How Invoice Automation Can Transform Your Business

How much time is your company spending on invoice management?

Statistics show that most finance teams spend at least five days a month on the task. Yet this manual work can easily be automated, saving your company up to 81% of processing costs and 73% of processing cycle time. In terms of payroll savings, invoice automation usually costs one-third the salary of an offshore employee and one-fifth of an onshore employee.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

And the good news isn’t just about money.

The benefits of automating routine tasks like invoice processing also stretch to quality and efficiency. Robotic processing automation (RPA) of any basic task improves compliance, quality, and accuracy by more than 90% while enhancing productivity by 86%. Almost 80% of companies who are already enjoying the benefits of invoice automation expect to increase their investments over the next three years.

These are all promising figures, but many companies don’t know where to start when it comes to finding the best solution. We’ve based this article on Relevant’s experience working with clients looking to transition to invoice automation but need their questions answered. We’ll cover:

- The automated invoice processing workflow and its benefits

- The main features and challenges of invoice automation

- How to choose between ready-made and custom invoicing software development

So let’s get started!

How does automated invoicing work?

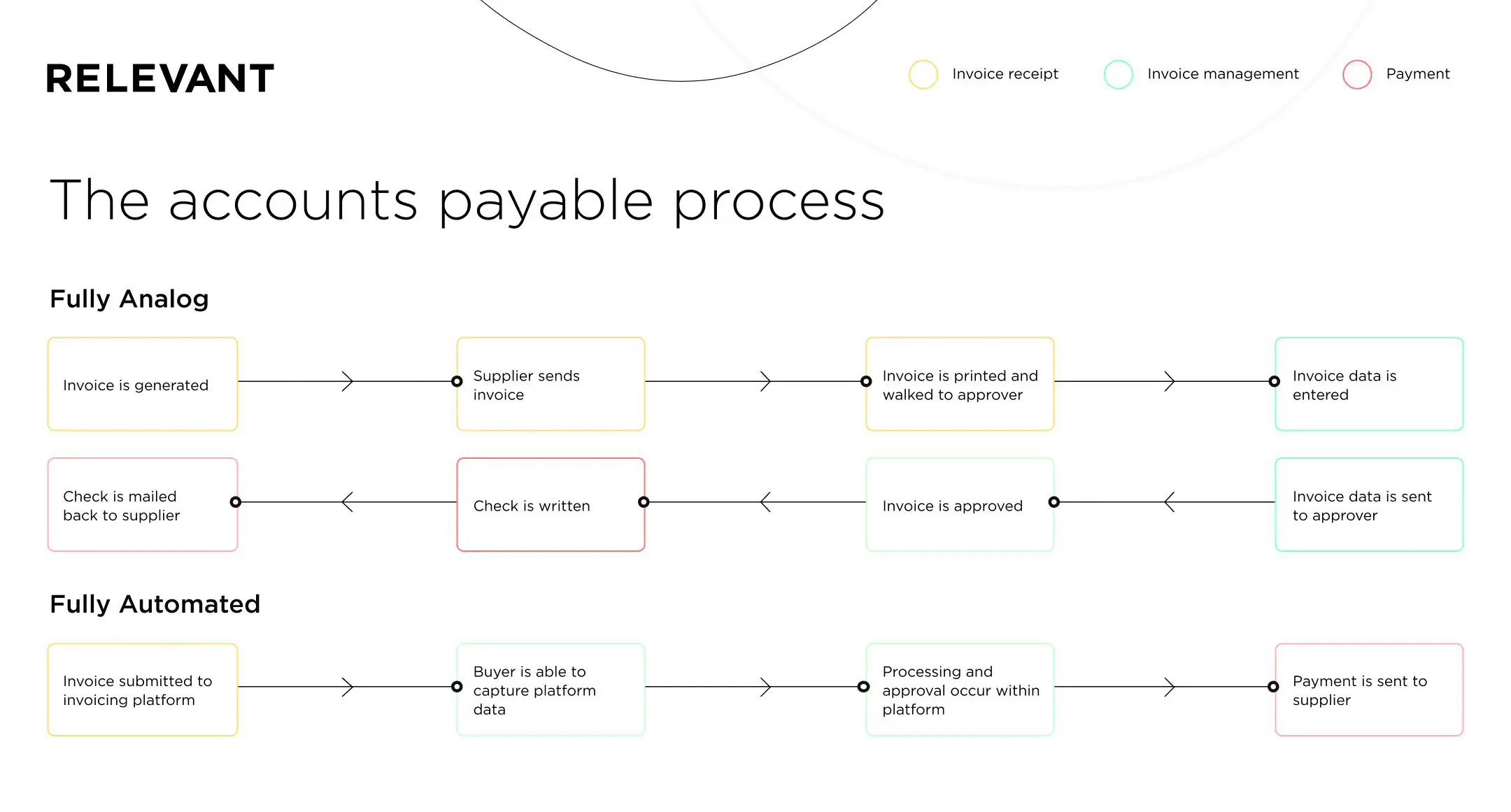

Manual invoice processing can take up to 15 steps, depending on the company and industry. This drops dramatically to just four steps in an automated environment.

Let’s take a look at how that happens.

In a typical invoice processing workflow, the first step is when your accounting team receives an invoice. After checking its type and matching it with any supporting documents such as a purchase order (PO) or delivery receipt, staff verify whether it’s been approved by the relevant authorized person—if it hasn’t, they request it. Once approval has been given, the team submits the invoice to the accounting system, where it waits for payment. After the payment has been processed, the accounting team archives the invoice and related payment information.

Now let’s take a look at the automated invoice processing workflow. When an invoice arrives, the software scans it to extract and convert the data into a searchable document. The software can also flag emails with attached invoices for data extraction or invoice monitoring. If the document structure is new to the software and it can’t extract some of the data, it sends the invoice to employees for review and manual checking.

Invoice and payment verification is also automatic. By checking the invoice against VAT rules and cross-checking it for duplicates and against related documents, the software evaluates whether the invoice is valid.

All this saves hours of work for your accounting team, as there is no more manual entry and no human errors. With invoice processing AI tools, the software remembers which fields to capture and register in your company’s ERP system. It also makes it easy for your accounting team to route the invoice to authorized parties for approval, not to mention that all communication and remarks are saved within the system and can be easily accessed when needed.

The benefits of invoice automation

In summary, companies using invoice automation feel the benefits in four main areas:

Cost and time savings: Automated invoice processing naturally speeds up invoice processing, leading to a significant saving in cost per invoice.

Enhanced productivity: Less manual work and more free time increase employees’ productivity, allowing them to focus on more important activities. At the same time, the elimination of manual work significantly reduces errors.

Robust data consistency and security: Automation software checks incoming invoices for inconsistencies, duplicates, or invalid payments, which reduces the risk of fraud. The centralization of incoming invoices enhances their visibility, while strict fintech security requirements ensure data protection. Automation streamlines the approval process, as it links invoices directly with authorized parties. This, in turn, leads to higher data security.

Earlier payment: A faster approval process means that your company can also benefit from early payment discounts. Early payments enhance relationships with your suppliers, leading to more savings down the line.

Now you’ve seen what invoice automation is and how it helps streamline business workflows, it’s time to think about which solution could fit your company best.

Is custom invoicing software better than ready-made solutions?

There are two primary choices when it comes to adopting invoice automation:

- A ready-made solution

- Custom invoice software development

A third option available if your company is already using accounting software is to customize it with automated invoice processing tools. Many financial management systems have this feature; you just need to check it with the system provider. Still, bear in mind that you will mostly get limited functionality and such software is unlikely to meet specific needs. What’s more, customizing complex ERP systems such as Oracle EBS or SAP can take significant time and cost your company a fortune.

Ready-made cloud software

Ready-made software is an option if you’re looking for basic features such as automated reminders and invoice templates. This software is easy to adopt and use because it has an understandable intuitive interface. It allows your financial team to start using the product almost immediately, as you don’t need to spend time on training and setup.

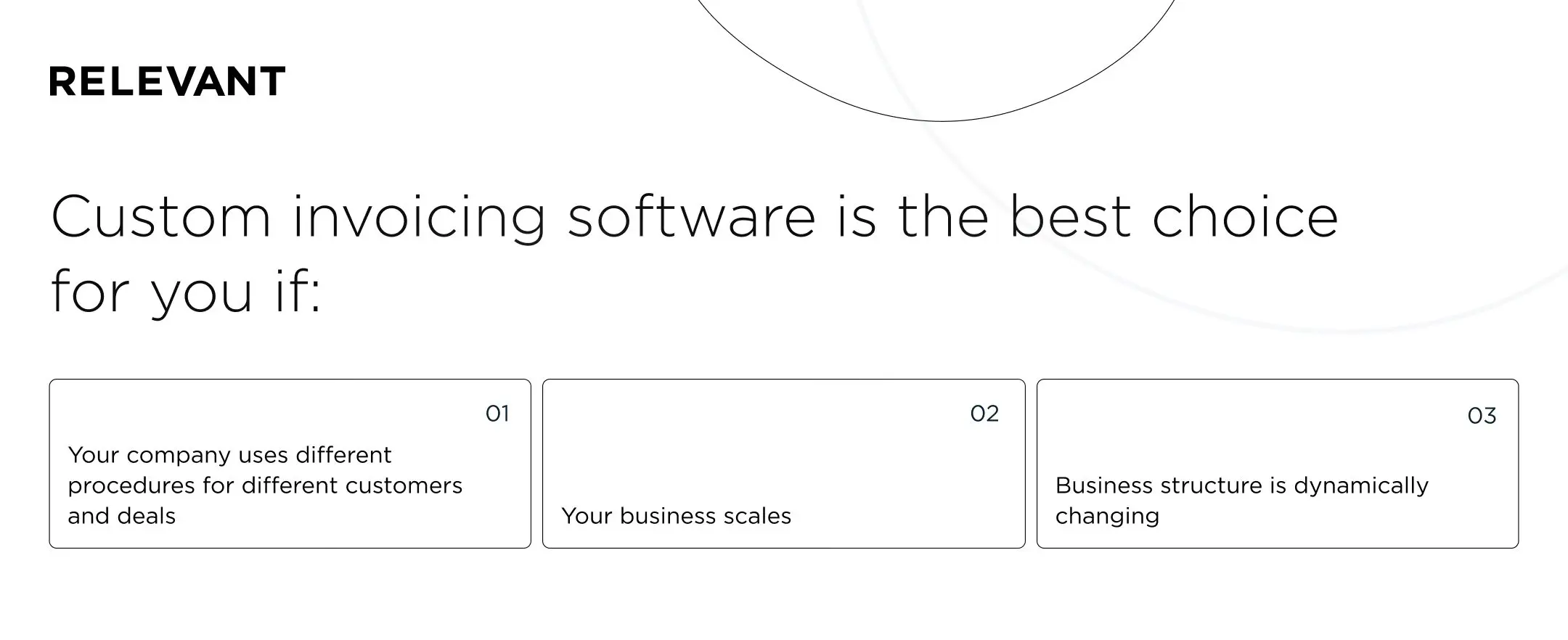

On the downside, ready-made software mostly offers standard functions and cannot handle unique invoices or deal with complex processes. If your company uses different procedures for different customers and deals, for example, a ready-made solution won’t meet your needs. The same is true if you have a complex system of discounts, premiums, and limits or if you use different invoice templates depending on the compliance regulations relevant to certain customers. In all these cases, you’ll likely need fintech software development services.

A final point to consider is cost. Monthly subscriptions to reliable software aren’t cheap, and as time passes, this cost obviously accumulates. Over time, SaaS billing software can work out more expensive than custom invoice software.

Custom invoicing software development

So is custom development right for you?

Before searching for an invoice processing software development guide, just consider two questions:

- Do you have specific needs that can’t be effectively solved by any solution available on the market?

- Is your business structure dynamic or likely to change or scale soon?

If the answer to either question is yes, you’re reading the right section.

While off-the-shelf software often obliges you to fit your workflow to the product, a custom solution can fully meet your business needs. With a team of experienced developers, you can have highly advanced functionality on a par with complex invoice banking software.

Custom-built software offers a modular architecture, meaning it’s easily scalable and can increase its functionality and capacity when needed. It also easily integrates with your company’s existing solutions for ERP and Customer Relation Management (CRM).

In summary, the right choice between a custom and ready-made solution depends on how complex your needs are. For basic invoicing needs, consider customizing your existing financial software or a ready-made cloud solution. If your needs are more complex or you anticipate that your business structure will change, custom software development will be your best choice.

Invoice automation features

Now let’s dive into the features of invoicing software. Regardless of whether you choose a ready-made solution or custom invoice software development, these are the terms you’ll often hear.

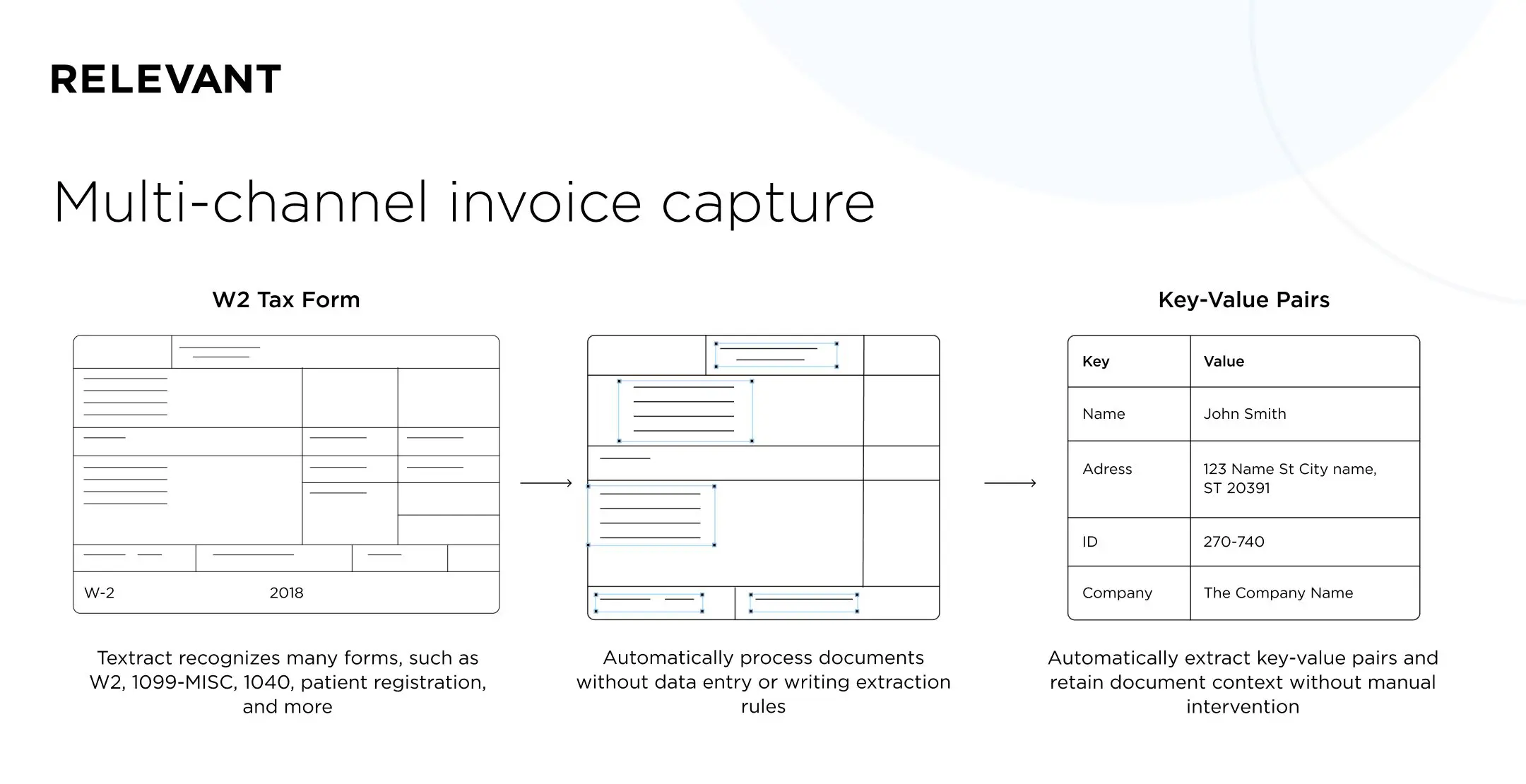

Multi-channel invoice capture

Simply put, invoice capture (or data capture) allows an automation system to extract the necessary information from a document, match it with related documents such as a purchasing order (PO) and/or delivery receipt, and convert the data into a searchable format. Multi-channel invoice capture enables invoice processing regardless of the document’s initial format, which could be XML, PDF, an image, email, or even a hard copy.

Optical character recognition (OCR)

This is the core technology that supports the data capture process. It recognizes and extracts required information in digital documents and assigns the data to appropriate fields. An automated invoice processing system often pairs OCR with other data extraction tools to increase the accuracy of data capture.

Purpose-built AI

Recording and verifying data is far from being a simple linear process. Financial documents are variable and complex, and every company has its own set of templates. Machine learning and artificial intelligence (AI) enable automation software to spot exceptions and recognize patterns on a case-by-case basis. This results in a better reading of invoice layouts: the software detects the right data without human intervention, regardless of the document format.

Electronic invoicing

An automated invoicing system digitizes the whole document life cycle, including invoice issuing, transmitting, receiving, and processing. Along with a payment gateway, e-invoicing leads to significant savings compared to PDF and paper-heavy invoices. What is more, it offers a secure and traceable document journey, transparent real-time processing, remote handling, and higher accuracy due to reduced manual work. It’s also environmentally friendly.

Workflow automation

Automated invoice processing creates a transparent and traceable document workflow. Comments, remarks, and approvals remain inside the software and can be easily accessed when needed, and automated reminders speed up the approval process.

Purchase order (PO) matching

Automated PO matching allows your company to customize configuration guidelines for each seller and then verify invoices for compliance. It also automatically checks if the amount in the invoice and PO match up.

KPI/SLA management

Automation allows you to monitor performance and service-level agreements (SLAs) related to invoice processing. Measuring these metrics gives you a clearer understanding of payment flows and financial compliance, resulting in better financial planning.

ERP integration

Off-the-shelf automated invoice processing systems easily integrate with simple ERP solutions, which can save time and positively affect ROI. However, if your company uses a complex ERP system, consider custom invoicing software that can immediately integrate specifically with your ERP without lengthy configuration and modifications.

What are the challenges with automating an invoice?

When trialing solutions or discussing with a vendor, think about these two main challenges.

How well will the solution cope with the diversity of your documents? Financial documents do not use standard templates. Every company uses its own layout, and critical information can appear in different places of a document. Creating a large number of invoice templates does not effectively solve the problem because even these can’t address every existing layout.

How well will it cope with poorly scanned documents? “Noise” on scanned invoices is another problem to be aware of. It’s common for invoices to be scanned in at an angle or together with other documents or present image problems due to low-quality office equipment.

If you want your software to understand “noisy” real-world invoices, recognize patterns, and extract necessary information without human intervention, opt for a robotic process automation (RPA) solution with an invoice capture functionality that leverages OCR and AI technologies. Invoice processing using RPA and AI is a self-learning process, so even if the software can’t fully understand some documents, it learns automatically. You won’t need to intervene again when a similar invoice arrives.

Summary

Hopefully, this article has shed some light on the invoice automation process and its benefits for business. In an increasingly competitive environment and with the growing interest in digital transformation, the faster businesses integrate automated invoicing, the easier it will be for them to grow and stay afloat.

At Relevant, our experience in fintech and personal finance app development means we’re well placed to offer the best in custom payroll automation solutions. If you want to upgrade to automation that can fully address your company’s needs, we’re here to create custom invoice software that will reduce both your development and management burdens. Don’t hesitate to contact us for a consultation.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.