Custom Automated Payroll System Development: A Complete Guide + Case Study

If you’re responsible for payroll calculations in your company, you’ll probably agree it’s not an easy task. In the best case, you may be struggling along with a mix of tools and methods that don’t always work well together. In the worst, you may be using an off-the-shelf solution or spreadsheet that you’ve outgrown as your company scaled.

Here’s the deal: you can eliminate the mistakes in your payroll, properly distribute all the paychecks, and free up time for your HR team using payroll software developed specifically for your business needs and accounting workflow. No monthly fees, no unnecessary features, and no struggling to get something working with your other software or your country’s tax system. Just payroll software that works.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

In this article, you’ll learn:

- The benefits of in-house developed payroll system to your company

- Which features a custom payroll solution can include

- How Relevant streamlined payroll operations at a US-based fintech company with a custom solution

- How much it takes in terms of time and budget to develop a payroll automation system

Let’s dive in!

Why develop payroll automation software?

A custom-developed payroll management system can help save two of your company’s most critical business resources—time and money. Even when your organization has few employees, manual payroll processing can create a mass of unstructured data and lead to errors in wages calculations, statutory deductions, and tax filing. These problems increase as your business grows, making manual processing of payroll a real pain.

The good news is that custom payroll software development can take the burden off your HR team’s shoulders. First and foremost, an automated payroll system can take the lead on approximately 70 – 80% of repetitive, rule-based tasks that make up payroll calculation so that employees can focus on more value-added responsibilities. For instance, it can:

- Compute pay rates

- Make all statutory deductions (including insurance, health plans, tax deductions, and reimbursements)

- Standardize record-keeping

- Provide easy access to payroll data for analysis

- Keep track of employee attendance (no more paper-based timesheets!)

- Make it easy to meet tax obligations

Good custom payroll software pairs well with RPA because it eliminates repetitive steps in each pay run, reduces manual handoffs, and keeps teams focused on exceptions rather than routine work. Recent benchmarks show a fast ROI for this style of automation: Forrester’s 2024 Total Economic Impact study of Microsoft Power Platform reports 224% ROI with a payback period under six months for a composite enterprise, indicating that well-scoped automation can return value in months rather than years.

These are just some of the benefits of developing a payroll management system. Now it’s time to get down to the features that you can add to a custom solution to streamline your business processes.

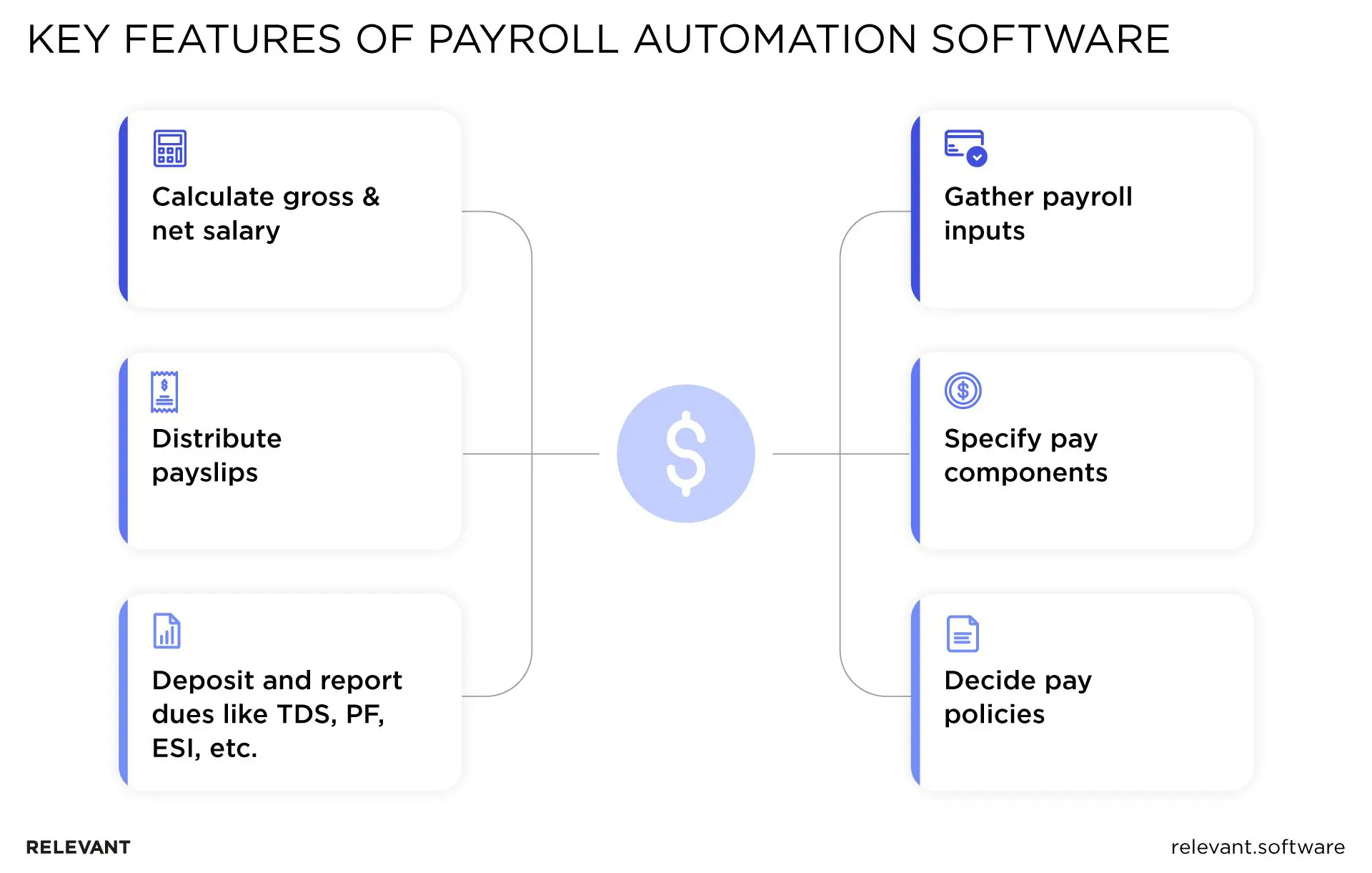

Key features of payroll automation software

Payroll software can streamline most of your routine payroll processes by doing all the calculations, thus eliminating inaccuracies and other human errors. What’s more, a custom solution works alongside what you already have in place, meaning you can decide on just the features you need.

We’ve gathered a list of the essential features you can choose to include in a custom payroll processing solution.

Automated wages calculation

Custom payroll software solution can perform all types of payments and automatically generate paychecks and stubs. Once you’ve entered all the required details, it can calculate wages by taking into account things such as:

- Salary payment schedules (weekly, bi-weekly, or monthly)

- Attendance and leave

- Overtime dues

- Double-time dues

- Bonuses

- Commissions

- Pay raises

- Wage deductions

- Taxes

This feature is especially useful for large companies with hundreds of employees.

Tax filing

Pretty much nobody enjoys filing taxes, which is not surprising since given fiddly state tax rules and multiple payment deadlines. Luckily, custom online payroll software can handle the job and let your team spend their time more efficiently. What’s more, it’s built from the ground up to fit your country’s tax laws and regulations.

From filing your returns and preparing reports to generating income tax returns for your employees, payroll software can eliminate errors and save you both your time and your sanity.

Leave, deductions, and benefits administration

Once payroll software identifies the gross income of an employee, it automatically determines and subtracts:

- Taxes

- Retirement savings

- Insurance deductions

An automated payroll system can also allow you to approve or disapprove employee requests and add them to the working schedule as necessary.

A cloud-based solution

Cloud software is a good choice if your HR team is distributed across multiple locations. All they need to access payroll data is a device connected to the Internet. A cloud solution is a no-brainer for large companies, but it’s also becoming the norm for small and medium-sized businesses given the global trend toward remote working and social distancing.

Direct deposit

When your payroll software supports direct deposit, you can set up a systematic process with banks to transfer money from your company’s bank account directly to your employees’ bank accounts on a specific day every month.

Many companies prefer this method of payroll payment, for good reason:

- Direct deposit is a safer option since it eliminates the risk of check-tampering fraud.

- It’s generally cheaper than other payment options.

- Direct deposit makes funds available to people sooner, which employees appreciate.

- It ensures you have a digital record of every transaction, which is especially useful for bookkeeping purposes.

Compliance management

Employment laws and regulations change at a fast clip. With compliance management features in place, your software automatically updates when any local, state, or federal employment law changes. It usually runs in the background, updating the rules in your system and ensuring your payroll data and tax returns align with the regulations.

Once the software finds non-compliant entries in your system, it can automatically flag them and tell you how to fix them.

Employee profiling and self-service

When planning what you need in your payroll system, it’s good to add an employee self-service (ESS) feature. This allows employees to:

- Track days worked and overtime

- Submit leave requests

- Download regulatory forms

- Check details of their pay scale, benefits, and advances

As well as giving your employees access to their data, ESS also makes the work of your HR team or payroll admins much easier.

Payroll reports

Custom payroll management software development can free up your team from spending hours generating reports manually. The software can do all that work for you with just a couple of clicks. You can use the information to see trends or to plan recruitment and staff retention strategies.

Priorities for a payroll management solution

Choosing how to automate payroll processing and increase your team’s productivity is only one side of the story. Here we’ll look at other hidden but equally essential aspects you need to pay attention to when developing a payroll automation system.

Security

Data security is critical in financial software development. Payroll operations use a vast amount of personal data, including your employees’ names, addresses, social security numbers, bank account details, and salary information. Therefore, any payroll solution should have proper data protection to secure sensitive information from misuse, loss, or leakage. Check that your custom solution will meet fintech security requirements by:

- Implementing data encryption

- Restricting payroll access

- Using peer review and approval processes

Scalability

Migrating from one payroll system to another is difficult and time-consuming. Make sure that your payroll software will match your company’s pace of development and cover more users, employees, and branches as you grow.

Integration

A key advantage of custom software over an off-the-shelf solution is that it can integrate seamlessly with your current setup. Think of the integrations you want to make at the outset when discussing the application architecture for your payroll system. Establish all the time-tracking, accounting, attendance, and other applications you need your payroll management software to integrate with to create your fully functional HR solution.

Compliance

We’ve already seen how compliance management can take the headache out of following changes in requirements and legislation over time. A professional software vendor will have knowledge of your country’s fiscal and employment system or know where to get the data to ensure that your payroll solution stays up to date.

Customization

Your company needs can change, and so should your payroll software. An excellent automated payroll system will be able to adapt to changes in workflow with minimal alterations.

Data

It’s quite possible that payroll is your biggest—if not number one—operating expense. Data is critical for feeding into reports to your management when plans for cost-cutting or expansion are on the table. When planning your payroll management software development, ask for good visibility into business-critical metrics through:

- Real-time analytics

- Preconfigured reports

- Advanced visualization

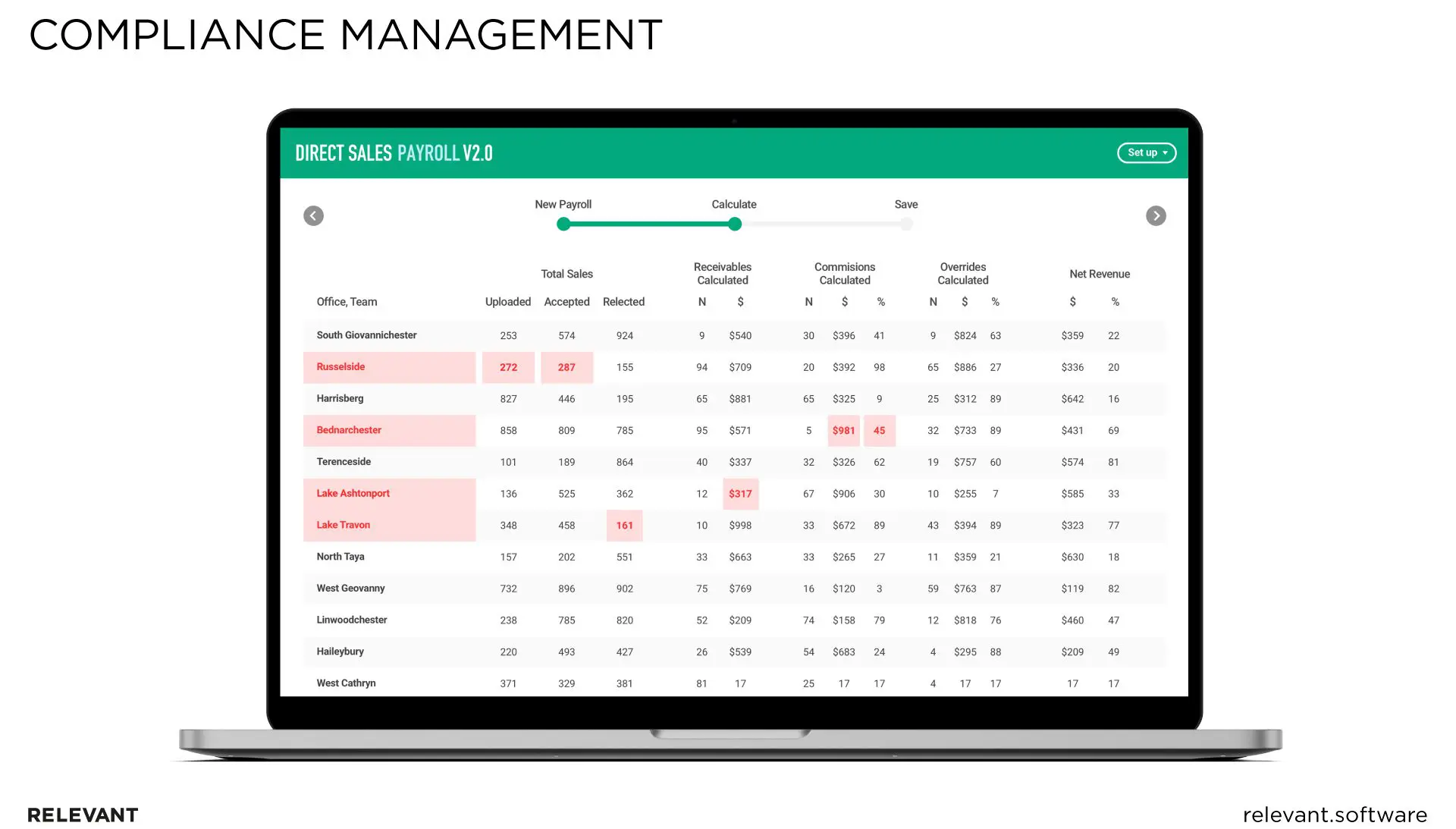

Relevant case study: Building an automated payroll report generation solution

A US-based fintech company approached Relevant to help them streamline their workflows, reduce paperwork, and minimize billing delays for their customers. Building on its experience in fintech software development services, Relevant started by analyzing the way the company handled payroll operations.

The client’s payroll database was large and complex, so our first task was to optimize it to prepare for development. Furthermore, their payroll used more than 50 parameters in its calculations, so we had to do two things:

- Build an efficient algorithm to handle calculations

- Create a user-friendly design to provide data to end-users in a simple, intuitive format

Implemented features

Our team accepted the challenges and developed a custom automated payroll system with the following features:

- A sophisticated payroll calculation algorithm. The algorithm we developed makes complex calculations blazing fast. An admin can set each of the 50+ parameters used in calculations for a single agent or a predefined group.

- Error prevention. All reports are checked against a second, smaller database of common variables. If it finds inconsistencies, the software instantly highlights them.

- Reporting and statistics. The system automatically provides a master report of the company’s state, including such crucial information as income, commissions, overrides, and revenue.

What are the costs and time involved in developing custom payroll software?

Numerous aspects contribute to the costs of building payroll software. The time frame will vary significantly depending on whether you need to integrate the solution with your current setup (e.g., time and attendance tracking software) or build a brand new solution from scratch. Obviously, this means costs vary too.

At Relevant, we suggest developing an MVP first and then extending the feature base in increments. On average, it can take from three to six months to develop a fully functioning MVP for a custom payroll solution. A sample project team could be:

- 1 project manager/business analyst

- 1 UX designer

- 2 back-end developers

- 1 front-end developer

- 2 quality control engineers

These are general guidelines. The complexity of your software, your choice of technology, and your time frame can influence the team structure and project costs.

Trust Relevant for custom payroll software development

Good payroll management software is much more than just a tool to cut your employees a check. It’s the sword in your hand for managing your company’s most valuable resources: time and money.

Building the right system for your company’s setup and burdensome payroll processes requires a reliable technical partner with a keen eye for detail. Our fintech software development services and experience in financial app development mean we’re well-placed to handle the application architecture for your payroll system and all the development and management. Contact Relevant today to discuss automated payroll system development in more detail.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.