Creating a Smooth Customer Experience in Digital Banking

Digital banking and customer experience have come a long way. Back in the day, moneylenders had a vast client base, and it wasn’t because they gave loans on more cost-effective terms than other moneylenders. The trick was that people had no alternatives—more often than not, there was only one “loan shark” in town.

But times have changed, and in 2021, customers have numerous online banking options to choose from. Even “the most cost-effective terms” don’t impress people anymore. That’s why modern banks and credit unions focus more on how they deliver than what. Superior customer experience is king.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

At Relevant, we’ve been building fascinating digital banking customer experiences for years, and this article distills our knowledge. Read on to learn about the trends in retail banking customer experience, tips on effective experience transformation strategies, and some real-life examples.

What is customer experience in digital banking?

The digital banking customer experience (CX) is what your customers feel when using your bank. Does that sound vaguer and less important than the fact that your bank, say, helps your customers transfer funds, issues loans, and accepts deposits?

Believe it or not, CX is even more important than that. How else do you explain that 68% of customers will walk away from a bank because of poor CX rather than poor service? Or that 32% will leave their favorite financial institution after just one bad customer experience? No wonder that, in 2020, CX is the second priority for financial companies after digital transformation, demonstrating a close connection between digital banking and customer experience.

What are digital customer expectations from a bank in 2021?

Just like any CX, digital customer experience in banking is based on the personal priorities of a customer. The logic is simple: if these priorities align with what a banking institution has to offer, the customer will have a positive CX. That said, the primary task of a company that is looking to offer the best online banking experience is to know precisely what their clients want.

Identifying customer needs can be challenging, especially given how quickly they change. To make the process easier for you, we’ve cherry-picked some hints on customer expectations and ways to improve customer service in banks based on statistics and our experience.

Speed and simplicity

Since most customers prioritize CX over services, many fintech companies tend to improve their existing services rather than add new ones. As a result, they’re killing two birds with one stone: improving financial customer experience and saving the budget.

One of the examples of digital banking companies that managed to deliver a superior new banking experience without a long list of services is N26. The Berlin-based fintech company appeals to customers that have had enough of long and complicated procedures connected with opening accounts. The clients of N26 can open their accounts “in minutes” via smartphone and start using them before the physical card arrives.

All N26 did was improve their onboarding procedure, but this simple trick allows them to boast 10,000 new accounts daily.

Multi-channel banking experience

Mobile often leads the journey, yet customers still want choice and continuity across touchpoints. Accenture’s 2019 Global Financial Services Consumer Study found that more than half of respondents wanted a true omnichannel banking experience that lets them switch seamlessly between physical and digital channels.

McKinsey’s 2025 research reinforces the trend: digital is the primary servicing channel for most customers, cited by 65% at midcap and smaller banks and 73% at megabanks. For product teams, the takeaway is simple: maintain context and progress when a customer starts on mobile, continues on web, and completes through an agent, branch, or virtual call center, without requiring repeated forms or identity checks.

Design

Many traditional banking institutions often neglect how their interfaces look and lose clients. Because another thing an average digital banking customer will not tolerate is the subpar UI of a website and mobile app. This makes good design one of the most important digital trends in retail banking. Let some stats prove this point:

- 57% of customers won’t advocate for a brand with a poor website.

- It takes approximately 50 milliseconds for a person to form an opinion of your website or mobile app.

- If a website isn’t mobile-first, 50% will switch to the other one.

- 29% will look for another service provider unless they find what they need within three seconds (even if you offer what a client looks for, your potential customer might never know it because the service is obscured by poor design).

Having a mobile app or website on your list of points of contact is no silver bullet. To make your customer stay with your brand, you should invest heavily and regularly in improving your digital channels.

Personalized services

Modern digital banking consumers don’t care about how many services you offer. But what they do care about is whether you can address their needs. And if you fail to (as you remember, it takes them 3 seconds to find this out), you’ll lose them. Meanwhile, many companies say they have no idea of their customers’ top priorities, which explains poor customer loyalty levels in modern banking.

Given that, personalized customer services in the banking industry are key to a superior CX. Luckily, modern digital banking service providers already have everything they need for CX personalization: they collect tons of necessary customer data every day through interactions with their clients. And to personalize a digital banking journey for a particular client, they just need to use information from previous interactions with this client and personalize the next interaction based on it.

Real-time assistance

In digital banking, support typically begins when the customer encounters friction, not when a bank prompts a message. A failed transfer, a suspicious charge, or a login issue creates an immediate need for answers inside the same channel. That expectation keeps rising: Zendesk reports that 72% of customers want immediate service, making response speed a direct driver of loyalty.

Accenture’s Global Banking Consumer Study 2025 explains why “fast” also needs to mean “continuous.” The report notes that mobile apps are the primary service channel, with customers completing around 150 interactions per year, yet most sessions stay transactional, and complex issues often break when people switch channels. It also highlights that chatbots deliver the lowest satisfaction and see minimal adoption, so progress comes from better resolution paths, not chatbot volume.

A stronger model blends in-app chat and guided self-service for routine questions with instant escalation to an agent who sees full context, plus options like co-browsing or secure video for complex cases. AI can add a second layer by supporting financial health guidance, and Accenture reports that 62% of respondents are open to using an AI-powered financial assistant.

Sustainability

Modern online banking consumers don’t want to just use the services they need while enjoying a seamless digital experience. They love to be a part of something grand. About 68% of respondents are much more likely to stay with a brand that shares the same values, such as social and gender equality, environmentally-friendly consumption, community investment support, and so on.

So, put words into action and help your customers make a difference.

Online banks with the best customer experience

We understand that even backed up with statistics and our experience, these banking customer experience trends might not look convincing enough to be a wake-up call for everyone using the “traditional” methods to attract clients. So, here are some examples of the companies that managed to take digital engagement in banking to the next level.

Apple Card

Apple Card is a classic example of a simple, speedy, and omnichannel customer experience with digital and physical versions of a card. A year ago, 2.2% of all U.S. adults with a credit card used Apple Card. You can apply for an Apple Card directly from the Wallet app and start using it immediately. For stores that don’t support contactless payments, you can order a titanium card. Besides, for online stores that do not support Apple Pay, you can apply the 16-digit code of your Apple Card.

Nina

Nina is a chatbot at Swedbank. The AI assistance resolves about 80% of issues (out of 40,000) per month, allowing the company’s contact center agents to focus on sales rather than basic customer support.

Erica

Erica is an American colleague of Nina, which has made a splash in the banking industry, too. In just 18 months, this Bank of America’s chatbot has managed more than 100 million client requests.

Zelle

Zelle removes the “wait days” problem from everyday transfers. Built into over 2,300 bank and credit union apps, it lets people send money directly between eligible accounts, with transfers typically available within minutes when the recipient is already enrolled. To send money, the sender only needs the recipient’s email address or U.S. mobile number, making Zelle a simple default for fast peer-to-peer payments within familiar online banking.

Bank of Oak Ridge

It’s no secret that the consulting element is crucial in customer-bank relationships, and Bank of Oak Ridge seems to realize its importance better than others. The CX of its clients goes far beyond routine transactions—the North Carolina-based enterprise offers chat support coupled with financial calculators.

MyTD Experience

The TD Bank Group goes even further in its attempts to personalize CX with the MyTD Experience. The AI-based assistant now sends data-driven, contextualized “nudges”: Low-Balance Prediction based on a customer’s recent spending and Upcoming Transactions based on recurring payments. Both features encourage customers to prioritize their spending and make important payments on time.

Managing customer experience transformation in banking: Relevant’s insights

In the context of the rapidly changing customer requirements, continuously improving the customer experience seems to be vital. And it is. However, the fact that you decided on a transformation doesn’t guarantee it will succeed.

Any CX transformation is a complex, time-consuming process with numerous pitfalls, such as new regulations, the risk of losing customer loyalty, information silos, the lack of inadequate data, financial risks, and more. So, how to improve an online banking CX with minimal risks? These digital banking best practices will help you handle your transformation with grace.

Choose a model to structure the process

As our experience suggests, companies that implemented successful CX transformation used a top-down purpose and bottom-up feedback loop:

- The process begins with top management’s commitment to the transformation and their belief that it is necessary.

- Once they give a green light, the transformation goal is defined.

- Implementation begins. Bank employees should actively participate in the process.

- A new CX is “delivered” to the customers. The company collects customer feedback and suggests improvement to the management (bottom-up).

Since CX transformation is typically implemented incrementally, the process repeats until all the increments are delivered, and in the continuous delivery settings, it’s actually never-ending.

Always look at the business value

The potential of CX transformation for a financial services provider is undeniable. However, the transformation-for-the-sake-of-transformation approach is a waste of budget.

What we mean is that it’s critical to initiate any change only if it relies on a specific business case. For example, avoid statements like “we need to improve a CX in our digital bank because everyone does so.” Instead, use reasonings like “customers willing to promote a brand are six times more likely than others to make purchases using our online wallet, so we need to improve a CX in our digital bank.”

Rely on data, but stay human

In the settings of customer-centricity, no transformation is implemented “just because.” You should begin the transformation process with a customer data analysis. Look at their current customer journeys, which touchpoints they use, where and why they fail to achieve their purpose and drop out, what kind of issues they face, and so on.

At the same time, avoid relying solely on data, especially when making final assumptions on what motivates and frustrates your customers. Apply a “human filter” to your data. Let your audience speak for themselves with the help of interviews, surveys, customer panels, etc.

Foster collaboration, not chaos

When it comes to creating a digital customer experience, everyone “chips in,” including C-levels, developers, designers, marketers, sales managers, customer support teams, and others. That’s why it’s critical to apply a people-oriented leadership style and encourage everyone involved to make their input into the transformation strategy.

At the same time, it’s critical to not turn collaboration into chaos, where each department looks at the process from their own point of view. Here’s what one organization did when they found themselves struggling to approach CX transformation in a uniform way instead of actually improving customer journeys:

They defined a common “glossary” to describe different aspects of a customer journey. The “glossary” is applicable to any journey.

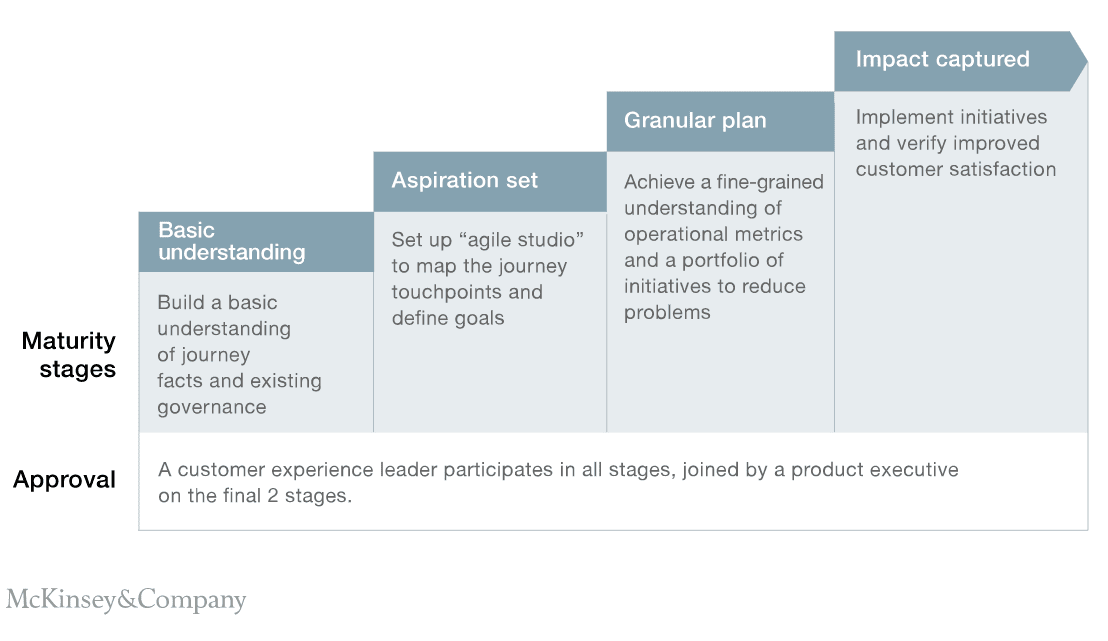

They defined a “maturity” model as a uniform way for the management to track the progress of the CX transformation. The model combines agile practices, such as iterative development and prototyping, and is applicable to any customer journey.

As soon as a new CX was delivered, they continuously tracked its impact on customers and made changes where necessary. As a result, they saw a significant improvement in customer satisfaction, from five to ten points.

The bank’s case is no one-size-fits-all, of course. But it can serve as a role model of how you can make the most out of agile principles by using a uniform approach.

The bottom line

The importance of customer service in banking is undeniable. Still, implementing a successful CX transformation strategy isn’t easy. Quite often, companies fail in their attempts to revolutionize relationships with their customers.

If you feel that your in-house resources won’t suffice to carry out a successful CX transformation, there’s no need to give up—you can outsource this task to Relevant. No matter what kind of services you need—creating a retail banking customer journey map, benchmarking, improving your KYC procedure, or managing CX transformation from A to Z, we’ll happily help you begin a new chapter in the relationships with your customers.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.