Nordigen CEO Shares with Relevant His Thoughts about Open Banking and Its Future

Rolands Mesters, CEO and Co-Founder of Nordigen:

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usNordigen is a Latvian-based company which launched a free PSD2 data application programming interface, making open banking more accessible to businesses. With its commitment to financial transparency, it helps various companies across the globe not only use but also understand open banking data.

Meet Nordigen: Your saviour from drowning in streams of raw data

Tell us a little about Nordigen and its mission.

We started a few years ago in Riga. There aren’t so many people there, meaning the distractions are much less, and so it works out to be a great environment in which you can build a company. Our initial mission was to build a better alternative to credit bureaus. We wanted to leverage open banking, which wasn’t really that popular 5-6 years ago. The crux of the idea was that you could use banking data to understand an individual so much better than by using traditional credit bureau data. When we specialized in building the analytical tools on top of raw data streams coming from banks, we started to build an analytics company providing a lender with the opportunity to plug into in order to better understand someone’s credit rating.

During this period, did you come up against any obstacles?

The main problem we noticed was that banking was incredibly expensive. The first-generation open banking companies were charging us extortionate rates, which we considered unfair. In facing this issue, we discovered that we could instead, ourselves, build an alternative to these services. We knew we could get the license to plug into open APIs and build connectivity and even if we were to give it away for free to anyone in Europe, we would save ourselves money, as opposed to using the previous system’s services. Therefore, the last year was spent building, and in doing so, we built the next-generation open banking company. You see, if the first generation was all about selling access to the connectivity across Europe, then the open banking version is about leveraging bank APIs that are secure and built by banks under regulated standards. This is very exciting because it changes the dynamics and logging, as only the second-generation open banking company offers completely free access to banking connectivity across Europe.

This is a really great story of how you developed your product! So, you launched the free APIs a year ago, which was a relatively risky move because a free alternative to any paid product, of course, raises the question of its quality and if it can be trusted. Can you tell us about this strategy?

When you hear that something is free, you immediately associate it with lower quality. But then you look at things like blockchain, for example, that itself is built on top of this inclusive platform. And the barriers to building a company on its basis today are relatively small. If something is free, it doesn’t mean it’s bad. It’s just a different model in which people contribute to the same core source code that can be freely used to build applications. And also, the second-generation open banking company that we’re developing today is literally based on the same foundations which already exist in the blockchain and open-source world.

In Europe, the regulation forces banks to open up their APIs, but at the same time, it forces them to build great APIs at zero cost. And the end-users don’t have to pay anything to the banks for these APIs. Not only are the APIs free, but also the quality is quite incredible. So, in essence, what we did was, we built a pipe that simply passes through the data. That’s it. At first, we thought, “Should it be the lowest fee? Maybe there should be some kind of cost for the connectivity.” But then we realized it’s not supposed to be that way. The next-generation company is built on a business model that is drastically different from the existing one, even at the expense of people finding it weird.

What are the benefits you get when providing free services?

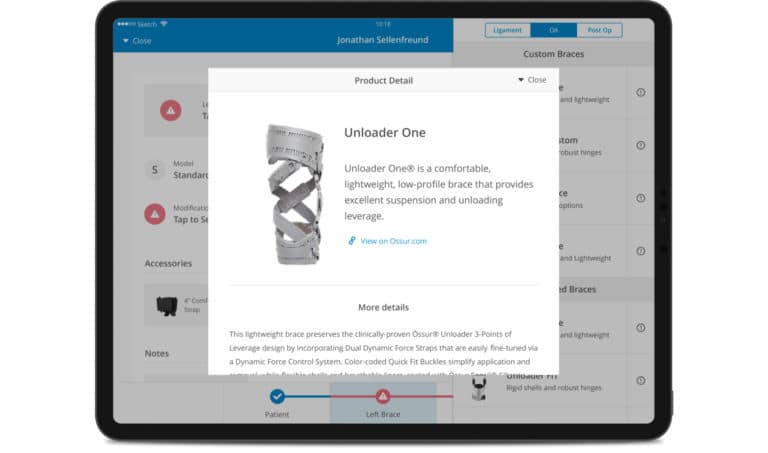

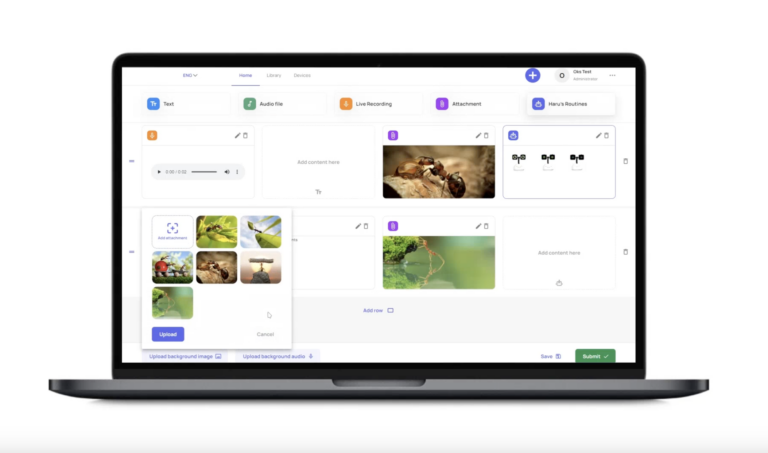

As I said, we do not charge for banking connectivity. What we charge for is our value-added services on top. For example, we have developers who are connecting to bank accounts. They have these data streams now directly from bank accounts to their end-users. This data is very unstructured and hard to understand. As a developer, for you to make sense of that, you have to be a software engineer and a data scientist at the same time, which is a very rare combination. We observe many developers struggling with data quality, struggling to understand and make sense of open banking data, and so we built analytical tools which help them to do just that. There’s an area of things which we can help with. Open banking is free in Europe and will be free in all regulated environments. There will be lots of value-added services. This business model is really transparent. If you were to zoom out, it can be considered very similar to how an open-source solution might work.

Open banking opportunities for the industry

In your opinion, what opportunities do open banking platforms provide to FinTech startups and for the industry as a whole?

Open banking enables free movements of banking data and the ability to use bank accounts in order to make payments. These are the two things which have been regulated in Europe by the payment services directive. If you’re building a FinTech app, you have to know beforehand that it is very hard to get access to the transaction data of your users if they have a bank account. Today, when building a FinTech app, your users will be able to connect their accounts — whether the HSBC account or Deutsche Bank one — to your app free of charge. Due to secure connections, this is a complete game-changer. Because of APIs, you don’t have to think about how to onboard customers and ensure that their data from third-party places is acquired securely. In my opinion, the most fantastic opportunity is that if you’re starting a FinTech company today, it’s significantly cheaper than it was 10 or even 5 years ago.

Open banking has all the potential to shape the competitive industry, landscape, and consumer experience. Could you please explain to us about how it is of benefit to advanced providers and customers themselves?

Now banks have more control, which still comes at a huge cost because the banks have to build APIs compliant with standards. They have to make sure that they are good. Otherwise, they are not complying with the law. So it’s pretty expensive, as you can imagine. And they have to figure out how to make these APIs work with their legacy systems, which is pretty challenging.

But for FinTech, it is a complete game-changer. If you were a FinTech that needed banking productivity before PSD2, it was expensive. Only really rich companies were able to afford this. That’s why many businesses actually build their own tech stack to connect to bank accounts. FinTech companies were also limited in how much functionality they could get. But now, with the free APIs, all you need is a license and to teach a few developers how to connect to bank APIs. Or you can use a service like ours to have all the banks in one place.

And what are the challenges which can arise when opening banking APIs?

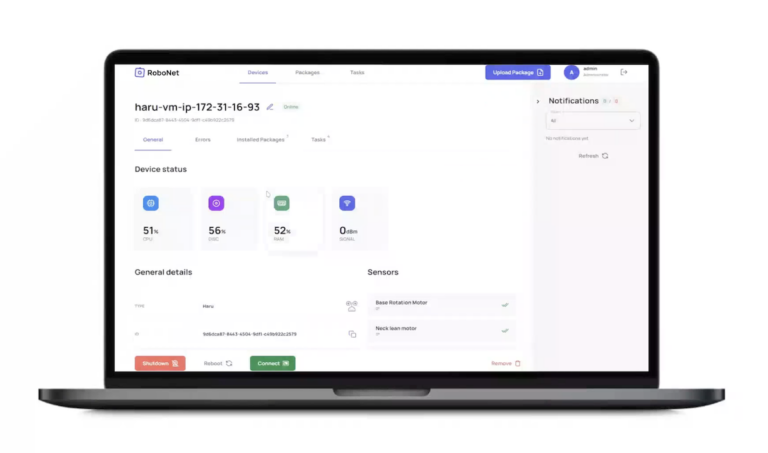

Two years ago, there was no connectivity. PSD2 appeared. Banks were supposed to have APIs, but very few had them. There are 6000 banks in Europe. The vast majority of them have decent and even outstanding APIs. We integrated with more than 2000 banks with a small team of developers in 11 months. That’s how good these APIs are. Still, sometimes the banks build APIs of a lower quality. So we are then required to give feedback to banks in order to explain how to work better with APIs.

Many companies in the market are still claiming that it’s incredibly difficult to connect to bank APIs, but they’re not even trying to do it. Often these are cogeneration automation companies. They want to make money on connectivity and in doing so spend a lot on it. But if we were able to do it with a small team in 11 months, someone else can do it in 9, and the next company can do it in 6 months.

So the main challenges here are a lack of understanding.

The main reason why you do what you do is because of your customers. Let’s talk about how you foster trust with them. How do you see third parties fostering this kind of trust with customers in order to encourage them to share their data?

The point of open banking is to empower people to do more with their bank accounts. The days of closed banking were the opposite of what we have today. At that time, you opened bank accounts, had a relationship with your bank, and did whatever the bank let you do with your account. And usually, that list was pretty limited. You could only send or transfer money. And then, internet banking appeared, and now transactions are visible over the phone. And in doing so, you then kind of always find yourself at the mercy with the bank. If it decides to create features, it probably benefits the customer. If it doesn’t do anything, you stay with the bank anyway. And then some neobanks have come along, and they’re interesting to us. But users have to literally live two financial lives, constantly having to think about what to do about it and what the consequences might be. And it’s terribly uncomfortable. Open banking allows you to link these two banks together as if you were sending a messenger from one city to another. We can give the users the ability to use this technology, but we don’t force them. Without their consent, the app won’t receive any data from the bank. And a lot of users do agree to provide their data now.

Also, in the next couple of years, I think we’re going to see rapid adoption of open banking in areas that aren’t so tech-savvy. For example, bank statements are still actively used in Europe when renting an apartment or taking out a mortgage. That will become much easier once open banking is introduced. The process will be more enjoyable, which will also increase users’ confidence in it.

Inside out: Is outsourcing a good idea?

How did you create your product? Did you have an internal team working on the product or hire an outsourced one?

We are very lucky to live in a country with many good developers, so we created everything ourselves. Also, we don’t have a lot of unicorns in Latvia. For example, our neighbour is Estonia, where there are a lot of really huge companies, and the competition for talent there is crazy.

Do you think it is hard for professionals to find a job in this competitive market?

Some companies say that there is not enough talent, and the big tech giants have already hired all the best people. But we also see that many companies are very inflexible when it comes to finding talents. In today’s reality, employees want to be more flexible and work from home. Going to the office is now more of a whim than an obligation. That’s why it makes sense for companies to be flexible. It no longer matters where your team is located – you can hire a great analyst in San Francisco, a developer in Indonesia, and a product manager in Ukraine and yet the only things you need worry about are time zones and taxes. This is where great opportunities open up for technology companies.

Then why do companies outsource work, in your opinion?

There’s this theory that everything that’s core work for your business must be done by yourself, and it makes sense to outsource all the other tasks to a third party. When we started building a better alternative to a credit bureau, we realized that many banks and lenders don’t really want to outsource the credit rating to a third party because it’s the core of their business.

Today, as we think about fully scaling the business, absolutely everything related to financial operations, the ecosystem, and product development is critical to us and doesn’t make sense to outsource. Some things are less critical, and you don’t have to create them on your own. If you need some custom features for a particular tool, hiring someone externally makes sense. I believe that everyone should identify these critical and non-critical points and outsource the latter’s development to special agencies or to individual specialists.

Your Next Read

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us