The Ultimate Guide to FinOps in 2025 for Cloud Financial Management

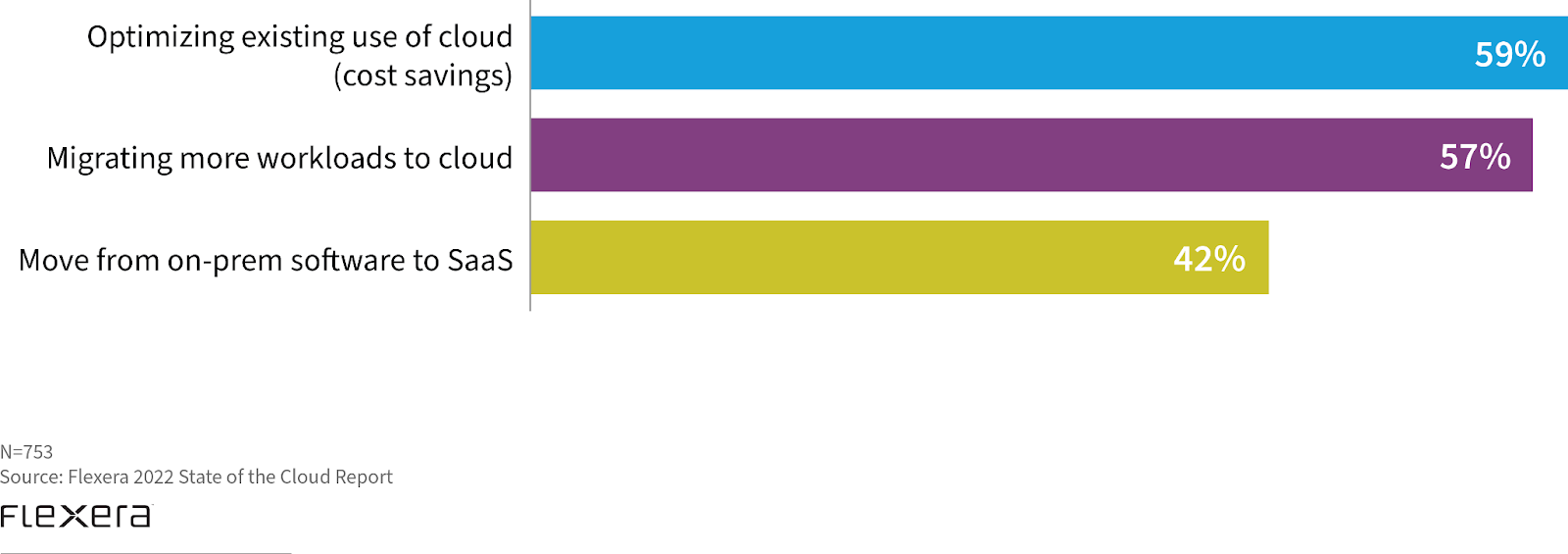

The cloud’s benefits are indisputable, and its on-demand functionality promises cost savings through a pay-as-you-use model. But in practice, things can be quite different. If the consumption of cloud resources is not carefully monitored and regulated, costs can spiral out of control.

Therein lies a fundamental problem you could face in 2025: cost optimization in the cloud can be far more challenging than expected. And as cloud computing bills increase, the costs will begin to undermine the benefits of migrating there.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

With about a third of companies overrunning their cloud budgets by as much as 32% on idle or underutilized resources, it’s clear that optimization needs to be taken seriously. Getting a solid grasp on your cloud spending is urgent to harness the full power of the cloud.

If cloud overspending is becoming tiresome, it could be the time to incorporate FinOps into your company. And we at Relevant will help you do that by providing you with the FinOps guide you need to maximize business value.

Why cloud computing doesn’t always reduce IT costs

After migrating to the cloud, you can frequently spend more than expected on the cloud. There are three key reasons behind it:

- Overprovisioning: This is the case when cloud resources, such as instances, database warehouses, virtual machines (VMs), etc., are stocked up to fulfill any unforeseen spike in demand. Overprovisioning is necessary for uninterrupted business operations. However, if idle resources aren’t suspended or shut down when unused, this can drive up cloud expenditures.

- Variable cloud spending: You purchase cloud infrastructure through public discounts. This cost on the cloud is variable; i.e., it can change anytime. The variable cost associated with the cloud is why cloud bills don’t stay within the defined limits.

- Siloed teams: Different teams are involved in your software development project. If resource procurement is done without discussion between the stakeholders (responsible for managing cost), it will inflate the overall cloud cost.

What is FinOps in the Cloud?

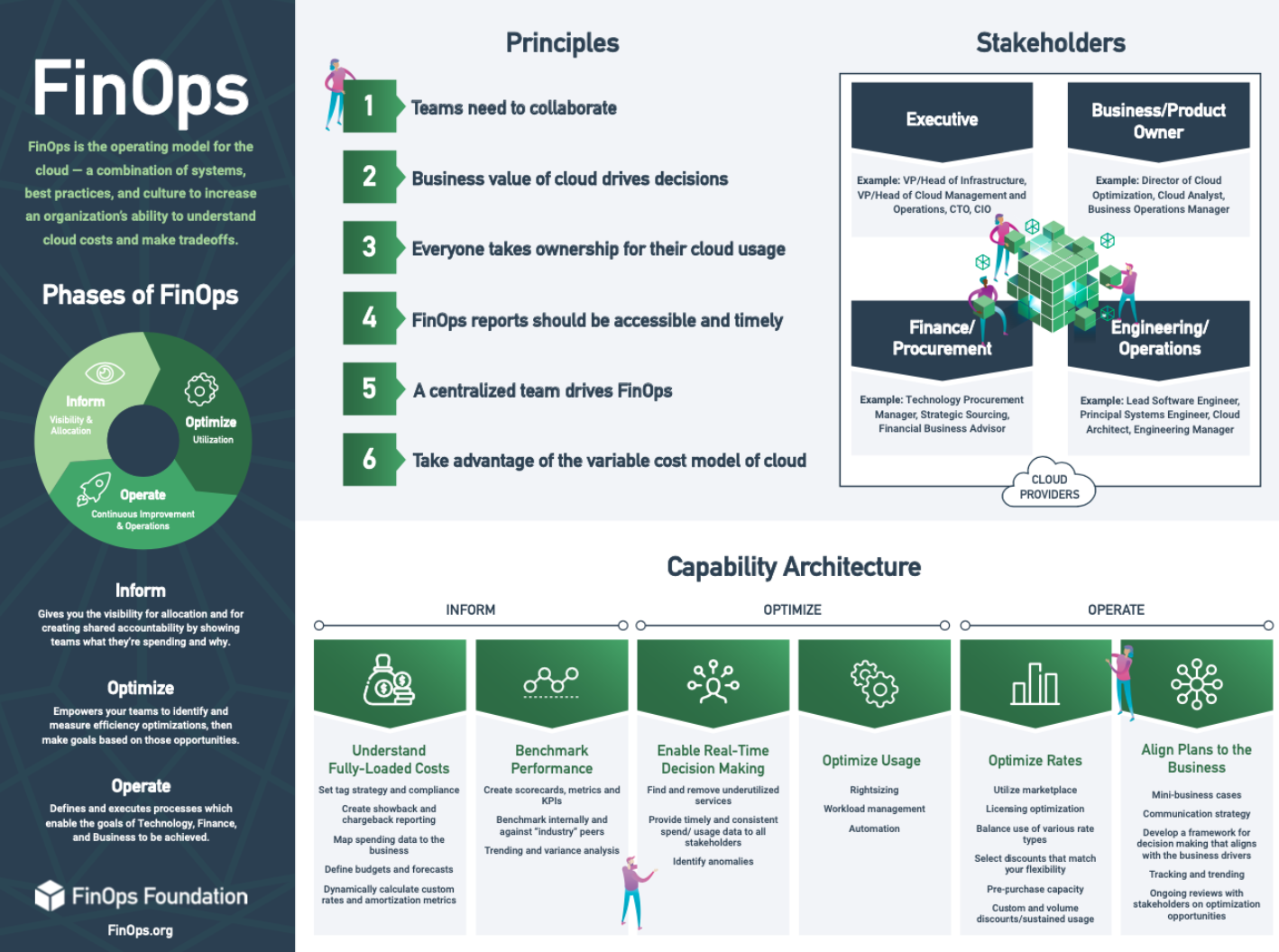

Finance DevOps is a management practice that brings IT, DevOps, and finance teams together towards the common goal of optimizing cloud computing usage and costs by providing full accountability for every product feature and every operation.

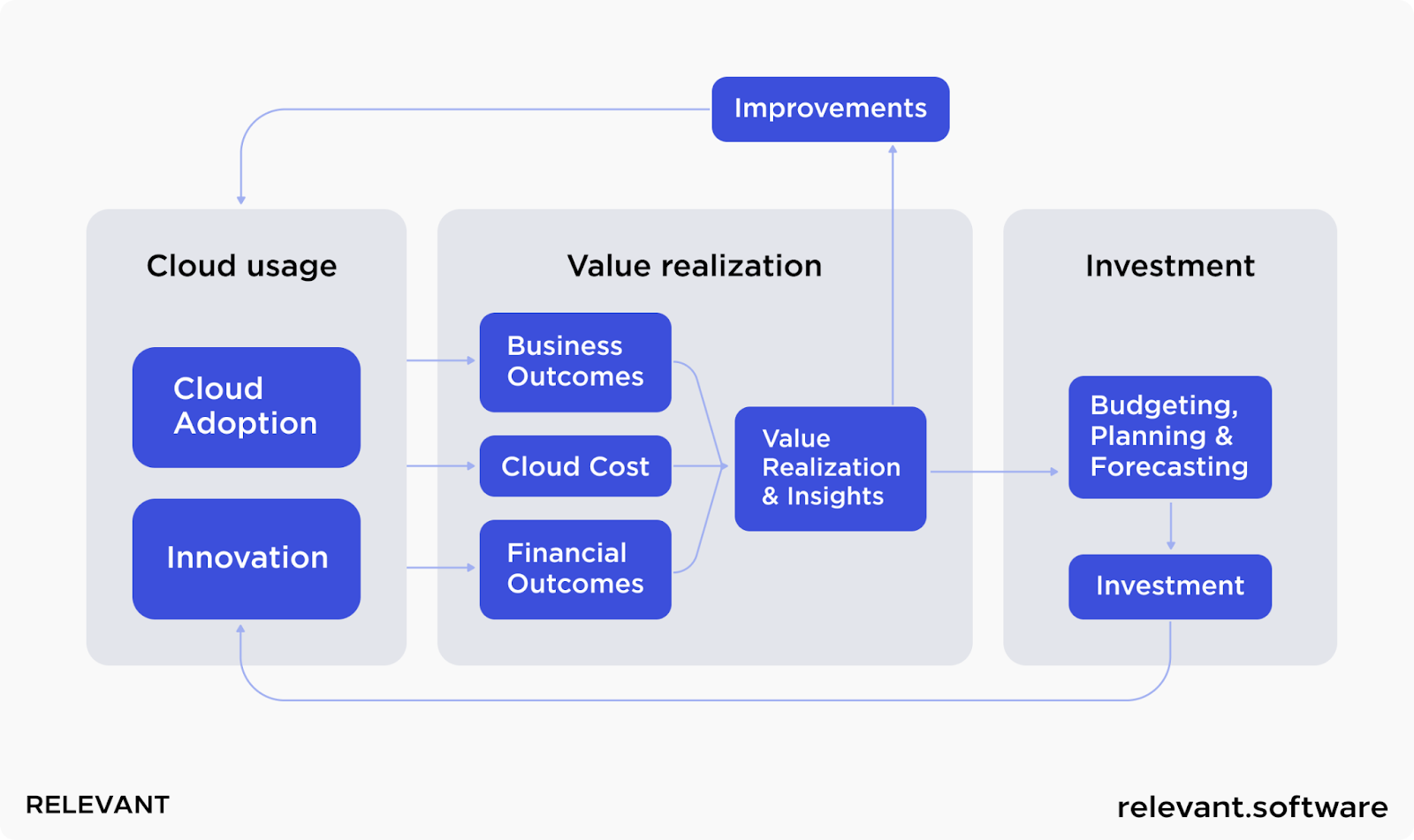

FinOps methodology focuses on building an effective cloud environment to ensure the fastest and most profitable business growth, as well as increased productivity, new feature releases, and higher ROI. It is an ongoing process of improvement on all IT processes to specify and remove blockers and bottlenecks. FinOps enables your engineering teams to upgrade products faster, implement cloud migration strategies promptly, and determine when you’ll be belt-tightening or investing more.

FinOps vs. DevOps: What’s the difference?

If you’ve used the cloud, you’re probably aware of DevOps, the combination of software development and IT operations to provide continuous delivery. The FinOps framework brings an equivalent approach to cloud resource utilization. But while DevOps delivers agile and repeatable processes to get the best final product through automation, FinOps aims for cost optimization with powerful cloud computing tools.

This is not a real competition. FinOps and DevOps units should work together in synergy to create a well-architected cloud from the point of cost, security, and performance. In the same way that engineers can no longer ignore security in development, financial optimization should be front and center of DevOps teams’ daily work. For this to work and for DevOps to integrate Finance DevOps goals seamlessly, companies need to champion cloud transparency, a culture of cost optimization, and a solid foundation of automation that embeds best practices into everyday work.

How FinOps works: The three phases of FinOps

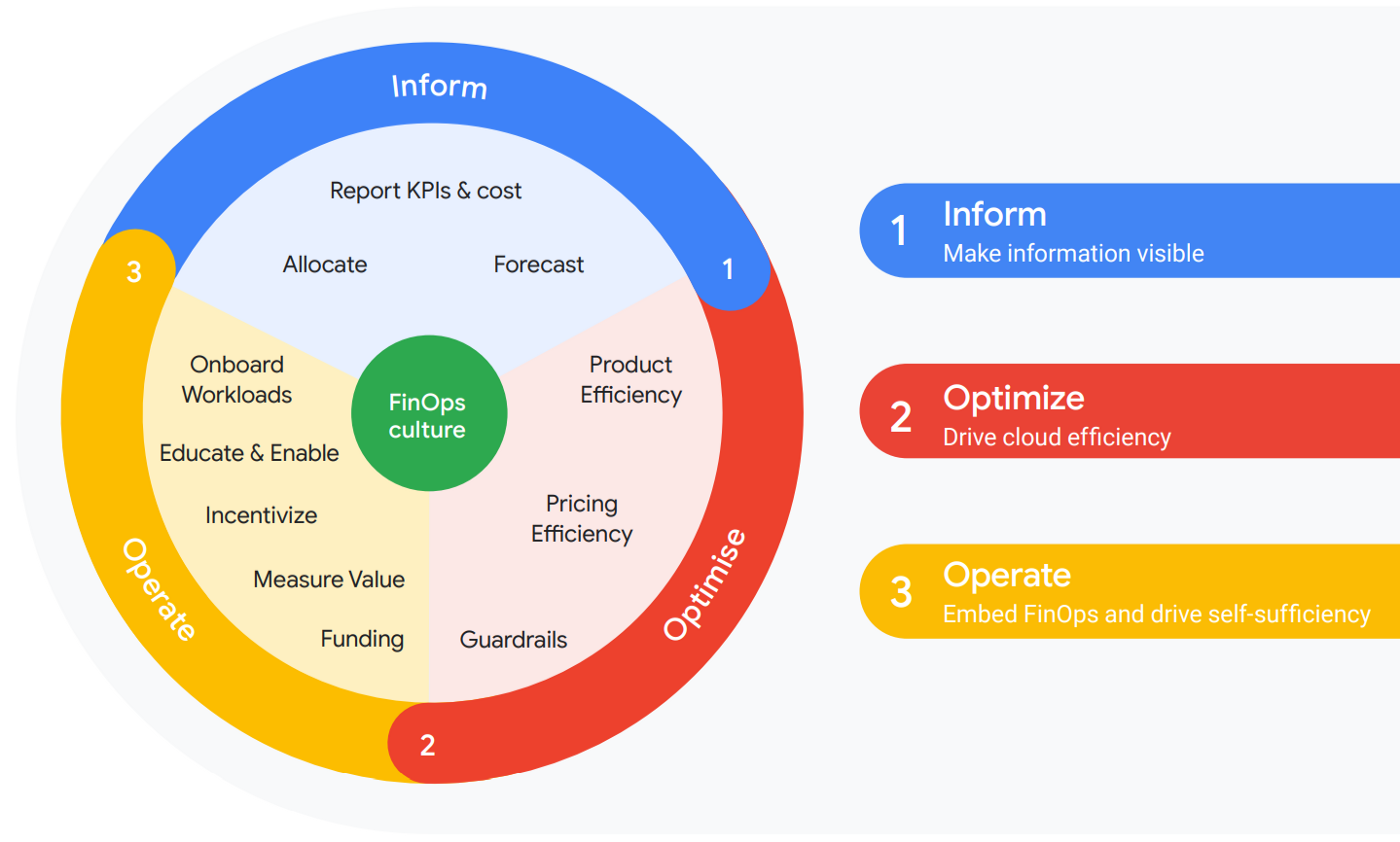

The FinOps Foundation has divided the FinOps journey into three stages: Inform, Optimize, and Operate, and a company can find itself in several steps at the same time depending on which stage of maturity each team or division Finance DevOps is in.

Moving to FinOps is not a linear process that ends after the third step but should be continually iterated as the company refines its Finance DevOps model.

Inform

During the inform phase, the company gains visibility over cloud resources that have been allocated, deployed, and available. Detailed allocation information enables the FinOps team to tie cloud utilization and costs to business units.

Optimize

The optimization phase focuses on discovering opportunities for savings. To reduce costs, the Finance DevOps team must evaluate a cloud environment, right-size resources accordingly, and utilize tools to automatically scale down or shut off unnecessary resources.

Operate

Operate is the final phase of the FinOps journey, where organizations continually evaluate their performance against business objectives and metrics and implement processes that help scale efforts. Then FinOps team shares outcomes with the stakeholders to demonstrate the cloud’s operational and financial effects on the business.

Cloud FinOps benefits

FinOps provides a set of best practices to bring the following benefits to companies and stakeholders:

Accurate cost analysis

By analyzing your cost variance, Finance DevOps improves your decision-making by giving you accurate, actionable insights into your cloud usage or critical issues like asset allocation.

Real-time reporting

FinOps focuses on implementing processes and tools that offer visibility into all business expenses – as they happen. Real-time access provides the most accurate information for measuring and improving business performance.

Better team collaboration

Finance DevOps creates a shift in your company and removes silo mentalities. The entire team should strive to understand the relationship between cloud infrastructure, the resources that fund it, and business goals.

Increased operational flexibility

Some activities have to be centralized to reduce duplication. Centralizing some of the processes enables you to avoid time-wasting and increases the quality and speed of the operations.

Cloud cost optimization

Optimization is an ongoing practice whereby costs are continually examined and managed up or down. Insights into available or reserved resources at a more competitive price facilitate the proper procurement of cloud resources and avoid unnecessary spending in the first place.

More-efficient workflows

As your FinOps infrastructure evolves, you can use automation to streamline your workflows. For example, pre-configure different instance types to match business priorities, automate server tagging, and, for large workloads, enter a rationale for how migration and cost increases fit your business goals.

Adding to the list of benefits of a Finance DevOps culture is that cost optimization leads to a reduction in cloud-related energy consumption (more than 2% of global spending) and, therefore, a reduction in the organization’s carbon footprint.

FinOps Team Structure

FinOps is an ongoing collaboration between engineers, managers, R&D, Operations and Financial departments, CIO, CTO, and VPs offices. Here is a list of roles engaged in the Finance DevOps process:

Executives

The role includes VPS, members of senior management, and anyone in high-level leadership positions or decision-makers. Their mission is to drive accountability and transparency in spending practices and keep a close eye on the overall budget.

Business/product owner

Similar to executives, product owners generally represent the department heads or project leaders directly responsible for creating, deploying, and managing products according to business value or ROI. Some roles under this category are Director of Cloud Optimization, Cloud Analyst, and Business Operations Manager.

Finance/Procurement

It is the role of anyone involved in Finance or Procurement, such as a Financial Business Advisor or Technology Procurement Manager. These use FinOps reports for accounting, forecasting, and historical data to build more accurate cost models and negotiate rates with cloud service providers.

Engineering/operations

Engineers or DevOps team focuses on building and supporting services. They track and monitor cost and other performance metrics and explore ways to increase efficiency, and identify spending anomalies.

FinOps practitioners

Team members in this role are typically responsible for cloud cost forecasting and budget allocation. These include individuals with titles such as Director of Cloud Optimization, Cloud Fin Ops Analyst, or Cost Optimization Data Analyst. They may be direct employees at an organization who have been specially trained or third-party practitioners brought in for their expertise.

FinOps Best Practices

While there is no one-size-fits-all approach to Fin Ops and cloud cost management, practitioners recommend specific actions that can have the greatest impact.

Plan for FinOps before moving to the Cloud

It would be best if you planned your Fin Ops implementation before migrating to the cloud. It can help you plan future cost optimization while accounting for shadow IT, scaling, and leveraging opportunities like bulk user pricing and free trials. It also gives you time to learn the difference between on-premises and cloud financial planning.

Put business value ahead of savings

Cost optimization can help you save money, but it shouldn’t be your main goal. Successful implementation of FinOps maximizes value, not reduces costs. The goal is to derive the maximum of your cloud investment while balancing savings and trade-offs.

Calculate your actual costs

Financial accountability is the core principle of FinOps. This requires you to understand cloud spending on an ongoing basis and upfront expenses. This is why Fin Ops collaborators should calculate current ROI and TCO, forecast future costs, and conduct regular audits.

Define roles and responsibilities

When planning a FinOps implementation, you must set clear roles and responsibilities. It involves determining who is responsible for Fin Ops and whether you want to hire a dedicated professional or someone from your existing cloud or finance teams.

Make FinOps an ongoing process

FinOps is not a one-and-done scenario but an ongoing process requiring monitoring and fine-tuning over time as cloud providers offer additional services, billing constructs, and discounting mechanisms.

Top 5 FinOps tools

An ongoing journey to cloud cost optimization must start with a FinOps-oriented suite of instruments that allows you to identify and understand cloud spending and anticipate, manage, and implement efficient cost optimization strategies with the right DevOps solutions. Below, we’ll look at some widely used Fin Ops tools:

AWS Cost Explorer

The solution lets you visualize, understand, and manage AWS costs and utilization over time, analyzing data at the highest level (including total costs and usage across all accounts).

- Category: AWS Native Tools

- Best fit for: Businesses with relatively straightforward billing and spending patterns

- Pricing model: Free with AWS

ProsperOps

ProsperOps optimizes your AWS compute reserved instances and savings plans. Algorithms merge multiple discount instruments to maximize savings and minimize commitment terms.

- Category: Automated Cost Optimization Software

- Best fit for: Companies looking for a new, modern approach to AWS savings plans and reserved instances

- Pricing model: $0.05 per dollar saved on compute and $0.35 per dollar saved on purchased/optimized convertible reserved instances

CloudZero

This tool provides accurate, granular, and actionable cost insights for finance, engineering, product teams, C-Suite, the board, and investors.

- Category: Cloud Cost Intelligence

- Best fit for: Companies looking to transform spending into business-centric dimensions

- Pricing Model: Custom to your environment.

Harness

With Harness, you can prioritize software development projects depending on resource allocation and changes in company strategy. Harness checks and reports on underutilized instances on an hourly basis.

- Category: Automated cost management

- Best fit for: Companies that need more details about their cloud spending beyond AWS.

- Pricing model: by the percentage of cloud spend (2.25% of cloud spend for teams, and 2.5% for enterprise users)

Densify

The tool automatically matches application demands with the right cloud resources in real-time using a patented machine learning analytics engine.

- Category: Hybrid cloud and container financial management

- Best fit for: Companies that want to reduce overwhelm by checking their hybrid cloud spending in one place.

- Pricing model: On request

As noticed by Fin Ops Foundation, there’s no single tool to manage all cloud spending. Companies rely on a mix of native tools provided by AWS, Azure, Google Cloud, and an average of 3.7 third-party tools. Keep also in mind that cloud cost management tools can help with the principle and take care of the majority, but not all, of the steps. If your team isn’t educated well, you won’t get the best out of Fin Ops.

How To Implement A FinOps Program

FinOps goes through three stages of evolution: crawl, walk, and run. For example, during the crawling stage, you can fix problems only after they occur. The running stage is characterized by proactive group budget planning and forecasting, including the mandatory integration cost into your architecture choice and project life cycle.

We recommend you move in small steps, gradually increasing in scale and complexity as business value guarantees transformation into functional activity. In addition, quick actions on a small scale and with limited scope enable your Fin Ops teams to evaluate the results of their efforts and understand the value of further steps more comprehensively and in detail. Approach it as a journey of continuous improvement rather than a specific endpoint and start with:

- Maintaining a strong culture of commitment

- Providing the right tooling at all levels of the organization

- Creating a comprehensive cost allocation system

- Considering the cost-per-transaction or cost-per-customer metrics

- Monitoring the use of cloud services

Is Fin-Ops right for your business?

Adopting a FinOps framework can be worthwhile for any company managing cloud expenditure. If you anticipate your cloud usage scaling up any time soon, it is especially important to implement the right processes and principles early on. Besides, we strongly recommend adding Fin Ops to your Saas business if:

- You feel you have little control or visibility of your company’s expenses

- You have manual or lengthy workflows that you would like to optimize

- You have disparate systems that you use to manage your company’s expenses

- Your team members fill their time with monotonous and time-consuming work

By focusing on FinOps, you can avoid financial pitfalls and growing pains that come as a company scales.

Challenges of FinOps

Challenges faced by an organization that is spending $3 million per year are often very similar to those faced by a company spending $300 million per year. FinOps Foundation conducted a survey where respondents ranked Fin Ops challenges they met in previous year. We have listed the most common ones:

- 39% – reported problems with accurate forecasting of spending

- 30% – noted that it was difficult to get engineers to take action to cost optimization

- 20% – faced complications in enabling automation

- 19% – stumbled on stage, reducing waste of unused resources

- 16% – had difficulty with aligning finance/procurement teams with tech/eng teams

If you, too, have encountered similar difficulties in the FinOps implementation process, then the next section of our article can serve as a hint for further actions.

Relevant’s FinOps Solution

Many entrepreneurs think they can look at what their peers or competitors are doing in similar-sized enterprises or marketplaces and replicate it. This, unfortunately, is not true. Each Fin Ops strategy is unique, and implementing these practices requires advanced expertise and skills that your internal team may not have.

In this case, outsourcing to an experienced FinOps vendor like Relevant can cost you much less investment than assembling an in-house team. Outsourcing eliminates the expenses of onboarding and training the team and the time required to mature their FinOps understanding.

For over 9 years, we have been helping our customers innovate what is possible through data analytics, cloud infrastructure, DevOps, and software product development. So, we provide you with such FinOps services like:

- Assessing your FinOps maturity and providing actionable insights to understand and plan thші journey

- Сreating a custom strategy based on your company’s unique cloud usage

- Choosing and setting up cloud cost management tools quickly and efficiently

- Tagging your cloud resources for visibility into your cloud spending

- Carrying about your cloud security posture

- Supporting compliance with finance-related regulatory controls and requirements

Interested to know more about cloud cost optimization or hiring cloud engineers? Contact Relevant experts to talk about FinOps.

FAQ

Is FinOps about reducing cloud costs?

The end result of FinOps can be savings — but it doesn’t need to be. The FinOps Foundation says, “FinOps is about making money.” FinOps-based decisions can range from pinpointing where to cut costs to improve overall margins to which high-margin products to invest more money in to maximize ROI.Can I find big names among FinOps adopters?

Airbnb, Starbucks, The New Your Times, Twitter, Shopify, Atlassian, NBC Universal, and Yelp have adopted FinOps practices. They represent different industries and offer various services to their clients. However, they all implement FinOps principles to provide the best possible service and ensure a return on IT spending.What does a FinOps analyst do?

The role of a FinOps Analyst is to monitor cloud usage and present opportunities for cost savings and healthy cloud usage. This individual will analyze cloud environments and make recommendations based on budget, best practices, timelines, and goals.Why is FinOps important for startups?

FinOps ensures that a startup’s cloud spending aligns with its business goals, while cross-functional teams work together to achieve greater financial control and predictability, reduce friction, and release products faster. Larger organizations typically hire a dedicated FinOps specialist or an entire team. Smaller companies, such as SMBs or startups, usually distribute these responsibilities across several roles, including DevOps, infrastructure engineering, or finance personnel like FPu0026amp;A.Are there any limitations to FinOps?

Everything has its limits. But as with DevOps, it makes little sense to start with why FinOps wouldn’t work. FinOps is more interesting and impactful when used with dynamic workloads than with static server estates. But implementing a mindset and an approach that’s conscious of cost-of-usage and cost-of-design is of value, regardless of application type.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.