Payment Gateway Development: What You Need to Know

Do you want to develop your own payment gateway and become a payment service provider? Or maybe you have an innovative payment model (such as one based on QR code payments), and none of the available payment gateways meets your requirements.

Developing a custom payment gateway is the logical solution in both cases, but it’s dangerous to embark on payment gateway development without knowing all the details that could make or break your project.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

At Relevant, custom web development is just one of the things we do well. With over ten years of experience under our belt and a team of professional app developers for hire, we know all the ins, outs, and “throughs” of payment gateway software development. Our developers are ready to build a custom solution for your company’s needs.

In this article, we’ll run you through all you need to know on the topic—from must-have features through legislation and security to the costs to expect if you decide to outsource your payment processing software development.

Who needs payment gateway development services?

Before answering this, let’s clarify what we’re dealing with. What is a payment gateway?

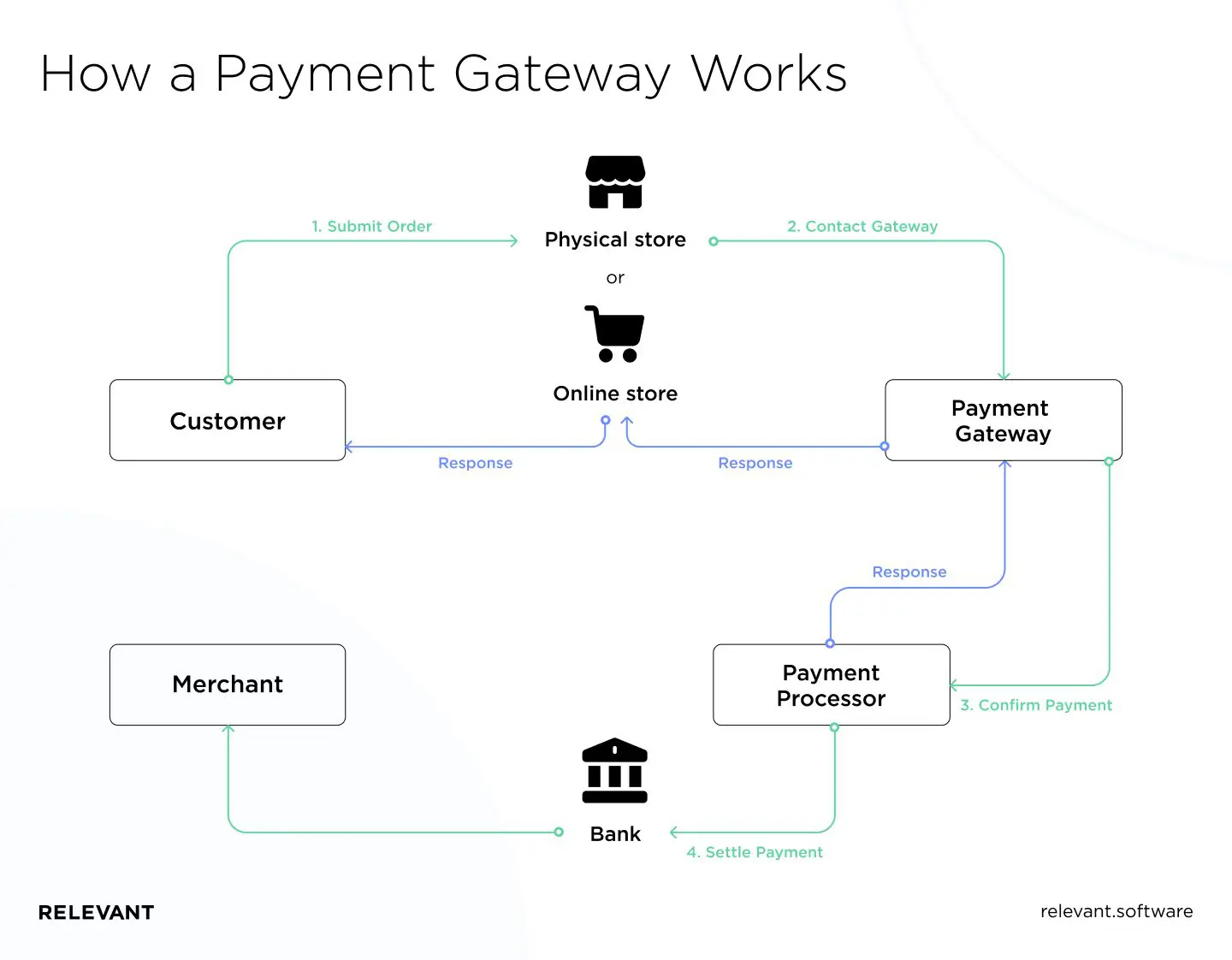

From a business standpoint, a payment gateway is an intermediary between a customer (and an issuing bank acting on their behalf) and a merchant (and the acquiring bank acting on their behalf). A gateway enables secure online payment from one bank account to another. Two important aspects of payment gateway operations are fraud prevention and ensuring PCI DSS compliance. We will cover these in more detail below.

From a technical standpoint, a payment gateway is a system that accepts a customer’s billing details, encrypts them in a format understandable by a payment processor, and carries them across the payment network. It also sends notifications about approved or declined payments to the merchant’s web or mobile app.

There are two reasons you might want to create a custom payment gateway:

- If you have particular requirements—such as processing a certain currency, supporting certain payment methods (like QR code payments), or working with a particular payment processor—that aren’t supported by existing payment gateway solutions

- If you want to become a payment service provider

Either way, you’ll have to build and integrate a payment processing module that complies with regulations and meets your functional needs.

Let’s take a closer look at the features a payment gateway should provide.

Common features of payment gateway solutions

Building a custom payment gateway can be a complex task, as you need to strike a delicate balance between your company’s requirements, the available tech capabilities, and security and legal compliance.

Determining the full list of features to implement will require conducting research and consulting with your chosen development team. To get you started, here’s a list of common features you’ll need in order to interact with payment systems and meet security requirements.

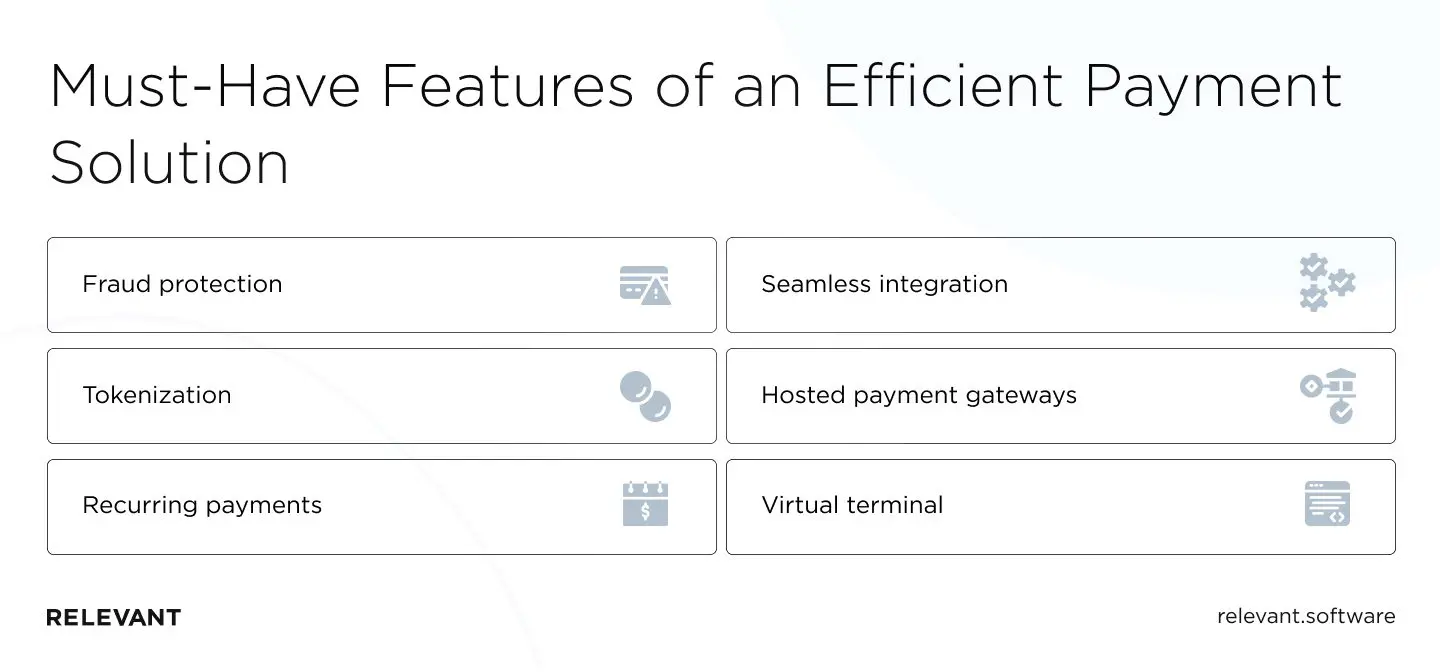

- Fraud protection. With online credit card payments, you always run the risk of card-not-present fraud. As building a fraud protection solution from scratch is no small feat, it’s best to partner with a fraud prevention and risk mitigation platform from the start. This way, future integration will be much easier.

- Tokenization. As a part of the payment data encryption process, tokenization replaces an IBAN and other sensitive details with random alphanumeric tokens. With tokenization, only the payment processor can handle the transaction, and even if the payment gateway gets hacked, no customer data is lost. This significantly reduces the attack surface and limits your liability.

- Recurring payments. A payment gateway can provide a scheduler to enable recurring payments, which is useful if you’re offering a subscription service. This functionality can be configured via dashboards (for hosted payment gateways), with APIs, or via virtual terminal commands. Make sure you have a way to get customer consent for recurring payments and don’t enable them by default.

- Seamless integration. Your (or your customer’s) CRM system should be able to seamlessly interact with your payment gateway. Ensure you have clean and robust APIs to support integration with popular business software tools.

- Hosted payment gateways. When your merchant app redirects to a hosted gateway, no secure details pass through the consumer’s cart. This is another great way to minimize the attack surface and limit your liability.

- Virtual terminal. Some customers prefer to pay over the phone instead of using online credit card payment. You can turn a PC into a virtual POS terminal by simply connecting to a cloud-based service, with no installation required.

This is just the tip of the iceberg, as your full feature list will depend on your project specifics. Still, these are the must-have features of an efficient payment solution.

As you can see, cybersecurity and regulatory compliance are important requirements for payment gateways, so that’s where we’ll head next.

Legal and security requirements for payment gateways

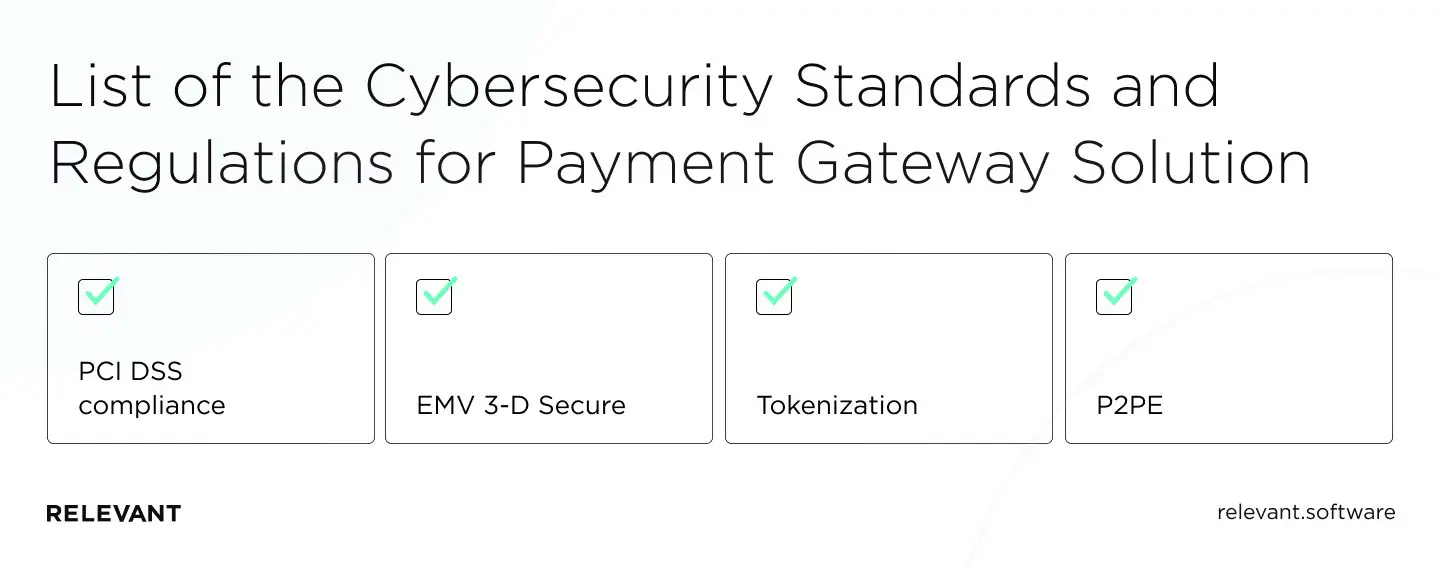

Secure payment gateways win consumer trust and help protect merchants from fraudulent chargebacks. Here’s a list of the cybersecurity standards and regulations your payment gateway solution will need to comply with in order to be registered.

PCI DSS compliance

Every business that has access to the cardholder information of its clients must meet the requirements of the Payment Card Industry Data Security Standard (PCI DSS). Failing to comply with PCI DSS opens the way to insecure transactions, a high risk of fraudulent chargebacks, increased payment processing fees, and even closure of the merchant’s account. You should also check the legal requirements of the countries you’ll be accepting transactions from, though PCI compliance is mandatory.

There are four PCI DSS compliance levels. The levels that you need to meet depend on how you handle your transactions.

- Collection. Do you collect the cardholder’s information on the payment gateway server, in the customer’s browser, or on the merchant’s app server?

- Storage. Will the data be stored on the merchant’s server or on the payment gateway server?

- Transmission. How will you transmit the data to the payment processor?

- Processing. Who will process the data: the merchant or the payment gateway?

To fully comply with PCI DSS requirements, you’ll also need to consider the cybersecurity standards and processes listed below.

EMV 3-D Secure

EMV stands for EuroPay, Mastercard, and Visa and is a global standard for credit card transactions. It uses chip technology to prevent card-present fraud by exchanging dozens of different pieces of data between the card and the POS terminal.

EMV 3-D Secure means “three-domain” secure, so each transaction is secured by three domains: the card issuer’s domain, the payment acquirer’s domain, and the interoperability domain—the infrastructure used to deliver the payment data. Protected by SSL (TLS) communication and XML messaging, EMV 3-D Secure enables liability shift for chargebacks, meaning that when a fraudulent chargeback occurs, liability shifts from the merchant to the card issuer.

Tokenization

As mentioned above, replacing sensitive credit card details with tokens is a best practice for keeping potential attack scope minimal and protecting a customer’s payment data.

P2PE

Peer-to-peer encryption (P2PE) allows organizations to build secure communication channels between particular devices to avoid transmitting secure data over an open network. This is yet another best practice recommendation to decrease the potential attack scope.

Now that we’ve covered security and compliance, it’s time to take a closer look at how to develop a payment gateway and integrate it with your systems.

Payment gateway development and integration services

There are three ways to get a payment gateway: by buying an off-the-shelf product, by developing it yourself, or by outsourcing the task to a reliable payment gateway software development company.

Relevant has extensive expertise in mobile and web development of payment gateways. Our payment solution development services include:

- Custom payment gateway development: building secure platforms with robust features from scratch

- EMV-compliant software customization: adjusting or refactoring your software to make it EMV-compliant

- Payment integration services: integrating payment solutions with your existing software or platform

- MSP & ISO payment integration: empowering your merchant capabilities by enabling MSP & ISO integration with Visa and Mastercard

- Payment processing software development: developing high-performance and versatile payment processing solutions

- POS terminal development: enriching your payment processing options with a virtual POS terminal

- E-commerce integration: integrating the latest and feature-rich payment processing solutions with your e-commerce platform

- Mobile integration: ensuring secure and seamless mobile payments by integrating powerful payment tools with your apps

- Marketplace integration: creating online marketplaces with a variety of payment options

- White-label payment gateway solutions: building ready-to-use white-label payment gateway services

- Payment processing fraud protection: securing revenue streams with reliable real-time fraud protection tools

- Multi-currency processing solutions: enabling multi-currency payments to increase consumer comfort and reach

If you’re considering the outsourcing route, the budget is obviously a big factor. How much does payment gateway development cost, and which factors affect it?

Let’s set you straight.

How much does it cost to create a payment gateway?

The total cost of a solution depends on the number of features you need to implement and the complexity of integration with the rest of the systems you use. That said, manpower will be a large part of your project.

The cost of talent varies widely according to your outsourcing country. If you decide to hire a software development team in Ukraine (one of the best software outsourcing locations), these are the hourly rates you can expect in 2021:

| Role | Rate |

| Business analyst | $40-$63 |

| Architect | $50-$77 |

| Project manager | $45-$70 |

| Junior engineer | $25-$42 |

| Middle engineer | $35-$60 |

| Senior engineer | $55-$90 |

| Junior QA | $25-$42 |

| Middle QA | $30-$49 |

| Senior QA | $40-$63 |

| UI/UX designer | $35-$56 |

These are ballpark rates: the final cost of developers will depend on things such as the technical seniority of the talent you hire, the technology stack you choose to build the product, and your project engagement model. For example, Relevant provides professional payment gateway developers that can build an end-to-end solution for your business or just be a temporary reinforcement of your capacities.

For a payment gateway development project, you’ll generally need the following roles at each project stage:

- Business analysis—business analyst, project manager, team lead/architect

- Design—UI/UX designers, project manager

- Development—developers, DevOps, project manager, architect

- Testing and launch—QA specialists, DevOps, developers

If you also need post-launch support or help with platform management, Relevant can help.

Wrapping up

If you decide to develop your own payment gateway, your main challenges are:

- Addressing compliance and cybersecurity concerns

- Implementing a variety of features, from fraud protection to recurring payments

- Ensuring on-time product launch

- Providing reliable post-release support with an ability to adjust the platform should such a need arise

Unsurprisingly, mistakes at any stage cost. To guarantee the best outcome, you need access to people who know how to develop a payment gateway system from scratch. At Relevant, we can provide web and mobile app development services to help you achieve this goal.

Are you ready to get started on building a custom payment gateway for your business? Get in touch today and let’s help you succeed!

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.