Building a secure loan automation platform for a leading Caribbean lender

Reduced loan processing time

From 30 sec → 3 secSoftware licensing costs saved annually

$100,000Maintenance costs cut

4x reductionTHE CHALLENGE

How to modernize and automate a loan management system without relying on rigid third-party tools?

A licensed loan company in the Caribbean wanted to replace its legacy software and eliminate the inefficiencies in its loan processing workflows. The existing platform required high licensing fees, offered limited flexibility, and couldn’t adapt to changing compliance requirements.

The goal: build a secure and fully automated platform for loan applications, approvals, disbursements, and repayments. It had to work for both customers and internal loan officers, and support legal compliance, real-time processing, and financial reporting.

The client brought in Relevant Software to create a system that could replace outdated tools, cut operational costs, and support future growth. We had to design and build the entire solution from scratch, covering core workflows, data handling, and long-term scalability.

CEO & CFO at Caribbean Loan CompanyWe are pleased to recommend Relevant Software as a strategic technology partner. What stood out most was their realistic approach to managing expectations. They delivered a tailored platform that aligned with our needs and gave us far more flexibility than any turnkey solution we used before.

Have a similar challenge?

We can help!

Book a free consultationTHE SOLUTION

A full-featured financial operations platform with built-in automation and customization

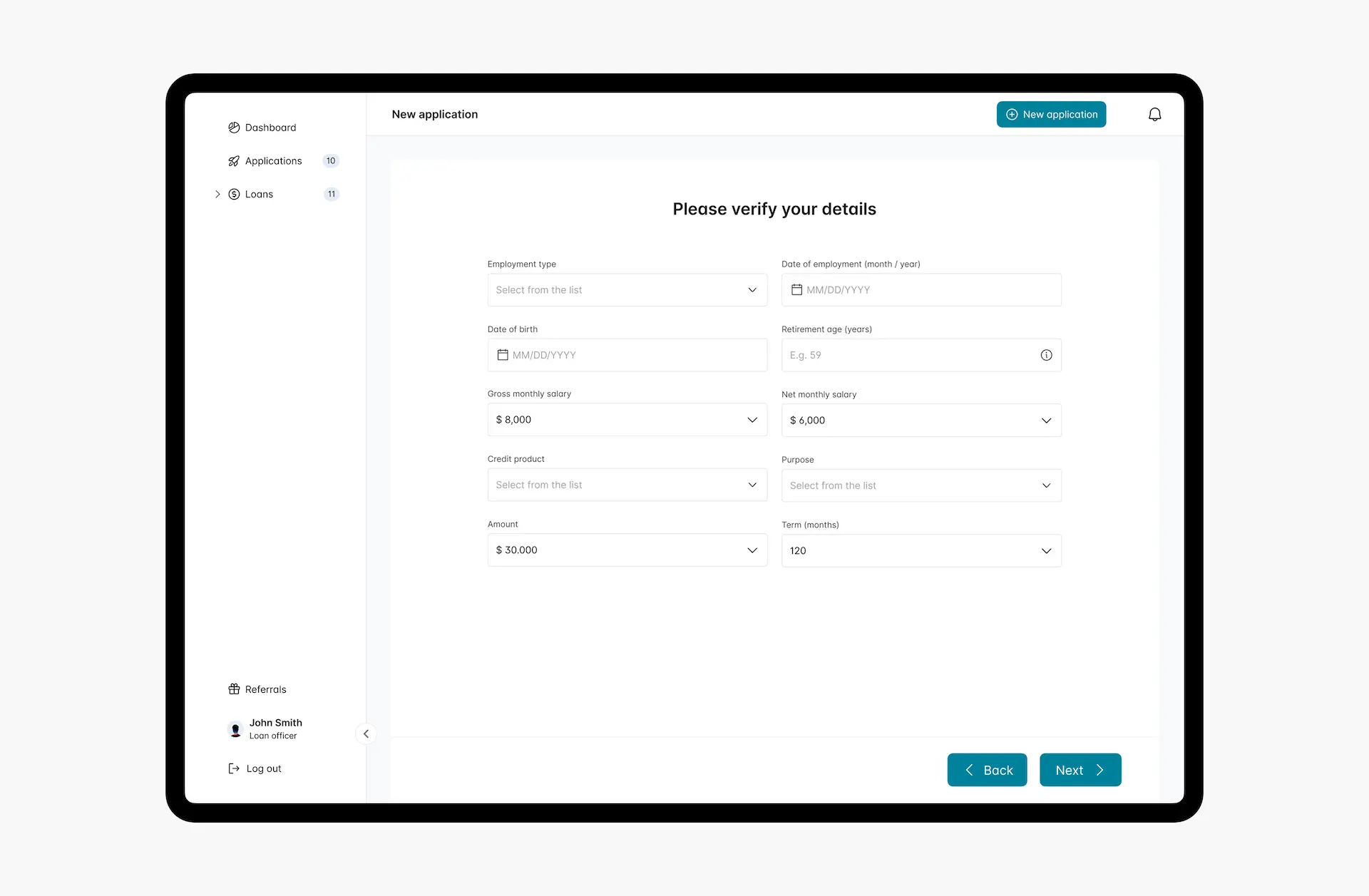

Loan application

Our developers built a fully digital loan application system that lets users submit requests with a few clicks. Customers can complete the form on their own or request help from a loan officer — no paperwork involved.

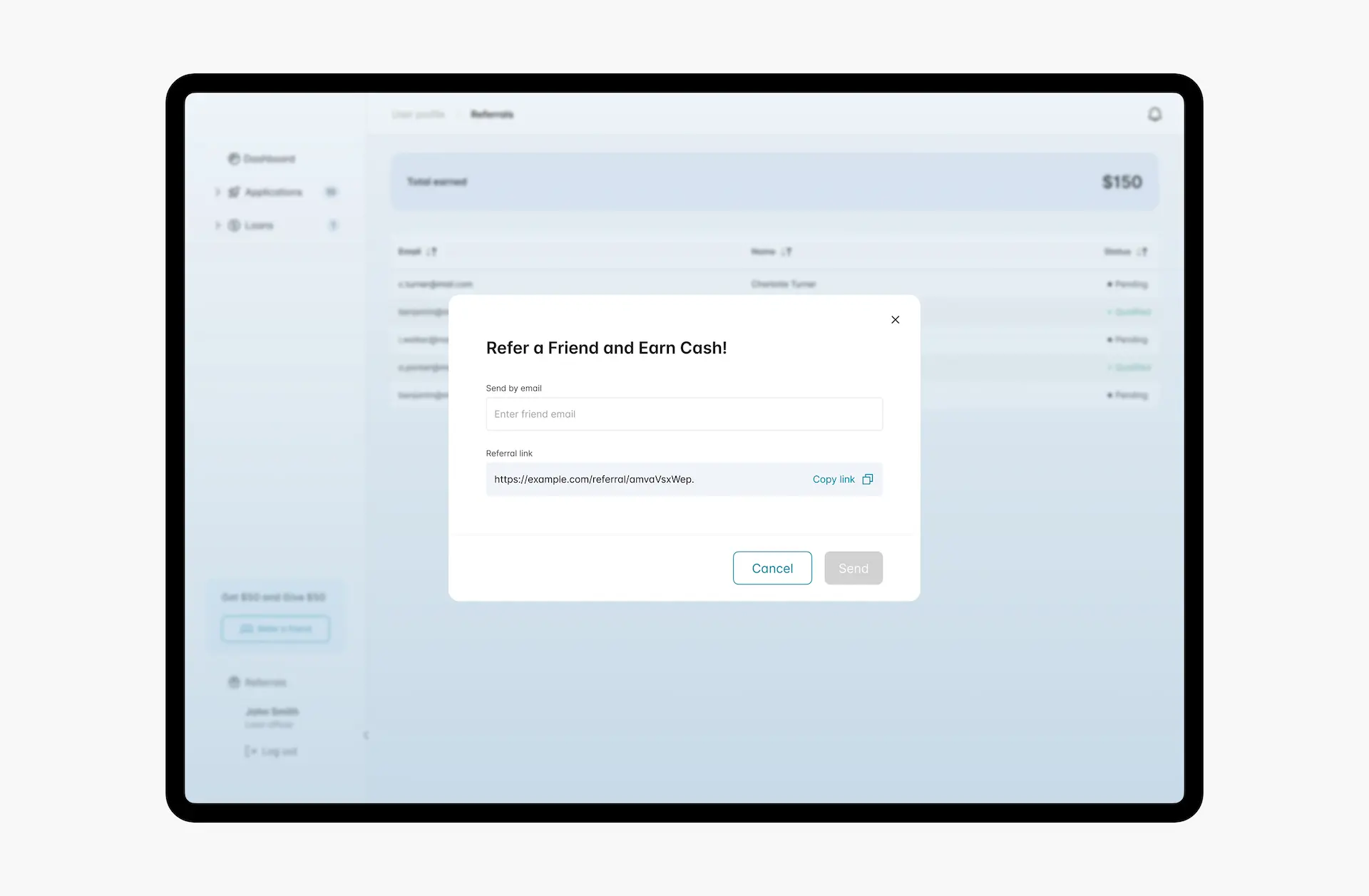

Referral program integration

We added a built-in referral program that rewards verified users for inviting others. Once a referral gets approved, the original user receives a bonus automatically.

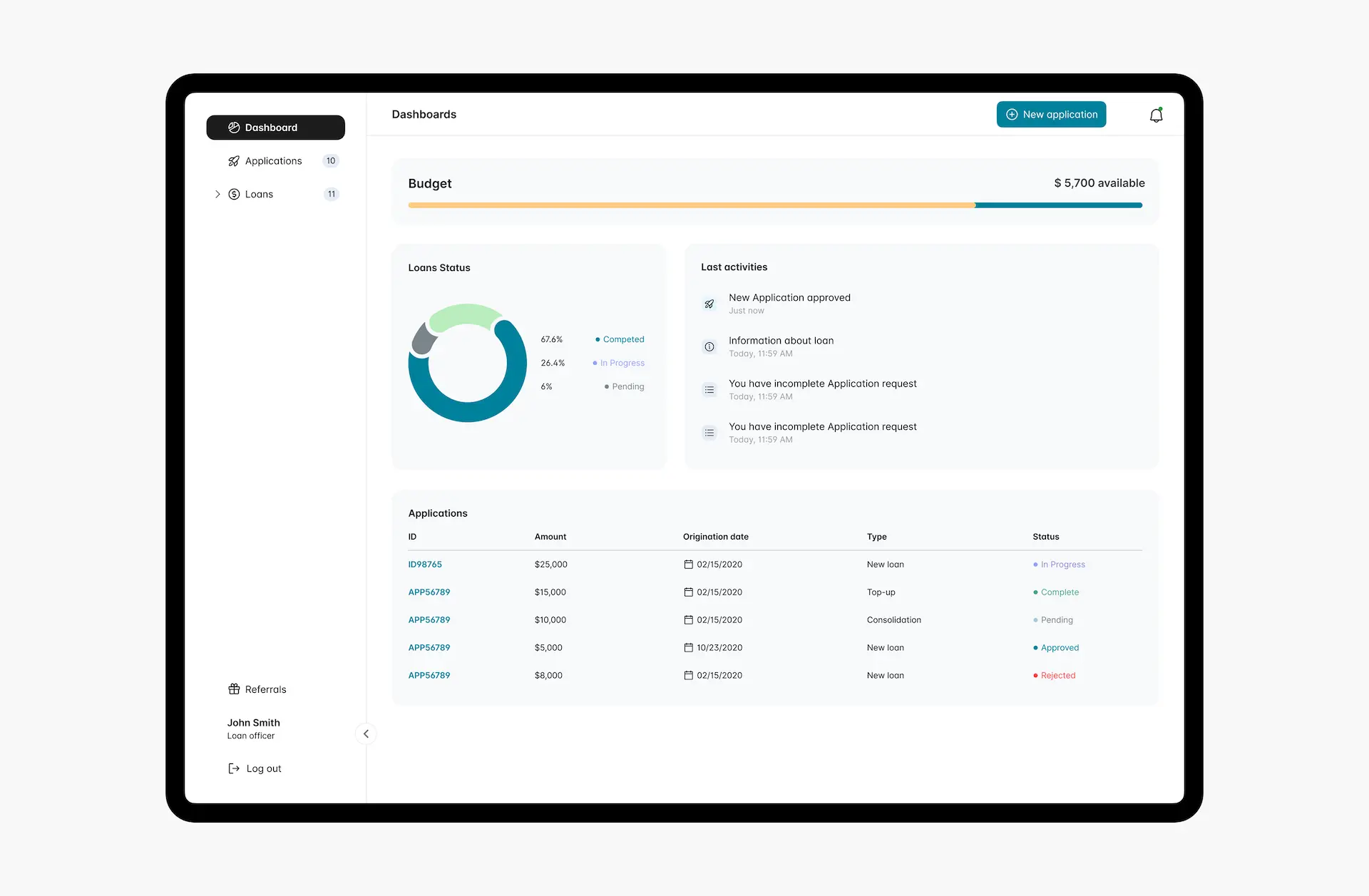

User-friendly customer portal

We created a secure portal where borrowers can apply for loans, check their status, review transactions, and calculate repayment plans — all in one place.

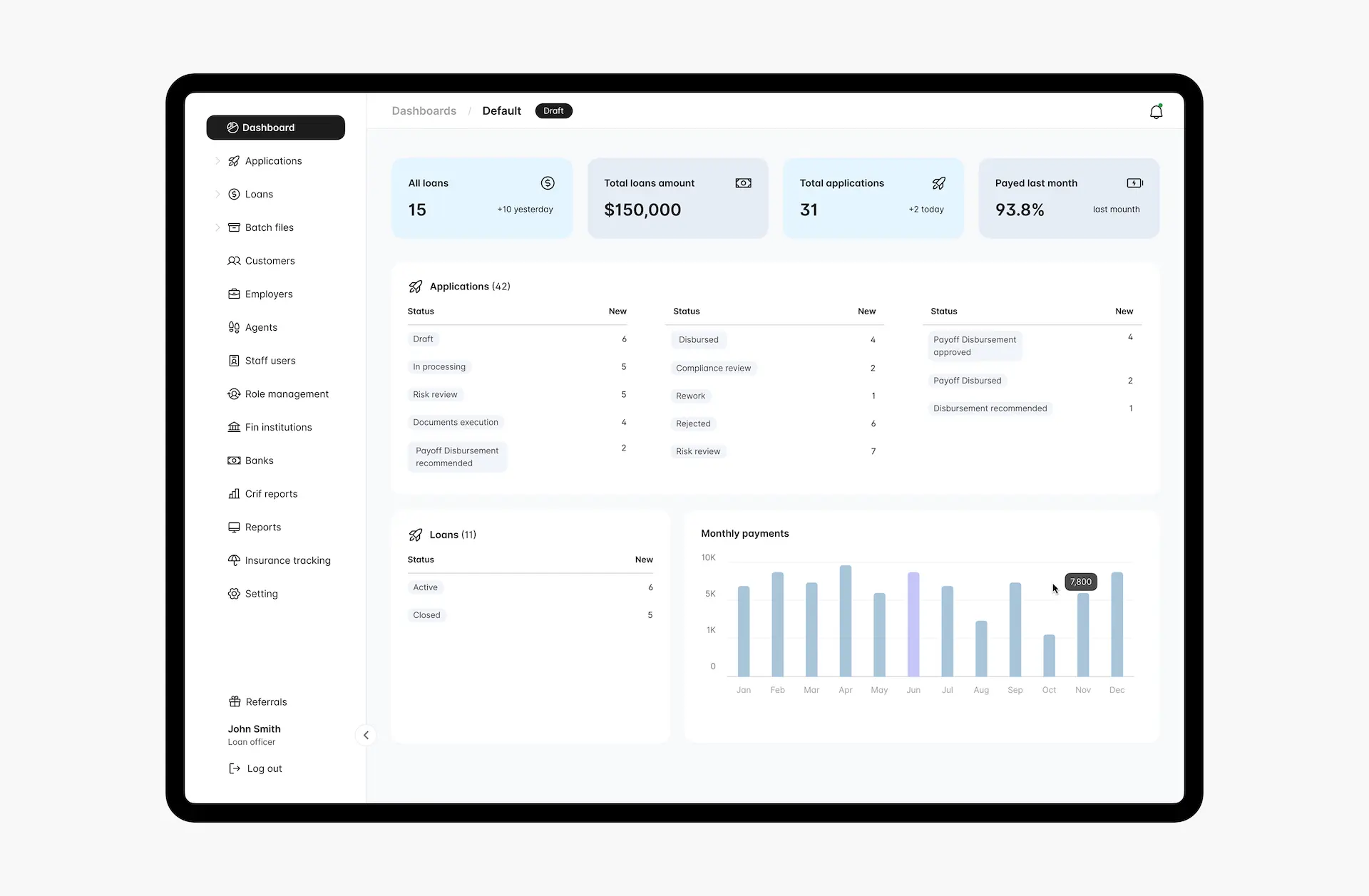

Dashboard for loan officers

Our team delivered a centralized dashboard that helps loan officers manage applications, track performance, and generate documents. Built-in leaderboards highlight top performers and streamline daily work.

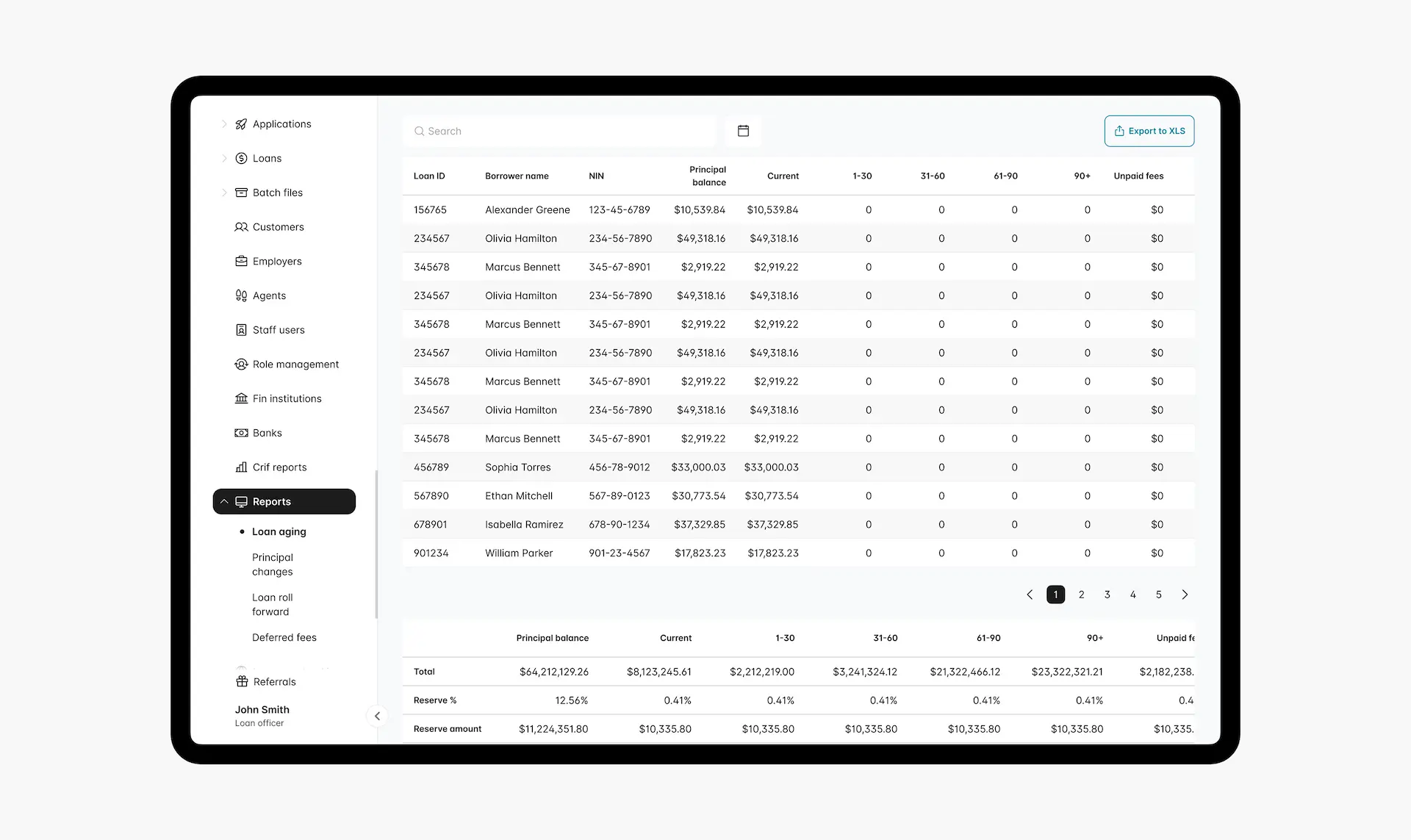

Enhanced reporting tools

We developed reporting modules tailored to the company’s needs, including Long Aging, Principal Changes, and Deferred Fees. These reports help staff track loan performance and meet regulatory standards.

THE RESULT

Paperless,error-free workflow

Automated document generation, e-signatures, and digital records eliminated manual bottlenecks and compliance risks.

Flexible and future-proof app

White-label features and modular components allow the app to adapt quickly to new business needs or policy changes.

2× more loans processed with the same team size

The platform allowed the client to handle twice the loan volume without hiring additional staff.

THE CLIENT’S REQUEST

- Replace expensive third-party software

- Build a digital loan management system

- Enable automatic disbursements and payroll deductions

- Improve officer productivity and customer experience

- Ensure compliance with financial regulations

WHAT WE DID

✓ Custom financial automation platform with white-label capability

✓ Full digital loan lifecycle with document generation and e-signatures

✓ Real-time disbursement and repayment automation

✓ Officer dashboard with analytics, approval tools, and reporting

✓ Compliance-ready infrastructure built for scale

CEO & CFO at Caribbean Loan CompanyFor companies seeking innovation and thoughtful engagement, Relevant Software offers a dynamic and collaborative experience that genuinely adds value.

Be our next success story

Share details about your project and book a free call

with us to discuss your development strategy.

Success stories across industries

Let’s talk about your project

- Our experts will analyze your requirements and contact you within 24 hours.

- If needed, we’ll sign an NDA to guarantee your privacy.

- You`ll receive a detailed proposal with estimates, timelines, and CVs.