Let’s meet in person!

Secure your personal meeting slot today — let's connect and discuss opportunities!

29-31 July. Dublin, IE

01-02 August. london, uk

Petro Diakiv,

Delivery Manager

at RELEVANT SOFTWARE

Navigate the World of Digital Assets with MeetAmi Innovations

The new crypto investors know how to make money but still need advisors to help them reinvest and bypass the tax implications. However, are there any brave souls ready to become a beacon of light in this fast-paced world? Well, today you’ll discover one of them.

Founded in 2019, MeetAmi Innovations Inc., the Vancouver-based fintech company, offers a suite of products and services aimed at helping wealth management firms navigate the world of digital assets on behalf of their clients. The company’s first platform AmiPRO bridges traditional finance and digital assets in Canada and US, providing an ecosystem to take a firm or advisor the business support from learning to liquidity.

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usWe on Relevant Founders had the pleasure of speaking with CSO and co-founder at MeetAmi, Sarah Morton, about her contribution to the alternative investment industry and her path to success. Let’s find out about her story!

Table of Contents

The impulse to start the sixth

Sarah Morton has spent most of her career in the startup industry, and MeetAmi is her 6th startup adventure. With a background and devotion to “The Art of the Start,” Sarah’s next undertaking, we believe, is destined for success.

When Sarah became interested in cryptocurrencies, blockchain, and tokenization a few years back, she immediately understood the scope of the prospects they promised to the market. But she wondered if traditional finance and systems would be able to integrate with the world of digital assets.

The main driver of digital assets’ growth is their decentralization, which reduces the cost of transactions by eliminating levels of administration and significantly increases the speed of transactions. The result is a parallel investment system that unlocks new value and exciting opportunities for innovation.

However, many traditional financial services companies are unsure of how to seize these opportunities, given the volatility and opacity of many blockchain initiatives and regulatory uncertainty. In turn, clients have less knowledge about these investments than traditional asset classes. Needless to say, evaluating investments in cryptocurrency is difficult even for experienced investors.

Sarah decided that her company’s role would link two worlds and guide firms and advisors through the business and regulatory process needed to include digital asset investing in their practice.

The unexpected impact of Covid

Nothing has affected the digital space more than the COVID-19 pandemic, with its lockdowns, quarantines, event cancellations, and the transition to remote work everywhere. Many projects have failed this test. MeetAmi was not one of them…

“This situation had its pros and cons. The downside is that many of the features we considered in early 2020 fell completely out of the picture because early adopters had other problems. Therefore, we took our time and focused on creating a roadmap, and the depth dived of technology.

The upside is that people have learned more about the world of investing because they have done more research while sitting at home, so our market has also developed. In the age of Covid, the world of asset management has become more digital, and so have its advisors.”

Road to the original MVP

“Initially, it was me, my co-founder, and a couple of others who worked on the project. When we knew the way forward with the idea, it was time to develop the programming interface. We needed a strong, experienced leadership team because the world of finance and banking has a lot of complexity, regulation, and change management. Therefore, we expanded our team and brought in consultants with special experiences, like compliance and security.

We had a lot of discussions about whether the MVP would work. It scared my CTO, but we really came up with a whiteboard workflow.

An additional local outsourcing step was to build the Figma demo. The experienced group helped us with boxes and user interaction. So we spent the latter half of 2020 demoing, getting feedback, and validating it.

Also, we hired a project manager from the wealth industry, a young guy who braved experience in traditional wealth, loves crypto, has a passion for it, and understands our mission.

To this day, we can still use that Figma demo. And it still stands true, which we were pleased with because neither of us had built software from scratch. We got fantastic feedback because we’ve covered many things and thought about the roadmap. It was what we needed. It was something that was missing in the market.”

A hybrid approach to outsourcing: best of both worlds

“We were looking for someone who could deliver our vision and provide the expertise. We required a team that could provide us with what we were hoping for without knowing exactly how to manage that process and ensure everything was included. So their domain expertise was critical.

From the very beginning, our team was a hybrid of in-house and outsourced employees, and because of this, we could determine what we needed to know and should own. The in-house team members worked on the product’s core, and we outsourced some parts. As in the case of marketing, we did some things with the help of our internal team and attracted external resources as needed.

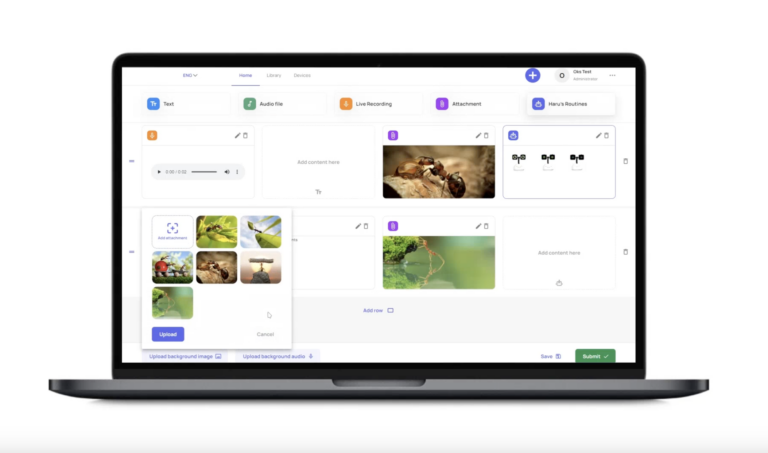

The same for our AMI Learn app. We can’t create all the required content. So we have a network of partners who’ve made purpose-built content and learning modules, and we package them together. So it’s very effective for us. I fundamentally believe the future of software development will be hybrid.

Regarding engineers, our biggest problem is that the blockchain world is so new that you won’t find someone with 10 years of experience, right? This is very rare. Therefore, our engineers must learn on the job in many ways. But curious engineers usually experiment with blockchain. ”

Tech challenges that had to be resolved

Even mature startup owners face challenges they must address. In the case of MeetAmi, this was the technological complexity of the future solution.

“It was an incredibly deep process, during which our team had to map out things and workflows that we hadn’t built yet. We work with vendors with consumer products and workflows and have to layer our workflows on top of them. We had to work with the storage and liquidity solutions already in place and plan how to build them into our platform.

In addition, discretionary account providers do not like to transfer money to crypto exchanges, and we had to think about how to make money move faster. We also wanted the EA to be able to process trades through a simple interface and then get that data into their money or portfolio management system. As you can see, the technical challenges that our team faced were quite serious.”

MeetAmi’s mission: support and guidance

Looking at the complexity of the digital assets world and how consumers navigate it on their own, Sarah realized that financial professionals must be qualified to support their clients, provide guidance, and build regulatory certainty to make this place safer.

“In the beginning, we were selling a product the world didn’t yet know it needed. In January 2020, about 10% of consumers turned to consultants for help in this area. And now we see that from 50 to 80% of consumers turn to their consultants. So we go from very little demand and interest to just an abundance of need and interest.”

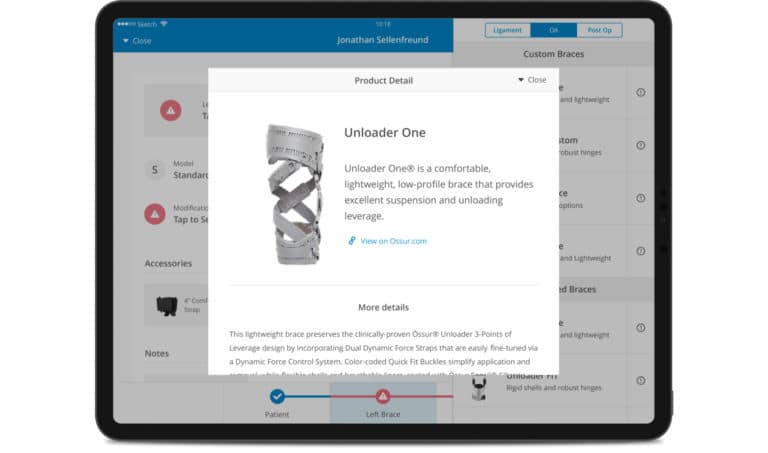

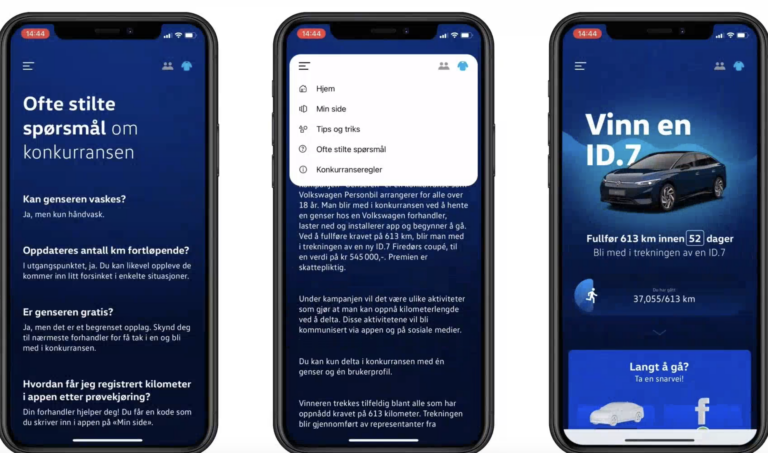

MeetAmi’s AmiPro wealth management platform helps firms de-risk the process of investing in digital assets. Also, MeetAmi offered AmiLearn and AmiServices, two platforms that advise the digital asset ecosystem and support firms and advisors in designing their digital asset practice, meeting their fiduciary responsibility, and addressing their proficiency requirements.

“We’re building communities of practice. So advisors will be able to visibly show what courses, what modules, what learning they’ve undertaken, and be able to share that and carry that with them. So our goal is to make it digestible. We see regulatory movement, but there isn’t absolute clarity yet. So much of that’s in flux, so advisors must be entrepreneurial and take a leadership role in the space.”

What does the future have in store?

We asked Sarah Morton what this industry’s future will be within the next few years and how she uses her experience to get ahead of the trends.

“I spend a lot of time reading and absorbing information about building network protocols and what’s really going on with Web3. And looking at my children, I imagine what the world will look like for them.

Will they be paid in cash? Are they going to do wire transfers? Would they want a mortgage backed by bitcoin where they can hold the asset and use it? So I’m looking at what their world will be like, and I’m thinking about how we build rails to support that incredibly exciting and what it can be in such a short amount of time.

As for the industry, we will see more adoption of basic cryptocurrencies integrated into traditional finance systems. So if we want all our investments side by side, we need single portals. And regulatory certainty is coming. Because there have been too many problems, regulators now have to drive some confidence.”

CEOs advise: Don’t pull it all alone

At the end of the interview, we always ask our respected guests what advice they would like to give to new and mature founders. Sarah was happy to share her experience:

“There are two parts to it. The most important part is the team you surround yourself with. Make sure you have a strong support network so that when you’re down, there are people who can lift you.

And the second part is to be really customer-focused so that they see enough value in your product to pay for it.”

Your Next Read

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us