RPA in Finance: The Complete Guide

A leading fintech lender faced slow approvals, high costs, and operational inefficiencies—challenges perfectly suited for RPA in finance. Manual bottlenecks and reliance on rigid third-party loan management software limited scalability and created compliance risks, making growth increasingly difficult.

With Relevant Software’s robotic process automation services, the company took back control. They replaced outdated processes with a custom RPA-driven platform, which removed inefficiencies, cut costs, and sped up loan approvals. The result is a fully digital, scalable system that improves customer experience while ensuring compliance and long-term expansion.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

This success story reflects a larger transformation in finance—automation enhances precision, scalability, and competitive strength. As financial institutions expand to serve a global market, automation in fintech will play a greater role than ever.

What is RPA in finance?

What is RPA meaning in finance? Robotic Process Automation (RPA) in finance refers to software bots that replicate human interactions across financial systems to execute rule-based tasks. Unlike traditional automation, RPA operates at the user interface level, allowing rapid deployment without modifying core financial infrastructure.

RPA vs. traditional automation in finance

While both RPA and traditional automation improve efficiency, they differ in scope, implementation complexity, and flexibility:

| Feature | RPA in finance | Traditional automation |

| Integration | Works on top of existing systems | Requires deep backend integration |

| Implementation Time | Weeks to months | Months to years |

| Adaptability | Easily modified for regulatory changes | Requires IT development for updates |

| Best for | Repetitive, rule-based tasks (e.g., invoice processing) | Large-scale, complex IT process automation (e.g., core banking system upgrades) |

How RPA works in finance

At its core, finance robotics process automation follows a structured workflow:

- Data extraction & processing – RPA bots retrieve financial data from structured (spreadsheets, databases) and unstructured (emails, PDFs) sources, utilizing optical character recognition (OCR) technology.

- Validation & reconciliation – Extracted data is cross-verified against predefined business rules, regulatory guidelines, or external databases.

- Automated execution – Based on conditions, bots process transactions, update records, or escalate exceptions to human operators.

- Compliance & audit logging – Every action performed by RPA is recorded in an immutable audit trail for regulatory transparency.

Why do financial institutions need RPA?

Banks, fintech firms, and financial institutions struggle with rising operational costs, compliance risks, and manual inefficiencies. Without automation, transaction delays, regulatory fines, and data inconsistencies put companies at a competitive disadvantage. Based on Relevant Software’s experience, RPA in banking and financial services accelerates loan processing, fraud detection, and financial reporting, giving firms the edge they need to thrive in a digital-first economy.

Let’s look at the concrete benefits of RPA in the finance industry.

Increased operational efficiency

Financial workflows involve high transaction volumes, strict deadlines, and compliance-heavy processes. RPA eliminates bottlenecks by automating routine yet time-intensive tasks, enabling finance teams to focus on analytical and strategic initiatives.

For example, in accounts payable, bots process invoices from start to finish—extract data, verify details against contracts, and update ledgers—cutting turnaround times from days to minutes. RPA use cases in finance illustrate its role in eliminating inefficiencies across operations.

Reduction in human error

Precision remains critical in finance, where small miscalculations or data entry mistakes cause financial discrepancies, regulatory breaches, or reputational damage. By standardizing processes, RPA removes variability, ensuring accuracy in calculations, reports, and compliance checks.

In audit and risk management, bots provide a layer of assurance by continuously cross-referencing transactional data against compliance frameworks. Robotic process automation in finance enhances accuracy, ensuring financial institutions meet both internal and external governance standards.

Enhanced compliance and risk management

As financial regulations evolve, maintaining adherence requires strict oversight and documentation. Robotic process automation in financial services enforces policies, automates anti-money laundering (AML) checks, Know Your Customer (KYC) verifications, and audit trail creation.

RPA also enhances risk mitigation by detecting anomalies in financial transactions. Bots can flag suspicious activity in real-time, alerting compliance teams before potential regulatory infractions occur. Recent insights from the PwC CEO Survey show that financial leaders view automation as critical for ensuring compliance and reducing regulatory risks.

Cost savings and improved ROI

While technology requires an upfront investment, long-term cost reduction through RPA in finance exceeds implementation expenses. By reducing reliance on manual work for repetitive tasks, financial institutions cut operational costs and improve efficiency. Labor-intensive processes such as claims validation, regulatory reports, and financial reconciliations now operate at a fraction of the cost, with greater accuracy and speed, making RPA a key driver of financial sustainability.

Moreover, robotic process automation in finance and accounting offers scalability—once a bot is deployed, additional processes can be automated without proportionally increasing costs. This operational leverage translates to a measurable return on investment, often within the first year of implementation.

RPA use cases in finance: how banks & fintech firms automate operations

According to Gartner, 80% of finance leaders have either deployed or plan to deploy RPA, recognizing its potential to streamline financial workflows, minimize errors, and enhance risk management. But the true value lies beyond simple task automation—leading institutions leverage RPA in finance and accounting to reinforce compliance, optimize liquidity, and transform customer interactions.

Below, we examine how financial leaders apply RPA to strengthen competitive positioning and drive measurable outcomes.

Accounts payable and receivable automation

Manual invoice handling, payment tracking, and reconciliation create inefficiencies and errors. RPA optimizes AP and AR functions by executing tasks with precision and speed.

- Invoice processing & reconciliation: bots extract data from invoices, validate details against purchase orders, and update ledgers without manual input.

- Fraud detection & anomaly identification: RPA in finance operations flags suspicious transactions by analyzing deviations from historical payment patterns.

- Automated payment execution: ensures timely payments and collections, reducing overdue accounts and improving cash flow.

Financial reporting and reconciliation

Aggregating data for financial reports requires precision and consistency. RPA accelerates reporting while eliminating discrepancies across systems.

- Automated report generation: bots consolidate financial data and produce statements, tax reports, and compliance documents.

- Data validation & accuracy: cross-checks transactions between multiple financial platforms to ensure consistency.

- Audit-ready documentation: maintains structured logs for regulatory bodies, simplifying audits and compliance reviews.

Regulatory compliance and audit preparation

Evolving financial regulations increase workloads for compliance teams. RPA enforces policy adherence by automating compliance in finance.

- KYC & AML enforcement: verifies customer identities, cross-checks data against sanctions lists, and flags anomalies.

- Continuous audit logging: tracks financial transactions and activities, ensuring full transparency for regulators.

- Regulatory form submission: prepares, verifies, and submits tax filings, compliance reports, and financial disclosures.

Tax processing and management

Accurate tax handling prevents compliance risks and ensures adherence to deadlines. RPA in finance industry standardizes tax calculations across jurisdictions.

- Automated tax calculation & filing: extracts data, applies tax rules, and submits filings without manual errors.

- Multi-jurisdiction compliance: adjusts tax rules based on location-specific requirements to meet regulations.

- Tax audit support: structures tax records for seamless retrieval and verification.

Customer support and onboarding

Finance companies benefit from AI-driven assistance, faster verification processes, and frictionless onboarding.

- AI-powered chatbots for financial queries: responds to balance inquiries, transaction status requests, and fee explanations.

- Automated customer verification: validates identity documents, credit histories, and financial records.

- Faster account setup: streamlines data collection and approval, cutting account activation time.

Loan processing and credit scoring

Loan approval involves document verification, risk analysis, and compliance checks. RPA expedites these processes while maintaining accuracy.

- Document verification & approval: extracts and cross-checks borrower information to accelerate underwriting.

- Automated risk assessment: integrates with credit scoring models to evaluate applications objectively.

- Faster loan disbursement: reduces approval delays, ensuring rapid decision-making and fund allocation.

Treasury and cash flow management

Liquidity management and treasury operations require real-time oversight. RPA provides financial teams with accurate forecasts and efficient allocation to ensure the company’s cash flow is effectively managed.

- Cash flow forecasting: analyzes financial patterns to predict liquidity needs and prevent shortfalls.

- Optimized fund allocation: ensures proper distribution of capital across accounts to prevent overdrafts.

- Automated bank reconciliation: matches transactions with bank statements, eliminating manual review.

Challenges of RPA in finance

Implementing RPA in finance introduces significant efficiency gains, but without the right strategy, automation efforts can lead to unexpected costs, process failures, or compliance risks. At Relevant Software, we have helped financial institutions successfully navigate these strategic tasks and challenges, ensuring automation delivers long-term value rather than short-term fixes.

High implementation costs

Many firms hesitate to adopt robotic process automation for finance due to high upfront costs. One European bank we worked with underestimated the complexity of customer onboarding automation, which led to budget overruns. Refocusing on high-volume, structured processes—such as transaction matching and invoice reconciliation—cut costs early in the rollout. Cloud-based solutions and phased rollouts reduced financial strain, which ensured controlled expansion without unnecessary expenses.

The complexity of financial processes

Not all financial workflows align with standard automation models. Finance robotics process automation must handle diverse regulations, making implementation more challenging for global institutions. Our approach starts with identifying rule-based tasks, such as financial reconciliations, that provide immediate value. For more complex workflows, we combine RPA with AI workflow automation to improve decision-making in areas where traditional automation fails.

Security and compliance risks

Financial institutions face mounting regulatory pressure, making compliance one of the most critical RPA use cases in the finance industry. While benefits of RPA in finance include greater accuracy and efficiency, failing to establish secure automation frameworks can expose firms to regulatory penalties.

One U.S. bank automated its anti-money laundering (AML) checks but neglected to integrate audit-ready compliance trails, leading to security risks. To resolve this, we implemented robust access controls, finance robotics process automation for compliance tracking, and continuous security assessments.

Need for continuous monitoring and maintenance

RPA for finance is not a one-time deployment—it demands constant adaptation. A fintech company we helped automate financial reporting experienced disruptions when an ERP update changed data structures. By establishing an oversight framework with automated controls and scheduled performance audits, we ensured their system retained resilience against unexpected changes.

Learn more about the business process automation benefits and how it complements RPA in finance.

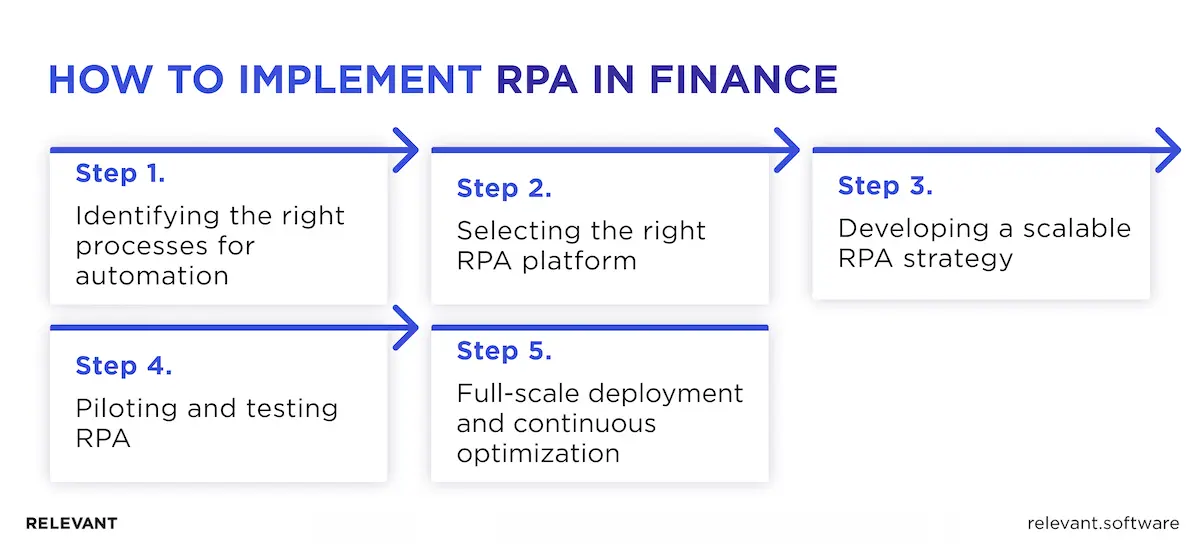

How to implement RPA in finance

At Relevant Software, we develop robust, future-proof RPA frameworks that align with financial regulations, integrate seamlessly with existing systems, and evolve with market demands. But real success goes beyond RPA implementation in financial services —it takes the right strategy, careful testing, and continuous improvement. Below, we outline our structured approach to delivering automation that drives long-term value for financial institutions.

Step 1: Identify the right processes for automation

Not every financial workflow benefits from automation. A poorly chosen process can lead to inefficiencies rather than improvements. The Relevant Software team conducts in-depth process audits to identify:

- High-volume, repetitive tasks such as reconciliations, transaction validation, and regulatory reporting.

- Rule-based processes where automation ensures compliance, such as KYC verification and AML monitoring.

- Bottlenecks in loan processing, claims handling, or financial reconciliations that impact operational speed and accuracy.

By selecting the right workflows for automation in banking operations, we improve efficiency, maintain regulatory compliance, and uphold process integrity.

Step 2: Select the right RPA platform

RPA platforms vary in scalability, security, and integration capabilities. Financial institutions require solutions that comply with strict regulations while integrating with:

- ERP systems (SAP, Oracle, Microsoft Dynamics) to automate financial reporting and reconciliation.

- CRM platforms (Salesforce, HubSpot) to enhance customer onboarding and approval workflows.

- Risk management and financial process automation tools to automate fraud detection, audit trails, and compliance checks.

Our expertise in UiPath, Blue Prism, and Automation Anywhere ensures we tailor the right automation framework to fit each Relevant client’s unique needs.

Step 3: Develop a scalable RPA strategy

Automation delivers value when it aligns with business goals, compliance frameworks, and risk management strategies. We establish key performance benchmarks to measure:

- Process speed and accuracy improvements across financial workflows.

- Reduction in operational costs through automation of manual tasks.

- Compliance readiness by ensuring bots adhere to evolving regulatory mandates.

With clear success metrics in place, automation becomes a strategic enabler rather than a short-term efficiency tool, as demonstrated in our case study.

Step 4: Pilot and test RPA in a live financial environment

Launching RPA without proper validation can create compliance risks and operational inefficiencies. Relevant Software’s team of product developers and consultants implement proof-of-concept pilots to:

- Test automation logic in real-world financial processes.

- Ensure seamless exception handling for non-standard transactions.

- Validate regulatory adherence before scaling automation across departments.

By refining automation workflows before full deployment, we prevent system failures, regulatory breaches, and inefficiencies.

Step 5: Full-scale deployment and continuous optimization

Long-term RPA success relies on constant oversight, compliance alignment, and system resilience. We implement:

- Governance models to enforce security policies and maintain audit-ready logs.

- Scalability roadmaps for expanding automation across finance, compliance, and treasury functions.

- Performance analytics to adjust bots as regulations change and business needs evolve.

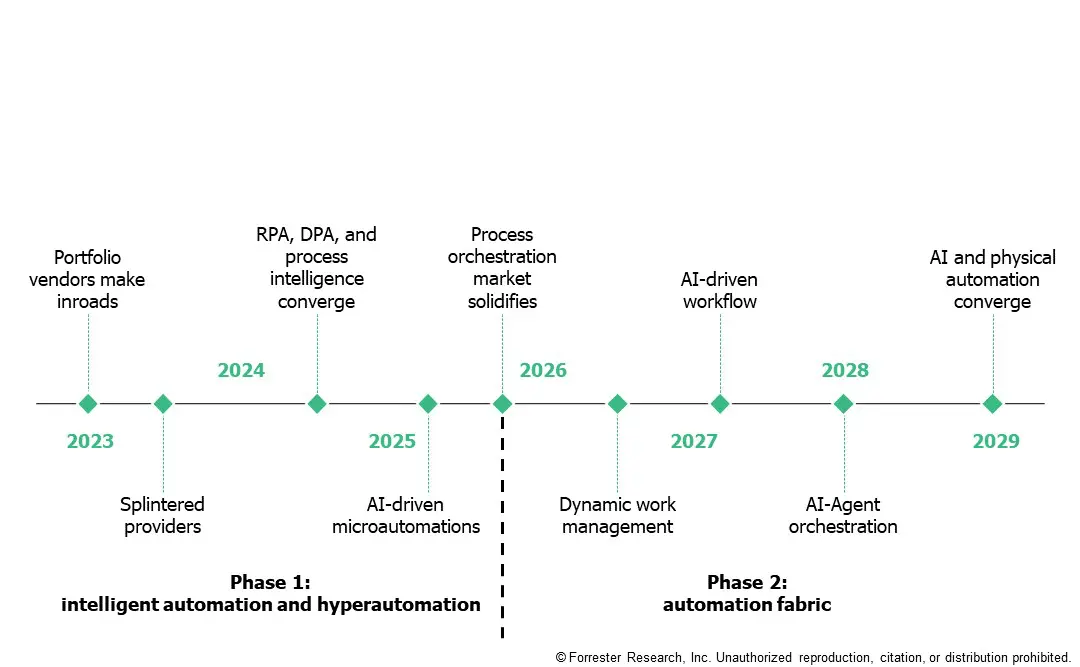

RPA trends reshaping finance in 2025 and beyond

The financial industry is shifting toward more adaptive, intelligent automation, with RPA evolving from basic task execution to a core driver of efficiency, compliance, and strategic decision-making. As institutions face increasing regulatory demands and competitive pressures, RPA trends in financial services in 2025 and beyond will focus on AI-driven automation, hyperautomation, blockchain integration, and autonomous financial systems.

AI-powered automation: from rules to reasoning

Traditional RPA follows strict rules, but AI-driven automation introduces context awareness, decision-making, and self-learning capabilities. Banks and fintech firms now deploy AI-powered RPA to interpret unstructured data, detect fraud in real-time, and predict financial risks before they materialize. Instead of merely executing predefined workflows, automation evolves, adapting to new data patterns and regulatory updates without human intervention.

Hyperautomation: the death of siloed operations

Financial institutions historically automated tasks in isolation—loan approvals, compliance reporting, or claims processing ran independently. Hyperautomation ends this fragmented approach, integrating RPA, AI, machine learning, and advanced analytics to connect entire workflows across departments. Instead of simply automating, banks now create self-orchestrating financial ecosystems where risk management, customer interactions, and regulatory compliance function as one.

Blockchain and RPA: automating trust in transactions

RPA and blockchain together eliminate the need for manual verification in high-value financial transactions, reducing fraud and increasing transparency. Banks increasingly use RPA to automate smart contract validation, track asset ownership, and verify transaction integrity in real-time. This removes human error and ensures financial institutions maintain immutable, audit-ready compliance records without additional overhead. Those who integrate RPA and blockchain early will redefine security and efficiency in global finance.

The future of finance: from automated to autonomous

Financial institutions that automate today’s workflows without planning for tomorrow’s disruptions will struggle to adapt. RPA, combined with artificial intelligence, is already moving beyond simple rule execution— it predicts, adapts, and continuously optimizes processes without waiting for human input. From AI-driven risk modeling to self-adjusting investment strategies, AI workflow automation is evolving into a decision-making force that reshapes financial operations at every level.

Progression of automation tools market (by Forrester)

Source: Forrester

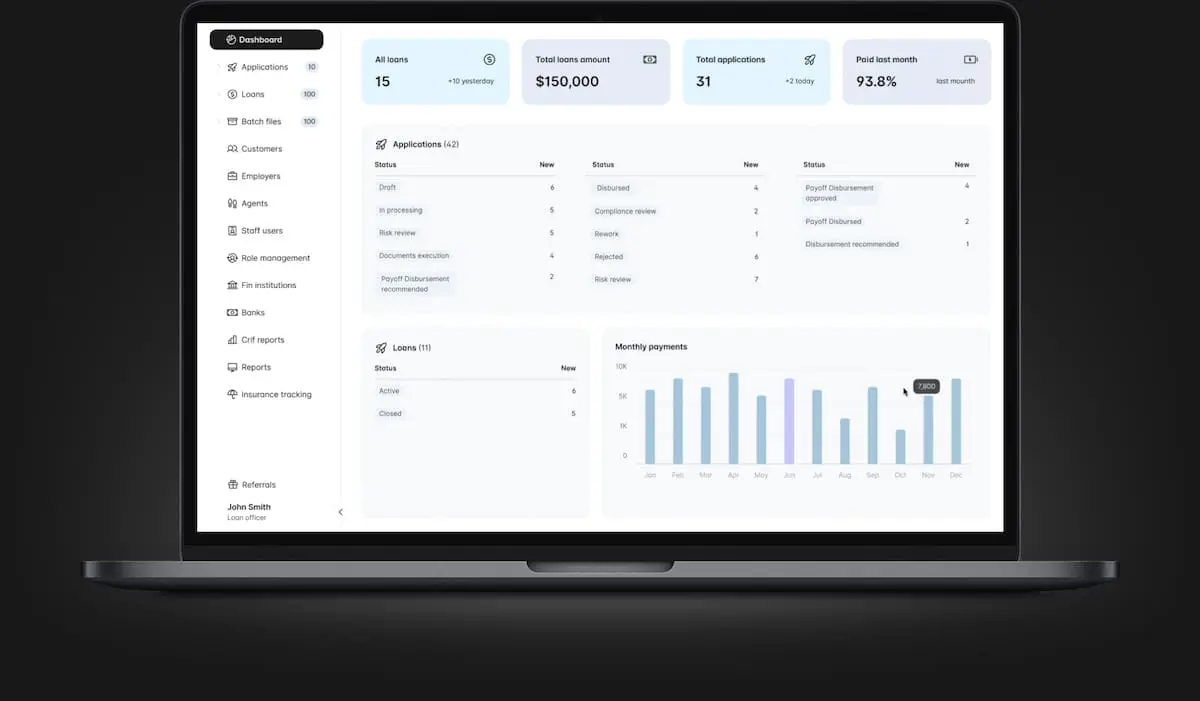

Our success story: successful RPA adoption in finance

We started this article with our case study of a top fintech lender in the Bahamas to illustrate how robotic process automation in finance transforms operations. Together, we built a custom financial automation platform that eliminated outdated workflows and removed the need for paper-based processes.

Value delivered by Relevant Software experts:

- Loan approvals now process 10x faster, with batch file execution reduced from 30 to 3 seconds.

- $100,000 saved annually by replacing third-party loan software.

- RPA-powered salary deductions lower default risks.

- CRIF and XERO integrations ensure accurate credit scoring and accounting.

- Batch payment automation removes manual intervention.

Most financial firms focus on cutting costs and accelerating approvals, but, according to the experience of Relevant Software’s clients, the real competitive edge lies in control and adaptability. The company no longer depends on rigid third-party tools or outdated processes—it owns its financial ecosystem.

Read the full case study.

Implement RPA in the fintech industry with Relevant

Most financial institutions treat RPA as a way to cut costs and speed up transactions, but that approach often backfires. Automation doesn’t stand still. Markets shift, regulations tighten, and technology advances. Without a strategy that adapts over time, financial firms risk creating rigid systems that fail when change inevitably comes.

At Relevant Software, we design RPA solutions that evolve alongside your business. When regulations shift, workflows change or new opportunities emerge, automation should support—not hinder—growth.

Struggling with financial inefficiencies? Discover how RPA in banking and financial services can cut costs and improve compliance. Contact us to build your automation strategy.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.