Let’s meet in person!

Secure your personal meeting slot today — let's connect and discuss opportunities!

29-31 July. Dublin, IE

01-02 August. london, uk

Petro Diakiv,

Delivery Manager

at RELEVANT SOFTWARE

Get More Financial Flexibility and Predictability with Tymit

Updated: June 7, 2024

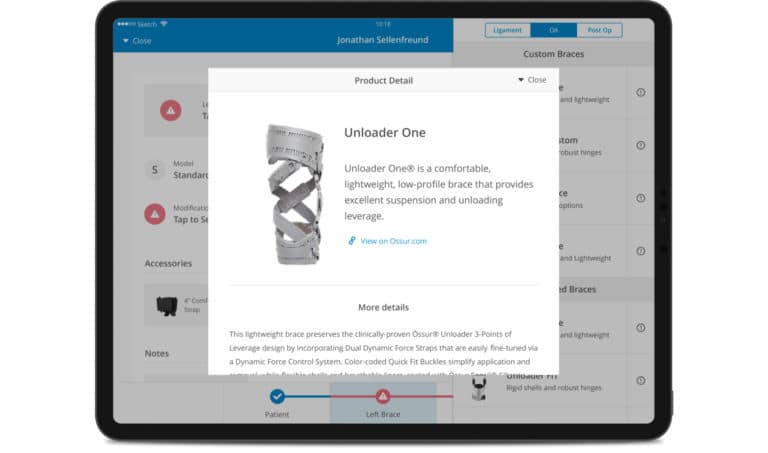

Founded in 2017, Tymit is a UK-based financial services company that provides a viable alternative to standard credit cards or loans. The Tymit team leveraged the latest technology to build better solutions (card and app) from scratch with features like choosing when to make payments, paying interest only on purchases spread over time, advanced fraud protection with 24/7 monitoring, ID theft, and more.

At Relevant Founders, we offer leadership lessons from the CEOs of some of the world’s most successful companies. Our next guest is Tymit CEO and co-founder Martin Magnone, who will share his FinTech startup story with us.

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usTable of Contents

The Tymit eureka moment

Why is now the time for Tymit?

I think it’s a perfect time. Before starting the company, I saw the problem with cards – unclear pricing, lots of fees, and a lack of features to keep balances under control. Meanwhile, it’s one of the most widely used financial services products in the world. In the UK, more than 30 million people use it regularly – a product that hasn’t evolved since the 90s. It’s crazy.

The big banks relied on old technology, and because they’ve had a monopoly for so long, they haven’t given much thought to providing a great user experience. Although fintech unicorns like Revolut try to recreate banking experiences, lending is still lagging. I felt it was the right time to enter the market with a solution that meets customers’ needs and fills these gaps.

Why is it lagging behind?

Since we see specific problems with the most prominent lending solutions, people do not know how much it’s costing them. They are very frustrated about the spiraling costs and how they’re being charged fees in interest.

When was it you had this eureka moment where you thought this is it? This is going to take off.

It was in 2017 when I worked with the largest credit card issuer in the world and participated in large-scale research among credit card and personal loan customers. I got research results showing that many people were going through a lot of pain trying to get a small personal loan. They had to fill out a paper form, wait a week for the bank to deliberate their case, and, eventually, ended up with $1,000 at roughly 25% APR.

We wondered why they didn’t use a credit card? And the top answer was, “because if I take out a personal loan, I have a plan to pay back, I know what I’m getting myself into, I know that I pay these streams of payments, there won’t be any surprises. But credit cards… I have no idea how that balance and interest will be calculated or how to get out of it.”

I saw the opportunity here, and technology had already evolved to the point where I could implement it.

The determining role of conviction and motivation

How to find the time to build a start-up and work a full-time job??

It is all about motivation. At the time, I was single and had a lot of personal time. So, I would do it on weekends, at night during the week. The startup track is a pretty rough road. If you’re not passionate about your work, you will likely give it up.

So it’s all about priorities?

I felt a little bit empty at my previous job. It was the best company to work for, but I was too detached from the customer. I wanted to create products that would improve people’s lives and be rewarding. It was a passion, and I found time for it in my schedule.

What has this success cost you? I don’t mean money-wise or financially, but personally.

One thing to understand is that an early-stage startup takes all of your attention. You must be almost obsessed with it, explore every angle, and have them thought-out in your head. Just working 40 hours a week will not work. So it’s something that you have to take on consciously. Other areas of your life will suffer if you want to make a business successful.

What has been the most challenging year for you since Tymit’s creation?

It was in 2020 – the first year of COVID – when we were supposed to launch our Series A, but the situation impeded our plans. It is difficult to raise money; investors were more worried about saving their portfolios than investing in new companies. We had to start signing up for smaller rounds instead of racing a big round. So many times, investors told me, “you guys are probably the riskiest investment I’ve ever considered.”

A moment of doubt?

Was there a moment when you had to stop and think: “Does this work”? Or is it impossible in a startup? Or is it always forward, forward, forward?

It’s a matter of style. If you want it to work, you must focus on it 100%. So there should be no doubt that you can do it right. You will constantly visualize how you will solve the next problem, the next challenge of your company. And that visualization gives you confidence in what you need to do as the CEO and founder and sets the company’s direction.

A new standard in the fintech space

What do you think will happen in the FinTech space over the next few years? What are we waiting for?

I’m at least focused on lending credit and payment experiences. Traditional credit scores are not a great predictor of someone’s ability to take on credit. There’s a lot of work to be done to underwrite credit better. Open banking and new data sources are available, but their potential has not been fully realized. Besides, you have the technology and products and lending products and experiences that can cross the border, and it’s very challenging because you’ve got different regulations and cultures.

So we focus on analytics to understand and serve customers better, evolving products that can work across borders and make those solutions widespread. It emerges as a kind of new standard that you can deploy.

CEOs advice: ask the correct questions

What is your go to material, a book or something, that has given you direction to build Tymit?

I didn’t get my inspiration from books. It was more from practical experience. I think the number one thing that is most useful is speaking to customers, and to be honest, that was the most valuable thing. It was an understanding of what was happening, what was wrong, and how it could be improved.

You get accurate data and insights if you ask the right questions. It informs what needs to be done to solve the problem, builds confidence, and provides the unique insights you need to develop your company.

Insights can come from many places. You can get those from the books, these can give you frameworks and methodologies, but you need to get to a point where you have a clear insight that nobody has.

Subscribe to the Relevant Founders podcast for more conversations on the CEOs’ practices and mindsets.

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us