Modernizing Legacy Systems in Banking: Best Practices and Benefits

The technological gap between traditional banks and fintech challengers shows up in everyday service quality, not only in architecture diagrams. The UK Competition and Markets Authority’s banking service quality survey consistently places challenger banks at the top of satisfaction rankings, while many high-street providers trail across core experience measures, including digital journeys.

Legacy modernization offers a practical way to close that gap. Banking legacy software modernization upgrades the core platform, integration layer, and data foundations that shape onboarding speed, product launch cycles, and service reliability. When banks retire brittle interfaces, standardize APIs, and strengthen governance, digital channels stop acting like a thin wrapper over legacy constraints and start supporting real product innovation.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

Relevant provides outsourcing and fintech software development services that help banks modernize without losing operational control. Our dedicated software development teams deliver core modernization programs, integration work, and custom branch solutions that match security requirements, compliance obligations, and the realities of multi-channel delivery. This guide explains why legacy infrastructure in banking must evolve and how to run modernization with clear scope, risk control, and predictable outcomes.

Why banks can’t delay upgrading core legacy banking platforms

Banks are notorious for their resistance to change. The main reason is hidden in the amount of pressure and regulations in the banking sector. Even though many are embracing modernization and are open to innovation, the overall pace remains painfully slow. The outdated core banking is one of the culprits to blame for that.

The definition of core banking encompasses the essential financial services such as payments, loans, mortgages, and accounts, as well as the backend technology that banks require to provide those services. These fundamental components directly affect the speed and reliability of every operation. When they are obsolete, meeting customer expectations becomes a challenge, let alone staying ahead of them.

After years of being supported and reworked by different IT service providers, core banking platforms often become cluttered, clunky behemoths, quite costly to own and maintain. The antiquated technology (like COBOL, a programming language born in 1959 and still used by 43% of US banks, as per the Financial Times report) is an evolutionary dead end, incompatible with current software solutions.

Fintechs, on the contrary, are agile, responsive to market changes, and able to efficiently modify and update their core systems. The advantage they gain over traditional banks in today’s world of finance is obvious. New products and trends are emerging all the time. To stay afloat, banks must rethink the way they serve customers and get on the road of digital transformation and innovation.

The immediate benefits of banking legacy software modernization

It’s not a fashion show, so being trendy isn’t the end goal for banks. Let’s talk about the more tangible, down-to-earth reasons for modernizing legacy systems in banking. Here are the advantages banks get when they go for the upgrade:

- Advanced digital capabilities. Without an upgraded core, it’s impossible to leverage the power of modern technologies such as artificial intelligence, machine learning, data analytics, cloud computing, blockchain, and other hot tech.

- Streamlined business processes. With the state-of-the-art technologies at their side, banks can achieve a considerable productivity boost in day-to-day operations and optimize resources. This will inevitably lead to an increase in revenue.

- Improved security. Legacy systems are more vulnerable to data breaches and other malicious attacks. By upgrading the core components to meet today’s security standards, you’ll protect your business and customers from current and future risks.

- Access to a variety of new digital products. Financial institutions shouldn’t miss new business opportunities due to outdated software. For instance, a core system compatible with modern APIs (Application Programming Interfaces) can be a start for creating your own BaaS (Banking as a Service) platform. Which, in turn, can aid the shift in mentality for banks—from a product-oriented to a platform-oriented business model.

- Optimized operating expenses. Banking legacy software modernization requires considerable initial investments. But the costs of maintaining the new software and hardware are often significantly lower than with a legacy system.

- Capitalization on the value of data. Modern banking software uses a far more efficient approach to data management, ensuring no revenue is lost where it can be earned. For one, banks can offer more customized products and services based on the customers’ data analysis.

Ultimately, a complete redesign of legacy infrastructure in banking leads to monetary gains while also making financial institutions significantly more relevant and future-proof. It doesn’t happen overnight, but it always pays off.

Modernizing banking legacy software: the process

Most processes of banking legacy system modernization boil down to transitioning from a hefty mainframe application to a modular cloud-based solution. There are two types of core banking platforms available on the market today:

- Cloud-native. Based on microservices, these platforms provide compatibility with a variety of external and internal services through APIs. They offer a pay-as-you-go model, which guarantees access to unlimited resources while only charging the client for the amount used.

- Service-oriented architecture (SOA). Geared towards creating a prompt response to changing market conditions, these platforms are normally represented by BaaS solutions with license or subscription payment options.

On a side note: the above descriptions may sound a bit complicated. Upgrading legacy systems is a serious undertaking that requires technical expertise, especially when it comes to the finance industry. If you’re about to commence a modernization project in your financial institution, we recommend outsourcing fintech software development services to a qualified partner. Programmers with industry knowledge in banking will explain your options and help you choose the best strategy.

Even though there are differences in ways of strategy implementation, the logic that governs the process is similar. In general, you’ll have to take three steps. Let’s look at each of them in more detail.

Evaluate your legacy system

As the name suggests, during this step of banking legacy software modernization you’ll need to define the areas where your existing system is holding you back under current market conditions. A bird’s-eye view will work best, and answering the following questions will help structure your findings:

- What business opportunities does the current system limit?

- Where are we losing business value?

- What problems with agility does the platform create?

- Is the cost of ownership unreasonably high?

- Can we count on continuous tech support and scalability?

- Is the software too complex?

- Are there any compromises in security or compliance?

We can’t give you an exact score you’ll have to get on this test to be concerned, but you will need to interpret the diagnosis carefully. The best practice is to involve those executives and decision-makers from your company who are well-acquainted with its core services and business objectives.

Assess modernization options

Depending on the “patient’s condition”, you can follow different approaches to banking legacy system modernization. To choose the one that will suit your financial institution best, you’ll need to take into account the severity of issues you’ve identified, as well as the cost and complexity of modernization.

Here are some common scenarios: :

- Keeping the existing functions and data but turning them into services accessible via APIs

- Not altering the code and functionality but deploying the components in a different infrastructure

- Transiting to a different platform, making minor adjustments to the code, but keeping the core functionality untouched

- Refactoring (rewriting and optimizing) the current code

- Making substantial modifications to the platform’s architecture

- Rebuilding the software from scratch to eliminate legacy technology

- Building a completely new core banking platform based on current solutions and implementing functionality that best serves your updated business objectives

No matter what approach you’ll follow, inviting a software vendor with experience in financial app development to join the discussion is crucial at this stage.

Select the most suitable approach

As you can see, choosing the most efficient approach to legacy application modernization in the banking industry requires careful consideration.

The closest analogy we can think of is that of deciding between ordering a custom-built Tesla Cybertruck and fixing your old trusty pickup. A simple paint job and a couple of minor repairs here and there might keep it running for another 3-5 years, taking you from point A to point B with a few occasional breakdowns. Conversely, a brand new automobile with custom options will need a much larger investment while offering seemingly superficial improvements.

In the first scenario, after three or five years of slow and cautious driving, you will likely end up with a rusting jalopy. You could never trust the car enough to cross the state border, and its whims cost you many lost opportunities.

In the second case, you’ll have a future-proof modular vehicle that runs on sustainable energy, saves your hard-earned cash, and can take you to places you’ve never even dreamed of.

Of course, this analogy shows things in a simplified form. However, just like electric vehicles are the next link in the automotive evolution, agile cloud-based core banking solutions are certain to take over the market from legacy systems.

But let’s go back to the actual implementation process and talk about how to make it as smooth as possible.

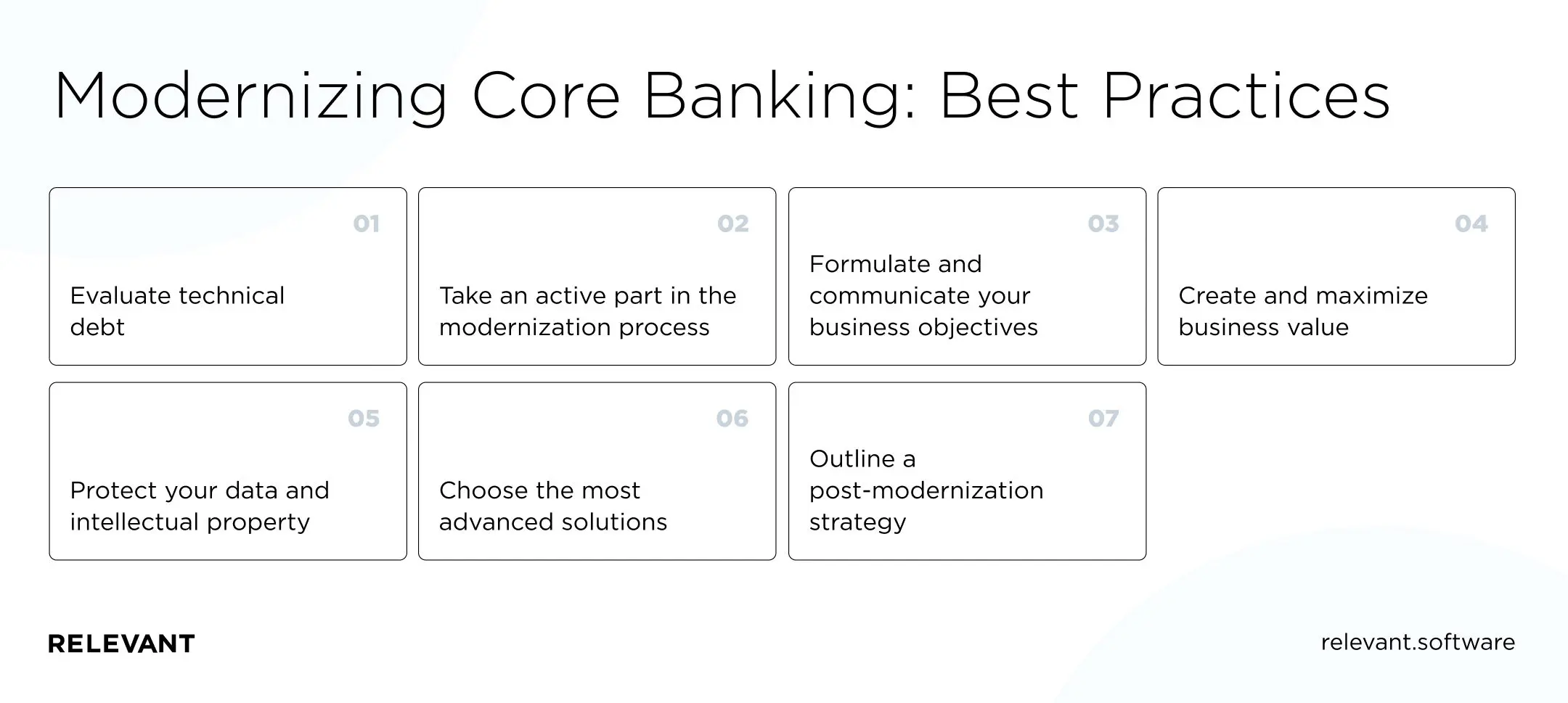

Modernizing core banking: best practices

Once you get a general understanding of your strategy for legacy banking system replacement, you can initiate the implementation process. Below is a list of recommended practices.

Evaluate technical debt

Technical debt accumulates for numerous reasons, for example, developers taking shortcuts to meet deadlines or budgets. It’s a common occurrence on long-term projects handled by different contractors, which is often the case with legacy banking software. To get an accurate assessment, you’ll need to factor in the prospective cost of adding or altering features and functionality later.

Take an active part in the modernization process

It’s important for all decision-makers to cooperate closely with the IT service provider. Delegating does work miracles, but in this instance, each party needs to apply their expertise, share ideas, and take responsibility for the outcome. Remember: technology is a tool for reaching your business heights, and they should always come first.

Formulate and communicate your business objectives

Focusing on the pain points that you need to address and the strategic business advantages you plan to achieve is crucial. Always consider the context and set measurable goals, assess risks, and define tolerance. Discuss those parameters with your IT partner and make sure you share a common vision prior to making irreversible changes.

Create and maximize business value

Direct your efforts towards creating maximum value for your business and customers. Prioritize it over the technical side of things, and aim for immediate tangible benefits. This will help justify the investment. In the same vein, concentrate on the total cost of ownership instead of the purchase price. Look at the big picture.

Protect your data and intellectual property

Over the years, your financial institution has surely accrued lots of valuable data and intellectual property. Those digital assets must survive the transition intact. Pay close attention to the process and reiterate the importance of preserving them to your software partner.

Choose the most advanced solutions

Go for the most cutting-edge tech stack and architecture to ensure your new platform’s maximum relevance and compatibility for years to come. Consult with your IT partner concerning the best options.

Outline a post-modernization strategy

Allow time for employee training, and be prepared that there will be a learning curve. Discuss and plan onboarding with the software development company, clarify schedules for updates and maintenance details. Even the most robust and well-tested solutions have a tendency to fail, so you need to get ready for incidents in advance.

A brief summary

The time to mull over the prospect of banking legacy software modernization has passed. Banks and other financial institutions must weather the storm and adapt to the new reality dictated by the rapid evolution of fintechs. The gravity of such decisions is immense, but they will attract customers and unlock new revenue streams.

However, this can’t and shouldn’t be a solitary journey. Finding a trusted software provider is the natural first step.

Our team at Relevant is willing to keep you good company and build a solution that will match your needs. By outsourcing to Ukraine, you’ll get favorable rates and a product of the highest quality. So get in touch, and we’ll discuss your modernization project!

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.