Fintech in the UK: Perspective and Challenges

The need to provide a better customer experience, optimize processes, and follow the global trends increase the number of fintech startups every month. The UK is one of the world’s biggest fintech hubs, where both government and investors alike support the growth of innovative financial solutions.

In the past few years, London has seen an outburst of tech firms, R&D departments, and headquarter relocations. What are the main reasons for this? Will the fintech landscape in the UK change due to the pandemic and the post-Brexit uncertainty? As a company helping fintech businesses solve tech-related challenges, we were interested in diving deeper into the current situation within the UK fintech market. Here’s what we discovered.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

UK fintech market overview

According to the Global Fintech Index City Rankings 2020, the UK comes in at the second place after the USA in terms of fintech investments (2019), with around 3.7 billion pounds-worth of deals and contracts. Despite being in the second place, people consider London a fintech capital thanks to firms such as TransferWise, Greensill, BGL Group, and others.

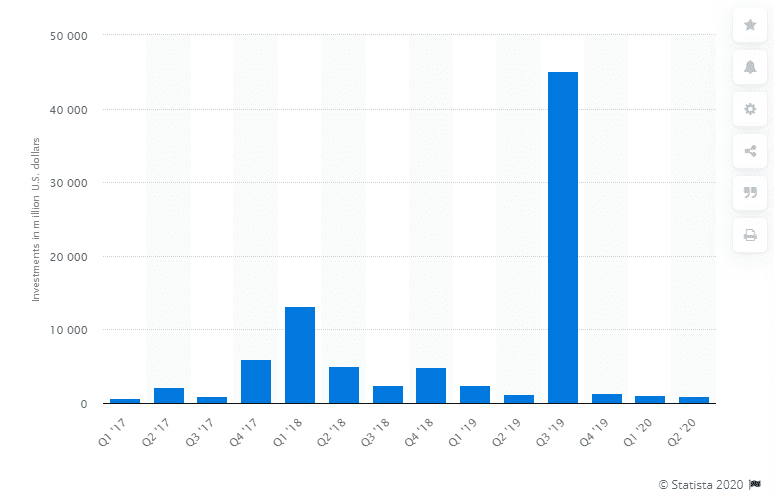

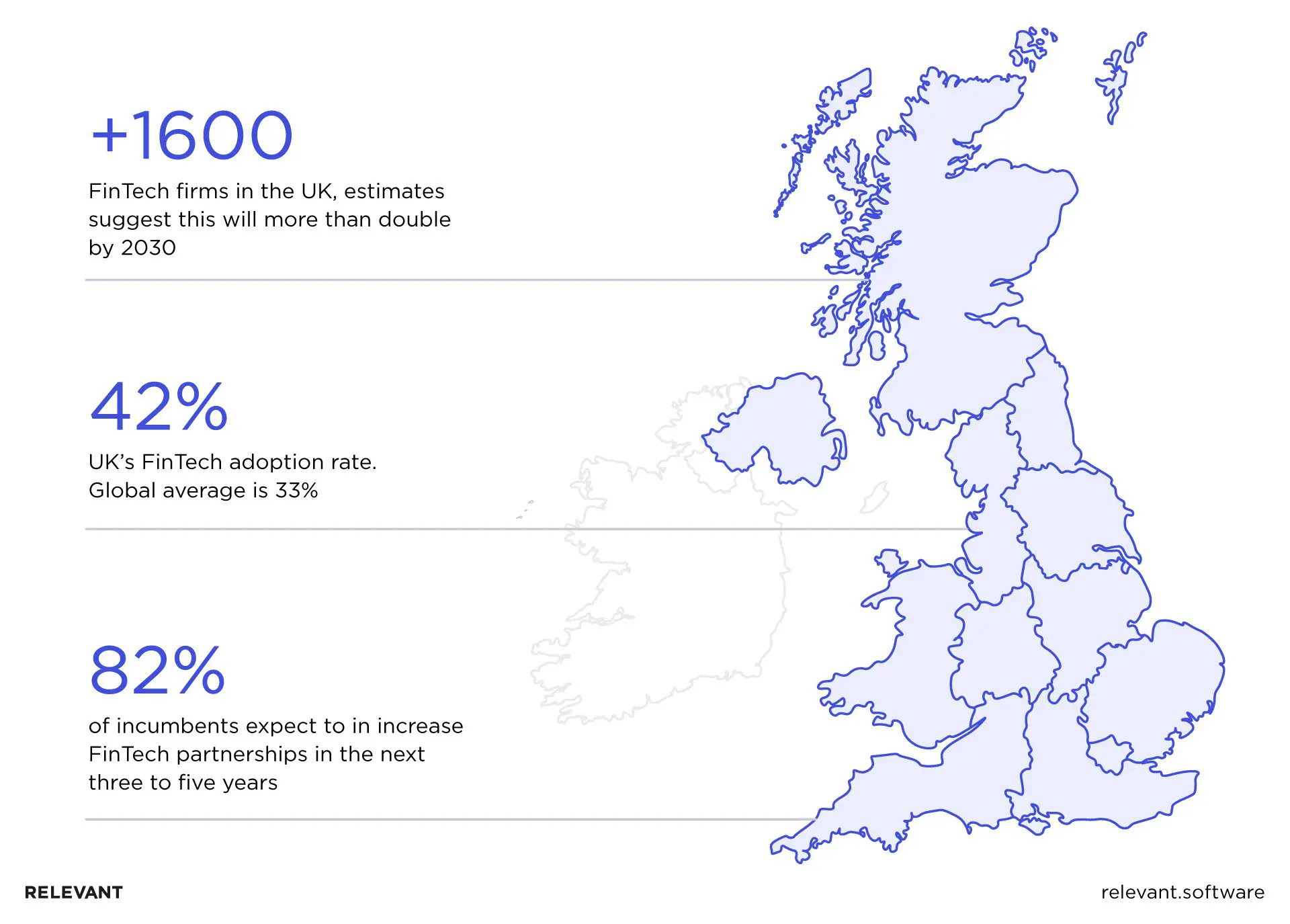

As of 2020, Crunchbase lists around 1,400 fintech firms based in the UK. And the total value of investments in fintech companies in the UK during the Q1 2017 and Q2 2020 has reached more than £7.7 billion.

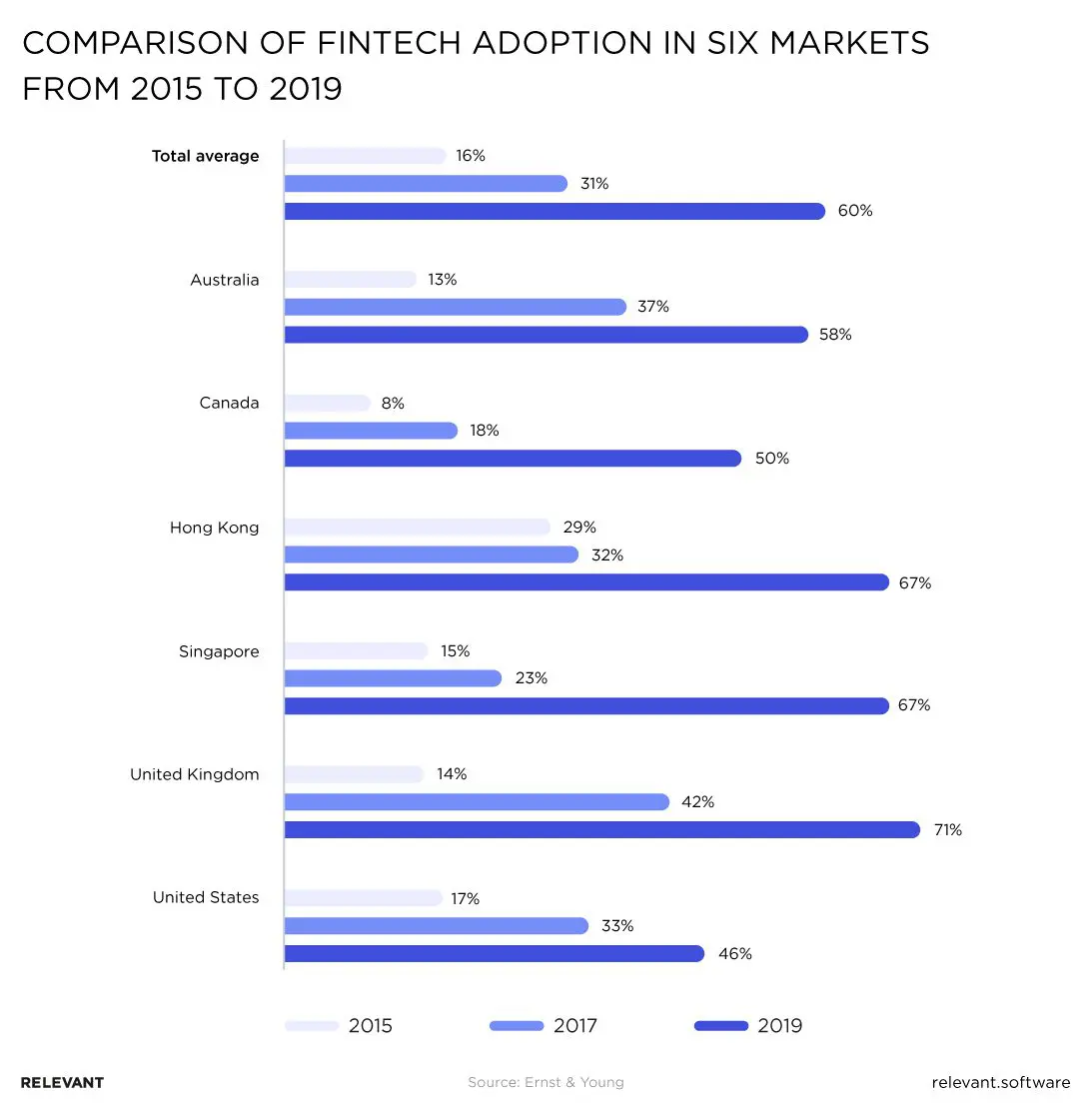

Surprisingly, the coronavirus pandemic has turned out to be beneficial for fintech businesses: the UK adoption of online banking is predicted to increase even more, despite the fact that in 2019, it had the highest adoption rates in the world – 73%.

Several factors that make Great Britain one of the global fintech leaders are progressive regulators, access to capital, and professional expertise. In 2020, the sector employed around 60,000 people across the UK and is seen as one of the key enablers of the post-COVID economic recovery. So, despite the crisis and Brexit, the British government is wired to maintain fintech leadership by combining investment, talent pool, and policies.

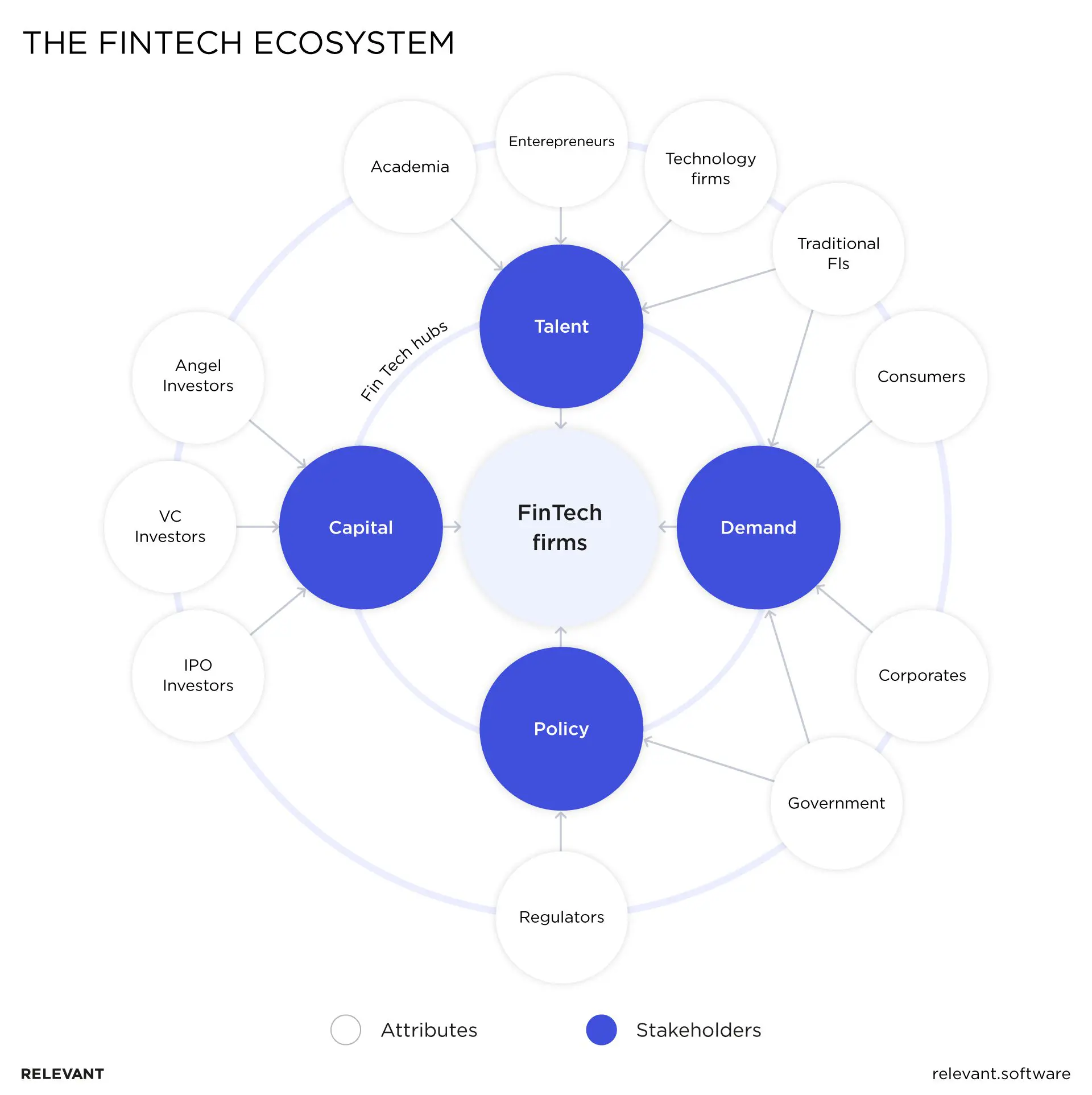

The fintech ecosystem

In order for us to get a better picture of the UK’s well-functioning fintech market, let’s take a look at all the components of the ecosystem:

There are four key aspects:

- Talent – technical, entrepreneurial, financial services expertise

- Capital – access to funds and accelerators

- Policy – regulations, taxes, and governmental fintech initiatives

- Demand – fintech adoption by consumers, enterprises, and financial institutions

Let’s see how everything is functioning within the British fintech ecosystem.

Fintech investment

The UK claims to have the most mature funding ecosystem in Europe, including business angels, crowdfunding, venture capital, and public markets. The government is also a critical component of this ecosystem. There are initiatives like tax-advantaged venture capital schemes – SEIS, EIS, VCTs, which provide tax-efficient benefits to investors for contributing to early-stage British startups. For instance, the Enterprise Investment Scheme offers 30% of share price as a credit that reduces the investor’s individual income tax for the year when the investor purchased the shares.

In the Q1 of 2020, the UK fintech firms have clinched nine over-million GBP deals compared to six and four contracts in the USA and Europe, respectively. To sum it up, the investments in the UK fintech firms have grown by a drastic 500% during the past three years.

However, startups need more than just capital to grow and prosper. Another side of the investment coin is education and consulting. To support young firms, the UK offers access to multiple accelerators, incubators, and startup programmes that provide legal advice, mentoring, access to professional networks and investors.

They have proven beneficial: an average accelerated startup can raise 44% more funding and achieves a 75% higher valuation. In 2018, there were around 186 accelerators and 205 incubators in the UK, and the number has undoubtedly increased by 2020. As we’ve already mentioned, the government is one of the key factors in the UK fintech market potential.

Read also how to hire iOS and dedicated Android app developers.

Regulations

British regulators form an important part of the fintech landscape. In 2016, the Competition and Markets Authority pioneered Open Banking Standard, making UK banks implement API communication standards. The initiatives from the Financial Conduct Authority help firms introduce and test new fintech services in the regulatory sandbox. The solutions are tested on a short-term and small-scale basis, where startups can avoid regulatory pressure and fine-tune their internal infrastructure to become fully compliant.

One of the biggest innovations in terms of impact is the government’s “green light” that allows fintech companies to be official loan providers. It is supposed to serve as the government’s post-pandemic economy rescue scheme. This makes fintechs competitors to traditional banks and leads to faster adoption of advanced technology by traditional players.

And while regulatory sandboxes are the success that the UK government is looking to export to other industries, the current problem lies in regulating cross-border fintech change. According to the EU laws, the UK fintechs could function under the passporting system. Basically, a “passport” allows a firm to conduct the same business throughout the whole EU without additional authorization. However, this system will not be applicable as the EU’s transition period ends in January 2021. After that, new “equivalent arrangements” will come into force.

The post-Brexit uncertainty has already affected some major fintech players like the mobile bank N26 GmbH that announced its withdrawal from the UK market, and another bank Revolut Ltd. that relocated its payment activities to Dublin.

Still, the government is inclined to keep the UK’s leading position in the fintech market, so we can expect that both regulations and immigration policies will soon be adapted to the new reality as the negotiations between the UK and EU are finished.

UK fintech firms: the scope of expertise and challenges

With the government’s efforts to support innovation, it’s not strange that the number of fintech firms is growing every year, with London being the central hub of the sector. To be more specific, around 75% of startups are concentrated in the City of London and Westminster.

According to the Beauhurst report, out of 1,139 firms that hit the researcher’s high-growth triggers, 40% are in the seed stage. What’s even more promising is that 87% have been securing investments since 2011. Also, London fintech companies are well-connected to Europe – they are second only to Silicon Valley for international cooperation. It means that the UK’s market reach is extended across Europe and globally.

The list of top UK fintech startups from Beauhurst looks like this:

- OakNorth Bank: one of the most active lenders in the UK

- Revolut: mobile banking services

- Atom: digital-only banking services

- Paymentsense: virtual payment solutions

- Monzo: digital-only bank

- WorldRemit: online money transferring service

- TransferWise: money transferring platform

- SumUp: payment processing system

- iwoca: risk assessment and short-term loans

- Starling Bank: digital-only bank accounts

Borrowing and lending, messaging and communication, and payments were the three most popular fintech products and services in 2020, states the Robert Walters report. But the offerings are not limited to these three, ranging from innovative insurance solutions to advanced open banking platforms and products for the crypto-market. The specifics of the UK fintech market lies in the diversity of sectors: investments are poured not only into challenger banks but also into finance and wealth management solutions, alternative lending, blockchain and digital currencies, insurtech and payments. The scope is vast:

- Money transfers and payments: payout management tools, non-bank money transfers, cryptocurrency payments, etc.

- Insurance: usage-based car insurance, peer-to-peer or microinsurance, insurance comparison sites

- Borrowing

- Financial planning: online budgeting tools, financial products analysis and comparison

- Savings and investments: peer-to-peer investment platforms, investment management and advice, online stockbroking, online spread betting

- Regtech: advanced analytics, blockchain solutions, risk management, core banking, insurance, asset management software, credit reference data and analytics, cybersecurity and digital identity, etc.

- Trade finance

- Gateways and payment optimization

UK customers are open to trying innovative financial products: 90% of consumers claim that a user-friendly digital solution is important when choosing a bank. With the lockdown, the demand for online banking services is only increasing, and so is the number of solutions UK fintechs are developing. The audience’s interest in advanced financial products is reflected within market trends that gain investor recognition.

Fintech trends attracting talent and money in 2020 and beyond

With the global trends circling around IoT, AI, AR/VR, big data analytics, and blockchain, the financial market is ready to adapt the new tech for its needs and invest in the research and development of innovative products.

AI-based intelligent automation

Virtual assistants and human-like interactions are becoming increasingly popular these days. But automation is not limited to customer service: data gathering from unstructured sources (various embedded and connected IoT devices including) and natural language processing can enable automated KYC procedures, reduce employee mistakes, put to work customer data, and much more.

Automated trust

It may be hard to blindly trust artificial intelligence when it comes to financial decisions. But the convergence of AI, IoT, and blockchain is what helps make decisions on audit trails, data sharing, automated insurance more trustworthy, and, therefore, widely adopted. An example is a blockchain-based authentication process for automatic auto insurance payments.

Extended reality

Fully immersive digital experiences are appreciated across different industries, so why shouldn’t fintechs provide them? AR and VR help customers locate the closest ATM, virtually access accounts and transaction history, complete complex financial processes and purchases, etc. AR interfaces, VR trading workstations, and even VR payments are what millennials and Generation Zs desire: physical bank visits have decreased by 36% between 2017 and 2022, while the mobile experience is rising by 121% in the same period.

But it is not all smelling of roses. To ensure high-level customer experience, stay competitive, and innovate, UK fintech firms have to overcome some of the significant challenges, especially the critical challenges that arise in an economic crisis.

Current and future challenges of the UK fintech

One of the top issues fintechs experience now is the lockdown and post-Brexit reality. However, the pandemic has brought more recognition to remote services and open banking, which is a good sign for British startups. As for the post-Brexit uncertainty, the negotiations between the EU and the UK are expected to bring some clarity by the end of the year.

Other challenges fintech firms face are:

- Cyberattacks

- Lack of qualified talent

- Need for reliable partnerships

Let’s take a closer look at each issue and the possible ways to solve them.

Cyberattacks

As financial services digitize, cyber risk continues to rise. The UK Cyber Security Breaches Survey 2024 reports that 50% of UK businesses experienced a cyberattack in the past year, with financial services among the most targeted sectors. At the same time, investment reflects the urgency: UK cybersecurity startups attracted over $1.5 billion in funding during 2023–2024, as banks and fintechs strengthened defenses against growing threats.

See how to hire a top cybersecurity expert.

Talent and skills

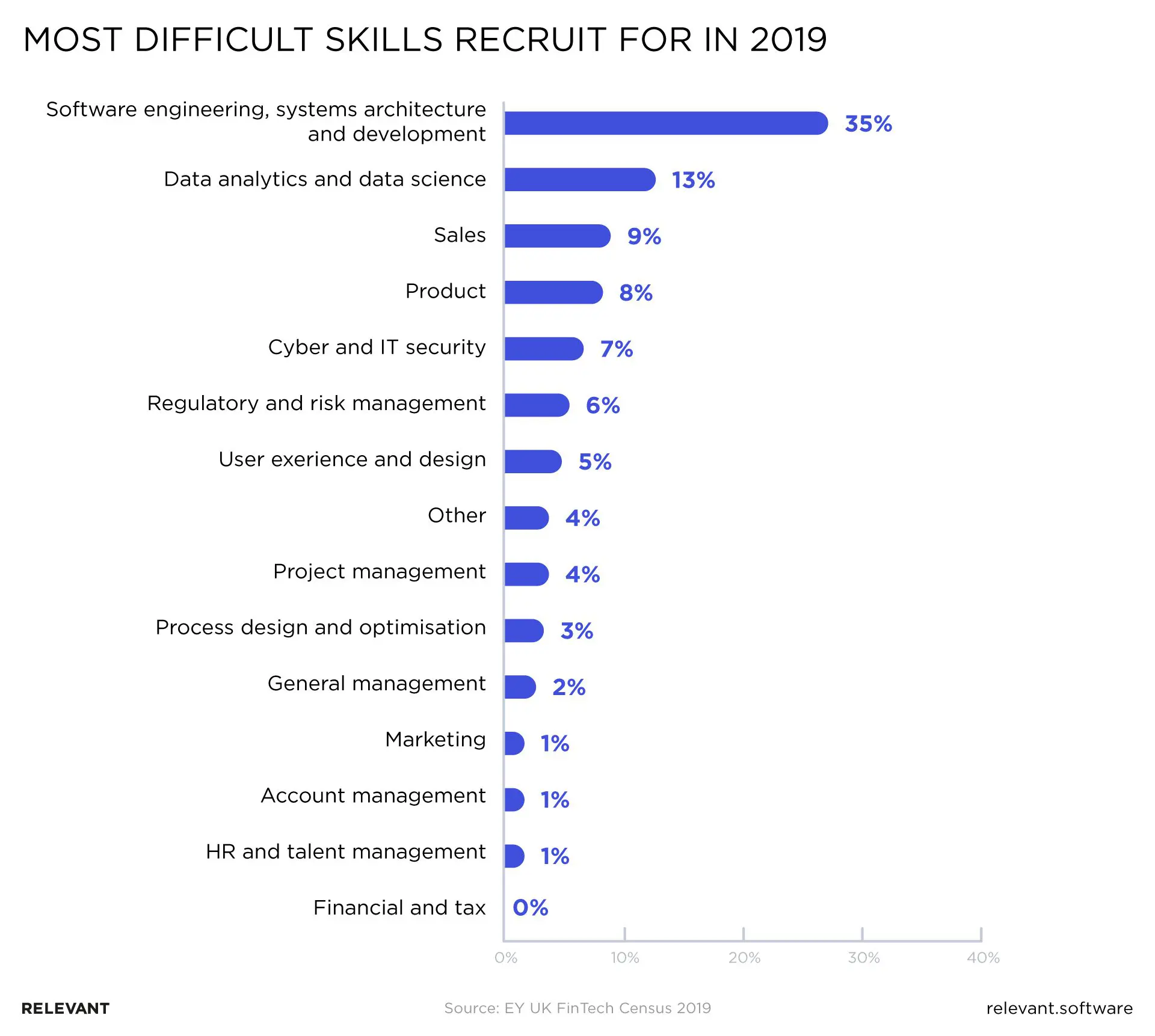

While Great Britain and specifically London are known for their fintech expertise, the new tech trends require an even bigger talent pool and specific technical skills. To support the market’s leading position, businesses see the need to invest in talent development and research. The competition for specialists in data analytics, machine learning, and cybersecurity is global. In 2019, these roles accounted for 15% within the financial services sector, and they are predicted to account for 29% by 2022.

While most UK fintech firms are trying to build their UK talent base, many large businesses seek the needed skills abroad. The government attempts to reform the education system to provide more entrepreneurial graduates, as well as launch multiple incubators and extra-curricular activities to supply the fintech industry with much needed expertise. These are long-term solutions that may have an impact on the market in several years.

Right now, under the coronavirus remote work circumstances, many firms may find outsourcing and outstaffing profitable and feasible. As a reliable tech partner, Relevant can provide a dedicated development team in Ukraine to cover the talent gap.

Building partnerships

Both traditional players and innovative fintech startups feel the need to augment their knowledge base – and market reach – with reliable partners. As remote work becomes the “new norm,” building an in-house team is not as critical as before. Cost reduction is one of the key reasons for attracting specialists outside the UK. It includes both software development services and dedicated development teams. Moreover, it provides space for scaling and expansion, as the tech talent pool is not only limited to the UK market.

“With Brexit uncertainty still on the horizon, it is essential to build international relationships and keep our position secure across the rest of the world. By collaborating with international partners, we believe a co-operative sector will be created that encourages fintechs, regardless of size, to grow and scale.”

Gareth Lewis, CEO Delio

Relevant has already been working with the UK fintech firms, helping clients with building a dedicated development team in Ukraine, microservice architecture and security measures.

The know-how of building financial services, flexibility, and experience in the innovative tech needed for the evolving UK fintech market is what Relevant offers to its partners. So you are more than welcome to contact us and find out how to scale your engineering teams with the required talent quickly and seamlessly.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.