Fintech and DevOps: Does Your Company Need a DevOps Strategy in 2023?

Since the COVID-19 pandemic, many finance firms have tripled their digital services to meet increased consumer demands. As a result, mobile banking, KYC, online customer support, and self-service had to scale on the go. That was a moment of truth for the financial industry, which fully realized the importance of timely innovation, fast release of new features, and uninterrupted service to end-users.

All these benefits come with DevOps. Therefore it’s not surprising that 91% of financial institutions have adopted this methodology. It would seem that job is done. But in 2023, Gartner predicts that 75% of DevOps initiatives will not be fully implemented, and Fintech is no exception.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

If you feel upset already, don’t. There is a way out. We would like to explain how your organization can make a complete transition to DevOps practices in the most effective way. We will also cover the role of outsourcing companies in popularizing DevOps financial services.

What is DevOps, and how does it work

Advances in Agile development highlighted the need for a more holistic approach to the software delivery lifecycle, which led to the emergence of DevOps. DevOps stands for Dev, which includes planning, coding, building, testing, and Ops (operations) for release, deployment, management, and monitoring.

It is a set of techniques and tools that enhance an organization’s ability to deliver products faster than traditional software development processes.

One of the fundamental DevOps practices is making small but more incremental updates that can be deployed more frequently than traditional release methods.

Another important part of DevOps’ suite of practices is communication and collaboration. Simply put, DevOps removes the barrier between traditionally disparate teams, so the whole organization, including marketing and sales, works together throughout the entire lifecycle of a software app – from development and testing to deployment and operations.

Software delivery process automation enables collaboration by physically integrating workflows and development and operational responsibilities. Continuous integration and delivery allow DevOps teams to work quickly, securely, and reliably. Monitoring and logging help DevOps teams track application performance so they can promptly respond to issues.

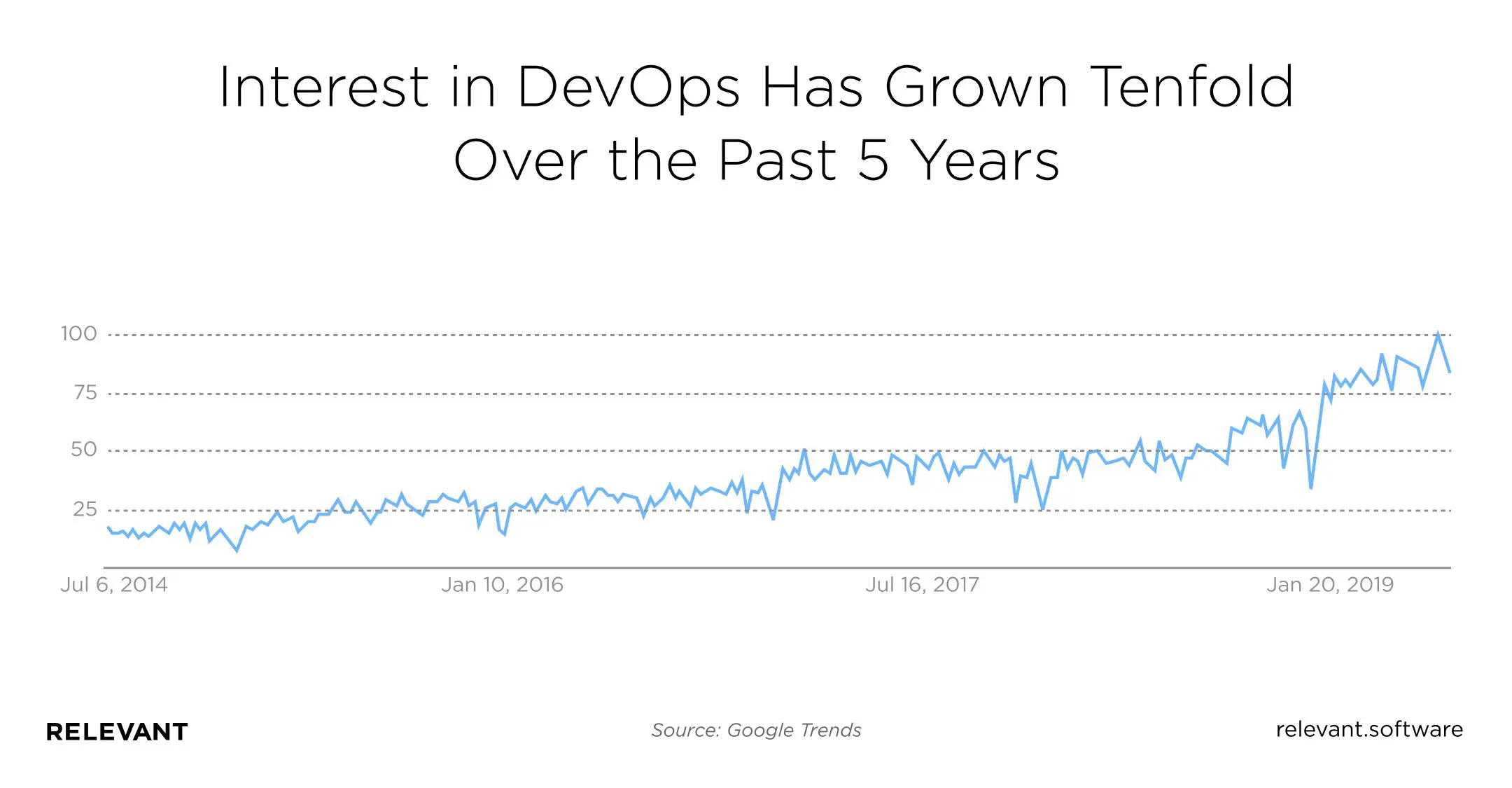

In short, DevOps practices turn the entire development cycle into a well-tuned mechanism to ensure the reliability and stability of the production infrastructure. The result is not only faster time to market but also improved product and code quality. That is why interest in DevOps consulting has become increasingly popular over the past years.

The state of DevOps in the finance world

Some time ago, financial organizations were wary of DevOps because of governance, security, regulatory, and compliance concerns. But now, finance companies are so good at adopting DevOps practices that they are keeping pace with other players in the technology industry.

Statistics show that with a high acceptance rate of 16%, firms have reduced operating costs and sped up their software delivery, resulting in new and innovative services/products being released to the market. At the bottom level, nothing has changed except for the names of the commands and several internal processes.

Well, the overwhelming majority of surveyed firms in 2020 (79%) belonged to a group that can be characterized as the average level on the evolutionary scale of DevOps. And at this level, many organizations remained in the past two years.

So why do Fintech startups and companies need DevOps?

The financial industry implies stability of operations, constant availability of services, and predictability of results. That explains why financial institutions have always been the most conservative in terms of infrastructure management. It took decades to shape the systems they used, and changing architecture, or workflow was almost impossible.

However, in reality, stability, security, and predictability in innovation are the primary goals of DevOps Fintech workflows and practices. It described server setup procedures using Kubernetes and Terraform manifests. That means the cloud infrastructure is managed as code, eliminating the possibility of manual iterative tweaks and configuration drift.

Ansible and Jenkins DevOps tools enable you to create pipelines that automate every action – from coding to preparing test environments, testing code and packaging it for release, updating production servers without disrupting service through rolling updates, and more. As a result, adopting DevOps in banking provides better security, uninterrupted server availability, and faster updates.

DevOps approach allows financial institutions to securely leverage rapidly growing technologies, such as blockchain and AI, and keeps up with existing Fintech industry trends. Below, we will explain how this is possible.

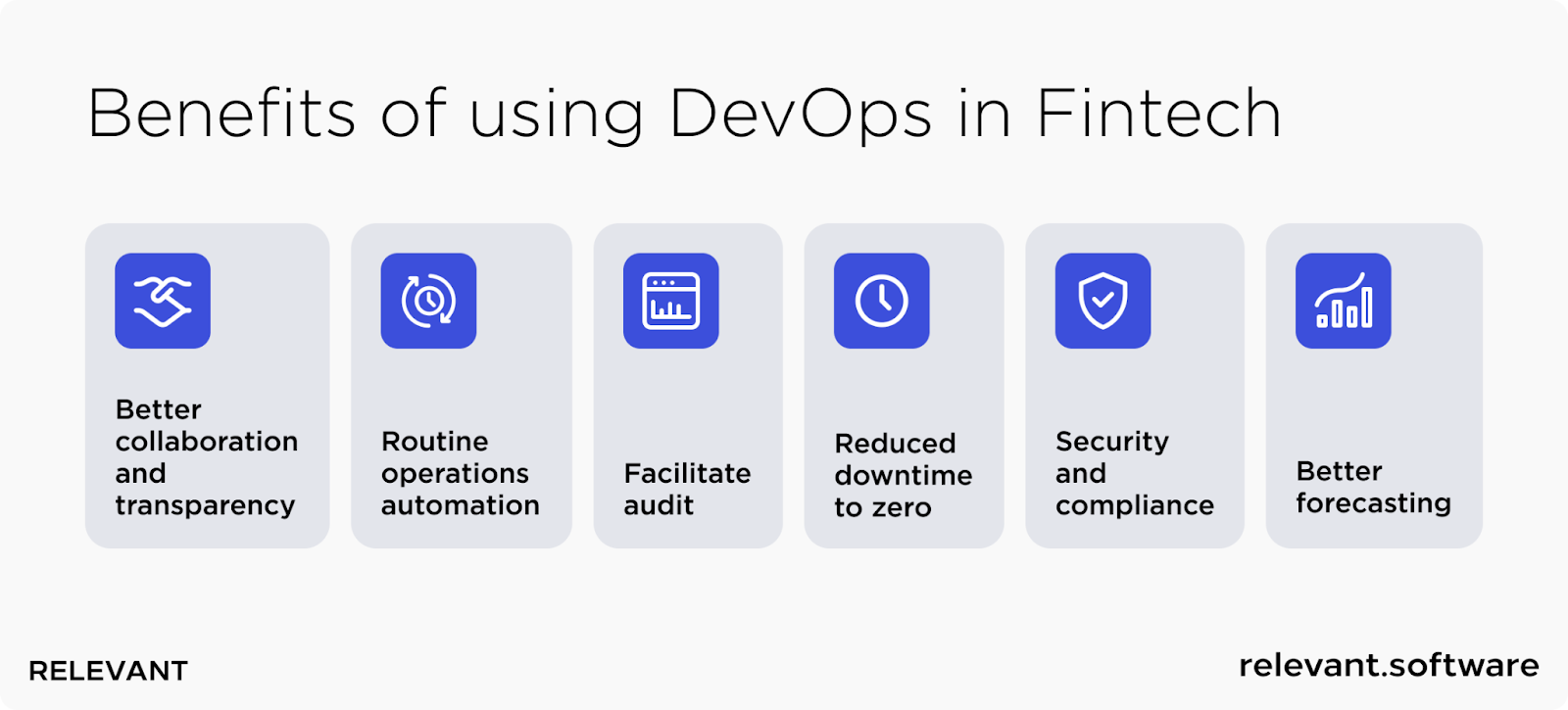

What are the benefits of using DevOps in Fintech?

DevOps offers a set of fintech best practices, operating patterns, and tools designed to optimize all aspects of business operations beyond IT operations. Here are the major benefits of the DevOps approach for financial institutions:

Better collaboration and transparency

DevOps is not only about culture but also about using good engineering practices and technology tools. Since many financial companies are geographically dispersed, their operations speed, focus, and collaboration efficiency ensure operational stability.

DevOps strives to provide visibility and transparency to all teams so that all participants share responsibility for the success of the software. Fintech vendors have a say in the software design phase. So developers can adequately assess the number of resources required to run the software and plan its architecture accordingly. Customers are also involved in all stages of fintech software development and help developers respond to feedback more quickly.

Routine operations automation

DevOps tools provide deep automation of many processes associated with:

- software development and maintenance

- preparing and configuring servers

- software updates and rollbacks

- setting up test environments

- backing up and restoring databases

- software delivery pipelines

- monitoring production servers, and maintaining logs

These daily routine tasks can and should be automated.

IT departments can finally focus on improving the operational versatility and performance of the infrastructure rather than stumbling around on repetitive, low-skill, time-consuming tasks. For example, automating security and authorization controls can help financial institutions remove some of the most common software barriers and release faster while staying compliant.

Facilitate audit

Because financial institutions must comply with many industry rules and protocols, systematic auditing processes may be challenging and stressful. Many DevOps finance tools include security permissions capabilities that ensure that only allowed users can perform specific actions. Also, it includes tracking capabilities. That will let auditors know who logged in and when, what changes they made, and confirm that compliance has been met throughout production.

The information does not need to be collected post-factum by everyone who worked because all logs are saved. Therefore, you can easily identify the sources of problems. In addition, these security measures can help organize audits and minimize stress.

Security and compliance

The competitive Fintech world forces financial institutions to implement updates and new features faster than ever. This rush can create new security and compliance threats that are the number one priority for the financial company. Previously, financial providers spent three times as much on cyber security for fintech as other businesses. But now, they can make the most of their security budget with DevOps.

DevOps principles of continuous integration (CI), continuous deployment (CD), and immutable infrastructure in code lead to automated software lifecycle pipelines that eliminate human error or malice. Developers address security issues before creating new code packages and launching them into production. In addition, once regulatory compliance is achieved, the scenario is repeated, which largely removes security and compliance issues from the product development lifecycle.

Reduced downtime to zero

IBM states that the cost of unplanned outages is the highest in the financial services industry. In today’s highly competitive business environment, financial companies cannot afford these kinds of infrastructure failures.

There is a need for an alternative approach to reducing downtime, which is precisely part of the DevOps practice. It includes using a microservices architecture that allows organizations to develop FinTech applications as a set of independently deployable modular services. This design approach enables to achieve zero downtime in deployments, reducing maintenance windows and deployment delays.

Better forecasting

When most processes are started and controlled automatically, accurate prediction increases, allowing businesses to deliver more value to their clients by providing quick feedback and consistent product operations.

Adopting DevOps the right way

DevOps enables finance firms to improve service delivery and simplifies the entire process of complying with security standards, regulations, and governance strategies. While the adoption of DevOps in the financial industry is not slowing down, organizations have many questions about properly adopting it.

DevOps in the finance world: the best practices

To make things clearer, we’ll break down six financial services industry DevOps best practices that can help your company stay competitive and secure.

Automation, including CI/CD and continuous monitoring

Even using a basic pipeline (build, test, deploy, release) provides a repeatable process, reducing the security work on your team. If you make a conveyor strictly compliant with financial regulations and required security measures, you know that all packages passing through that conveyor are compliant.

Automation is a personal tool for high-performing teams, and in a DevOps culture, it is no exception. That is especially important if you are using third-party open-source tools. It has potential vulnerabilities, so you should build your pipeline to remain compatible and check for security issues.

While you can use the information regularly updated in the National Vulnerability Database to fix security issues manually, an automated process is safer because it is faster and reduces human error.

Tip: The more you automate, the more secure your IT processes become.

Configuration management (CM)

A CM system ensures that all software and hardware assets in a company are constantly known and monitored, serving as a single source of reliable data for their configuration. That involves using an up-to-date and readily available inventory of these assets, known as a version control system (VCS), throughout their entire life cycle.

CMS and VCS make it easy to roll back development in case of problems and means that systems and software can be fully replicated and supported, often through an automated process. Once again, this returns to business agility – the ability to make changes and continually strengthen with no hassle, saving time and money.

Tip: Use the widely popular configuration management technique known as infrastructure as code.

Infrastructure as Code (IaC)

Human error in IT poses the greatest security risk for financial institutions: the greater the chance of human error in a manual workflow, the greater the security issues that could harm the company. Companies are increasingly adopting Agile practices throughout their organization. However, Agile doesn’t work if IT becomes a bottleneck when projects are delayed by the IT department, which relies on manual processes.

Adopting an Infrastructure as Code (IaC) DevOps mentality allows you to automate many processes that previously required huge IT resources. IaC has the added benefit of enhancing security: process automation eliminates human error from the equation at all stages of the process. Following the transition to standardized, automated infrastructure products, McKinsey noted that a European bank had cut its IT infrastructure team by 45%.

Tip: Make sure your pipeline is up to date and reduce the possibility of human error.

Uniting disparate teams

There is often fragmentation among large, multi-regional, or multinational companies. Because of this, only a few people “see” the overall picture of the processes. That creates artificial barriers that block productive communication and slow down all IT processes. There must be communication and frequent feedback between the various teams involved in the project/product. And DevOps provides this condition.

Tip: Leverage an Agile DevOps environment with your team. With effective communication channels, the collaboration will be easy.

DevSecOps

It’s no secret that financial services providers are a prime target for cyber attackers, and the financial sector spends the second most on cybersecurity than other industries.

DevSecOps, an abbreviation for Development, Security, and Operations, aims to implement automated security best methods at every stage of the SDLC, from design to deployment. While DevSecOps cannot fully replace proactive security measures, this movement can ensure you are not leaving any wide gap an attacker could explore. In addition, DevSecOps encourages the establishment of automated compliance and governance in the development process — somewhat 63% of mature DevSecOps teams in finance already do.

Strong DevSecOps is even more important for financial blockchain projects due to the unique nature of the blockchain ecosystem. Many blockchain fintech or DevOps projects based on smart contracts are tempting targets for attackers.

At the same time, writing secure code and fixing any problems found after the project is launched on the blockchain is more difficult. In addition, smart contract hackers have significant advantages because they can often read the project’s source code and easily gain the access needed to carry out their attacks. A successful attack is not easily reversed.

Managing the threat of insecure code on the blockchain requires developers to support the DevSecOps movement and update development pipelines for better security integration. There are tools for detecting vulnerabilities in smart contract code, and developers can integrate many of them into automated development pipelines. By taking advantage of these solutions and validating all code before running it on the blockchain, smart contract developers can minimize the threat that vulnerable code poses to them and their users.

Tip: Move towards pipeline-as-code, as well as security-as-code. Also, look at additional security hooks based on industry best practices.

Right DevOps tools and cloud technologies

Many people think that implementing tools is central to the transition to DevOps. Indeed, DevOps tools can provide much-needed automation and repeatability – key principles of DevOps. But even the best software will fail if it doesn’t support the appropriate operating processes outlined above.

Some common tools include:

- Version control and source control tools

- CI / CD automation servers like Jenkins, Bamboo, or GitLab CI / CD

- Continuous testing tools like Appium, Selenium, and Test Sigma

- Automatic release and deployment tools (pipelines)

- Containerization and virtualization tools such as Kubernetes, Docker, and Vagrant.

- Orchestration and workload scheduling tools, and so on.

As far as the cloud is concerned, it is not the driving force behind DevOps; rather, the opposite is true – DevOps is driving interest and growth in cloud computing. As DevOps focuses on continuous innovation and speeding up software delivery from development to production, cloud operations also require continuous improvement in cloud environments.

Today’s DevOps environment must update the underlying distributed cloud infrastructure to scale and manage applications that use similar services to support these operations. DevOps needs to focus on the measurable value of all the cloud services they use. Various cloud management platforms (like AWS or Azure) can help.

Tip: DevOps tools can handle legacy on-premises infrastructure and the public cloud.

Monitoring indicators and testing

As you transition your financial institution to DevOps, it is critical to provide measurable tokens of success to leaders while maintaining high IT team morale and open communication.

It is useful for financial institutions to track metrics such as “the number of incidents caused by the release” and “the percentage of all changes that ultimately lead to major incidents.”

Automating the release process certainly reduces release accidents, saves time, keeps customer data safe, and protects your company’s reputation. Metrics such as on-time delivery can show executives the speed of these safer releases.

Reliable metrics are also a reliable way to generate positive feedback for your teams. Metrics such as release success rate show that your DevOps processes are working for the benefit of everyone.

Tip: Use these metrics to measure the success of your team and your company.

DevOps for Fintech: Should I build a DevOps team or find a DevOps partner?

Getting the most out of DevOps in the finance industry requires building a professional DevOps team. But then the organization may face a dilemma – create an internal team or entrust the processes to a third-party DevOps team. We will try to outline the control points that can help choose one option.

When to choose your in-house DevOps team?

For large companies with 500+ employees, the infrastructure grows to such a size that it needs people to manage various parts. The organization can create a small team that can purposefully work the DevOps process. Here are the main reasons to develop your DevOps team:

- You have a large staff, and you can painlessly redistribute internal tasks.

- The company has enough time and resources to hire and train new employees. Note that an in-house team can cost three or even four times more than outsourcing.

- You are ready to take care of the goodies for all employees

- Delivery mechanics are important to your company’s business

- You are not afraid of downtime if key employees are fired

When to choose DevOps outsourcing?

Today, even companies with millions of revenue rely on third-party IT providers for Fintech software development. And nearly 78% of clients are completely satisfied with the cooperation with outsourcing companies. Outsourcing DevOps has also helped 59% cut costs on normal business operations.

DevOps as a Service offers standardized, centralized, and personalized templates to ensure consistency across all teams. By hiring a dedicated development team, you get a full set of DevOps services, particularly CI/CD, backup, cloud, monitoring, release automation, orchestration, etc.

- You need a DevOps development team with unique skills, but you cannot select suitable candidates.

- You aim for shorter development cycles with better quality, less risk, and no additional costs.

- You are a startup that needs to hire DevOps engineers

- You want to get rid of the pains associated with staff rotation

- Finally, if your team is not keeping up with the pace of the workflow and you want to offload it for more pressing tasks

Final Thoughts

We hope that DevOps collaboration principles – end-to-end communication, small-scale iteration, feedback loops, continuous learning, and improvement – will become common practice for all teams in a few years.

But now, to remain competitive in the FinTech marketplace, financial services institutions need to focus on fully implementing DevOps across their organizations. Working with a business partner with DevOps and financial services expertise – like Relevant – will help you bring your planned digital transformation to life much faster and with no business risk.

Relevant Software has a solid track record of delivering solutions through DevOps, and all of them have been successful. Our customers have long appreciated the benefits of DevOps, including shorter development cycles, frequent deployments, increased release resilience while meeting all regulatory and security requirements, and lower company budgets. So, if you want to know how to hire a DevOps engineer from our company, contact us!

FAQ

What are the examples of FinTech and traditional financial institutions that use DevOps practices?

Large financial companies turn to DevOps to keep up with booming customer expectations and competition from the next generation of Fintech contenders. To your attention, an example of using DevOps by a new generation company and two old pros of the market:- Business Case 1. Lunar Way began its DevOps journey to cloud computing by dividing its monolithic application into smaller microservices. Lunar Way used Ansible, Terraform, and Jenkins to deploy these microservices. Now the company employs about 80+ microservices using Kubernetes.- Business Case 2. One of the biggest financial institutions in the world, Bank of America, also adheres to the DevOps practice. Nearly 4,300 retail financial centers support its digital corporate operations and about 16,600 ATMs worldwide. The award-winning digital bank has approximately 38 million active users and approximately 29 million mobile users.- Business Case 3. HSBC has set out to transform banking with cloud computing and DevOps and has developed a new business banking service that will run on a Kubernetes managed container infrastructure using Google’s suite of tools. It has already invested 10 million dollars in this project.How can DevOps take advantage of AI in fintech?

Leveraging the speed and precision of AI to develop, deploy, manage, and test infrastructure and software already relies heavily on AI and ML. DevOps teams should look at these capabilities and technologies as new ways to improve product quality and better manage their systems and services by offloading some manual tasks to AI-powered automated solutions.Where to find DevOps engineers for Fintech?

The best option – hire DevOps engineers through reliable fintech development vendors like Relevant. Spanning integration into IT strategy, industry expertise, automation, the cloud, and large-scale application delivery with modern tools, we provide DevOps managed services that exceed our client’s expectations.How quickly can you assemble a team of fintech developers for my project?

How quickly can you assemble a team of fintech developers for my project?u003cbru003eTo help you meet the challenges of fintech and quickly bring your financial services closer to customers, we are building dedicated teams with relevant experience within a few weeks. However, our ability to assemble a team depends on the exact experience you require and the resources we have available.Why are Fintech companies turning to DevOps?

Adopting a DevOps approach brings significant benefits to the financial industry that outweigh any difficulties in adopting the latest technology and associated workflows. DevOps means:– Faster product and feature releases– Improving product quality through process automation and early error detection– The safe application development process– Better regulatory compliance– Bringing teams and processes together to achieve common goals– Improving the infrastructure for customer service.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.