How to Get Funding for Your Startup Business in 2026

As 2026 begins, the venture capital market shows signs of recovery, but capital is concentrated in fewer, larger rounds, with AI taking a disproportionate share of deal value. Crunchbase data shows $205B raised in H1 2025, and investors expect global VC deployment to rise from the low $400B range to the high $400B range in 2026, implying continued momentum even as check sizes skew upward. PitchBook also reports that AI captured 65% of total VC deal value in 2025, which helps explain why later-stage rounds continue to lead the totals.

According to Relevant Software’s team of experienced product developers and industry analysts who have closely studied the market, even with these tailwinds, the VC industry is consolidating. The Financial Times, citing PitchBook data, reports that the number of VCs investing in US-headquartered companies fell to 6,175 in 2024, down from 8,315 in 2021, which means many firms went dormant while influence pooled among a smaller set of large platforms. For founders, that raises the bar: to get funding for your startup, the pitch must prove durable demand, efficient growth, and a clear path to defensible scale.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

This guide, “How to get startup funding in 2026,” breaks down the venture process and the practical signals that can help a startup raise capital with less guesswork and greater credibility.

Getting funding: Ways to raise capital for your startup

With the current economic climate, securing funding for your business can feel like an uphill battle. But don’t let the challenges discourage you. With the right strategy and approach, you can receive the funding you need to take your startup to new heights. Relevant Software experts have shared some viable options to get funding for your startup:

Bootstrapping

Starting a business from scratch without or with little outside funding and using personal or family funds are the easiest ways to raise capital for a startup, which is why 10% of business founders do just that. Of course, such financing for a business comes with some risk. While borrowing money from family or friends may have little (or no) interest attached, it can still be expensive if it harms your relationships.

How to find: Friends and family funds are all legitimate sources when your startup begins. Therefore, even for them, you must specify the repayment terms in the contract, including partial ownership, interest rates, or other conditions when raising capital.

Crowdfunding

According to the experience of Relevant Software’s clients, crowdfunding is another proven way of getting funding for a startup that does not have any of the resources to implement their ideas. Crowdfunding is a method of raising funds for a project, business idea, or cause by soliciting small contributions from a large number of people, typically via the Internet.

While hundreds of app and startup ideas go unnoticed and unfunded on crowdfunding sites, pitching them right can be a lucky shot for your app. You get enough funds to make your dream come true in exchange for a service fee from the crowdfunding platform and a transaction fee from the payment processor.

How to find: Crowdfunding is usually performed online via sites like Kickstarter, GoFundMe, and Indiegogo, making it easier to put your product in front of a wide audience.

Business incubators

Partnering with a larger company or joining an incubator can be a good way for startups to gain access to new markets, consumers, and resources. Such partnerships and incubations often involve stock exchanges or other forms of financial compensation.

Incubators provide resources such as mentorship, office space, networking opportunities, and access to funding to help companies overcome the challenges they face in the early stages of growth.

Most well-known academic institutions have initiated incubation programs to develop entrepreneurship among their students/graduates and regions. They can be an excellent source of low-cost funding for very early-stage companies, many of which are not even ready for angel funding.

How to find: Many incubators are available online – one of the most popular options Relevant specialists advise to check is YCombinator. If you can’t find local alternatives, focus on online platforms and check if your business fits their criteria.

Accelerator programs

Accelerator programs are equivalent to incubators because they provide a wide range of resources. Unlike incubators, accelerators focus on existing companies, not those with an idea. Such programs can be private, funded by investment firms, or even owned by companies or colleges. For entrepreneurs wondering how to get funding for a startup, accelerators are a great option, providing not only financial support but also access to experts, training, and valuable resources to drive success.

How to find: Accelerators are available locally and online on platforms like Gust. We recommend you find a local group first. They may be less competitive and benefit from a more personalized approach.

Venture capital investors

Venture capitalists are firms or groups of investors funding a startup in the early stages in exchange for company ownership. That can be a good option for mature startups with a clear growth trajectory that need more resources or credit to secure traditional forms of funding.

VCs also provide mentoring, add value to startups by connecting them with the right people, and assist in startup team building by helping hire key employees. In recent years, many traditional venture capital funds have also introduced micro-venture capital accelerator programs to identify high-potential startups early on in their journey.

How to find: You can see venture capital firms and individuals online. Websites like AngelList and Gust provide a database of VC firms and individual investors, and allow startups to search for and connect with potential investors. From there, investors can contact you, giving you a chance to reply if interested. You can also find the best investors by doing some research and requesting suggestions on LinkedIn.

Angel investors

Angel investors are typically successful entrepreneurs who invest their own money in startups that they suppose to have the potential to become promising in the future. In addition to granting the capital needed to grow a business, angel investors share their business experience, valuable mentoring, and industry connections to help startups thrive. The angel investment market size was valued at around $25 billion in 2023 and is forecasted to achieve a market size of $65 billion by 2032.

How to find: Like venture capitalists, angel investors are associated with different platforms. For instance, the Angel Capital Association is an investment network of business angels made up of accredited investors who fund promising ventures. Additionally, you can find individual investors or groups of investors using resources like Angellist.

App funding contests

Entering an app competition can be a great way to get funding for a startup. Many competitions are sponsored by universities, tech companies, business angel networks, and other organizations that offer new entrepreneurs the resources to pursue their business ideas.

How to find: Browse the Internet to choose from hundreds of contests worldwide. Websites like Challenge.gov, Gust, and Kickstarter provide listings of app funding contests and opportunities for startups to find and apply for funding.

Bank loans and credit lines

Debt capital is usually one of the main sources of financing for traditional enterprises with stable cash flows, which can provide collateral to lending institutions. It is not a practical way for many startups to raise money, though, as most do not get significant revenue in the first few years.

However, at a later stage, some categories of startups may use it to raise funds rather than venture capital money instead of shares. Many traditional banks have now established finance departments that offer startup lending options.

How to find: Bank loans are available from any financial institution, local, national, or online. Finding suitable loans through affiliated financial institutions is made easier with the support of the Small Business Administration (SBA).

Each of these investment alternatives has advantages, so it’s crucial for businesses to carefully weigh their options before deciding on the best course of action. But remember that some investors, like accelerators and incubators, only work with businesses in the early stages. If you want to control your business fully, consider an angel investor and avoid VCs looking for partial ownership.

How startup funding works

Companies seeking external sources of funding for startups usually start with a pre-seed round. Some will then move on to Series A, B, and C rounds. But before any round begins, the company must be evaluated. This can affect investor interest in the company and how much new capital a startup can raise.

A valuation examines:

- Startup maturity

- Governance

- Track record

- Market size

- Profit

- Risk

After the valuation is completed, startups can open a funding round. The timeline and process vary by company. Some founders look for investors for months, others close the round in a few weeks.

And while some startups are slow to move through each funding round, others are accumulating capital at a much faster rate. It is not uncommon for an innovative startup to raise several million dollars in one or two rounds while another company raises $25 million in the same number of rounds.

You may also be interested in learning about ESG investing for startups and why it becomes a more important decision factor for investors.

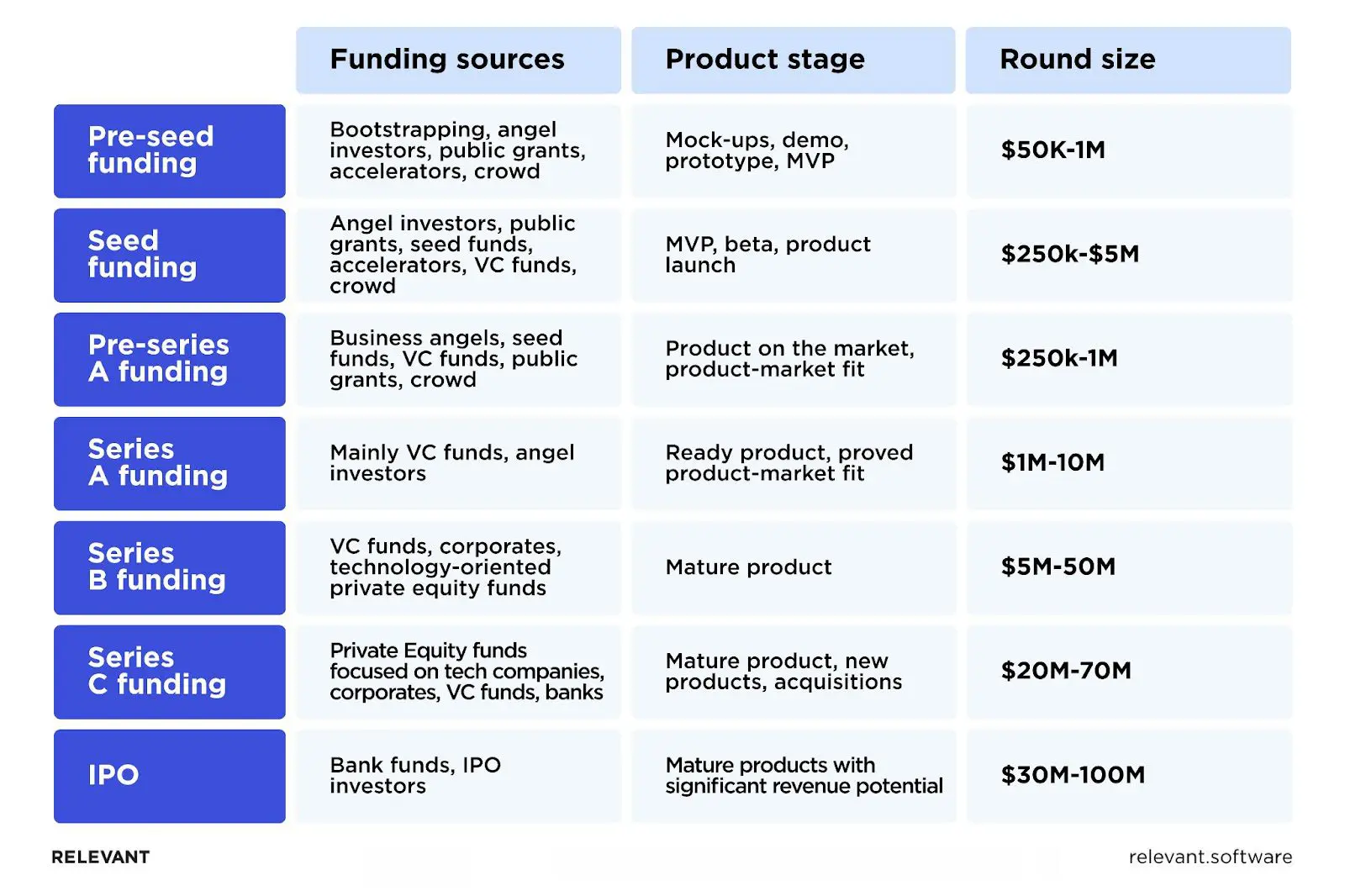

Main types of startup funding rounds

The investment process is divided into funding rounds. Let’s examine each step of the process and what it means for startups and investors.

Pre-seed funding

A pre-funding round aims to kick-start a startup idea from the ground up — let it participate in the project full-time, hire key team members, and build a proof-of-concept (POC), prototype, or viable product (MVP), prepare a go-to-market strategy and get some initial traction needed to attract the (next) seed round of investment.

- Product stage: mock-ups, demo, prototype, MVP

- Round size: depends on the startup location, from $50k up to 1M

- Funding sources: bootstrapping, angel investors, public grants, accelerators, crowd

Note: The pre-seed funding stage is generally not included in official funding rounds.

Seed funding

A seed round occurs when a startup has created: a proof of concept, go-to-market strategy, demo/MVP, and/or seed traction. Seed investments are typically used to develop other products and teams, formally go to market, acquire customers, and test product-market fit and business model (revenue generation). Angel investors and early venture capital funds usually lead the seed round.

- Product stage: MVP, beta, product launch

- Round size: from $250k up to $5M

- Funding sources: angel investors (including business angel syndicates), public grants, seed funds, accelerators, VC funds, crowd

Pre-series A funding

Post-seed / pre-series A / early A takes place when a startup already has a product-market fit and generates revenue. But it needs additional money for marketing & sales and an effective customer acquisition strategy that will deliver solid metrics to land series A investment. A startup needs $1M in annual recurring revenue to hit a round.

- Product stage: product on the market, product-market fit

- Round size: $250k-1M

- Funding sources: business angels, seed funds, VC funds, public grants, crowd

Series A funding

A Series A funding round (also known as a Series A funding or Series A investment) is the next round of fundraising after the seed investment. That is the case when a company has: established product-to-market fit, robust unit economics, and an operational and adaptable business model that can scale quickly. In addition, it must generate revenue (preferably 1 million dollars annually) and be able to stimulate market growth through additional funding. Typically, Round A is led by venture capital funds.

- Product stage: ready product, proved product-market fit

- Round size: $1M-10M (and getting higher yearly, in the US, can exceed $50M)

- Funding sources: mainly VC funds, angel investors

Series B funding

Series B is a funding round at a stage where the company has already built a significant user base and introduced a proven business model. Round B aims to build on existing success and scale rapidly. The capital raised is typically used for team growth, marketing, and geographic expansion. Large VCs run B rounds, typically starting at $5 million and can go up to $60 million.

- Product stage: mature product

- Round size: $5M-50M (and growing)

- Funding sources: VC funds, corporates, technology-oriented private equity funds

Series C funding

Series C and beyond are funding rounds that support mature companies in further development and scaling. At this point, the company is most likely valued at over $100 million and can be on the fast track to an exit or at least significantly enlarging market share. The business is de-risked enough for financial institutions to involve in investment. Apart from large VC firms – series C is led by PE funds, banks, hedge funds, and corporates. One of the most probable outcomes from this stage is an IPO or acquisition by a bigger player.

- Product stage: mature product, new products, acquisitions

- Round size: $20M-70M

- Funding sources: Private Equity funds focused on tech companies, corporates, VC funds, banks

IPO

An initial public offering (IPO), which marks the culmination of a startup’s lifecycle, allows the general public to purchase shares in a private company. This creates new opportunities for fundraising on the open market and raises the level of transparency. However, since you now have to deal with shareholders and investors, this also entails more complications. Maintaining these relationships will take a lot of work and be expensive.

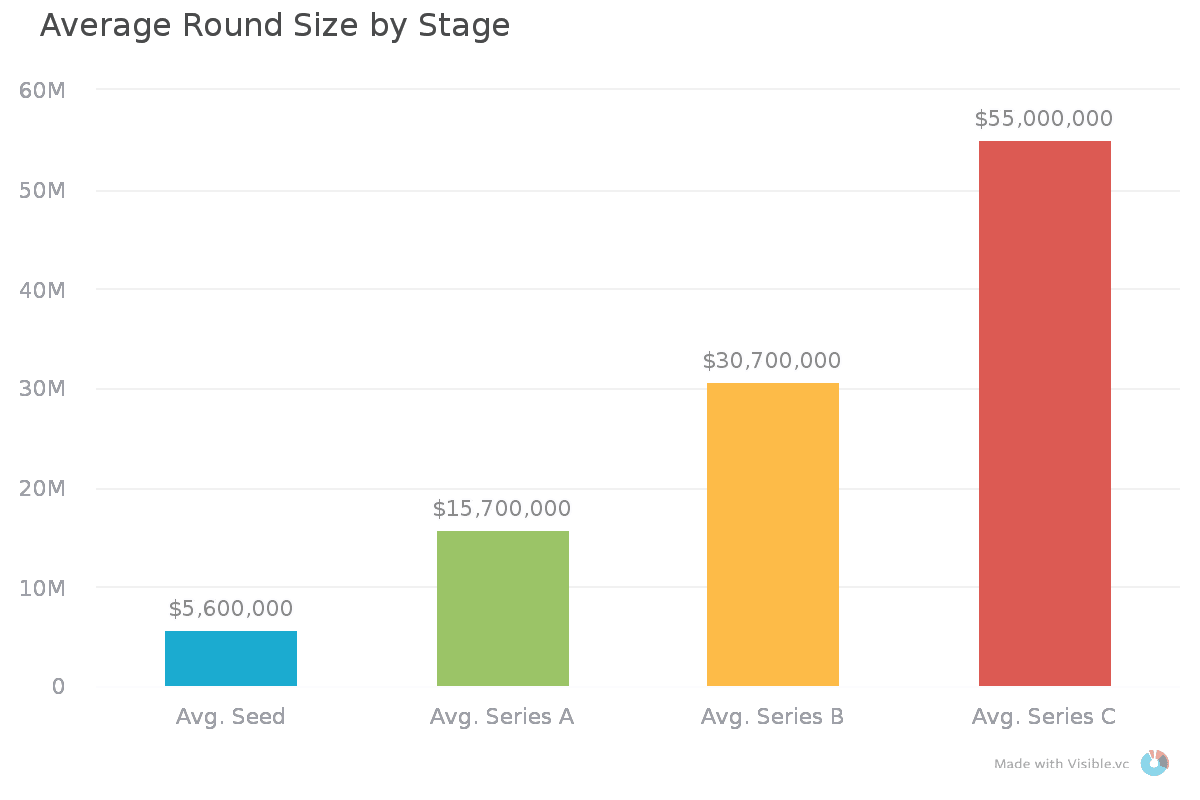

Source: Visible

How to pitch your startup idea to potential investors

Now that you are aware of each stage of the startup fundraising procedure, it is time to think about convincing investors to give you money. Developing a good pitch that highlights your value proposition and market potential is highly important if you want to get funding for startup. Relevant Software’s team of product developers and consultants have shared their insights to help you develop a persuasive pitch that will resonate with investors.

Validate your app idea and define the market size

Creating a successful pitch starts with validating a business idea. You need to describe everything that makes your business valuable carefully and why it is worth investing in.

Identify the target market for your product realistically by segmenting it into the TAM (Total Available Market), SAM (Serviceable Available Market), and SOM (Serviceable Obtainable Market). While the TAM evaluates the upside possibilities, the SOM and SAM assist in de-risking the venture. Plus, it will enable you to develop a more conscious rollout strategy.

If you can, try to create an image of the user or your ideal customer by talking about your target market. This might aid in visualizing the possible clientele and demonstrate that you have given serious consideration to the target market for your startup.

Create a killer elevator pitch

The name “elevator pitch” grows from the idea of grabbing attention in a very short time (typically 30-60 seconds). Keep in mind that the elevator pitch objective is to arouse interest, not close a deal. It is aimed at intriguing your potential investors so they can want to get to know you better. Also, you usually don’t use other materials, such as slides, during this speech.

Prepare a pitch deck

You can use some presentation materials to highlight your speech during a common pitch, which is longer than the elevator pitch. Although you have more time, keeping your presentation concise and brief is vital because audience attention spans are typically only about 15 minutes. The slides that comprise your presentation have been named a pitch or startup deck.

For it, you should prepare meaningful illustrations instead of long texts. The text, in turn, should be spoken freely and included not in slides but in presentation notes. So you can easily send your presentation as a PDF.

Here is a list of what the Relevant Software product development team suggests to include in your pitch deck to increase your chances of getting funding:

What can be included in your pitch deck

- Vision and value proposition. That sums up your company’s mission and the value you offer clients in a single line. The short and uncomplicated description is best.

- The problem you solve. Investors will fully grasp your business and objectives if you outline the problem as vividly as possible.

- Target market and opportunity. Here is where you describe the size and extent of the issue you are trying to resolve.

- The solution you offer. Describe how customers will use your product and how it will solve the issues you’ve listed.

- Revenue or business model. After describing your product or service, you must explain how it generates revenue.

- Traction and validation/roadmap. Here, you must offer proof that your remedy to the issue you’ve described is effective.

- Marketing and sales strategy. To get your product in front of potential clients, you must describe the major strategies you plan to employ.

- Team. Investors will want to know that your team has the right set of skills, motivation, and experience to grow the business.

- Financial viability. Investors will demand to view your financials, which include a three-year cash flow prediction, an income statement (also known as a profit and loss statement), and a sales estimate.

- Competitive landscape. Describe your position in the market’s competitive environment and how you vary from available alternatives.

- Investment and its usage. Investors will be curious about how their money is being used and how it will assist them in realizing the objectives they have set for their company.

Build an MVP (minimum viable product)

Building an MVP with minimal features and presenting it will help investors experience your solution firsthand, demonstrating its usability and potential market fit. Investors who see that you are serious about your product and, more importantly, can realize your idea are more willing to invest in it. On top of that, an MVP allows you to collect user feedback and provide investors with data-backed insights into user engagement and demand.

How Relevant helped Fisk startup build an MVP to attract investors

We want to share our case where we developed an MVP for the Fisk company to show you how a well-executed MVP can set your project up for success.

Fisk’s CEO approached Relevant with the idea of creating an automated investing and virtual card tipping platform that will allow users to save and invest their tips or receive them directly into an investment account. Our team overcame the challenge of integrating multiple financial APIs for KYC, card issuing, payment processing, and multi-bank connectivity to deliver a robust and secure MVP on time and within budget. Now, the company can analyze customers’ needs and offer a more efficient service while attracting investors for the project’s further development.

So, if you want to interest investors with a high-quality MVP, let our dedicated team take care of it!

Bottom line

The current funding problem, like most things, is also an opportunity to foster a new entrepreneurial mindset. The recession will limit the generation of free-spending startups and create new kinds of companies focused on performance and market fit, not lightning-fast scaling or the promise of changing the world.

If you are a startup that needs support in climbing to the top of the world, Relevant is here. We are a global IT outsourcing company whose key purpose is to provide exceptional and supremacy software solutions. Interested in how we can lead you to success? Contact us as soon as possible.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.