Let’s meet in person!

Secure your personal meeting slot today — let's connect and discuss opportunities!

29-31 July. Dublin, IE

01-02 August. london, uk

Petro Diakiv,

Delivery Manager

at RELEVANT SOFTWARE

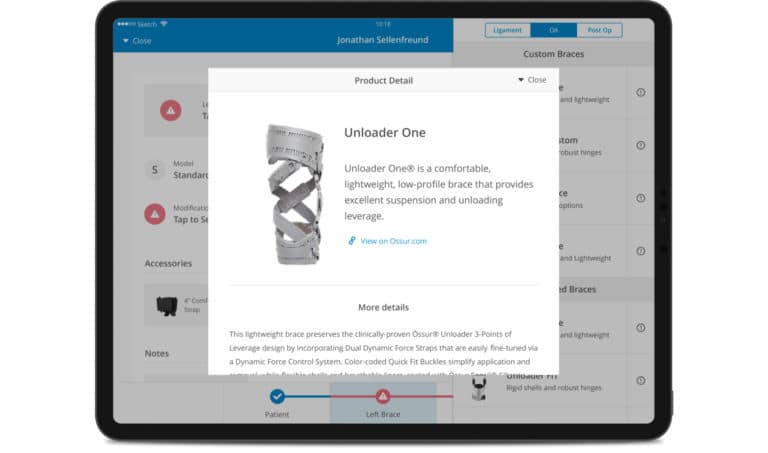

A FinTech Leader About How to Increase Loyalty in Your Customer Base and Target Customer Rewards Based on Bank Data

OptioPay is a B2B2C open data platform revolutionising customer engagement, currently concentrating on bank transaction data as data source. Bank data enables a new era of customer insights, monetisation of a customer base, online & offline tracking, targeting, personalization, and loyalty initiatives to serve future business needs.

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usOptioPay was founded in 2014 by Oliver Oster and Marcus Börner. Nicola Breyer joined the C-Level team in 2020 as Chief Growth Officer. The company’s caters to enterprises with large B2C customer bases and advertiser customers. Through OptioPay’s white-label loyalty platform end customers receive tangible rewards in return for their bank account data.

Thus, they capitalise on their own data through exclusive cashback and many other deal types, as well as rewards based on sustainable consumption like trees being planted, plastic being rescued or getting deals donated.

In our conversation, Nicola highlighted that OptioPay’s belief is that every person should be able to capitalize on the value of our own data footprint. To be able to receive tangible value in return for sharing data rather than giving it away for free or over-protecting their own data.

In this article, we are eager to find out more about the story of their creation, discuss the commercial perspective and customer pain points.

Meet OptioPay: revolutionary customer engagement solution

OptioPay works with large enterprises that want to engage more with their customer base.

“Every large B2C company could be a platform customer: a bank, an insurance, a retailer, a media or an energy company. Anyone with a large customer base today needs to engage more with their customer base, create new monetisation opportunities and more loyalty.”

Having access to customers’ bank transaction data allows for the creation of new and tailored products and service offerings. This in addition to our loyalty solution moving from being a cost center to a profit contributor as it scales is one of the key reasons why enterprises work with OptioPay.

“We also have our merchant network. These are advertisers who have much more daily issues especially with new privacy limitations coming into play on the large technology platforms and an increased need for ROI. We can offer them highly-targeted campaigns to address very specific customer segments. So, through our ecosystem, merchants benefit from customers’ sharing their bank transaction data with explicit consent and in a regulated environment.”

“We offer more interaction and more engagement with the customer base. Basically, people are asked or incentivized to check in more frequently. Then you get to know your customers based on the bank data, which is always essential. Considering that even a bank is not allowed to market to you based on your transaction data without your consent — open banking creates huge market opportunity.”

The OptioPay team help companies to better know their customers by understanding their 360-degree data, where they shop, how they move, what family situation they are in, etc. A company can create new products and services or improve current ones significantly.

As a B2B2C player with two types of business customers, OptioPay creates an ecosystem and has an attractive revenue model.

“We make SaaS revenue from our platform customers for the licence of our white label B2B2C product. We also sometimes offer consulting and marketing services to these companies. So these are the revenue models we have with our publisher base. In addition, we create revenue on our platform. We make money on different parts of our business, but we never make money from the customer.”

So, with the hundreds of merchants, OptioPay works with, it resembles Facebook or Google ads. Companies pay for the advertising, the marketing, the deals put on the platform, and then OptioPay shares that revenue back with its publisher base. However, targeting is not based on preference, but on factual behaviour through transactions. Also, offline behaviour can be seen and targeted.

Open Data in banking: how to encourage customers to share their data

All this raises a legitimate question: how does OptioPay encourage customers to ongoingly share their data?

Nicola is confident that enough customers are willing to share their data. Right now, there’s about 22% of millennials and digital consumers in the market have very different attitudes about data sharing. So there’s already an opportunity to engage 22% of all consumers. Also, about 50%, in general, are willing to share their data for tangible return.

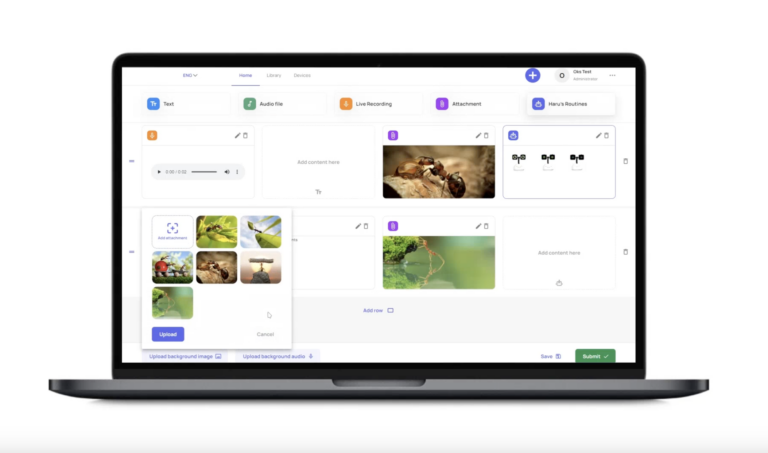

First of all, it’s worth mentioning that the company interacts with customers solely under the name of its client. Nicola gave a great example: a user of a certain mobile operator receives a notification in the app, “Telecom X Rewards.” By clicking on it, they are presented with a feed with attractive deals the user can interact with for a reward. This can be anything from 1 euro to your wallet to a tree planted in your name. In order to receive certain rewards that require transaction tracking. A bank connection is fully required, so the customer is then educated about this need, connects their bank account and enables the deal.

“We make this process fully transparent. And when the bank account connection happens, we get some history of bank transactions, can then track customer behaviour. We know from research that it is important for users to explore the product before sharing data, so this is why we make that possible.”

In addition, the product can play on the fear of missing out on effect. Did I receive the cashback in my wallet? Or maybe they planted a tree because of the action in the app?

“You know, we don’t need to evangelize and convert everybody. We have opportunities for people willing to share data who just need some proof that we are fully transparent and deliver real value. We of course need to take appropriate security measures and treat people’s data carefully, within regulation and compliance. By seeing that we keep our promises, users will not have a reason to lose confidence.”

How can companies benefit from this data?

OptioPay provides businesses with information about its own customer base that it had previously seen exclusively within its internal environment.

“If you’re targeting customers based on banking data rather than preference, as the large networks do today, you can also target customers you’ve never had access to. Data doesn’t lie. The information we get goes far beyond the targeting you can do on today’s platforms like Facebook or Google and you can also target offline behaviour like in-store purchases.”

“Part of our product suite is a campaign manager where merchants can create campaigns and deals. We gradually optimize it so that people need as few clicks as possible to create their deals, including customizable targeting. We also provide guidance on reward levels. We only accept rewards from a certain uplift, and it must always be the best reward in the market since it is in exchange for data.”

In terms of loyalty and rewards program opportunities, Nicola believes that now large brands have a great opportunity to retain their customer base and make sure they don’t lose touch with it.

The commercial perspective: how to grow in 2022?

From a commercial perspective, OptioPay has ambitious growth plans for 2022, based mainly on platform traffic. Having an office of about 60 people in Berlin, the company aims to first solidify its position in its home markets before it then expands into other European countries.

“The markets are evolving, and open banking is becoming something that is moving from a pipe connection to real business models, and that’s why the opportunity to grow is now.

We are also growing our talent pool on the technology and commercial side, but in our business model, you do not scale by simply bringing in more people. We are focussing on scaling through building great technology & seamless processes.

Right now, OptioPay operates as a fully serviced Open Data solution for businesses from various industries without integration. The company is one of the first that delivers added value services based on open data that provide an ongoing data flow in a B2B2C environment.

“With us, there’s no need to integrate. We integrate into the customer journey through our web app, and we lead people to our solution and then go back to the actual customer solution. And the beauty of it is that the enterprise customer doesn’t make any effort on their IT side. We do it for them. So we take all that pain, hassle, and project management off their hands. That is why we can go to market quickly, bring in results and the client can always think about deeper integration at a later stage.”

As for the company’s development needs, OptioPay is increasing its consultancy-based sales talent as they develop each enterprise’s solution together with the clients.

“We’re building much stronger content and B2B marketing plans as well as our sales enablement and lead generation processes. But, in general, we have a great pipeline based on a really strong network. So thankfully, custom access is not the problem on the enterprise side. We have to ensure we grow our team strong enough to overdeliver on our plans.”

Your Next Read

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us