level of transparency and trust that traditional methods simply can’t match.

Big Data and Analytics

The sheer amount of data businesses have to handle is mind-boggling, and that’s where big data and analytics come in. RegTech takes advantage of big data tools to examine vast quantities of compliance information (transaction, customer data, etc.) to discover patterns or data correlations that may indicate non-compliance or fraudulent activity. For example, if a sudden spike in certain types of transactions occurs, analytics tools can flag it for further investigation.

Cloud Computing and SaaS

Last but not least, among the RegTech trends, cloud computing plays a huge role in making RegTech solutions scalable and flexible. By offering RegTech as a Software-as-a-Service (SaaS) model, companies can easily adapt these tools to their existing systems without major overhauls. Cloud-based solutions also provide secure data storage and easy access to updates, so businesses can keep pace with new regulations without having to constantly update their infrastructure.

RegTech Use Cases by Industry

The financial sector is the main target audience of RegTech, yet far from being the only beneficiary of using it. Any industry that deals with a number of rules and regulatory frameworks will find RegTech helpful. Here are some of the industries that can experience the biggest impact from RegTech.

RegTech in Financial Services

So, the financial industry is well-known for complex regulations and compliance requirements. That’s why FinTech and RegTech solutions work hand in hand in this space to address the most pressing regulatory challenges like adherence to anti-money laundering AML and KYC policies and strengthen fraud detection. With the help of the latest tech solutions and monitoring tools, RegTech streamlines most of the time-intensive compliance tasks while strengthening your risk management posture. Fintech consulting is the way to learn more about how to implement these solutions properly and tailor them to your particular needs. Here are the many applications of RegTech in financial services:

- Identity verification

- Customer due diligence

- Transaction monitoring

- Case management

- Risk management

- Regulatory inventory

- Regulatory reporting

- Reputation monitoring

- ESG risk management

RegTech in Insurance

The insurance industry is also one of the most prone to frequent regulatory shifts, which can vary widely depending on the region. No wonder staying compliant for insurers is a true and constant challenge. For example, Aviva was fined $600,000 last year for failing to meet auto insurance regulations. The company was required to offer insurance quotes to all eligible customers according to its approved underwriting guidelines, but a lapse in compliance resulted in significant financial consequences. Here, RegTech is a big facilitator of compliance management as it reduces manual errors, streamlines underwriting compliance checks, generates instant audit trails, and more. The major RegTech applications in insurance include:

- Compliance

- Risk management

- Customer behavior

- Fraud detection

- Policy pricing and underwriting

- ESG risk management

RegTech in Healthcare

With the rising importance of protecting sensitive health information, the healthcare industry is currently under big pressure to comply with HIPAA and GDPR data protection regulations. Often, outdated healthcare systems use different data formats that complicate the uninterrupted data exchange required by the regulations. RegTech helps healthcare organizations with that and automates compliance monitoring so your patient data is secure and regulations are adhered to at all times. For instance, RegTech tools can track how patient records are accessed and ensure only authorized personnel have the right permissions. Healthcare can benefit from the following RegTech applications:

- HIPAA compliance

- Secure data exchange

- Data protection

- Fraud prevention

- Predictive analytics

- Streamlined operations

- Reduced penalties

- Increased efficiency

RegTech in Energy

The energy sector also has to deal with regulations, but those around environmental issues and emissions, which, by the way, are actively evolving in recent years. RegTech has appropriate features for energy companies to improve their emission tracking, reporting, and, of course, compliance. With regulatory technology, it’s much easier to gather and analyze environmental data, generate accurate reports in minutes, and quickly adapt to new regulations as they come into effect. We can safely say that RegTech is a cost-effective way to maintain sustainability standards and avoid hefty fines. Some of the RegTech applications in energy are:

- Environmental compliance

- Emissions tracking

- Carbon reporting

- Risk management

- Real-time monitoring

- Transparent auditing

- Automated regulatory updates

- Sustainability metrics

What Is RegTech?: Final Thoughts

Staying compliant doesn’t have to mean losing sleep or drowning in paperwork. RegTech is a solution that’s always on duty, automating the tedious stuff, flagging risks, and helping your team stay ahead of the curve. Regulatory technology tools cover virtually any compliance need and can be rightly considered a one-stop shop for every business that values efficiency, accuracy, and risk mitigation.

If you’re one of those forward-thinking companies that is ready to simplify regulatory compliance to a few clicks and automated checks, then RegTech is the answer. Relevant has the necessary expertise and a team of professionals to help businesses innovate and achieve the desired level of efficiency while following industry standards. Our FinTech software product development services incorporate compliance considerations from day one, so your product is compliant from the moment we start building it. Stop stressing about compliance and bearing the burden of manual processes—contact us and hire fintech developers to solve it once and for all.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.