Xero Integration: How to Streamline Your Business Finances with Seamless Connectivity

Manual accounting is not just outdated — it costs your business time, accuracy, and scalability. Still, many companies manage finances across disconnected systems, juggling spreadsheets, payment tools, and invoicing software to stay afloat. Xero integration connects it all.

According to Xero, businesses that use connected apps grow revenue 30 percent faster. By linking Xero with your CRM (customer relationship management), e-commerce platform, payroll system, and so on, you remove friction, automate workflows, and gain a real-time view of your financial health. Whether you are a fast-scaling SaaS company, a Shopify merchant, or an enterprise CFO, Xero integrations transform your accounting software into a command center for smarter, faster decisions.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

In this guide, you’ll learn what Xero integration is, why it matters, how to implement it, and which integrations unlock the most value. You’ll also see how Relevant Software, a fintech software development company, helps businesses like yours build secure, custom, and scalable integrations that boost performance without disrupting operations.

What is Xero integration?

Relevant Software experts describe Xero integration as a simple way to connect your accounting system with the tools your team already uses, so everything works together, not in silos.

Started in Wellington, New Zealand, around 2006, Xero has grown into one of the better-known accounting tools out there for small and mid-sized businesses. It’s cloud-based, and over four million businesses now use it across 180+ countries.

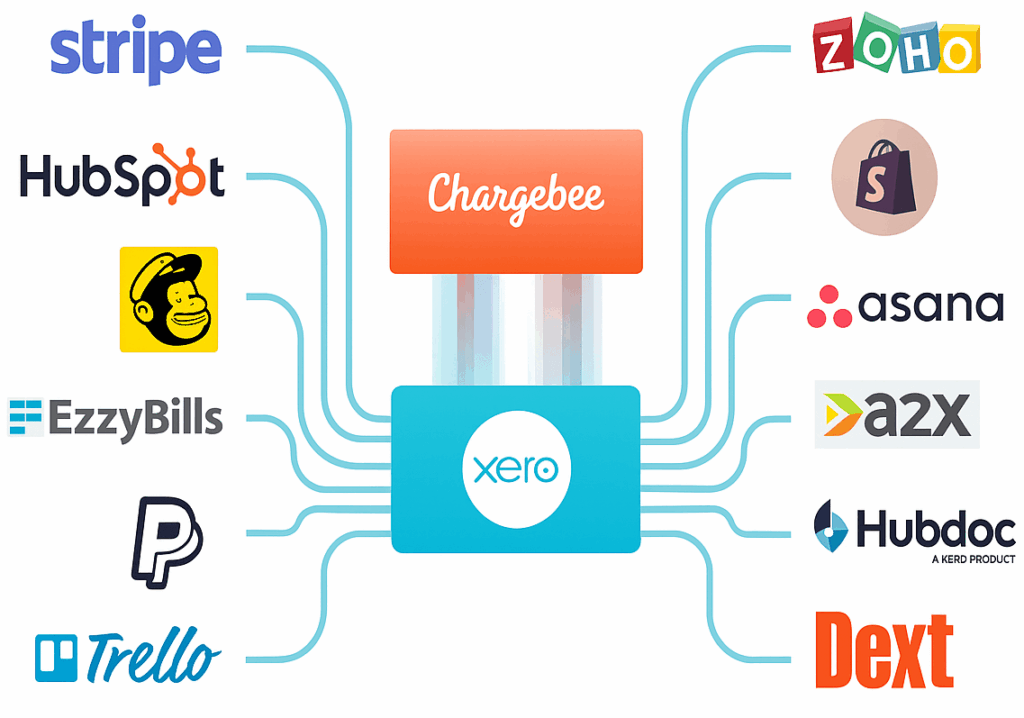

You can use it to send invoices, track payments, run payroll, and keep tabs on expenses. But what most people like, especially once they start using it, is how easily it connects with other software. There are over a thousand apps that work with it. You can hook it up to whatever tools you already use: Shopify, Stripe, Gusto, and even CRMs like HubSpot or Zoho.

In practice, Xero integration enables:

- Invoices from your CRM to automatically appear in Asana and Xero

- Payments from Stripe or PayPal to sync instantly with your accounts

- Payroll data from Gusto or ADP to update your ledger directly

- Expense receipts to match transactions in real time

- Inventory changes to reflect immediately in your financial records

This seamless data flow turns Xero into more than accounting software. It becomes the financial core of a connected business ecosystem.

Why businesses need Xero integration

Every business relies on a mix of tools — one for payments, another for payroll, a different one for sales, and maybe several more for inventory or customer data. The more systems your team uses, the harder it becomes to keep financial data accurate and aligned. This is where Xero integration makes a meaningful difference.

It connects your accounting system with the software your teams already trust. Customer records, transactions, and payments move between platforms without manual entry. This creates a single, up-to-date source of financial truth across the business.

This kind of integration does more than save time:

- It helps teams avoid costly errors and duplicates.

- It improves financial accuracy across the board.

- It reduces dependence on spreadsheets or disconnected exports.

- It gives you a real-time view of your cash flow and liabilities.

As your business grows, the complexity of financial processes increases. Xero integration brings structure to that complexity and ensures your systems work together instead of operating in isolation. Whether you manage payroll, track inventory, or reconcile payments, the integration provides control, speed, and confidence.

Key Xero integrations and their benefits

No team enjoys wasting time on double data entry. Yet many businesses still switch between systems to update the same information more than once. A sale closes in your CRM, but the finance team doesn’t see it. Payroll runs, but accounting scrambles to reconcile the cost. These disconnects don’t just slow your team; they create blind spots in your financial picture.

Xero software integration solves this by connecting your accounting system with the rest of your business tools. It turns fragmented processes into automated workflows that increase accuracy and visibility. Here are the most valuable Xero integrations driving that transformation:

Xero CRM integrations

Xero connects with CRMs like Salesforce, HubSpot, and Zoho to keep customer and payment data consistent across departments. When a deal closes in your CRM, it can automatically generate a Xero sales invoice, updating payment status in real time.

This kind of integration bridges the gap between sales and finance. CRM Xero integration also ensures teams work with the same data and improves billing speed, especially in SaaS product integrations, where client relationships depend on smooth handoffs between systems.

Xero + e-commerce platforms

If your ecommerce business runs a Shopify store, WooCommerce, Amazon, or eBay, integrating those platforms with Xero saves time and reduces errors, such as those encountered with Shopify integration for managing sales channels. Orders appear in Xero automatically, invoices are created, and taxes are applied based on the buyer’s location.

For online sellers, this type of Xero automation tool is critical. It keeps transactions, fees, and refunds in sync without manual input, simplifying reconciliation and streamlining month-end closes, making your first month of integration smoother.

Xero + payroll integrations

Payroll often runs through separate platforms. But when connected to Xero, tools like Gusto, ADP, or PayPal Payroll close the gap. Xero payroll integrations ensure wages, taxes, and benefits flow directly into your accounting system.

This is where Xero payroll software proves especially effective, helping teams eliminate manual work and maintain consistent records across systems. With the right payroll software integration, finance and HR teams avoid double entries, improve compliance, and simplify year-end reporting.

Xero compliance integration also plays a critical role here, verifying that every payroll transaction aligns with your financial data and reducing audit risk as you scale.

Xero + expense and inventory management

Platforms like Expensify, DEAR Inventory, and Unleashed help manage spending and stock across e-commerce channels. Without integration, though, they require constant manual updates. Xero add-ons eliminate that friction.

With tools like these, you can upload receipts, sort transactions, and adjust inventory levels automatically. These Xero plugins support Xero inventory management, improve margin tracking, and speed up Xero expense tracking at scale.

Xero + ERP (Enterprise Resource Planning)

Xero also works with enterprise platforms like SAP, Microsoft Dynamics, and NetSuite. These connections give larger businesses access to real-time financials across HR, logistics, procurement, and budgeting.

Relevant Software’s clients use ERP integrations to create structured, scalable systems. These integrations support Xero budgeting integration by automating updates to forecasts and procurement data. They also improve consistency across departments and cut time spent on manual updates. With help from official Xero integration partners, these systems scale smoothly and without silos.

Xero SaaS integration

It is a core part of the financial stack for many SaaS companies. By integrating tools like Chargebee, Stripe, and HubSpot, businesses can sync subscription billing, customer data, and revenue reports automatically, including support for credit cards, Google Pay, and custom payment gateways.

These Xero analytics integration setups enable faster forecasting, tighter cash flow control, and clean subscription metrics, all without juggling exports between platforms. For subscription-heavy businesses, this setup helps improve Xero financial reporting and accelerate growth.

Xero reporting and time tracking tools

Xero also integrates with tools for financial reporting, project time tracking, and mobile operations. With Xero reporting tools, finance leaders get real-time dashboards that support better decisions. Xero time tracking integration helps service teams log hours that feed directly into payroll or invoicing systems.

Field teams can also use Xero mobile integration to submit expenses, view account balances, or approve payments on the go, creating a more agile finance function.

Xero workpapers and compliance management

For accountants and finance teams, Xero Workpapers simplifies compliance processes and document preparation. When paired with other integrated systems, Workpapers help ensure accuracy in Xero bookkeeping, tax filings, and end-of-year reporting.

With real-time access to reconciled accounts and automated updates from Xero bank reconciliation, teams reduce risk and improve audit readiness. It’s also a vital tool for businesses that prioritize Xero tax compliance across multiple jurisdictions.

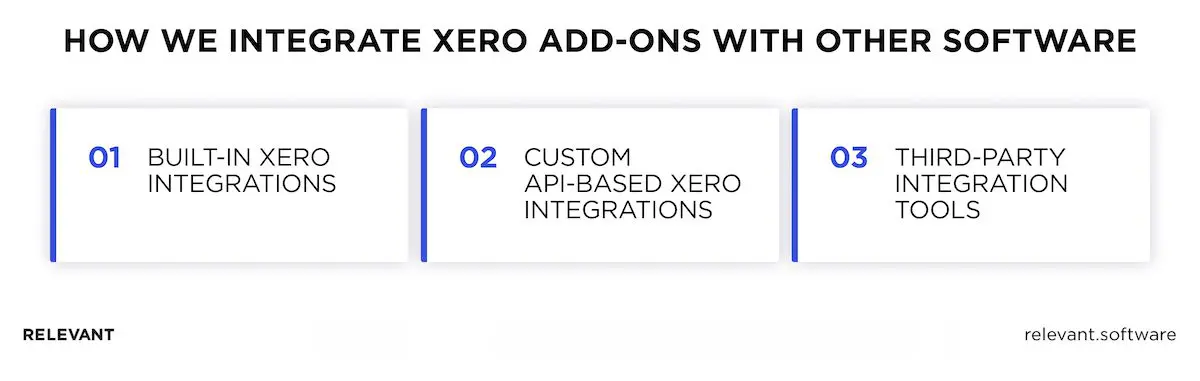

How we integrate Xero add-ons with other software

We support businesses by connecting Xero to the tools they already use. Our integration process focuses on accuracy, automation, and long-term stability. Relevant Software’s engineers adjust the approach based on your systems, your industry, and your internal workflows. Each method we use supports better decision-making, consistent records, and fewer bottlenecks.

Here’s how we approach Xero software integration across different levels of complexity.

Built-in Xero integrations

Many users start their integration journey with pre-built apps available through the Xero App Marketplace. These ready-to-connect solutions provide a fast, reliable way to extend functionality without custom development. At Relevant Software, we guide clients through the selection of the right tools, the configuration of integrations, and the validation of the data flow to ensure consistency and accuracy.

We begin by reviewing your current systems, including tools for payroll, sales, CRM, inventory, and payments. Then, we identify which apps offer direct integration with Xero. These include Shopify, Stripe, HubSpot, Gusto, and hundreds more.

We follow these steps:

- Confirm app compatibility with your plan

- Connect the app securely through the Xero Marketplace

- Adjust field mapping between systems (for example, product codes, customer names, or account numbers

- Set sync frequency, direction, and triggers

- Test invoice flow, transaction accuracy, and tax rules

- Train your team on what to expect and how to verify records.

This approach suits clients who want faster results without code. It cuts manual data entry, improves cash flow visibility, and supports automated reconciliation. Built-in apps also allow teams to create invoice records from CRMs, streamline accounting from e-commerce, and manage Xero bank integrations from payment platforms.

Custom API-based Xero integrations

For companies with more complex systems or higher compliance needs, we create direct connections using the Xero integration API. This method allows full customization of data structure, logic, and controls.

We begin by mapping your business logic. This includes your internal workflows, data hierarchy, reporting structure, and approval rules. Then, we define which parts of your system should send or receive data from Xero.

Our process includes

- Authentication of access with OAuth 2.0 and secure tokens

- Setup of a data layer to support custom rules (such as cost centers, tax logic, or project codes)

- Definition of sync triggers based on your internal events (such as deal close, inventory receipt, or payroll approval)

- Creation of custom error handlers and conflict resolution rules

- Execution of staged tests in sandbox environments

- Supervision of live sync processes to ensure long-term reliability

We use this method when the App Marketplace cannot meet specific needs. Our team builds APIs that integrate with ERPs, CRMs, project systems, or financial reporting software. Custom integrations also support advanced document management, real-time analytics, or internal compliance audits.

Third-party integration tools

Some clients prefer middleware solutions that connect Xero to other platforms without building a full API. For these cases, we use platforms like Zapier, Make, or other Xero integration partners that support no-code or low-code workflows.

These tools solve practical problems quickly. They link CRMs, HR platforms, helpdesk tools, and even spreadsheets to Xero. Our job is to build the logic, configure the flows, and ensure the data stays accurate.

We follow this structure:

- Choose the right connector for your stack

- Build conditional logic between triggers and actions (e.g., “When an invoice is approved in Tool A, send it to Xero”)

- Map data fields to avoid duplication

- Review edge cases and exception handling

- Document workflows for ongoing use by your team

This approach is best for growing companies that want control without complexity. These integrations support CRM integration, expense syncing, payment updates, and light inventory management. They also keep Xero SaaS integration in sync with fast-moving startup environments.

Best practices we apply to every Xero integration

We build each integration to serve the real-world pace and structure of your business. Here’s what we prioritize on every project:

- Data consistency

We ensure every system uses aligned names, tax codes, and account logic. This prevents mismatches in reconciliations or reports. - Platform fit

We match each tool to your business model. A small business accounting program needs a different logic than a system built for accounting software for banks or international SaaS platforms. - Stability and recovery

We plan for version changes, token expiration, API limits, and system failures. This ensures syncs don’t break silently and data stays complete. - Documentation and training

We provide detailed setup records, field maps, permission structures, and update policies. We also train your internal team to manage the connection with confidence.

Each project focuses on real business challenges, not just technical features. We help you reduce delays, gain control over your numbers, and scale operations without sacrificing financial visibility.

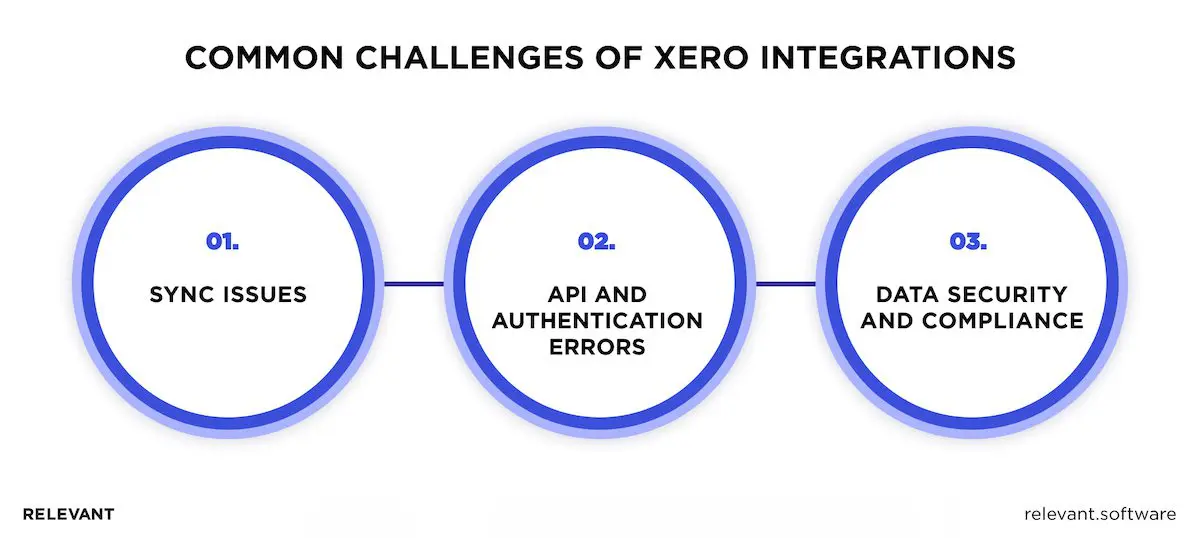

Common challenges and troubleshooting Xero integrations

Even with a strong setup, integration issues can surface. They often result from platform changes, user errors, or security gaps. We focus on identifying the cause quickly, applying a direct fix, and setting rules that prevent future disruptions.

Sync issues

Sync problems usually show up as duplicated records, missing entries, or mismatched transactions. These errors can confuse finance teams and cause reporting delays.

We solve this by:

- Reviewing sync rules and trigger conditions

- Matching field structures across both systems

- Removing duplicate entries

- Reconnecting systems after test validations

Incorrect imports often point to outdated tax codes, currency mismatches, or incomplete customer records. We clean up the affected historical data and reset sync rules to restore accuracy.

API and authentication errors

When a custom connection fails, the issue often ties back to authentication. Expired tokens, rate limits, or blocked access permissions can all disrupt data flow.

To resolve this, Relevant Software experts:

- Renew API tokens using the latest authorization method

- Verify account permissions and access scopes

- Adjust API call frequency to meet provider limits

- Log all requests and responses for full traceability

We also install monitoring alerts that flag failed syncs. This keeps your team informed and allows a faster response when issues occur.

Data security and compliance

Any Xero for business integration that handles financial data must meet strict standards for privacy, security, and control. Relevant Software clients often work in finance, healthcare, and other highly regulated sectors. To support them, we apply a structured approach to compliance at every integration point.

We review every app involved in the integration. This includes checking its encryption protocols, permission model, and location of stored data.

To reduce compliance risk, we:

- Choose platforms with proven audit controls

- Limit access based on role and team structure

- Avoid third-party tools that lack clear privacy documentation

- Offer direct, in-house alternatives when data sensitivity is high

Relevant Software developers work only with Xero integration partners that follow verified security practices. When external apps create risk, we isolate financial data and manage the entire process within your own environment.

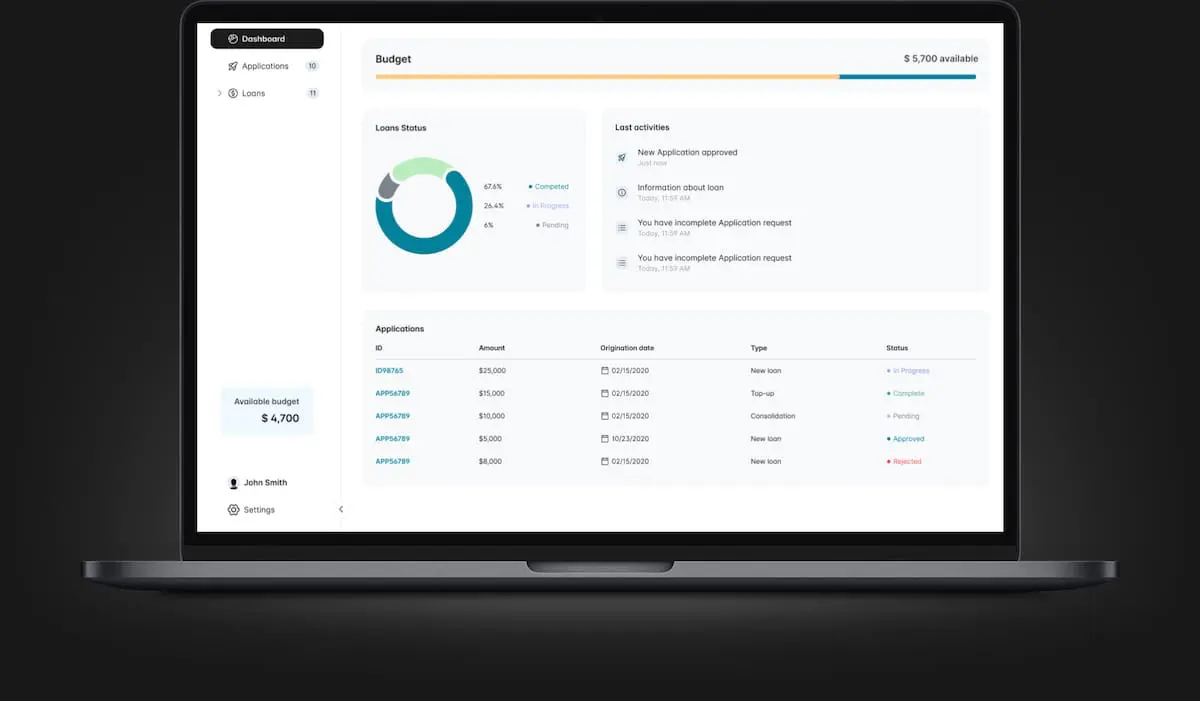

Our success story: Xero integration in finance

A leading loan provider in the Caribbean reached out to us with a clear goal. They wanted to replace outdated systems, lower operating costs, and regain control over financial processes. Their team relied on disconnected tools and paper-heavy workflows, which slowed operations and increased compliance risk. We designed and delivered a full-scale financial platform that included seamless Xero integration and resolved every key pain point.

The problem we had to solve

The company faced several issues that held back efficiency and growth:

- Teams processed loans manually through outdated, paper-based systems

- A third-party loan management platform added unnecessary expenses

- Batch processes delayed approvals and reduced transparency

- Finance teams lacked real-time access to financial records

- Customers experienced long wait times and poor visibility over application status

They needed a system that combined speed, accuracy, and compliance—all in one place.

Our solution

We built a custom web platform tailored to the company’s business model and financial structure. Here’s what we included:

- A secure customer portal that allowed applicants to submit and track loan requests

- Automated loan disbursements that transferred funds instantly after approval

- A built-in referral program that encouraged customer-driven growth

- Dynamic reporting dashboards that supported daily operations and long-term planning

- Full Xero integration to align every loan transaction with the company’s accounting system

We connected the platform directly to Xero. Every loan record, adjustment, and disbursement fed into the ledger without delays. This setup eliminated the need for manual entries and gave financial teams up-to-date information at all times.

The results

Within weeks, the client saw a measurable impact:

- Cut platform maintenance costs by 75%

- Reduced batch processing time from 30 seconds to 3 seconds

- Removed the third-party loan system, saving $100,000 per year

- Delivered real-time payment and reporting access to the finance team

- Eliminated delays in the loan process and improved customer visibility

By integrating Xero into a purpose-built platform, we helped the client take control of financial operations, scale with confidence, and create a faster, more reliable lending process.

Integrate Xero with Relevant Software

If your business needs more than a basic Xero setup, we help you turn it into a connected financial engine. At Relevant Software, we work with companies in finance, e-commerce, SaaS, and other sectors to design structured, scalable systems that integrate seamlessly across tools and teams.

Our process begins by assessing your current software stack. We identify where data gets stuck or duplicated, then connect Xero to the systems you already use, whether that’s a CRM, payroll platform, or a custom ERP. Each connection is designed for long-term reliability, real-time visibility, and audit-ready compliance.

This approach draws on our experience delivering complex fintech solutions for global lenders, payroll providers, and payment platforms. It’s not just integration—it’s building a financial foundation that performs at scale and evolves with your business.

Want to explore what that could look like in your business? Contact us to start a cooperation.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.