Expert Insights: How to Build Equity Management Software in 2025

Updated: January 22, 2024

In today’s fast-paced business environment, it’s hard to find the right tool to manage a company’s equity. This is where equity management software comes in handy.

When it comes to recording an organization’s matters, it is essential to ensure swift data collection, a pleasant interface, continuous maintenance, and security. The Relevant team can help you with all of those, whether you want to create the software from scratch or integrate the solution with your existing platform.

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usIn this article, we will tell you everything you need to know about equity management solutions in 2024. Particularly about how to develop such software for your company.

Table of Contents

The state of the equity management software market

The equity management software industry has developed tremendously in recent years due to the quickly changing requirements of businesses throughout the world. Let’s learn more about the market development possibilities and the importance of automation in the financial industry.

Equity management software market

Equity management is the process of creating and managing proprietors in your organization. This may appear simple; however, it entails everything from tracking and recording changes in ownership to renewing reports, interacting with stakeholders, advising your senior management team, and remaining compliant.

According to Grand View Research, the worldwide wealth management software market is anticipated to reach $9.14 billion by 2028, growing at a CAGR of 13.5 percent from 2021 to 2028. The rising need for effective asset management, corporate finance, and other financial guidance is related to economic expansion.

The increasing usage of equities management software in large and medium-size corporations is supporting market growth. Despite a severe economic crisis, the equity management software market has rebounded via the implementation of new strategies and the development of new technical capabilities.

Types of equity management software

Choosing the right equity management software solution for your company can be a grueling task. In this section, we will look at the main types of equity management software so it is easier to determine which tool you should use.

- Portfolio management software for investors: Private equity firms that require investment management tools can utilize portfolio tracker software to monitor key performance information from their portfolio companies. By examining financial, administrative, and ESG indicators in one location, you can make faster choices on portfolio businesses.

- Cap table management software for private companies: By utilizing cap table equity management software, CFOs and other senior leaders may gain comprehensive insight into critical and game-changing cash flows. You can manage your option administration, cap table, ESOPs, and stock options and ensure you understand how new term sheets influence your future in a single interface.

- Equity management software for service providers: It extends integration capabilities and white labeling, making it simple to include stock management into your service offering. This application also gives access to a centralized dashboard and control over and maintenance of several equity databases.

Top 5 equity management service providers

Now that we know the technical details, it’s time to jump from theory to practice. Here are the most popular service providers who applied their core competencies to the development of equity management tools:

Carta

Carta is the first equity management software on the list. It is a powerful tool that streamlines the process of controlling a company’s equity, stock, and options holdings. Carta is a sophisticated and user-friendly business program that offers a way for conducting valuations while keeping stakeholders up to date on the state of their firm.

Capshare

Capshare is a complete cap table management system that transitions businesses away from spreadsheets and toward a more simplified, effective, and time-saving method of maintaining and analyzing stock information. Users of Capshare can offer investors the information they want about their stocks or provide individuals specific access to view how many vested shares they have.

Gust

Gust Equity Management uses a total capitalization method. The software supports businesses in all stages of fundraising by handling option grants, losses, stock issuances, vesting dates, and so on. Preserving Excel spreadsheets becomes more challenging when a firm grows and obtains funds. So, Gust Equity Management assists businesses in managing their capitalization.

Shareworks

Shareworks assists businesses and investors in maintaining their stocks and equities. Users can utilize this solution to track and monitor their capital while also receiving crucial stock information. The software is appropriate for smaller and large businesses. Shareworks also assists firms in safeguarding their shareholders during blackout days by restricting trading in the system.

Ledgy

Ledgy includes several functions such as fund, portfolio, and compliance management. It is a scalable, adaptable, and user-friendly equity management system designed for fast-growing businesses. Because the program is hosted in the cloud, users may access it from practically anywhere at any time.

Benefits of a custom equity management solution

There are five main ways a company may benefit from using a custom-made equity management tool. Let’s check them out:

- Lead the charge in finding more investors: Since the procedures are computerized, an equity management platform helps you to stay organized so that you can spend less time on documentation and more time bringing in new investors.

- Scalable growth: On a centralized screen, all of your equity and financial information is consolidated and updated automatically, saving you time and money as you grow. This can help with economies of scale in the long run.

- Audit ready: The $100,000 ISO limit prohibits individuals from classifying more than $100,000 in exercisable options as incentive stock options (ISOs) in a calendar year. So you never have to bother about laws like the $100,000 ISO limit since equity management software lets you comply with them.

- Stakeholder satisfaction: Investors and employees can acquire electronic securities, adhere to vesting schedules, assess their potential tax liabilities, and execute options all in one location. This enables everyone in the company to track sensitive information as and when required without relying on multiple permissions.

- Round-the-clock help: There is a chance that the software will encounter technical or other technological problems, resulting in a time out. For such cases, a support crew is available around the clock to assist you in such circumstances.

How to build equity management software

The creation of equity management software is a time-consuming and complex process that needs appropriate coordination among multiple teams (design, development, testing, etc.) Continue reading to find out the software’s key features and principles of work.

Features of the perfect equity management solution

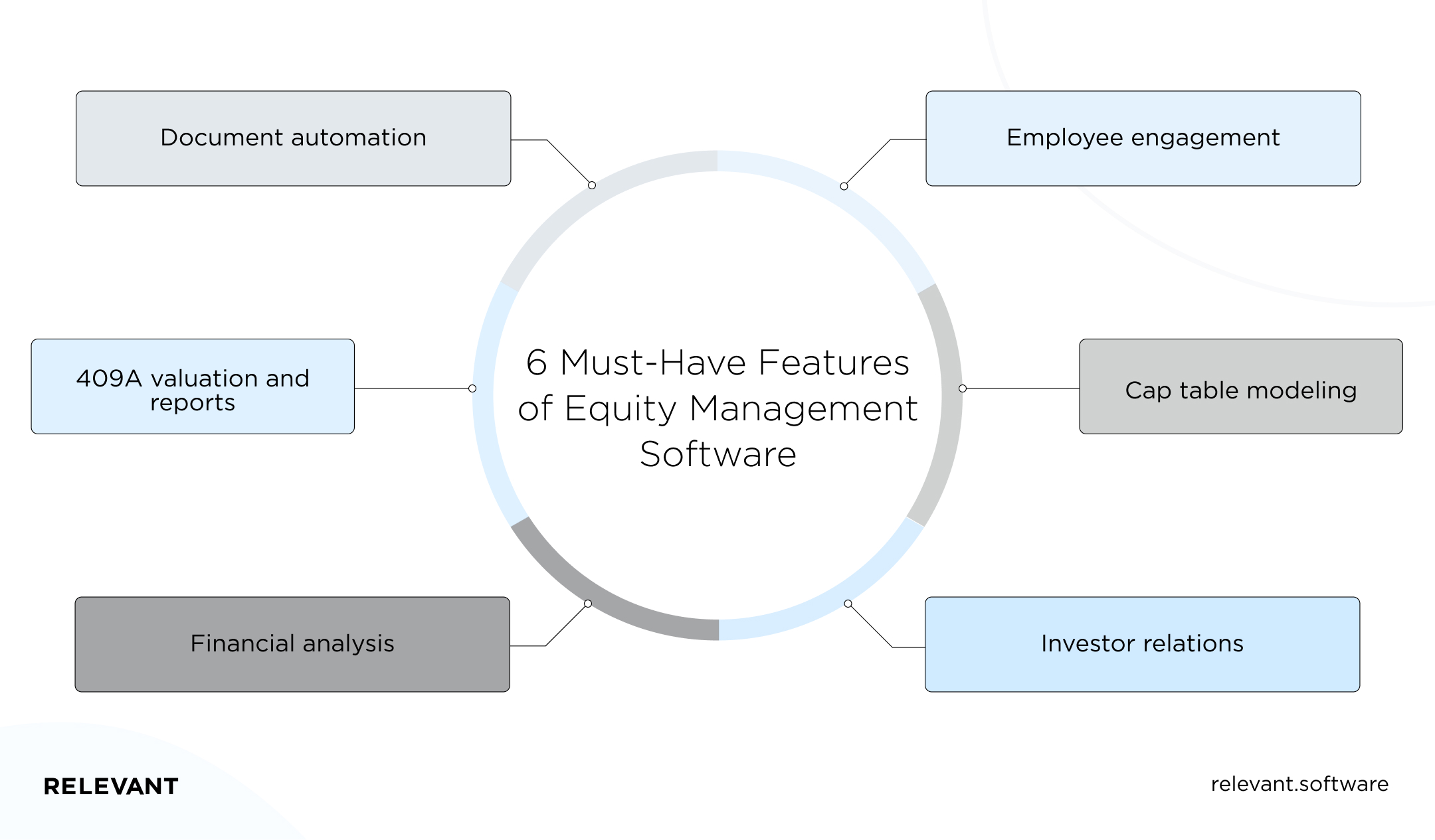

There are various features of equity management software, and the most important ones include:

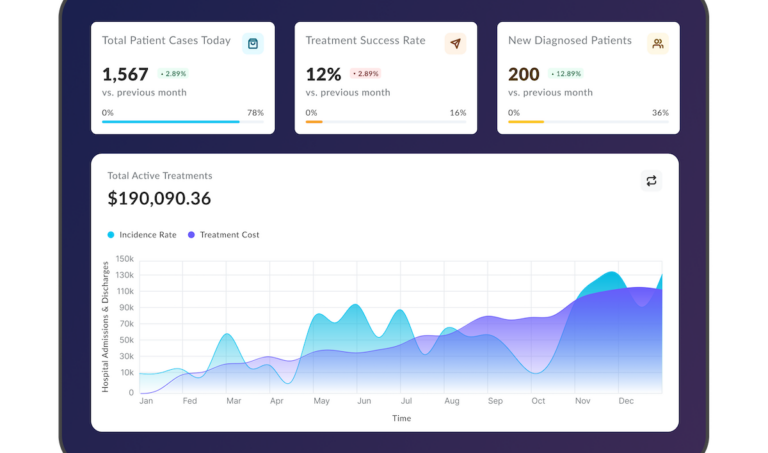

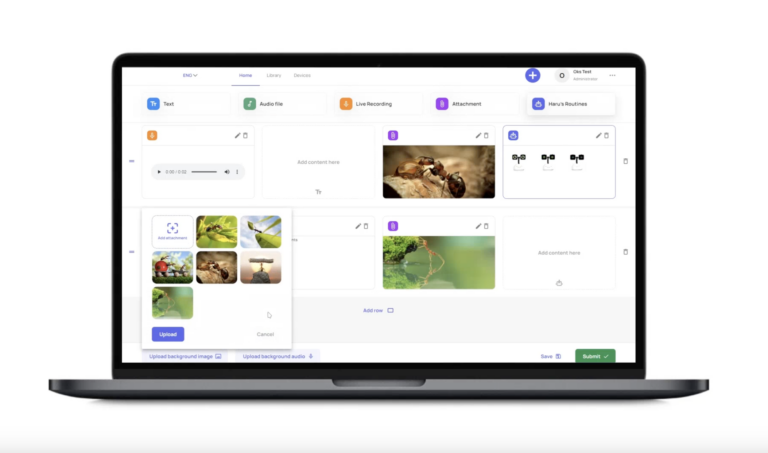

- Employee engagement: Inspiring dashboards that display present and future values of their ownership in your company can encourage your staff and keep them connected and intrigued in your firm’s day-to-day operations management.

- Cap table modeling: As your business continues to issue securities, the cap table becomes more complex, so the ideal equity management system must assist in the development of realistic financing and predictions with liquidation preferences and waterfall assessment.

- Investor relations: A good equities management solution should engage your shareholders while also providing detailed dashboards, KPI sharing, and automated monitoring. Thus, every investor has real-time access to their portfolios and can make informed decisions based on their goals and risk tolerance.

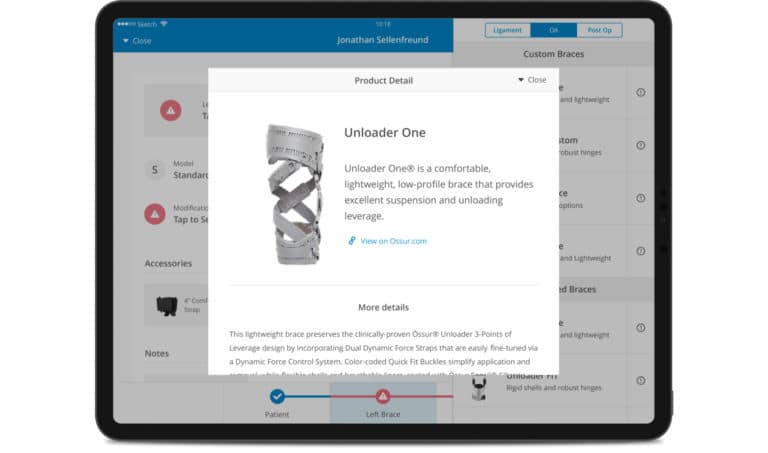

- Document automation: Maintaining and registering all of the company’s shares is essential. This is also a key task that the software must perform. A strong equity management system should help with configurable variable templates and eIDAS-compliant signatures that are automatically linked to transactions.

- 409A valuation and reports: 409A valuation companies can assist you in determining the worth of your company. A solid equity management software should give smooth 409A values, as well as simple tables and graphs, including business data. These valuation reports should be of excellent quality and understandable to the majority of stakeholders.

- Financial analysis: Smart equity management software maintains all your equity and stock records and information in their system, making it simple to create financial analysis and full records, so you understand where your firm stands. This helps with financial management, forecasting, and capital restructuring decisions.

7 steps of custom equity management software development

Except in rare instances, the software development life cycle consists of seven steps that must be completed in a precise order:

- Planning: The planning phase is concerned with defining the problem, obtaining the information required to develop equity management software, and reviewing all relevant data. This is an essential aspect of the project since proper planning may eliminate the bulk of difficulties.

- System analysis: System analysis is simply a conceptual study to determine the viability of your proposal. The objective is to investigate the concept of your equity management software through the eyes of a corporate executive attempting to avoid a losing proposition.

- Design and prototyping: You create a completely fledged design for your equity management software during the design process. All conceptual tasks are undertaken here so that the software developer may begin to work on the project.

- Software development: The equity management software is assembled throughout the development stage. This entails several procedures, including coding, infrastructural setup, and providing documentation on how the process works.

- Testing: When most of the work is completed, it may be sent to the database for testing. To detect software problems, the QA team utilizes technologies such as automated testers to aggressively test scenarios.

- Deployment: When everything is ready after testing, the equities management software is released. During the launch, support teams of designers and engineers collaborate to check for bugs and ensure that the software is usable.

- Maintenance and updates: The software needs regular maintenance and upkeep since numerous security procedures and techniques are required from time to time.

The resources involved in software development

The IT industry is expanding daily, and the need for professional development services has skyrocketed. Outsourcing can assist you not only with saving money on internal personnel but also in acquiring the best specialists from all over the world.

For example, you may outsource software development to Eastern Europe, particularly to Ukraine because of the low cost and high level of competence. Hiring a specialized development team in Ukraine is ultimately top-tier outsourcing IT practice, assuring outstanding service delivery.

Here is a cost-benefit table for hiring different specialists in the United States, the UK, Germany, and Ukraine (USD):

| Backend Developer | Frontend Developer | Full Stack Developer | QA Engineer | |

| London, United Kingdom | 10400 | 10630 | 10365 | 7660 |

| New York, USA | 8800 | 9325 | 12150 | 6470 |

| Berlin, Germany | 6890 | 6740 | 8450 | 8525 |

| Kyiv, Ukraine | 4000 | 4000 | 4000 | 3000 |

How to choose an equity management software development firm: Tips

There are several things you need to pay attention to before choosing the team for building the best equity management software:

Check out the portfolio

It’s very important to check out the background, experience, and portfolio of the development company before outsourcing your development process to them. For instance, Relevant provides fintech software development services that help companies get ahead and stay ahead, from financial services to peer-to-peer lending and from payroll fintech solutions to financial software.

Know the team you are collaborating with

The more experience a team has, the better the software development process will be. Our team has over eight years of expertise in custom software development and serves clients in Europe, the Americas, and other parts of the world. We can’t wait to talk to you, learn about your business needs, and help you build or improve your software solution.

Pay attention to clients’ experience

User experience is an integral part of your software development process. It’s very important that you learn about what previous clients say about your development company. Relevant has an excellent record, and you can check out what our clients say here.

Summary

Equity management software is intended to assist businesses in managing their capitalization. It alleviates the difficulty of utilizing spreadsheets to manage corporate capitalization tables as well as the time-consuming paperwork.

The most effective approach to build the software is to turn to professionals. The Relevant team, which has extensive expertise in software development, will be happy to assist you with the creation of an equity management platform according to your particular requirements.

FAQ

How is equity management software used?

Equity management software benefits both the organization’s share ownership and the management of the company’s cap table. It is used to track and manage the complicated procedures of issuing equity, maintaining compliance, getting 409A values, and staying on top of capitalization tables.

What are the examples of equity management software solutions?

The most prominent examples of equity management software solutions are:

– Carta

– Solium Shareworks

– Gust Equity Management

– Capshare

– Captable.io

– Backstop

How do you choose the right equity management software development company?

Look for a software development firm that can guarantee the proper management for your project. Building software necessitates a significant amount of time, effort, and talent. Look for a software development company with a solid portfolio and relevant experience.

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us