Fintech Compliance: A 2026 Guide for Navigating Regulations and Building Trust

In 2025, most fintech founders say that complex paperwork and compliance checks, not competitors, are the biggest reasons their product launches get delayed. Regulators now check how systems work in real time: how they verify users, control data access, and report suspicious activity, not just what the policy documents say. That’s why fintech compliance now shapes the core of every product. It affects how teams build the backend, assign permissions, track risks, and respond to problems. Key features like onboarding, credit checks, user consent, and dispute handling must follow strict rules from the start.

This guide, based on Relevant Software’s experience in fintech software development, explains what compliance really means in 2026. It covers the laws, roles, and systems needed to meet today’s expectations and shows how proper compliance helps companies grow faster and earn trust.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

What is FinTech compliance?

Fintech compliance refers to how financial technology companies meet legal and regulatory standards. In 2026, this includes much more than identity checks or fraud controls. Regulations now affect how companies structure data, define user flows, and handle risk exposure.

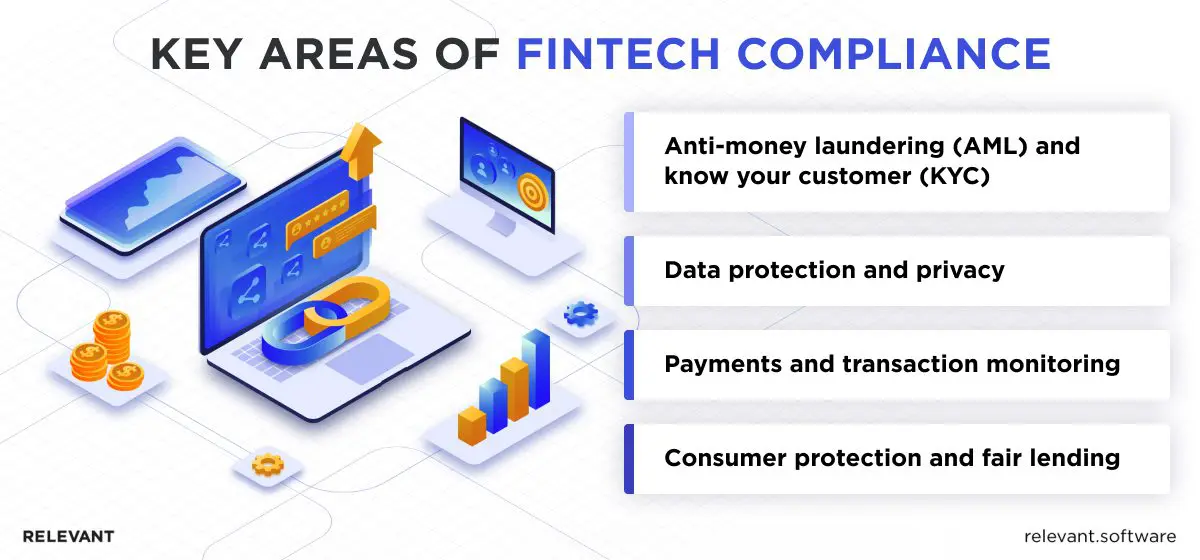

Typical areas include:

- User identity verification under Know Your Customer (KYC) policies

- Detection of suspicious transactions under Anti-Money Laundering (AML) rules

- Data encryption aligned with applicable privacy laws

- Regulatory license management in each target market

- Transparent disclosure of product terms and conditions

How fintech compliance differs from traditional finance

Traditional banks grew their compliance programmes over the decades. They have large teams, well-defined processes, and a limited set of products that rarely change. Fintech companies start in a very different place. Many launch with no compliance staff at all, then add controls while shipping features and entering new markets. This “build-as-you-go” approach brings special risks and forces tighter coordination between engineers, lawyers, and product managers.

Speed is another dividing line. Banks release major updates only after long review cycles. Fintech teams push code every week and rely on external APIs for payments, data, or identity checks. Each new integration exposes the platform to data-privacy rules, transaction-monitoring standards, and complex reporting duties that a legacy bank handles through closed systems.

Product reach differs as well. A bank may focus on domestic savings and loans. A single fintech app might blend crypto wallets, peer-to-peer payments, and instant credit, often across several countries. One feature can trigger multiple rule sets: securities law for a token, lending law for credit scoring, and consumer-protection rules for fee disclosures.

Regulators now inspect software logic itself, not only policy binders. They want proof that code enforces limits, logs every action, and adapts to regional requirements. Fintech firms that automate these checkpoints — clear audit trails, flexible rules, country-specific settings — scale faster and withstand scrutiny better than peers that rely on manual reviews.

In short, bank compliance grew slowly around stable products, while fintech compliance must grow quickly inside fast-moving code. Building controls into the architecture from day one turns regulation from a bottleneck into a license to expand.

The regulatory landscape for FinTech (2026 edition)

By now, most fintech founders know that regulators are no longer behind the curve. In 2026, the rules have taken shape. Data handling, digital payments, crypto assets, consumer rights, all of it now sits under real scrutiny. And in every major region, the message is the same: prepare early, or prepare for delays.

In Europe, GDPR (General Data Protection Regulation) continues to guide data protection. Companies must secure personal data, document usage, and respond to user requests within strict timeframes. Another key law, the Second Payment Services Directive (PSD2), forces banks to give licensed fintechs access to account data through secure channels. It supports open banking but comes with strict oversight. Then there’s the Markets in Crypto-Assets Regulation (MiCA), a newer law that now applies across all EU countries. MiCA sets ground rules for stablecoins, token issuers, and crypto exchanges. Registration is required. So are public disclosures and risk controls.

In the United States, long-standing laws now shape day-to-day fintech work. The Gramm-Leach-Bliley Act tells financial firms to be clear about how they share and safeguard customer data. The Bank Secrecy Act, along with anti-money-laundering rules, now covers apps that run digital wallets, handle payments, or move money across borders. The Office of the Comptroller of the Currency watches over banks and their fintech partners to make sure capital, risk controls, and “responsible innovation” stay on track. The Securities and Exchange Commission sets updated ground rules for digital assets, and the Consumer Financial Protection Bureau reviews credit models, consent screens, and user disclosures.

Across Asia, regulators have moved just as quickly. Singapore’s Monetary Authority issues detailed licences for digital banks and crypto firms, giving companies a clear checklist to follow. In India, the Reserve Bank requires strict KYC checks, keeps financial data within the country, and calls for regular audits of payment and lending platforms.

The old strategy of launching first and handling compliance later no longer works. Today, regulators expect companies to plan. That means building compliance into product teams, setting up documentation early, and proving control long before expansion.

Regional nuances and expansion considerations

Scaling across borders introduces more than technical challenges. Each country sets its own compliance rules, timelines, and approval steps. A product that works in Europe may require a different onboarding flow in India or new disclosures in Brazil.

Even the same fintech regulation, like KYC, can mean different ID checks, document types, or review procedures. Teams must adjust workflows without losing speed or consistency.

Regulatory sandboxes offer a way in. Countries like Singapore and the UK let fintechs test products under supervision before full licensing. These programs reduce risk but come with limits. Once outside the sandbox, full compliance applies.

To grow across regions, fintechs need flexible systems that support local rules. They also need clear ownership of compliance inside the product and engineering teams. The companies that expand smoothly treat regulation as part of design, not as a last step.

Key areas of fintech compliance

Compliance defines whether a fintech product will pass regulatory checks, gain investor confidence, or survive cross-border expansion. In today’s more regulated business environment, authorities across the financial sector focus on a few core areas. These reflect the minimum level of control expected from any company that handles funds, collects personal data, or evaluates financial risk.

1. Anti-Money Laundering and Know Your Customer

Regulators expect firms to identify users with accuracy and monitor how funds move through accounts. This begins with strict Know Your Customer (KYC) procedures: identity verification, documentation, and screening against global lists. Once onboarded, users remain under monitoring to detect erratic behavior, large transfers, or abnormal patterns.

Effective compliance management here means adaptive logic: firms must adjust their Anti-Money Laundering (AML) rules based on user behavior, transaction type, and jurisdiction. One-size-fits-all systems no longer meet the operational risk practice expected in today’s financial technology landscape.

2. Data protection and privacy

Modern fintech innovations hold highly sensitive records, including account histories, ID documents, and behavioral patterns. Compliance with regional privacy frameworks, such as the California Consumer Privacy Act and the General Data Protection Regulation, requires encrypted storage, secure access, and swift responses to breaches.

Firms must build responsible innovation into infrastructure: data should remain within approved jurisdictions, access must follow strict role-based permissions, and each access point needs a documented policy trail. Regulatory issues in this area quickly trigger audits and legal actions if mishandled.

3. Payments and transaction monitoring

Real-time detection of fraud, abuse, and system errors defines modern compliance management in fintech. Platforms must flag anomalies, act on alerts, and file required reports without delay. Systems must meet established standards, such as PCI DSS, while addressing local expectations around financial crimes and cross-border transfers.

Supervisory agencies, from the Office of the Comptroller of the Currency to the Federal Trade Commission, now assess whether a firm’s alerting and audit capabilities match its scale. A high number of flagged events without documented actions can raise questions, especially when linked to financial sector instability. Well-prepared teams treat these touchpoints as a daily discipline, not an afterthought.

4. Consumer protection and fair lending

Fair access, clear disclosures, and explainable decisions are central to the importance of compliance in financial services. Pricing must be transparent. Credit decisions must be supported by logic that teams can explain and regulators can test. Complaint handling must follow a structured protocol aligned with local mandates.

Regulators such as the Federal Deposit Insurance Corporation monitor how platforms treat users across demographics. Fintechs using advanced scoring or AI must maintain records of every decision, part of the broader regulatory frameworks now treating software logic itself as a compliance subject.

These four areas form the compliance core for modern fintech firms. A company cannot scale across markets or maintain licences without covering each one. By integrating advanced regtech solutions, demonstrating responsible innovation, and following recognized best practices, fintech innovators convert strict regulatory frameworks into a clear competitive advantage and sustained growth.

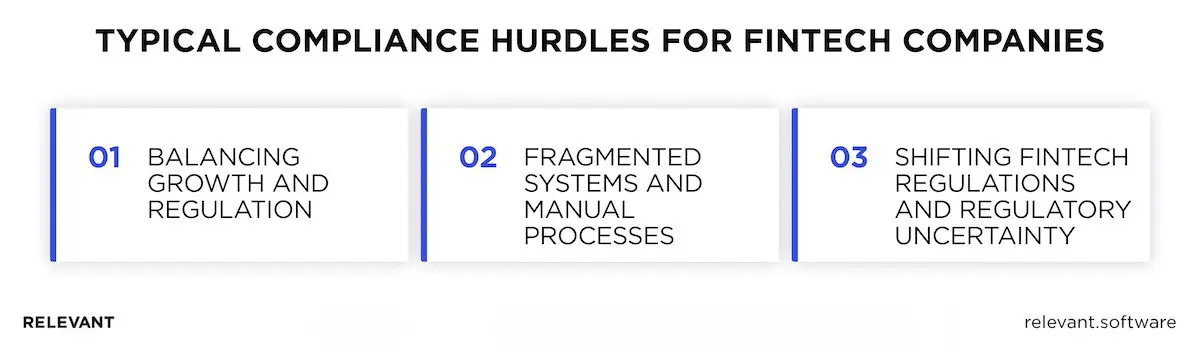

Common compliance challenges for FinTechs

Recent industry trends confirm that compliance directly impacts fintech product development. Relevant Software experts have seen high-growth companies attract early users but then lose ground when controls fall behind product velocity. Even well-known platforms feel pressure under today’s tighter regulatory frameworks. The most effective teams apply clear, proactive measures to reduce risk and avoid costly setbacks.

Below, we outline the most common compliance challenges fintech companies face and the actions that help overcome them.

Balancing growth and regulation

Founders often aim to expand into three regions within a year. Each jurisdiction, however, requires a complete fintech compliance checklist – identity verification, data governance, and audit trails. Launches that bypass local rules create technical debt and delay licences. Teams that plan sprints around regional obligations protect business reputation, satisfy investors, and turn speed into a strategic edge. As former U.S. Comptroller Keith Noreika observed, weak governance “finds its way onto the balance sheet”, a risk no fintech can afford.

Fragmented systems and manual processes

Storing risk scores in spreadsheets and routing alerts through disconnected tools slows response when anti-money-laundering controls demand immediate action. Fragmentation introduces blind spots and frustrates auditors. A unified platform that connects payments, user records, and alert workflows creates a clear view of system health and compliance readiness. Experienced fintech compliance companies build integrated architecture from the start and often display live dashboards to prove it.

Shifting fintech regulations and regulatory uncertainty

The fintech regulatory landscape shifts constantly. One week brings a cross-border guideline from the Financial Stability Board; the next, a new data-privacy rule closes off foreign storage. Teams that monitor changes, test internal controls, and push code updates without long freezes preserve market access. Legal trackers, policy engines, and versioned compliance libraries help companies stay agile. What once felt unpredictable becomes a routine process of review and adaptation.

Building a scalable compliance program

The next section outlines a practical roadmap based on real projects delivered by Relevant Software. Developed in collaboration with experienced fintech consultants, it connects each step to specific regulatory requirements and demonstrates how clear roles, structured documentation, and working controls turn compliance into a growth asset across the global fintech industry.

Steps to set up a compliance framework

A strong framework rests on four pillars: fintech risk insight, clear rules, skilled staff, and prompt reports.

| Stage | Key Actions | Why It Matters |

| Risk assessment | List every data flow, payment path, and third-party link. Score each one for fraud, privacy, and legal exposure. | A documented view of fintech risk and compliance priorities lets teams budget effort where regulators focus first. |

| Internal policies | Write rules for identity checks, data storage, and breach notice. Link each rule to the exact law it supports. | Precise text removes gaps between legal intent and code. Relevant Software clients avoid rework because engineers build from the final language, not interpretations. |

| Staff education | Give each team member a short lesson on the rules that affect daily work. Record quiz scores as proof. | Regulators treat education evidence as proof that controls move beyond paper. |

| Report procedures | State who files suspicious activity reports, the deadline, and the channel. Use software alerts to cut delays. | Fast, consistent reports satisfy fintech data regulations and preserve business reputation during audits. |

Together, these actions form a practical fintech compliance checklist that regulators recognise and investors respect.

Roles and responsibilities

Clear ownership convinces regulators the plan works in practice, not just on paper. Each role guards a distinct slice of risk, so compliance in fintech becomes a habit. The outline below shows responsibilities that Relevant Software experts use to align staff and maintain accountability.

- Chief Compliance Officer – Owns the entire framework, signs off policy updates, and speaks for the firm during regulator meetings.

- Legal counsel – Tracks new fintech regulatory technology and compliance mandates, drafts contract clauses, and validates rule logic in product flows.

- Engineering lead – Embeds controls in code, maintains immutable audit logs, and enforces least-privilege access.

- Product manager – Aligns release cycles with compliance milestones, allocates sprint time for control reviews, and gathers usage metrics for continuous improvement.

Weekly triage sessions ensure every team sees the same risk dashboard and acts before small gaps widen.

Documentation, audits, and record keeping

Good records prove the program works and shorten audits. Regulators trust systems that serve evidence on demand, not excuses. A rigorous archive, routine tests, and yearly reviews turn compliance from an overhead topic into a visible sign of operational discipline.

- Central repository – Store policies, fintech risk scores, consent artefacts, and audit trails behind role-based access.

- Retention rules – Keep logs for at least five years or longer when local fintech regulatory compliance demands.

- Internal control tests – Run tests each quarter to confirm alert logic, backup restores, and data integrity.

- External review – Invite an independent auditor once a year to compare evidence against formal fintech compliance certification standards.

- Audit kit – Maintain a ready folder with contact names, system diagrams, sample fintech compliance examples, and data maps. Provide the kit within hours when a regulator calls.

A disciplined approach protects operational resilience, strengthens investor confidence, and positions fintech companies for expansion across global financial services and financial markets. Relevant Software clients that follow this model enter new regions faster, avoid costly fines, and uphold trust with financial institutions and users alike.

Compliance as a competitive advantage

Fintech companies that embed robust fintech compliance solutions into every workflow consistently outperform peers that treat regulatory rules as obstacles. Experts at Relevant Software observe that transparent governance builds user trust, appeals to institutional investors, and unlocks new markets more effectively than traditional brand promotion. Alignment with fintech compliance regulations, global financial systems, and sound operational risk management sends a clear signal of long-term credibility and readiness.

Trust as a growth lever

Before forming partnerships, regulators, investors, and enterprise clients check how well a fintech platform follows legal and compliance rules. They look for full audit logs, clear data protection policies, and solid anti-money laundering (AML) controls. These show that compliance is built into the platform, not just added later. This builds trust that all transactions are legal and users’ rights are protected. Strong compliance also helps attract more partners, keep users longer, and grow a trustworthy global brand.

Faster market expansion

Getting licensed takes longer when companies try to add compliance controls after launch. A strong fintech compliance checklist, covering risk scores, clear policies, real-time alerts, and tailored solutions, helps teams answer regulator questions quickly and avoid delays.

Relevant Software clients with proven compliance setups often get approval up to four months faster in new markets. By building compliance into the product from day one, they grow faster and with fewer roadblocks.

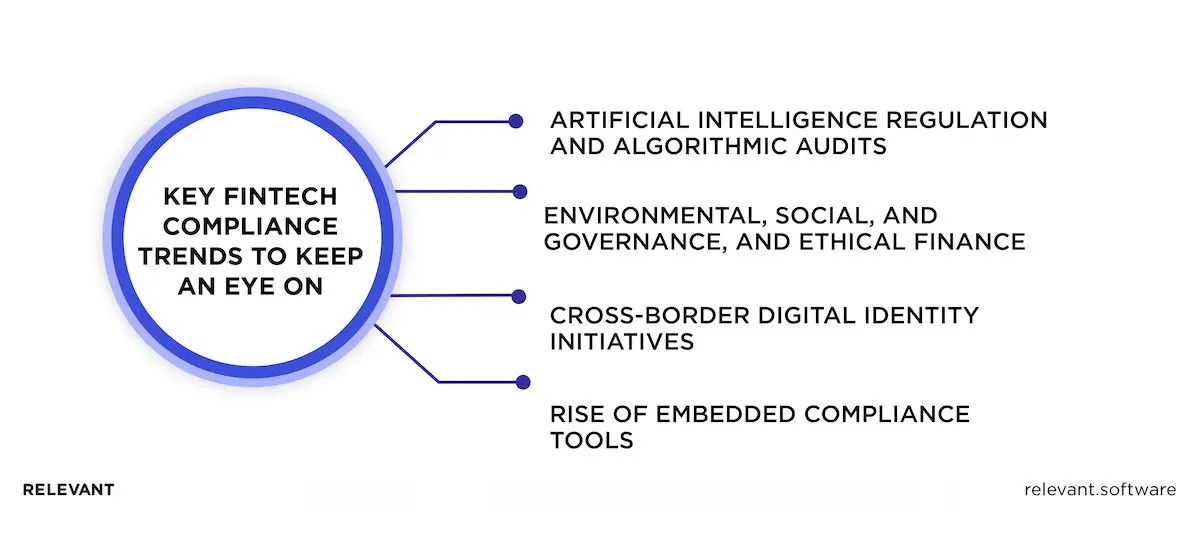

What’s next? FinTech compliance trends to watch

The fintech compliance rulebook never stays static. New technology, social expectations, and international cooperation constantly shape the rules. Leaders must closely monitor these themes to remain proactive, uphold regulatory credibility, and avoid costly legal actions.

Artificial Intelligence regulation and algorithmic audits

The European Union Artificial Intelligence Act, adopted in April 2025, classifies credit-scoring models as high-risk systems. Digital lenders like Klarna and Monzo now publish detailed “model cards” outlining data inputs, test results, and fairness controls before license renewal. The UK Financial Conduct Authority has adopted similar requirements during audits. Solid AI governance and transparency are emerging as standard best practices in fintech operations.

Environmental, social, and governance, and ethical finance

The EU’s Corporate Sustainability Reporting Directive (CSRD) pulls climate and social disclosures into the core annual reporting cycle by requiring standardized sustainability information in the management report alongside financial statements. Some digital banks already treat disclosure as a product layer: bunq provides in-app CO2 insights tied to card purchases and tracks sustainability impact directly in the customer experience, which gives investors and partners clearer, more auditable signals during diligence.

Cross-border digital identity initiatives

In Europe, the Digital Identity Wallet pilot lets people use their government ID across banks, insurance companies, and fintech apps. Singapore and Thailand connected their national ID systems, making it easier to set up cross-border money transfers. In India, Paytm uses Aadhaar-based e-KYC to cut account setup time from days to minutes. These examples show how fintech compliance must keep up with new ways of handling personal data.

Rise of embedded compliance tools

Stripe now integrates KYC verification and sanctions checks directly into its Payment Links product, eliminating separate compliance steps for merchants. ComplyAdvantage provides real-time transaction surveillance adopted by Wise for international payments. Alloy orchestrates multiple identity-verification vendors for Ramp, cutting manual reviews and keeping policies current with minimal code changes.

Our FinTech success stories

Relevant Software experts embed compliance and security in every layer of the product, so our clients can clear regulatory checks on the first try and scale with confidence. Three recent fintech projects from our company illustrate how a solid governance foundation translates into real-world growth.

FirstHomeCoach: digital home-buying companion for the UK market

- Challenge: Relevant Software was tasked to build a secure SaaS platform that guides first-time buyers through deposits, mortgages, and legal paperwork while protecting sensitive financial data.

- Solution: microservice architecture in React, Node.js, and TypeScript; proprietary algorithm for personalised property-buying plans; modules (mortgage calculator, deposit builder) available as white-label services.

- Outcomes: 25,000 property-purchase plans created, 5,000+ active users, 200,000 data points processed in the first year, all under Financial Conduct Authority rules and GDPR-aligned data-segregation controls.

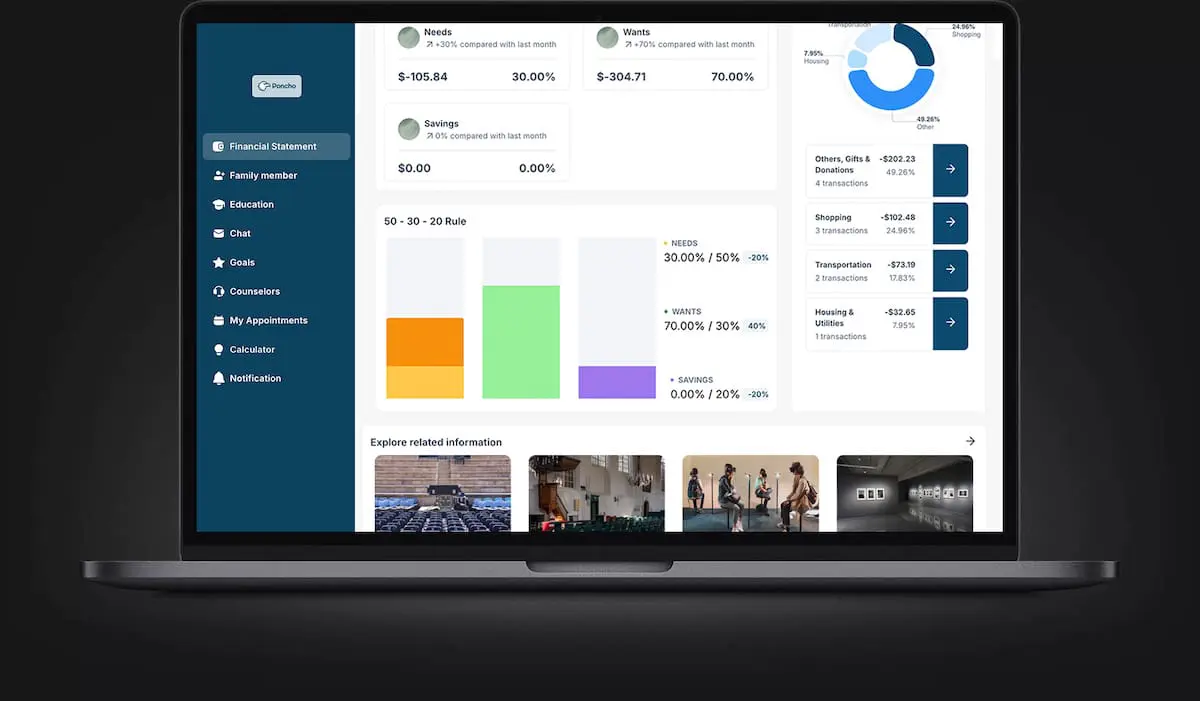

Poncho: a financial-readiness platform for U.S. military personnel

- Challenge: We had to deliver a web portal that aggregates real-time banking data, scores financial health, and meets strict security mandates for defence-sector deployments.

- Solution: secure integration with a leading U.S. data aggregator, advanced encryption, multi-factor authentication, and role-based dashboards for commanders; prototype delivered in three months.

- Outcomes: automated financial insights for service members, actionable readiness reports for commanders, zero security incidents since launch, and compliance with U.S. data-protection standards.

Swift Onboard: custom payroll onboarding & compliance platform

- Challenge: Client trusted us to replace an outdated third-party payroll onboarding tool with a custom, web-based SaaS platform that supports rapid contractor registration, meets strict encryption and data-protection rules, and stays flexible for future growth.

- Solution: A green-field build on AWS using React.js for the front end, Node.js + Nest.js with GraphQL for the back end, and PostgreSQL for persistent storage. The Relevant Software team first built a basic MVP, then added features like user management, e-signatures, staff dashboards, real-time reporting, and full audit logs. Each part was designed to meet KYC, AML, and data privacy rules.

- Outcomes: Contractors now complete payroll onboarding in <10 minutes; staff track every registration in one dashboard, cutting manual admin work; the new platform gives Swift Onboard a scalable, fully compliant foundation and remains the basis for ongoing product expansion.

These projects confirm that rigorous, early-stage compliance planning accelerates licensing, boosts user trust, and opens doors to new partnerships, advantages every growth-minded fintech needs.

Build FinTech solutions with Relevant Software

Whether launching a new product or expanding into a new market, fintech compliance should never slow you down. At Relevant Software, we help fintech companies build secure, scalable platforms that meet global regulatory standards from day one without sacrificing speed, user experience, or innovation.

Our team works closely with founders, product leaders, and compliance officers to integrate fintech and compliance into flexible systems that support sustained growth. Through targeted compliance automation for fintech, we ensure:

- Clear KYC, AML, and data privacy logic embedded directly in product architecture

- Modular, scalable systems adaptable to complex regulations across markets

- Cross-functional teams guiding your project from the first prototype to a successful launch

- Fast, transparent delivery with regular demos, detailed feedback, and clear documentation

- Proven expertise across lending, payments, insurance, personal finance, and beyond

Relevant Software clients launch with confidence and keep growing. If your fintech product needs both compliance and agility, contact us, and our team will help you make it happen.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.