Secure Payments Made Easy: The Role of Virtual Terminal Payment Gateways

If this is the first time you realize your business needs to start accepting electronic payments, you may wonder just how many options and solutions there are nowadays. Mobile payment application solutions, gateways, processors, and other variants can overwhelm. But if you are looking for a solution that allows payment processing anywhere, anytime, without the hassle of hardware, you should definitely look closer to a virtual terminal payment gateway.

The payment gateway industry is booming, expanding from $32.05 billion in 2023 to a projected $37.59 billion in 2024. Yes, the demand for flexible and reliable payment solutions is at an all-time high.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

That’s because virtual terminals offer incredible flexibility and convenience for business owners. They let you process transactions through any internet-connected device, so you never miss a sale, whether you’re at a trade show, a pop-up event, or working from a remote location. You don’t even need a physical terminal to accept payments. Sounds good? And that’s the way it is. Today, we want to tell you about the ins and outs of virtual terminal payment gateways, discussing their features, benefits, and why they might be the perfect solution for your business’s payment processing needs.

What is a Virtual Terminal?

Before we can go any further in our discussion of the topic, what we need first is to define the essentials. So, what is a virtual terminal, and what are its primary functions?

A virtual terminal is basically a digital variant of a physical point-of-sale (POS) terminal we can see in supermarkets and retail stores. It’s a web-based platform that enables companies to process payments digitally but doesn’t need hardware for it. What you need is an internet-connected device—be it a computer, tablet, laptop, or smartphone—and you’re ready to go.

The core function of a virtual terminal is to securely process payment transactions. To initiate a transaction, a user typically enters the customer’s card details manually, including the card number, expiration date, and CVV. The virtual terminal then encrypts this data and waits for the payment processor to approve it. As soon as it is authorized, the funds are placed into the accounts receivable.

On top of simply processing transactions, many virtual terminals have extra functionalities like:

- Batch processing: For processing multiple transactions at once.

- Recurring billing: For subscription-based businesses.

- Refund processing: For issuing refunds to customers.

- Customer management: For storing customer information securely.

- Integration with accounting software: For streamlined financial management.

Virtual Terminal vs. Physical POS

If we don’t take into account the most obvious aspect is that a physical terminal we can touch and a virtual one cannot, they also differ technically in their setup and operation:

| Feature | Virtual Terminal | Physical POS |

| Hardware | No physical hardware is required | Requires dedicated hardware (terminal, credit card reader) |

| Access | Accessible from any internet-connected device | Limited to the terminal’s physical location |

| Setup | Typically quicker and easier to set up | Requires installation and configuration of hardware |

| Portability | Highly portable | Not portable |

| Cost | Generally lower initial costs | Higher initial investment in hardware |

In a nutshell, an online virtual terminal is a more flexible, accessible, and cost-effective payment processing option compared to traditional POS systems. However, for businesses with high-volume, in-person transactions, a physical POS might still be necessary or preferred.

Payment Gateway vs Virtual Terminal Payment Gateway

Terms like “payment gateway” and “virtual payment gateway” will be used very often, yet what do they actually mean? Well, they both are critical components of the electronic payment ecosystem, but they serve distinct purposes.

A payment gateway is a digital tool that enables online and echeck payments by serving as an intermediary between the payment processor and a merchant’s platform. When a shopper clicks “buy,” the gateway encrypts their payment details, forwards it for authorization, and then reports back to the merchant.

A virtual payment gateway is a web-based interface where merchants need to manually enter customer payment information to process virtual terminal transactions. Strictly speaking, it’s a digital version of a physical POS terminal. Virtual terminals are mostly used for phone orders, mail-order sales, or in-person transactions where a physical POS terminal is unavailable.

| Feature | Payment Gateway | Virtual Terminal |

| Purpose | Facilitates online payments | Processes manual card entry |

| User Interface | Customer-facing | Merchant-facing |

| Transaction Type | Online, e-commerce | Phone, mail-order, in-person |

| Integration | Integrates with a website or shopping cart | Standalone application |

| Typical Use Cases | Online stores, e-commerce platforms | Call centers, pop-up shops, small businesses |

| Setup and Maintenance | Can involve complex setup and regular maintenance | Easy setup, minimal maintenance |

| Cost | Higher due to hardware and installation costs | Lower, as it’s web-based |

Note: Many payment gateway providers offer virtual terminals as an additional feature, allowing businesses to manage both online and offline payments through a single platform.

How Virtual Terminal Payment Gateway Works

A virtual terminal is a user-friendly interface businesses can access through an Internet browser on their mobile device to process credit, debit card, or AHC payments whenever they need to. To understand how it functions, we outlined the key components and principles of a virtual terminal payment gateway.

Key Components and Processes

For a virtual payment gateway to work, you need to make sure you have the following:

- Merchant account to accept card payments.

- Payment gateway to facilitate ecommerce transactions.

- Payment processor to handle the communication between the merchant account and the card networks.

- Card networks (American Express, Mastercard, Discover, Visa, etc.).

- The issuing bank, i.e., the bank that issued the consumer’s card.

- The acquiring bank you partner with to process transactions.

Merchant account setup

To use a virtual terminal, a business should first create a merchant account. You should apply through a payment processor and provide some information about your business (legal structure, business type, bank account details). You’ll also be asked about your sales volume and what kind of transactions you plan to accept. Once approved, you’re assigned a merchant ID and other credentials necessary to access the virtual terminal.

Data encryption and security protocols

Clearly, security is of paramount importance in such a delicate task as payment processing. In this regard, virtual terminal solutions employ the latest encryption methods to secure sensitive data. When a merchant enters card information, it is encrypted and transmitted securely to the payment gateway, which ensures data confidentiality throughout the transaction process. Also, good virtual terminals adhere to the Payment Card Industry Data Security Standard (PCI DSS).

Authorization and settlement processes

When you enter a customer’s payment details and hit ‘submit,’ the virtual terminal sends this data to the payment processor, which then queries the customer’s financial institution to confirm the available balance. Given the availability of the funds, the transaction gets the green light.

Now, the transaction moves to the settlement phase. This is where the money is actually moved from the customer’s bank to your merchant services account, usually collected and processed daily in batches.

In broad terms, that’s how a virtual terminal payment gateway works.

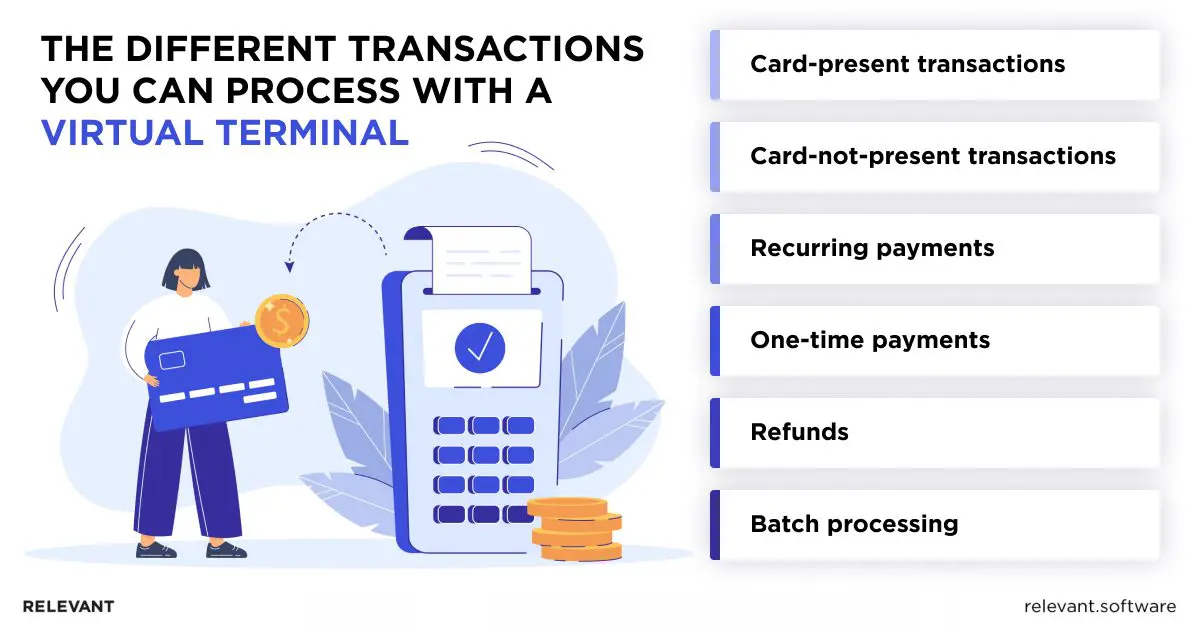

Types of Transactions Supported

Now, let’s understand what types of transactions you can conduct using a payment gateway virtual terminal.

Card-not-present (CRP) transactions

These transactions take place without the customer and their card being physically present at the time of purchase. We talk about phone orders, online sales, and mail orders, where CNP transactions are incredibly convenient for both businesses and customers.

Recurring billing and subscriptions

Virtual terminals can be used to conduct recurring payments, which is convenient for businesses with subscription-based models because they allow customers to be automatically charged at regular intervals. For example, if you manage an online streaming service, you can automatically bill your members every month. They enjoy uninterrupted access to your facilities, and you enjoy a steady cash flow without the hassle of manual invoicing.

One-time payments and invoicing

Whether it’s for a product purchase or a service rendered, virtual terminals make a one-time payment straightforward. For instance, a freelance graphic designer can send an invoice to a client. The client receives the invoice, enters their payment information, and the reward is sent. It’s quick, secure, and hassle-free. Plus, with the ability to generate invoices, businesses can maintain a professional appearance while simplifying their payment process.

Benefits of Using A Virtual Terminal Payment Gateway

When you seek a reliable and secure way to accept non-cash payments, a virtual terminal has some advantages over other solutions. Here are some of the virtual payment gateway benefits:

- Data encryption and tokenization

These security measures ensure solid protection. Encryption turns sensitive information into a secure code during transmission. Tokenization is another advanced data protection technique that substitutes a cardholder’s name and other details with a token or special one-of-a-kind identifier. Even if someone intercepts the token or encrypted information, it’s useless without the original data or special decrypting key.

- Compliance with PCI DSS

Virtual terminals comply with these strict industry security standards, which means a lower risk of data breaches and better protection for both businesses and customers.

- Remote payment processing capabilities

The beauty of a virtual terminal payment gateway is that you can handle transactions from anywhere with an internet connection. Whether you’re at a trade show, working from home, or on a tropical beach (lucky you!), you can keep your business running smoothly.

- No need for physical hardware

You don’t need bulky card readers or tangled cables to support digital payments. Virtual terminals operate entirely online, so a device with internet access and a web browser is enough to process transactions, which is extremely comfortable. It’s like a portable POS system in your pocket, minus the extra baggage.

- Lower setup and maintenance costs

Setting up a traditional POS system is often a complex and costly endeavor. Virtual terminals, however, are easier to implement and more economical. You can accept online transactions just as you would have a POS system. So, you pay less for the same functionality.

- Flexibility in payment options and currency handling

Virtual terminals support the most widely used payment methods one can think of traditional card payments, ACH transfers, and digital payment services. Plus, they can handle multiple currencies, so businesses with international clients can find them especially helpful.

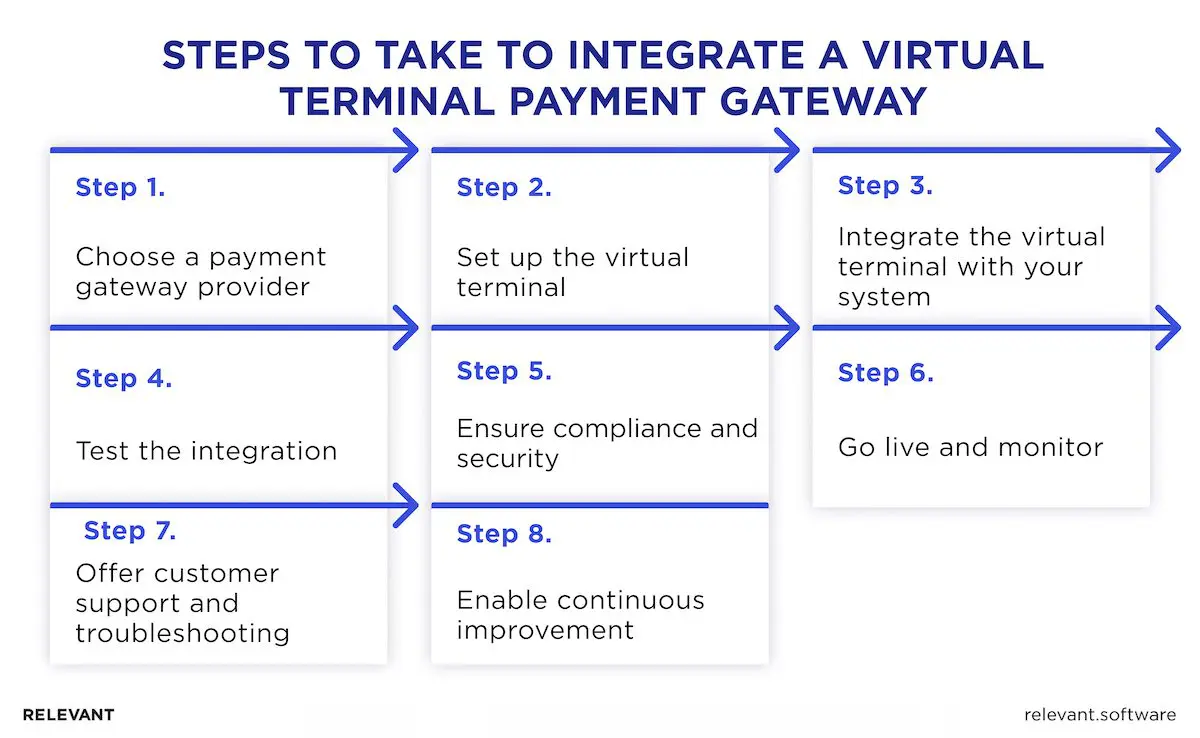

How To Integrate A Virtual Terminal Payment Gateway

So, intrigued by the benefits of a virtual terminal payment gateway, you’d like to integrate a payment gateway to give it a try, but how do you know where to start? We have helped many companies implement payment processing solutions, so we have prepared a guide where we share our expertise to help you easily adopt this tool.

Step 1. Choose a Payment Gateway Provider

Start with researching providers that offer the best virtual terminal capabilities and comparing their offerings. To pick the right payment gateway provider, take note of:

- Transaction fees. Understand the cost structure, including per-transaction and processing fees and any additional charges.

- Security features. To protect your customers’ information, make sure the provider’s tool employs data encryption and is compliant with PCI DSS.

- Integration options. Check how easily the gateway can integrate with your existing systems or software.

- Customer support. A reliable virtual terminal payment gateway for tech support can save you headaches when issues arise.

The choice of payment gateway providers is huge, but there are market leaders many business owners select for their payment processing needs. Here’s the list:

- Stripe is known for its developer-friendly APIs and global reach.

- PayPal is a household name offering a variety of payment solutions.

- Authorize.Net is a long-standing provider with a strong reputation for security.

- Square is popular for its point-of-sale solutions and integration with other Square products.

- Adyen offers a unified commerce platform for businesses seeking a comprehensive solution.

Once you’ve chosen a provider with the best payment gateway API offering that aligns with your needs, go to their website and create an account. Be prepared to submit your business details, which are required for the sign-up process: business type, bank account details, contact details, and similar information. Payment gateway providers often have verification procedures in place to ensure legitimacy, so you might be asked to provide additional documents or undergo a background check.

Step 2. Set Up the Virtual Terminal

Once you’ve successfully signed up for a virtual terminal payment gateway and undergone the necessary verification processes, it’s time to configure your virtual terminal. Here’s how to ensure a smooth setup process.

Access the Dashboard

First, log in to the payment gateway’s dashboard. This is your headquarters for managing all payment-related activities. Take a moment to familiarize yourself with the dashboard layout and then find a section dedicated to virtual terminals or payment settings.

Configure Settings

To ensure smooth operations, you’ll need to configure several settings:

- Specify the currencies your business will accept.

- Decide which payment methods you wish to support.

- Configure email or SMS alerts for successful or failed transactions.

Security Settings

Security is increasingly important in financial transactions, so you need to enable the following security features:

- Two-Factor Authentication (TFA): Fortify your security with TFA, which can be a code sent to your phone, a fingerprint scan, or a biometric facial recognition.

- IP Whitelisting: Limit access to the virtual terminal by enabling IP whitelisting, which allows only specified IP addresses to log in.

- Transaction Limits: Set transaction limits to mitigate fraud risks.

Step 3. Integrate the Virtual Terminal with Your System

For your new online payment processing solution to work in tandem with the rest of your IT systems, you should integrate it carefully. There are two ways to do that.

API Integration

For businesses that handle a high volume of transactions or require seamless integration with other software (CRM, accounting systems, etc.), using APIs for integration would be the best method. To use APIs, you need

- Obtain API Credentials. Your payment gateway provider will share with you the necessary API keys, secrets, or other credentials to access their system.

- Have some programming knowledge. Payment gateway development and integration typically demand programming expertise. You’ll need to write some code that will be responsible for secure payment data transmition between your system and the payment gateway. That’s why you may need to work with a developer or rather use a pre-built integration solution.

Manual Entry Option

If your transaction volume is relatively low or you don’t require complex integrations, you can utilize the manual entry option provided by the virtual terminal interface. It’s much easier to set up or, in other words, requires less technical expertise, but for each transaction, you’ll need to manually input customer payment information. That’s not as convenient as having the system automatically process payments.

Step 4. Test the Integration

Before you can start using a virtual terminal payment gateway in your operations, you should make sure it functions properly and is integrated correctly.

Many providers allow you to test the payment gateway in a sandbox environment, a safe space where you can simulate real-world transactions without risking real money. Here, you can experiment with different scenarios and fine-tune your integration.

In the sandbox, you can create and run different test scenarios to see how the terminal will behave under different conditions. It would be wise to test:

- Successful Transactions. Test standard transactions with valid card information to verify the payment flow.

- Failed Transactions. Simulate declined transactions due to insufficient funds, invalid card details, or other reasons to check error handling.

- Refunds. Process test refunds to verify the refund process.

Step 5. Compliance and Security

Credit card details and personal information are probably the most sought-after information for bad actors who never stop coming up with new ways to steal it. Therefore, there is so much emphasis on security and compliance.

PCI DSS Compliance

The PCI DSS is a comprehensive set of security requirements designed to protect cardholder data. To maintain compliance with this standard, businesses must:

- Regularly scan systems for vulnerabilities.

- Implement secure storage practices for cardholder information (tokenization or encryption).

- Educate employees on security and proper management of payment data.

- You may need to hire external security experts to audit payment systems.

Data Protection

PCI DSS and other relevant security standards set the minimum required best practices for protection and compliance, but it won’t hurt to take stronger information security measures. In fact, these security practices have become a standard in the Fintech landscape:

- Encryption: Encrypt sensitive data both at rest and in transit.

- Access Controls: Limit access to payment data to only authorized individuals.

- Regular Monitoring: Monitor your system for suspicious activities and potential security breaches.

- Incident Response Plan: Create a plan that will involve detailed steps on how to deal with security incidents like data breaches in the best possible way.

Step 6. Go Live and Monitor

After you have tested your 3D secure payment gateway, implemented security features, and made sure it performs well, you can confidently proceed and go live. Coordinate with your payment gateway provider to activate the live environment, which usually involves switching a configuration setting or obtaining specific approval.

Now that you can process digital payments, you should regularly monitor transactions for any irregularities or fraudulent activity. Use the gateway’s reporting tools to track sales, refunds, and chargebacks and set up alerts for any anomalies to be able to react swiftly.

Step 7. Customer Support and Troubleshooting

Most likely, you have decided to integrate a virtual terminal payment gateway to offer your customers more payment options and a better online experience. To ensure it is indeed so, you should invest in customer support.

Support Resources

To navigate potential issues, familiarize yourself with the payment gateway provider’s support resources:

- Documentation: Refer to the provider’s documentation for detailed information about the virtual terminal’s features and functionalities.

- Customer Support Contacts: Keep the provider’s contact information readily available for when you need assistance.

Issue Resolution

Different situations may happen with online transactions. That’s why it would help you if you can anticipate potential challenges and have a plan on how to resolve them:

- Transaction Disputes: Establish the investigation process and the way of resolving disputes with customers.

- Chargebacks: Understand the chargeback process and implement measures to prevent them.

- Technical Issues: Develop a contingency plan to address technical problems quickly, such as system outages or payment failures.

Step 8. Continuous Improvement

A virtual terminal payment gateway is basically a program that needs periodic updates or certain improvements to accommodate your business and customers’ needs better. The best thing you can do about it is to collect feedback from users and staff to identify any pain points or areas for improvement. This will let you make the necessary adjustments to improve the user experience.

Equally important is to keep your virtual terminal up to date with the latest technologies and compliance requirements. Regularly check for software updates, security patches, and industry best practices to ensure your virtual terminal remains secure and efficient.

Our Case Studies

Virtually any business needs a payment solution to process online transactions in one form or another, as modern customers demand it. Relevant Software has helped companies build payment systems and achieve that in-demand functionality to please their customers.

Software for Payroll and Accounting Services

Swift Onboard, a leading provider of onboarding and payroll registration services, contacted Relevant experts to develop a modern payroll system that could replace the existing solution and offer richer functionality, along with better security and scalability. Additionally, we needed to integrate the new system into Swift Onboard’s existing ecosystem while adhering to strict industry regulations.

Following an agile methodology, our team quickly developed a Minimum Viable Product (MVP) that helped agree upon functionality and proceed with development based on the client’s feedback. The custom-built software was designed to:

- Enable efficient contractor registration, from initial referral to payroll setup, within minutes.

- Provide a user-friendly interface for both staff and contractors.

- Introduce solid protection measures to safeguard confidential information.

- Offer detailed insights into registration status, payment processing, and other key metrics.

The platform we developed allowed Swift Onboard to scale their business and achieve their growth objectives.

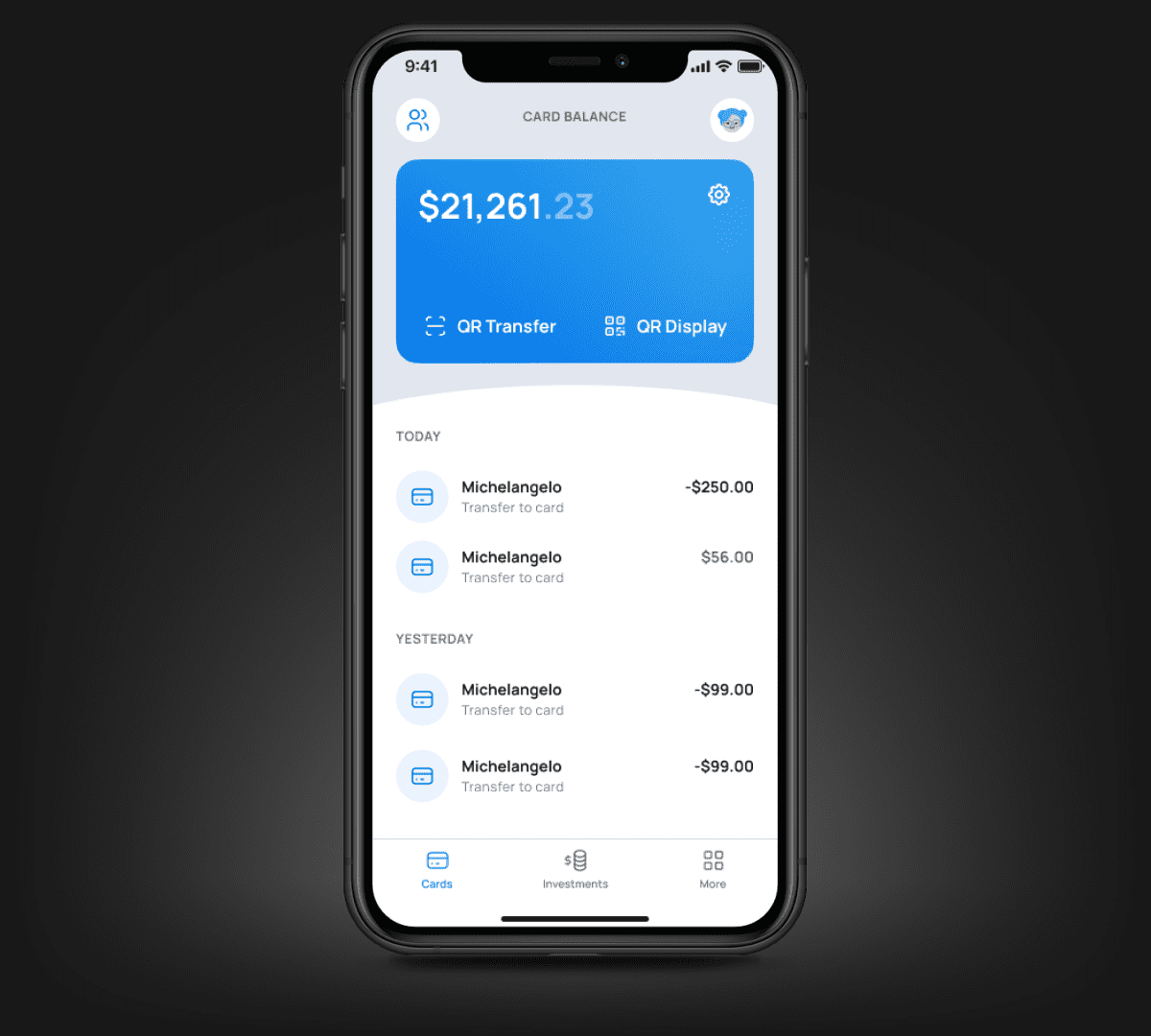

Optimized Tipping Process

55th Degree, an innovative fintech startup, approached Relevant to develop their inaugural product: FISK, a platform that lets users save tips or accept them directly into an investment. To realize this idea, they needed to integrate multiple financial API providers, which is quite a challenge. Seamlessly connecting KYC, card issuing, payment processing, and bank account data required a deep knowledge of the fintech ecosystem, which Relevant experts possess.

We successfully delivered a fully functional MVP within budget and timeline, which had such features:

- Tip Management: Effortlessly track and allocate tips between spending and investing.

- Automated Investing: Set investment goals and let FISK handle the rest.

- Peer-to-Peer Payments: Easily receive tips from anyone via a QR code.

- Secure Banking Integration: Connect multiple banks, brokerage accounts, and debit cards safely.

- Social Sharing: Invite friends to join the FISK community.

The successful development of FISK was crucial as it marked the first digital product for 55th Degree. The sales process has already begun, and users are enthusiastic about the upcoming second phase of development.

Integrate a Virtual Payment Gateway with Relevant

You should admit that the ability to process electronic payments is no longer a differentiating factor; it’s the customer demand you should fulfill to stay competitive. Whether you’re a small business owner looking to streamline transactions or a large enterprise aiming to enhance customer experience, the benefits of payment gateway integration are immense.

You can find and integrate a virtual terminal payment gateway on your own or hire an experienced Fintech software development services company like Relevant to do all the technical stuff for you. We are well aware of the complexities companies usually face when integrating financial APIs or implementing solid security solutions, so you don’t need to worry about these important yet challenging tasks.

Our team of diverse specialists can create a simple landing page with a payment gateway or complex fintech application as per your requirements to make your business more competitive and customer-friendly. If you have any questions or would like to learn more about payment gateways for your business. Contact us to share the details.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.