Open Banking API Monitoring: What It Is and Why It Matters

Open banking offers numerous advantages to everyone involved in the finance niche, from banks through fintech companies to end customers.

However, a single API error can prevent thousands (or even millions) of users from enjoying your services. That’s why continuous open banking API monitoring is critical for your digital banking business to stay afloat.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

If you are new to the subject, don’t fret. This article is a highly selective distillation of our extensive experience in fintech software development.

Here, we’ll guide you through the basics of open banking, explain why it’s ill-advised to fully rely on your APIs, highlight the essentials of open banking API monitoring, and help you decide on a perfect solution for your business needs.

The basics of open banking

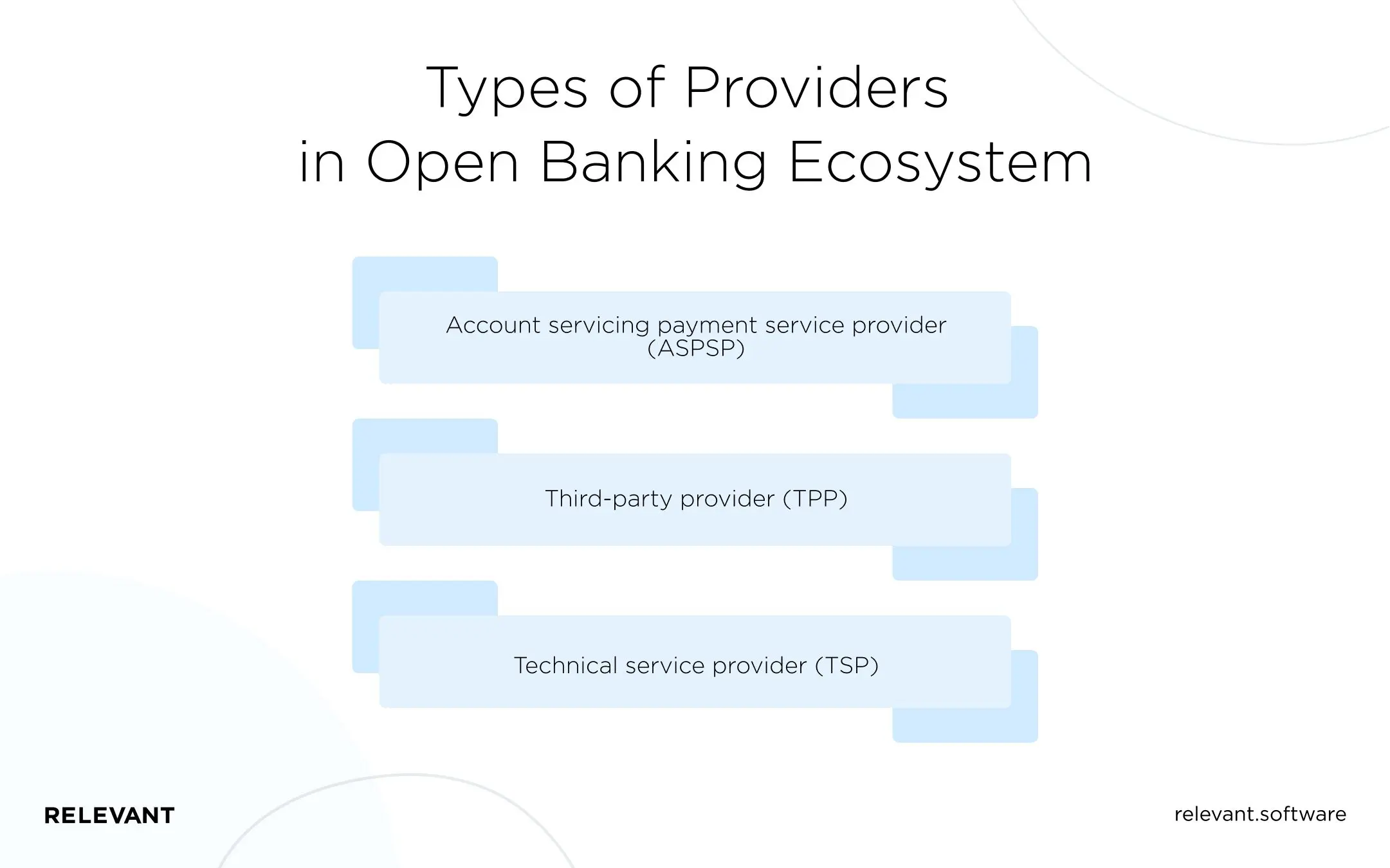

Open banking is a practice when financial institutions like banks pass customer data to licensed fintech companies using application programming interfaces (APIs), given the customers’ consent. The open banking ecosystem involves the following parties:

- Account Servicing Payment Service Provider (ASPSP). A bank or a non-bank financial institution that makes user data accessible to fintech companies

- Third-party provider (TPP). A fintech company that needs the ASPSP data to be able to deliver services to their customers

- Technical service provider (TSP). A company that provides software product development services and builds products supporting open banking API architecture

If you want to learn more about how open banking works, which advantages it offers, and how you can initiate a successful open banking project as a TPP, check out our previous articles on the topic. And now, let’s take a deeper dive into today’s open banking market.

The open banking market: Where are we now?

Open banking is now a stealthy trend, with 87% of countries having some form of open banking APIs in place. No wonder the number of open banking users worldwide is projected to grow by 50% from 2021 to 2024, based on Statista.

The rapid growth of the open banking market owes it to the following factors:

- The pandemic. The COVID-19 outbreak has demonstrated the benefits of interoperability between financial institutions. According to the UK research conducted in early July 2020, one in five adults started using a banking app during the lockdown.

- Tech advancements. Bank APIs show decent performance levels, making open banking solutions even more attractive to customers. For example, in July 2021, 98.94% of open banking API calls in the UK were successful, while the average API response time was 530 milliseconds.

- Regulations. While banks in countries like the US can choose whether to share customer data with third parties or not, joining the open banking initiative is mandatory for financial institutions in the UK and the European Union. So, while the latter simply have no choice, the former are compelled to keep pace with their foreign competitors.

As the customer appetite for new financial services grows, open banking projects are popping out like mushrooms in the rain. For example, there are about 200 regulated TPPs in the UK, with Nuapay, Crezco, and Volt being just a few pickings from the variety of initiatives. However, none of these projects would have ever succeeded without the proper monitoring of their third-party APIs.

But what is API monitoring? And why is it so critical? Find the answers below.

Why is open banking API monitoring so important?

Though bank APIs have seen significant improvements from the technical side of things, this doesn’t imply that they are absolutely secure and can work without a glitch at all times.

Are open banking APIs reliable?

According to Open Banking Implementation Entity data, more than a million open banking API calls in the UK failed due to technical issues.

When it comes to the security of open banking APIs, things are not so clear-cut, too. For example, based on Accenture’s research conducted in Hong Kong, many financial institutions in this location still haven’t established practices on the sharing of sensitive data outside their internal bank systems.

What’s more, according to Cifas, open banking is an attractive target to fraudsters, just like any new initiative. Users might have little idea of how open banking solutions should normally behave, which gives bad actors more wiggle room.

Consequences of open banking API failures

Even a minor API glitch, if unaddressed, can have a dramatic impact in time. For example, the five-hour shutdown of Amazon’s API in 2015 resulted in thousands of websites going offline.

Likewise, a similar malfunction in a large bank’s API can lead to their numerous open banking partners being unable to deliver their services properly, which might lead to increased customer churn and failed partnerships.

But the worst part is that these are just the tip of the iceberg. If something goes wrong in a large ecosystem like an open banking one, it’s sometimes not obvious where the problem is coming from. This can lead to increased litigation costs required to figure out which party is at fault.

With that being said, real-time API monitoring is important regardless of your role in an open banking ecosystem. But what does this monitoring imply, and how can you do it properly?.

Open banking API monitoring: What you should track

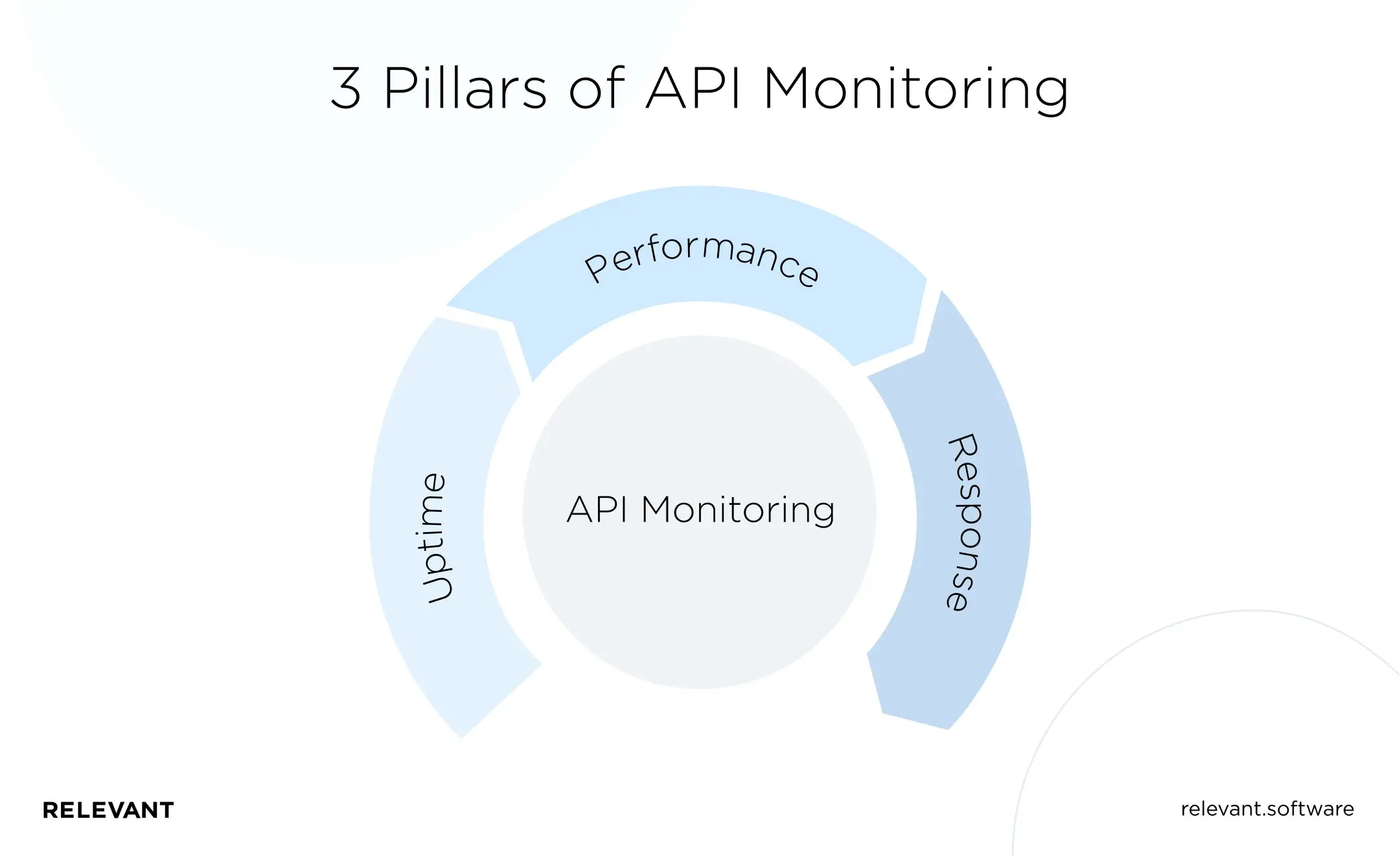

Open banking API monitoring is a set of processes that allow you to track your APIs—internal and external—and check whether they’re available and work as expected at all times. Effective API monitoring rests upon three “pillars”:

- Uptime

- Performance

- Response

Let’s take a closer look at each of them.

Uptime

Uptime is the most basic API monitoring metric and refers to verifying that your application programming interfaces are functioning or able to function in the first place. Usually, it’s a percentage calculated based on the number of minutes or hours the service is available during the selected timeframe.

At first glance, it seems that this metric doesn’t require special attention and a separate monitoring tool: when an API is down, it becomes obvious quickly enough as the entire app is affected. However, this isn’t the case with APIs that are rarely used. That’s why continuous API uptime monitoring is crucial for your entire open banking ecosystem to function properly.

Performance

Making sure that your APIs are available doesn’t guarantee that they produce the expected user experience. Your APIs should perform as promised under various conditions, which implies monitoring metrics such as:

- Average API response time. This refers to how many milliseconds it takes for your API to respond to a request. Based on our experience, it should be kept under a second.

- Requests per minute (RPM). As the name suggests, RPM shows how many requests your API is able to handle per minute. This allows you to evaluate the speed of your APIs.

If any of the API performance metrics suddenly show inadequate values, it’s not groundless. For example, your API transactions will take longer than usual because of the large distance between the server and the user or traffic congestion. Given that, it’s highly recommended to do API performance monitoring from various locations and under various loads—this will enable you to have a better insight into why your APIs underperform and how exactly you can fix this.

Response

If your APIs aren’t able to request and deliver data in a way both the sender and the receiver expect, this will also lead to customer dissatisfaction or even security issues. That’s why it’s critical to monitor metrics like the number of successful API calls and responses.

And be sure to have the right criteria for “successful.” For example, a successful API response doesn’t always imply a 200 status code. It can also be a 400 or 404 code if it’s expected.

If you, say, check your APIs for security and simulate a request that must be rejected, the 400 status code is a successful one. Besides, the response data must be in the expected format and structured correctly.

Selecting an open banking API monitoring tool: Critical guidelines

Open banking API monitor is a remote computer that periodically sends sample requests to your APIs and analyzes their responses. If it discovers that your API is down, slow, or responds in an inadequate way, it’ll notify you immediately.

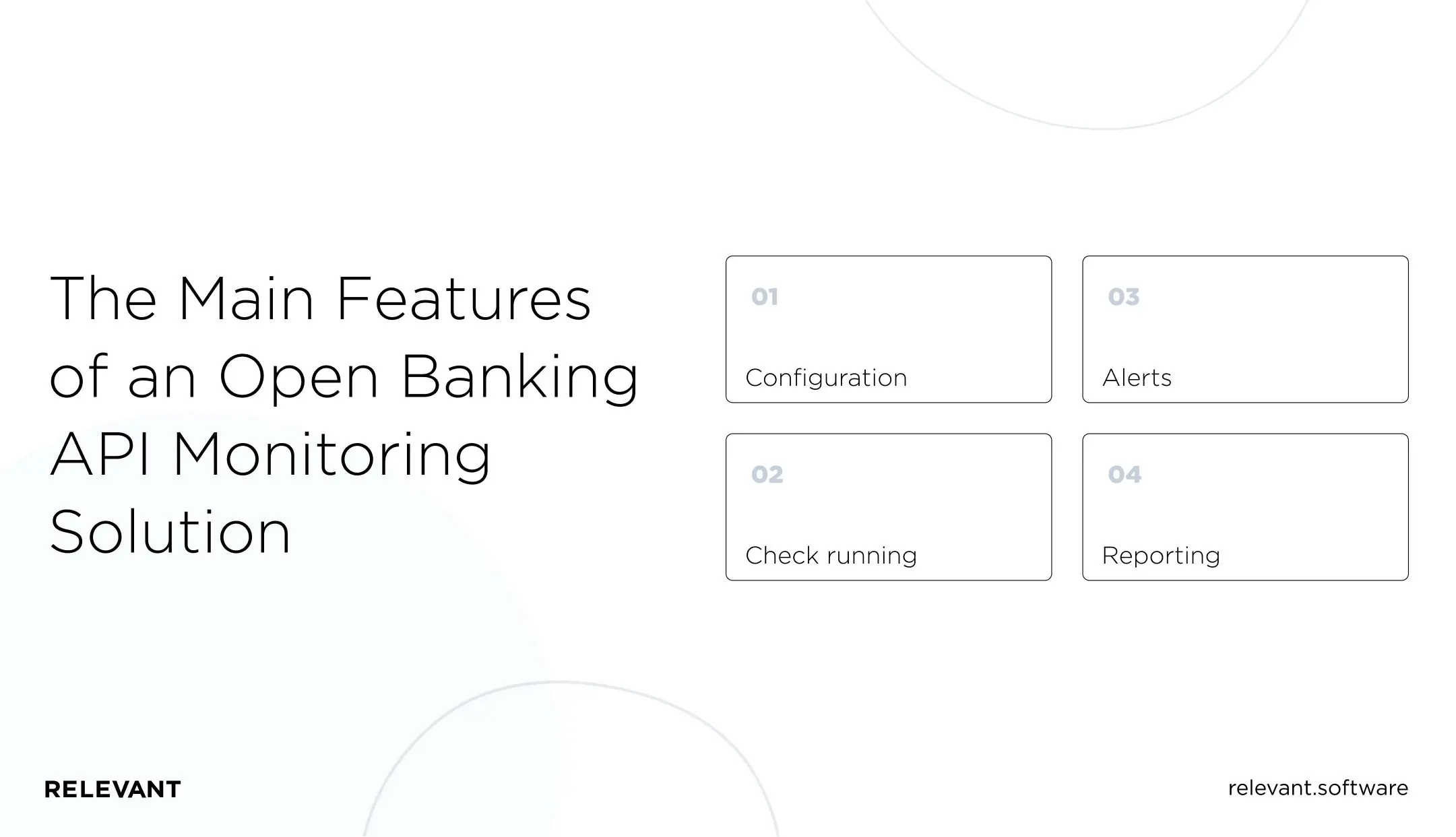

The main features of an open banking API monitoring solution

Whether you are selecting a monitoring solution or building one on your own, be sure it has features that correspond to a basic open banking API monitoring workflow. These include (but are not limited to) the following:

- Configuration. This usually translates into a user-friendly API monitoring dashboard where you can set up conditions for your APIs (like URLs, HTTP methods, and expected values), configure and schedule checks, set alerts, and so on. That’s where your monitoring flow actually begins.

- Check running. This is the core feature of any API monitor. It implies that the system will automatically invoke your APIs from various locations at specified time intervals and record response details, HTTP status, and transaction speed. The most effective solutions are able to perform multi-step API interactions (rather than making single API calls), run tests every minute, and cover hundreds of locations across the globe, giving you a 360-degree view of your APIs.

- Alerts. If any of your APIs doesn’t respond, return the wrong content, or otherwise behave strangely, the monitoring system will mark the corresponding test run as failed and send you an alert. This will allow you to detect and fix any issues before they affect your users.

- Reporting. All monitoring results are then transformed into comprehensive historical reports, allowing you to see average transaction duration, response speed, the number of failed and successful transactions, and other metrics over specified periods of time.

Besides, make sure that your open banking API testing tool has deployment options that suit your needs. For example, if you want easy data exchange between everyone involved in the monitoring process, choose from cloud-based solutions.

So, what are your open banking API monitoring options?

When it comes to selecting a suitable open banking API monitoring solution, it’s not quite so cut and dried.

First, you’ll have a hard time finding tools designed exclusively for monitoring purposes. Solutions like Yapily, Apimetrics, and Akana offer API monitoring along with other features. This means that if you decide on an off-the-shelf option, be prepared to pay for services that you might not need (unless you find a free API monitoring tool for open banking, of course).

Second, if you choose to cast a wider net and consider industry-agnostic solutions to find something focused on API monitoring, you’ll have to make sure the tool of your choice allows you to be compliant with Payment Service Directive 2 (PSD2) or the other legislation specific to your location (which might be challenging).

Given that, custom open banking API development is the best way out in such cases. A dedicated development team with a background in fintech will help you build a solution that meets both the industry requirements and individual needs of your business.

The latter implies that you’ll be able to go beyond the scope of the core open banking API monitoring features and consider adding something more sophisticated, such as AI-powered fraud monitoring, a bank API rating system, or a separate feature for testing the API ecosystem deployed on AWS.

Summing up

It’s impossible to reap the benefits of open banking if your APIs malfunction. Given that, open banking API monitoring is crucial for your business to thrive regardless of your role in an open banking ecosystem.

However, if you want to be able to spot and fix problems before your customers know about them, you’ll need a powerful tool that goes beyond a standard scope of features. In this case, custom development is recommended, and that’s where Relevant steps in.

With a profound knowledge of open banking and extensive experience in implementing fintech projects, our experts are here to lend you a hand. If you want to build an open banking API monitoring solution or implement any other open banking project, contact us.

FAQ

What is an open banking API?

Open banking API is a so-called “intermediary” that allows an ASPSP to share necessary financial data to a TPP in a manner specified by open banking regulations. Within the open banking partnership, an ASPSP is in charge of building the API, while a TPP is expected to integrate it into their product. Modern open banking solutions have multiple bank API integrations.What are the examples of open banking performance API monitoring tools?

Yapily, Apimetrics, and Akana offer API monitoring as a part of other services for open banking businesses. If you need a product that is designed solely for API testing or monitoring, you can expand your search with industry-agnostic solutions or consider building a custom tool for your specific business needs.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.