The Insider’s Story of Successful Mobile Banking App Development

Updated: February 3, 2025

Mobile banking software is reshaping finance, not as an option but as an expectation. Users no longer tolerate limitations—access to financial services must be instant, seamless, and available anywhere. If mobile banking app development feels like a decision still under review, consider this: your competitors act now. Ally Bank reimagined customer interaction with one of the first AI-powered virtual assistants. The Bank of Melbourne saw the potential in wearables and put banking on the Apple Watch before others even considered it. Emirates NBD disrupted the market with Liv, the UAE’s first digital-only bank, merging banking with social connectivity by letting Millennials split bills directly through social media.

Now is your time to deliver something truly transformative. With 10 years of experience in mobile app development services, Relevant completed projects like the UK’s FirstHomeCoach and Poncho in the US. Therefore, we have enough expertise to help you with the crucial steps to transform your mobile banking app idea into a fully realized, high-impact solution.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usTable of Contents

Mobile banking app market overview for 2025-2030

The global digital banking platform market is on track to reach $11.56 billion by 2025, with projections estimating further growth to $22.30 billion by 2030 at an annual rate of 14.04%, according to Mordor Intelligence. Simultaneously, the mobile payments market, valued at $126.68 billion in 2025, is projected to grow by 34.04% annually through 2030. This rapid expansion reflects the seismic shift in consumer preferences and behaviors as digital banking cements itself as a cornerstone of modern financial services.

What is the target audience of mobile banking?

By 2025, over 3.6 billion people worldwide will use online banking services, with the U.S. alone reaching more than 216.8 million users, according to Juniper Research. Mobile apps now act as the primary channel for many, with the American Bankers Association reporting that 55% of Americans chose them in 2024. Millennials drive this trend—60% prefer mobile apps over other methods, and 66% check their accounts at least five times per week.

What are the trends of mobile banking?

Based on research by Relevant Software, AI-powered banking software development remains a driving force in financial services. In 2024, 100% of consumers relied on AI-driven features for fraud detection, virtual assistants, and automated financial insights. Innovations like voice banking are set to add a new dimension to digital interactions, with the market projected to reach $1.88 billion by 2025.

What are the key features that should be included in a modern mobile banking app?

In 2025, mobile banking applications will evolve into comprehensive platforms that integrate money transfer, financial management, and customer service with personalized experiences and advanced security. These apps must address customer experience, combat unauthorized access, and cater to younger generations, who expect seamless and intuitive digital banking solutions.

Core features: the foundation of user experience

At the heart of any mobile banking app lies a set of key features that meet users’ fundamental needs. Without these foundational capabilities, even the most innovative app risks alienating users by neglecting their primary expectations.

1. Account management

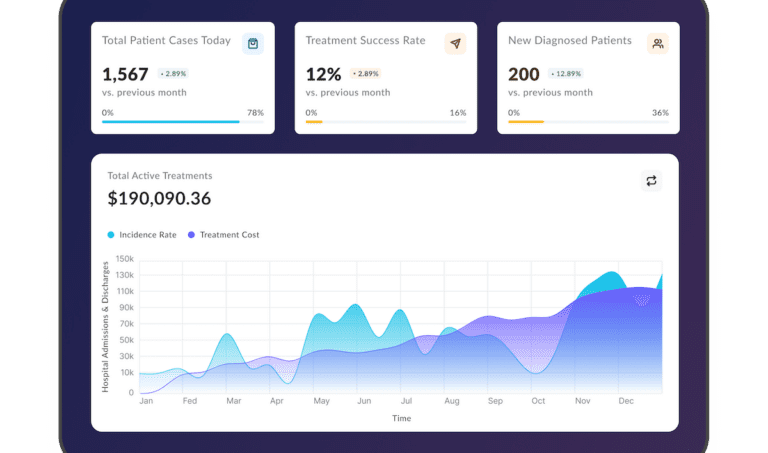

A seamless account management system forms the core of any mobile banking app. This feature must exceed basic balance views and past transactions. Advanced functions, such as categorization of expenses, access to downloadable account statements, and tools for managing multiple accounts—including savings, credit, and investments—now set the standard. Real-time updates and a visually clear dashboard keep users engaged and improve financial clarity.

2. Fund transfers

From Relevant Software’s experience, modern consumers expect instant, seamless transfers. This covers intra-bank, inter-bank, and international transactions. Features like live exchange rate calculators, SWIFT or IBAN support, and instant peer-to-peer payment options through contact sync or QR codes help keep your app competitive. Cross-border payments with minimal fees and real-time tracking also attract a globally connected user base.

3. Bill payments

A robust bill payment module eliminates friction in routine financial tasks. Beyond standard utilities, users should be able to pay credit card bills, subscription services, and insurance premiums directly through the app. Features like autopay scheduling, predictive reminders for upcoming bills, and detailed bill payment histories ensure that this feature integrates seamlessly into users’ financial lives.

Security features: reinforcing trust in digital banking

Cyber threats are no longer emerging risks—they are persistent realities. A mobile banking app must not simply include security measures but architect them into every layer of its infrastructure.

1. Multi-factor authentication (MFA)

Advanced MFA methods, such as biometric options like facial recognition, fingerprint scans, or device-based authentication tokens, are now essential. Compliance with regional and international data protection standards, such as GDPR or CCPA, strengthens user trust. Adaptive authentication, where risk levels adjust dynamically based on user behavior, adds another layer of security without compromising usability.

2. Fraud detection and prevention

Real-time fraud detection systems that leverage AI to analyze behavioral patterns can detect anomalies, such as transactions in unusual locations or spending spikes, with precision. A proactive approach that alerts users immediately and allows them to lock accounts or cards instantly directly within the app not only enhances security but also builds trust.

3. End-to-end encryption and tokenization

Beyond basic SSL encryption, tokenization of sensitive user data during transactions protects against breaches. This method replaces sensitive data with non-sensitive equivalents, which makes intercepted data unusable.

Personalization features: redefining customer engagement

Personalization transforms an app from a functional tool into a trusted financial companion, aligning seamlessly with each user’s unique financial goals and lifestyle.

1. Spending insights and budgeting tools

Empower users with financial literacy through AI-driven analytics in your app. Personalized spending insights with visual graphs, expense categories, and monthly trend summaries help users understand their financial habits. Features like goal-setting tools or automated savings calculators support users in achieving their long-term financial goals.

2. Push notifications with context

Notifications must provide actionable insights instead of generic updates. For example, rather than a low balance alert, suggest actions such as a fund transfer or a review of upcoming payments. Alerts based on unusual patterns or potential savings (e.g., “You saved $200 this month compared to last month—transfer to savings?”) strengthen user trust by addressing specific financial needs.

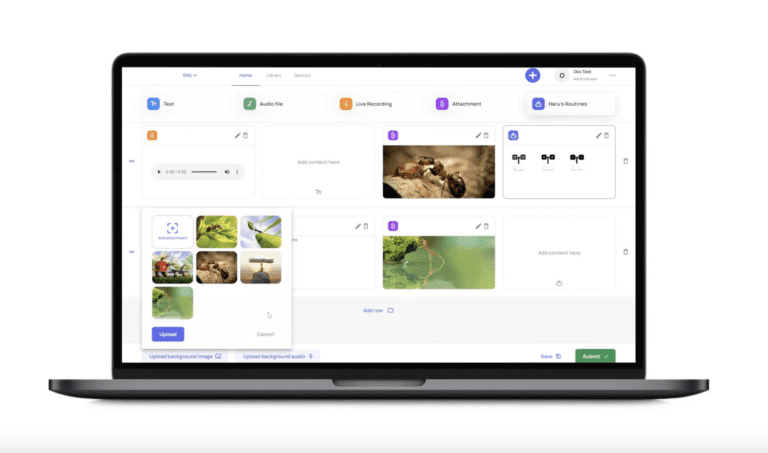

3. Customizable dashboards

Allow users to design their own experience. Whether through widgets for frequently accessed features, shortcuts for favorite payees, or dark mode options for better usability, customizable dashboards align the app with individual preferences, fostering loyalty.

Advanced features: anticipating user expectations

In 2025, advanced features will define the success of mobile banking apps. Be it AI, voice interfaces, or digital wallets. These innovations enhance convenience, accessibility, and user engagement.

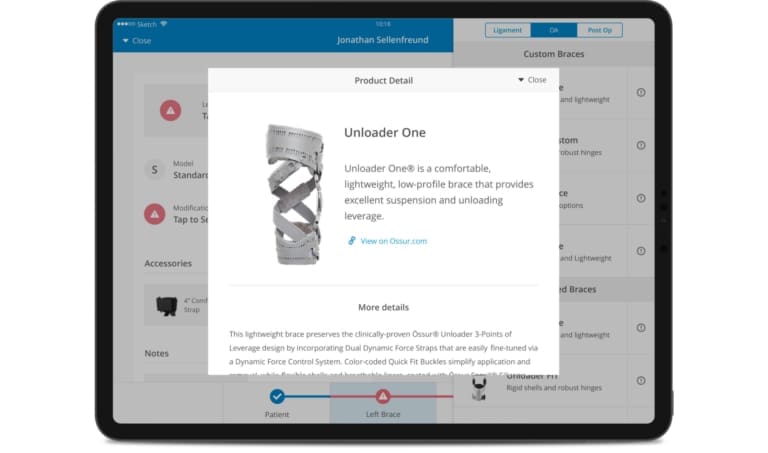

1. AI-powered virtual assistants

Sophisticated virtual assistants like conversational AI in banking guide users through complex tasks, such as savings optimization or international payment management. These assistants must understand natural language, recognize context, and integrate with voice systems like Siri or Alexa.

2. Digital wallet integration

A fully integrated wallet that supports Apple Pay, Google Pay, or Samsung Pay enables contactless payments. Expanding this, features like loyalty program support, receipt storage, and one-tap access for in-store and online purchases enhance ease of use for end users.

3. Voice banking

Voice-activated banking provides an accessible, hands-free option for users on the go. With natural language commands for tasks like balance checks, fund transfers, or bill payments, voice functionality broadens access and improves usability. Voice biometrics for authentication strengthens security further.

Convenience features: elevating everyday banking

These capabilities address real-world challenges like accessibility, connectivity issues, and location-based needs and make the app indispensable for users in their daily lives.

1. Branch and ATM locator

A feature that provides real-time insights into ATM availability, cash reserves, and operational branch hours ensures users avoid unnecessary delays. This proves especially valuable in regions with frequent ATM downtimes or cash shortages.

2. Offline access

Allowing users to access account balances or recent transactions even in offline mode can significantly enhance the app’s reliability, especially in regions with inconsistent connectivity. Synchronization upon reconnection ensures no gaps in the user experience.

3. Multi-language and accessibility support

Ensure inclusivity by offering multi-language support and compliance with accessibility standards (WCAG). Features such as screen reader compatibility, adjustable text sizes, and intuitive navigation enhance usability for all demographics.

Competitive differentiators: mastering market leadership

As the future of mobile banking evolves, financial institutions must offer more than standard features to stand out in a crowded market. Innovation in functionality, improvements in UI design, and a stronger banking app development process ensure a next-generation mobile application that meets user expectations.

1. Investment and wealth management tools

Expand beyond traditional banking with investment options such as stock trades, mutual funds, or cryptocurrency wallets. Personalized insights based on user portfolios and risk profiles turn the app into a comprehensive financial hub.

2. Bill Split and social payments

Features that let users divide bills instantly through contact sync or social media platforms serve a digitally connected audience. A payment app development company can enhance this functionality with automated payment reminders and expense tracking, which ensures a seamless and efficient user experience.

3. Card controls and insights

Advanced card controls, such as geo-lock, spend limits, or category-specific restrictions (e.g., block online purchases), give users precise control over their finances. Real-time spending notifications and detailed analytics per transaction type create a sense of financial transparency and empowerment in banking mobile app development.

Main challenges in mobile banking app development

Below is a detailed overview of the main hurdles in mobile banking application development, backed by insights from Relevant Software experts.

1. Ensuring robust security measures

Challenge: Protect sensitive user data and financial transactions from cyber threats.

Why it’s critical: Mobile banking apps handle vast amounts of confidential data, which makes them prime targets for cyberattacks. Any breach can lead to financial losses, reputational damage, and regulatory penalties.

Key complexities:

- Implementation of multi-layered security protocols, which include biometric authentication, end-to-end encryption, and tokenization.

- Protection against threats such as phishing, malware, and man-in-the-middle attacks.

- Compliance with security standards like PCI DSS, GDPR, or CCPA.

Solution verified by Relevant experts:

- Deploy AI-driven fraud detection to identify suspicious behavior in real-time.

- Perform frequent penetration tests and security audits to uncover and address vulnerabilities.

- Use advanced authentication methods such as FIDO2-compliant biometrics or hardware-based tokens.

2. Achieving seamless user experience (UX)

Challenge: Create an intuitive and responsive interface that meets diverse user needs.

Why it’s critical: Banking apps must balance functionality with simplicity to serve tech-savvy Millennials, digital-first Gen Z users, and older customers who may be less familiar with technology.

Key complexities:

- Optimize navigation to cover a wide range of banking services without overwhelming users.

- Ensure accessibility for users with disabilities (e.g., WCAG compliance) in mobile banking development.

- Maintain consistent performance across different devices and operating systems.

Solution verified by Relevant experts:

- Conduct extensive user research and usability testing to understand user behaviors and preferences.

- Employ a modular UI/UX design that simplifies complex workflows, such as fund transfers or loan applications.

- Optimize performance with lightweight architecture to ensure fast loading times, even on low-spec devices.

3. Regulatory compliance and data privacy

Challenge: Comply with an application with regional and global regulations governing financial services and data protection.

Why it’s critical: Non-compliance risks significant legal and financial consequences, along with a loss of customer trust.

Key complexities:

- Navigate diverse regulations such as PSD2 (EU), GDPR (EU), CCPA (California), and local financial laws.

- Implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) measures.

- Manage cross-border compliance when operating across multiple jurisdictions.

Solution verified by Relevant experts:

- Build compliance into the banking application development process from the outset with the help of legal and regulatory experts.

- Integrate API-driven solutions for KYC and AML to streamline compliance workflows.

- Use region-specific encryption protocols to align with local data protection laws.

4. Management of scalability and performance

Challenge: Handle a larger number of users and transactions without downtime.

Why it’s critical: Poor scalability can cause crashes during high-traffic periods, such as payday or promotional events, which damages user trust.

Key complexities:

- Scale infrastructure to support real-time data for millions of concurrent users.

- Ensure high availability with failover mechanisms and redundancy.

- Maintain speed and reliability during peak usage.

Solution verified by Relevant experts:

- Use cloud-based architecture with autoscaling capabilities to handle variable traffic loads.

- Implement load balancing and microservices to ensure smooth app performance.

- Monitor app health with real-time analytics tools to identify and address performance bottlenecks quickly.

5. Integration of emerging technologies

Challenge: Incorporate AI, blockchain, and other innovative features without compromising secure access or app performance.

Why it’s critical: Users now expect AI-powered chatbots in banking, real-time fraud detection, and seamless blockchain payments as standard features. Lack of innovation risks market relevance.

Key complexities:

- Manage AI and blockchain requirements without disrupting the user experience.

- Ensure third-party APIs and external systems comply with best practices for security and regulatory standards.

Solution verified by Relevant experts:

- Use lightweight AI models for real-time decisions, such as fraud detection or digital payment insights.

- Partner with trusted fintech providers to integrate digital currency wallets or secure blockchain payment systems.

- Maintain flexibility with a modular architecture to support fast updates and seamless adoption of new technologies over a long time.

6. Competition in a saturated market

Challenge: Stand out in a crowded marketplace filled with traditional banks and fintech disruptors.

Why it’s critical: A unique app experience is essential to attract users and keep them engaged amid countless alternatives.

Key complexities:

- Define unique selling points (USPs) that resonate with the target audience.

- Establish trust with users who hesitate to adopt lesser-known brands.

- Compete with large players that have significant resources for innovation and marketing.

Solution verified by Relevant experts:

- Focus on hyper-personalized features such as predictive financial advice and tailored investment options.

- Enhance user engagement with gamification elements like savings challenges or rewards programs.

- Build credibility with certifications, partnerships, and robust security measures.

7. Cost and time constraints

Challenge: Meet development deadlines and budgets without lowering quality.

Why it’s critical: Delays or cost overruns reduce ROI and delay market entry.

Key complexities:

- Align project milestones with business goals while accounting for unexpected obstacles.

- Manage costs for specialized developers and compliance requirements.

Solution verified by Relevant experts:

- Adopt agile methodologies to maintain flexibility and adjust timelines based on priorities.

- Use ready-made SDKs or APIs for features like payment gateways instead of building from scratch.

- Prioritize features for the initial launch and plan updates for post-launch phases.

8. Cross-platform compatibility

Challenge: Deliver a unified experience across iOS, Android, and the web without sacrificing performance or functionality.

Why it’s critical: Users expect seamless access to banking services, no matter the device or operating system. Any inconsistencies in performance, layout, or feature availability can undermine trust and usability.

Key complexities:

- Adjust to varying screen sizes, hardware limitations, and OS-specific behaviors.

- Maintain feature consistency across platforms without fragmentation.

- Optimize performance to ensure smooth interactions on all supported devices.

Solution verified by Relevant experts:

- Leverage cross-platform frameworks like Flutter or React Native to ensure efficiency and consistency across multiple operating systems.

- Conduct extensive validation across multiple devices and operating systems to eliminate inconsistencies and optimize user experience.

- Optimize code for platform-specific functionalities, such as iOS’s Face ID or Android’s Material Design.

Addressing these challenges with foresight and precision ensures that your mobile banking app not only meets industry standards but also positions itself as a leader in the market.

Step-by-step guide to mobile banking app development

Developing a mobile banking app demands more than just technical expertise—it requires a precise strategy, a deep grasp of financial ecosystems, and an acute awareness of evolving user expectations. Below is a detailed step-by-step guide from Relevant Software experts to ensure a secure, user-focused, and innovative solution.

1. Define your vision and objectives

Before developing a mobile banking application, establish a clear roadmap based on market research, industry best practices, and user expectations.

- Identify target users: Determine the primary audience—Millennials, Gen Z, SMEs, or corporate clients—and incorporate advanced technologies to meet their evolving needs.

- Set goals: Decide whether the app will prioritize convenience, financial education, investment management, or an all-in-one mobile banking features suite.

- Analyze competitors: Study market leaders, leveraging market research to identify gaps and opportunities for differentiation in the digital finance space.

2. Conduct market and regulatory research

Thorough research ensures your app complies with legal requirements and meets market expectations.

- Understand market trends: Analyze the demand for features like AI-powered chatbots, digital wallets, and budgeting tools.

- Review regulations: Familiarize yourself with compliance standards such as PCI DSS, GDPR, PSD2, or local fintech regulations to avoid legal risks.

- Evaluate user pain points: Conduct surveys or interviews to uncover frustrations with existing apps and design solutions to address them.

3. Choose the right features and technologies

Define the core functionalities and supporting technologies.

- Must-have features: Include account management, fund transfers, bill payments, real-time notifications, and multi-factor authentication.

- Advanced features: Integrate AI-based spending insights, voice banking, investment options, and digital wallet functionality.

- Technology stack: Select technologies based on scalability, security, and compatibility.

Examples:

- Backend: Node.js, Python (Django), or Java (Spring Boot).

- Frontend: React Native, Flutter, or Swift/Java for native apps.

- Database: PostgreSQL, MongoDB, or MySQL.

- APIs: Plaid for account linking, Stripe for payments, and Twilio for notifications.

4. Design the user experience (UX) and user interface (UI)

Your app’s mobile UI design significantly impacts adoption and retention. A seamless interface improves customer experience, simplifies money transfers, and ensures secure access to essential mobile banking features.

- Wireframes: Start with low-fidelity layouts to define the structure and user flow, focusing on essential mobile banking features such as money transfers and bill payments.

- Intuitive navigation: Use a minimalistic, modular layout that simplifies access to core features like transfers or bill payments.

- Accessibility: Ensure the design complies with WCAG standards, with options such as text size adjustment, dark mode, and voice control.

Prototype Testing: Interactive models help assess usability and refine the banking app development process before full deployment for a frictionless experience.

5. Build a secure and scalable backend

The backend architecture is the backbone of your app.

- Leverage Node.js Development Services: Utilizing Node.js ensures a lightweight, high-performance backend capable of handling concurrent requests efficiently while maintaining low latency.

- Focus on security: Use tokenization for sensitive data. Implement end-to-end encryption for all transactions. Enable real-time fraud monitoring with AI algorithms.

- Ensure scalability: Build a microservices architecture to handle growth without bottlenecks.

API integration: Seamlessly connect with payment gateways, KYC verification services, and third-party tools.

6. Develop the frontend

The front end creates a smooth and immersive user experience.

- Cross-platform compatibility: Use frameworks like Flutter or React Native to maintain consistency across iOS and Android.

- Responsive design: Optimize for various screen sizes to ensure full functionality on smartphones, tablets, and wearables.

- Performance optimization: Prioritize lightweight architecture and minimize latency for real-time account updates.

7. Test rigorously

Comprehensive quality assurance services are essential to ensure functionality, security, and usability.

- Functional tests: Confirm that transfers, payments, and notifications operate as expected.

- Security tests: Detect vulnerabilities through penetration tests and verify compliance with data protection standards.

- Performance tests: Assess stability under high traffic to maintain seamless operation.

- User acceptance tests (UAT): Collect beta user feedback to enhance usability.

8. Launch a minimum viable product (MVP)

MVP development services allow you to validate your app’s core features before a full-scale launch.

- Prioritize features: Focus on essential functionalities such as account management, transfers, and notifications.

- Collect feedback: Use analytics tools to monitor user behavior and identify pain points.

- Iterate quickly: Use feedback to refine features, improve design, and fix bugs.

9. Deploy the app

Prepare for a smooth rollout by ensuring readiness on all fronts.

- App Store submission: Adhere to Google Play and Apple App Store guidelines with accurate descriptions, relevant keywords, and high-quality screenshots.

- Infrastructure setup: Use cloud services like AWS or Azure for reliable hosting and automatic scaling.

- Monitoring tools: Deploy solutions like Firebase or AppDynamics to track app performance after launch.

10. Focus on continuous improvement

Post-launch, your work isn’t over, especially if you are designing for fintech. Continuously enhance your app to retain users and maintain relevance.

- Feature updates: Roll out advanced features like investment options, personalized financial advice, or blockchain-based transactions.

- Security updates: Regularly patch vulnerabilities to stay ahead of cyber threats.

- User engagement: Use personalized push notifications and loyalty programs to maintain user interest.

Key considerations for success

- Collaboration with experts: Work with experienced fintech developers who understand the nuances of secure, high-performance banking app development.

- Customer support: Provide 24/7 assistance through chatbots, in-app messages, or a dedicated helpline to resolve issues efficiently.

- Market adaptation: Remain flexible and adjust to user expectations, regulatory updates, and technological advancements.

How much does it cost to develop a mobile banking app?

The investment required for banking software development services varies based on app complexity, features, and development region. A basic app with essential functionalities such as account management and fund transfers typically costs between $100,000 and $150,000. More advanced solutions incorporating AI-driven insights, digital wallets, and enhanced security measures range from $200,000 to $350,000. High-end apps with blockchain integration, multi-platform support, and real-time fraud detection can exceed $500,000.

Development costs also depend on location:

- North America/Western Europe: $100–$250 per hour

- Eastern Europe/Asia: $30–$100 per hour

Accurate cost estimation requires a thorough assessment of project requirements, security considerations, and long-term scalability. Contact our experts to gain deeper insights and receive a tailored evaluation for software development outsourcing.

Related – How to digitize your business

Build a mobile banking app with Relevant Software

A mobile banking app is more than a product—it extends trust between financial institutions and their users. Success requires more than clean code or sleek design; it demands a deep understanding of security, regulation, and human behavior. Achieving this level of excellence demands a trusted technology partner —one with the expertise to turn vision into reality.

At Relevant Software, we don’t just write software—we solve complex challenges in digital finance. Through our fintech software development services, Relevant Software clients have successfully adapted to regulatory shifts, built secure and scalable infrastructures, and delivered intuitive user experiences that drive engagement and trust.

In an industry where the margin for error is nonexistent, and expectations continually rise, expertise defines leadership. Contact us if your goal is not just to participate in digital banking but to set new benchmarks.

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us