Fintech Product Development — The Ultimate Guide

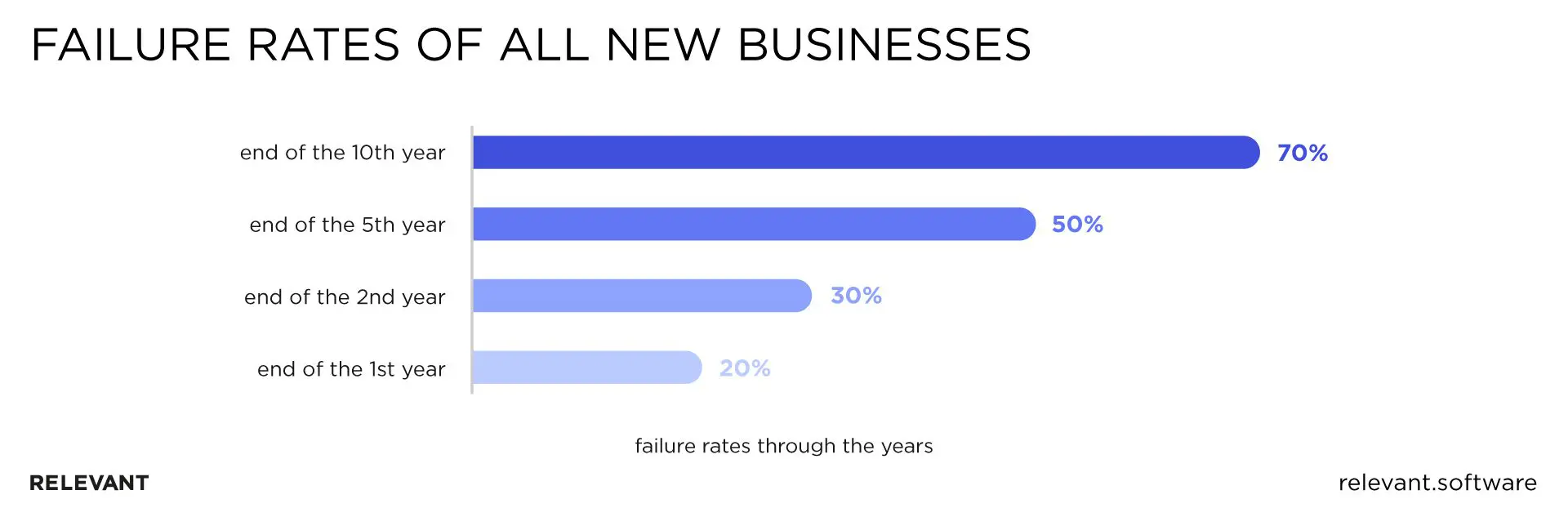

Most fintech startups struggle to become profitable. According to the 2020 Google Cloud’s fintech Focus Report, only 6% of financial services break even. But you can improve your chances of creating a successful platform. There’s no secret: you only need to build a fintech product around the customer’s needs using the right tools.

If you want to create a fintech app your users will love that adheres to regional regulations, Relevant is here to help. We’ve developed many fintech applications, including a mortgage app for UK’s FirstHomeCoach, so we can give you some tips on what to do and what to avoid in the process of developing a fintech product.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

How fintech startups comply with regulations

Financial services that don’t comply with governmental regulations are doomed. So, if you’re serious about developing a fintech app, your first step is to understand local policies.

For thorough researching, we recommend:

This should give you an understanding of the existing restrictions, conditions, risks, and licenses. Now, let’s take a look at the regulations that exist in the biggest fintech markets.

- Reaching out to companies in the same niche as your future project to learn from them

- Using a cloud-powered RegTech software to monitor and check regulations compliance

- Hiring a lawyer specializing in security laws who can analyze the legal environment

- Fintech consulting with a software development company that has relevant experience in your region

Fintech regulations in the US

Fintech businesses in the US adhere to federal and state laws. As for the nationwide regulations, you should study the following documents:

- Electronic Fund Transfer Act (EFTA). EFTA protects fund transferring using credit cards, ATMs, and other electronic transactions.

- Fair Credit Reporting Act (FCRA). FCRA regulates how financial organizations collect and use consumer report data.

- Anti-Money Laundering Act (AML). AML includes the Patriot and Bank Secrecy Acts. These documents regulate anti-money laundering measures, such as cross-border transactions.

- Gramm-Leach Bliley Act (GLBA). GLBA obligates financial services to disclose how they will store and share their user’s data.

- Jumpstart Our Business Startups Act (JOBS). JOBS is a set of requirements for crowdfunding platforms. This act includes requirements for disclosure, registration, and fundraising limits.

Fintech regulations in the EU

The European Union has many laws that apply to different types of financial services. The most widespread regulations are:

- Payment Services Directive (PSD). PSD1 and PSD2 regulate obligations for electronic payment service providers and users. This includes transactions, refunds, payment revoking, and liability for unauthorized payment tools.

- General Data Protection Regulation (GDPR). GDPR controls how fintech institutions process client data and regulates how it transfers beyond the European Economic Area.

- Fintech Action Plan (FAP). FAP introduces universal rules for operations in digital finance, retail payments, and crowdfunding platforms.

- Markets in Financial Instruments Regulation (MiFIR). MiFIR contains standards for investment firms and trading platforms with a focus on transparency during trading processes.

Fintech regulations in the UK

The United Kingdom doesn’t have a unified regulatory framework for fintech companies. Therefore, financial SaaS companies must evaluate their business’s type, scale, and size to understand if it falls within the regulatory perimeter.

There acts you should examine are:

- FCA Handbook of Rules and Guidance (FCA). The FCA Handbook contains requirements for insurers, investment businesses, banks, and a wide range of financial services.

- Prudential Regulation Authority (PRA) Rulebook. The PRA Rulebook sets standards for financial institutions and assesses the risk these firms pose to the financial stability of the market.

Policies in these regions are constantly changing to keep up with the evolving fintech market. Now, let’s see how the fintech environment looks today.

Important trends and challenges in fintech

“Blockchain will fundamentally change financial systems… It will be applied in many areas because it is about trust, credit, security and the privacy of data”

Jack Ma, founder of Alibaba and co-founder at ANT Group.

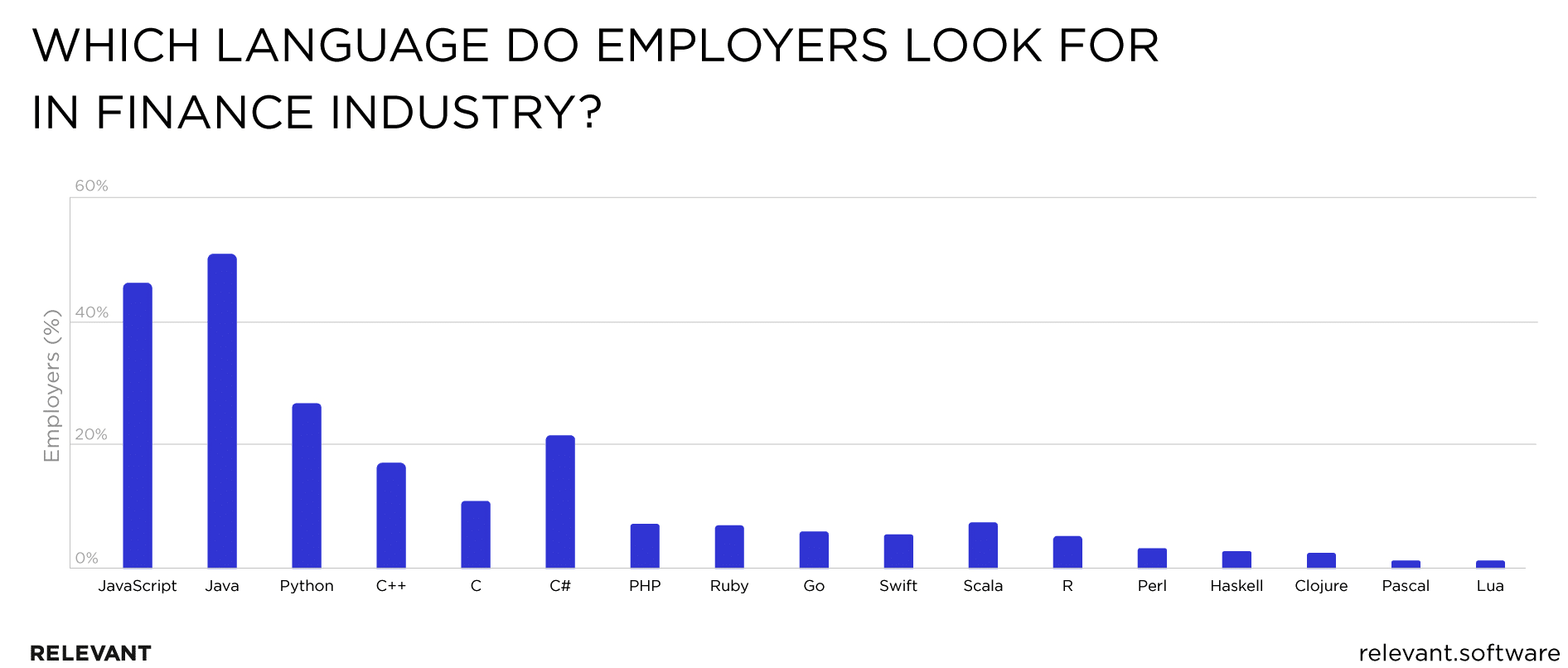

The financial technology market keeps evolving, prompting more companies to try out innovative solutions. Let’s look at the most important trends that could influence your approach to fintech product development.

- AI and Machine Learning. Autonomous Research predicts that Artificial Intelligence will help financial service firms reduce costs by 22% by 2023. The reason is simple: AI and machine-learning-powered platforms allow companies to analyze large blocks of data and truly make informed decisions. Furthermore, advanced algorithms help prevent fraudulent activities and unsanctioned account access.

- Blockchain. A decentralized P2P ledger technology that stores time-stamped blocks of unmodifiable data, blockchain is all about transparency and data privacy. This helps build trustful relationships between users and service providers. Expect the fintech landscape to be driven by this technology.

- Microservices. Many fintech apps are built as a set of interconnected modular blocks with decentralized data management. This approach has made online payment, investment, and money lending apps more responsive for users and easy to maintain for engineers.

- Big Data. The amount of data gathered from devices daily is estimated in quintillions. Big Data allows fintech companies to transform raw data into insightful information about customer’s behavior. This helps create the most effective marketing strategies and development opportunities.

- Cybersecurity. According to the 2019 CSBS Survey, 70% of bankers consider security the most pressing concern for future profitability. It gets worse: data breaches cost up to $18.3 million per company based on the 2020 Accenture’s Cost of Cybercrime Study. In other words, SaaS companies and institutions in fintech must focus on security measures above all else.

- Digital banks. Over 31% of respondents are using banking services via online apps, according to the 2020 Study by Provident Bank, and only 7% don’t use digital banking (and the vast majority of them are well over the age of 50). This means the digital banking domain is going to be the go-to option for customers who prefer convenient transactions and fund management.

- Autonomous finances. Financial technologies can help users make decisions about where to spend or invest their money. Just like navigation apps create the optimal route for your destination, autonomous finance apps use AI to help customers make the most out of their money. Autonomous finance is still in its early stages, but it’s a trend companies driven by innovation should look out for.

The fintech landscape is currently driven by AI and automation. These trends are universal for all types of financial technology applications.

Types of fintech apps

You can learn a lot about fintech by researching other apps in the industry. This would help you incorporate the elements of successful apps and identify useful features your competitors may lack.

Now, let’s look at different types of fintech apps and some of the most successful ones in each category.

Payment

Online payments are undoubtedly the most popular category of fintech. Thanks to the advancement of payment gateways, digital money transfer, and currency exchange have become the norm for businesses and consumers worldwide. Read also: How to Develop a Palm Scanner Software Like Amazon One

If you want to see what kind of functionality users come to expect from a fintech product, just look at the most popular digital payment services.

Payment services:

- PayPal. A leading payment platform that allows service providers and vendors to make transactions with a range of payment options.

- Payoneer. A popular payment service that supports cross-border money transfers and integrates with many freelancing platforms.

Lending and mortgage

Lending and mortgage apps are prime examples of how fintech makes some businesses easier and more transparent. The traditional money lending services are tedious and needlessly complicated for a modern user. Now, innovative lending and mortgage software automates most time-consuming tasks and checks with credit bureaus, speeding up the process drastically.

Lending and mortgage services:

- Wells Fargo. Efficient application with an organized layout for checking deposits and managing home loans.

- MoneyLion. A convenient lending platform that allows users to establish credit card history and take small loans with no interest.

Online banking

Digital-only banks are an excellent option for fast transactions and seamless fund management from your mobile device. Unlike traditional banks, you don’t even have to leave your house to create an account and deposit funds.

Online banking services:

- Point Card. A flexible banking app designed to satisfy contemporary customers with easy and transparent money management.

- Revolut. A digital-only bank with free international money transfers and access to the cryptocurrency exchange.

Cryptocurrency

With blockchain on the rise, many financial organizations are doubling down on cryptocurrencies. It also helps that the crypto transactions are anonymous, swift, and, most importantly, lie outside of governmental regulations. However, as crypto usage grows, understanding crypto taxes implications is essential for users and investors alike.

Cryptocurrency services:

- Coinbase. A popular platform where you can easily buy and sell most types of cryptocurrencies.

- Binance. A crypto exchange platform with a highly secure platform and a straightforward interface.

RegTech

RegTech refers to regulatory software that allows fintech companies to analyze regional policies. These platforms automate the monitoring processes and minimize human error. Needless to say, they are handy for multi-regional apps.

RegTech services:

- 6clicks. A platform designed to automate global compliance check-ups and risk assessment.

- Alyne. Advanced risk management and regulations monitoring SaaS with an extensive library of control templates.

Investment

Investment services and stock trading apps allow consumers to invest in financial assets. Furthermore, some of the key features of these apps include data analytics and recommendations for investments.

Investment services:

- Betterment. A digital platform that helps users invest in the right assets and build a portfolio.

- E*TRADE. An innovative service that suggests when and how to invest and provides comprehensible guides for online trading.

Insurance

Digital insurance services are designed to attract customers with mobile apps, data science, and other time-effective solutions. Getting insurance online is the preferred choice for most users who desire to speed up the otherwise excruciatingly slow commission process.

Insurance services:

- Credit Karma. A platform that offers free credit scores, allows comparing offers for loans and provides alerts for credit history changes.

- Bitrix24. A worldwide customer relationship management platform for insurance agents and other financial companies.

Personal finance

Personal finance services are useful for budget management and planning. This category of apps is trendy among the general public because it helps analyze expenses and forecast investments. You should check several personal finance apps to see what features customers expect from a contemporary fintech platform.

Personal finance services:

- MoneyPatrol. A service that allows managing multiple financial accounts (banks, PayPal, credit cards) from one platform.

- Mint. A straightforward portal for tracking the money flow that integrates with bank accounts and other fintech services.

Crowdfunding

Crowdfunding is a popular way to raise money. The low-risk nature makes crowdfunding platforms the desired funding choice for startups. These services usually have an easy-to-use UI, investment charts, a detailed payment history, and a comment section to keep funders engaged.

Crowdfunding services:

- Kickstarter. The most popular portal for voluntarily funding all types of projects, including other fintech apps.

- Patreon. A membership platform where users can financially support their favorite content creators.

Despite a wide range of categories, these apps share similar features users expect to see.

Key features for fintech apps

Looking to attract a bigger user base? Here are the features worth adding if you want your fintech app to meet consumer expectations:

- Intuitive interface. A compelling and easy-to-use interface with fast sign-in is what most users expect from the app. Besides, an excellent UI can make your fintech app stand out from the competition.

- Payment gateway. Your app shouldn’t complicate basic financial operations, such as money transfers, digital payments, and balance monitoring. However, you can’t compromise security in favor of convenience.

- Security. The 2019 Report by Aite Group indicates that 97% of financial services lack proper code protection, while 90% of apps leave important data in other apps. In other words, the authentication process should be secure in addition to being intuitive.

- Personalized experience. People love it when an app is built around their needs. At the very least, you have to allow users to filter the information they receive (such as push notifications).

- User management. Some types of service benefit from multi-user support. For example, finance management apps are often used by several family members. Additionally, larger companies want their employees to share a single account for easier monitoring.

- Online chat. Fintech companies can improve the customer satisfaction rate with online chats — a more convenient alternative to phone and email support for most clients. Additionally, AI-powered chatbots can help you elevate the user experience while reducing costs. Gartner’s April–May 2025 survey of 265 customer service leaders predicts that self-service and live chat will overtake phone and email as the most valuable support technologies by 2027.

- Bank account integration. It’s hard to picture a financial service that doesn’t involve banks. The approach is simple: you will improve the overall user satisfaction if you allow managing bank accounts in your app.

- Add-on plugins. Why stop at bank integration? You can include other third-party services in your app. For example, remittance software will become more convenient if it’ll work with food ordering and finance management apps.

Now, how do you build a fintech product that people would want to download? Let’s look at the process up-close.

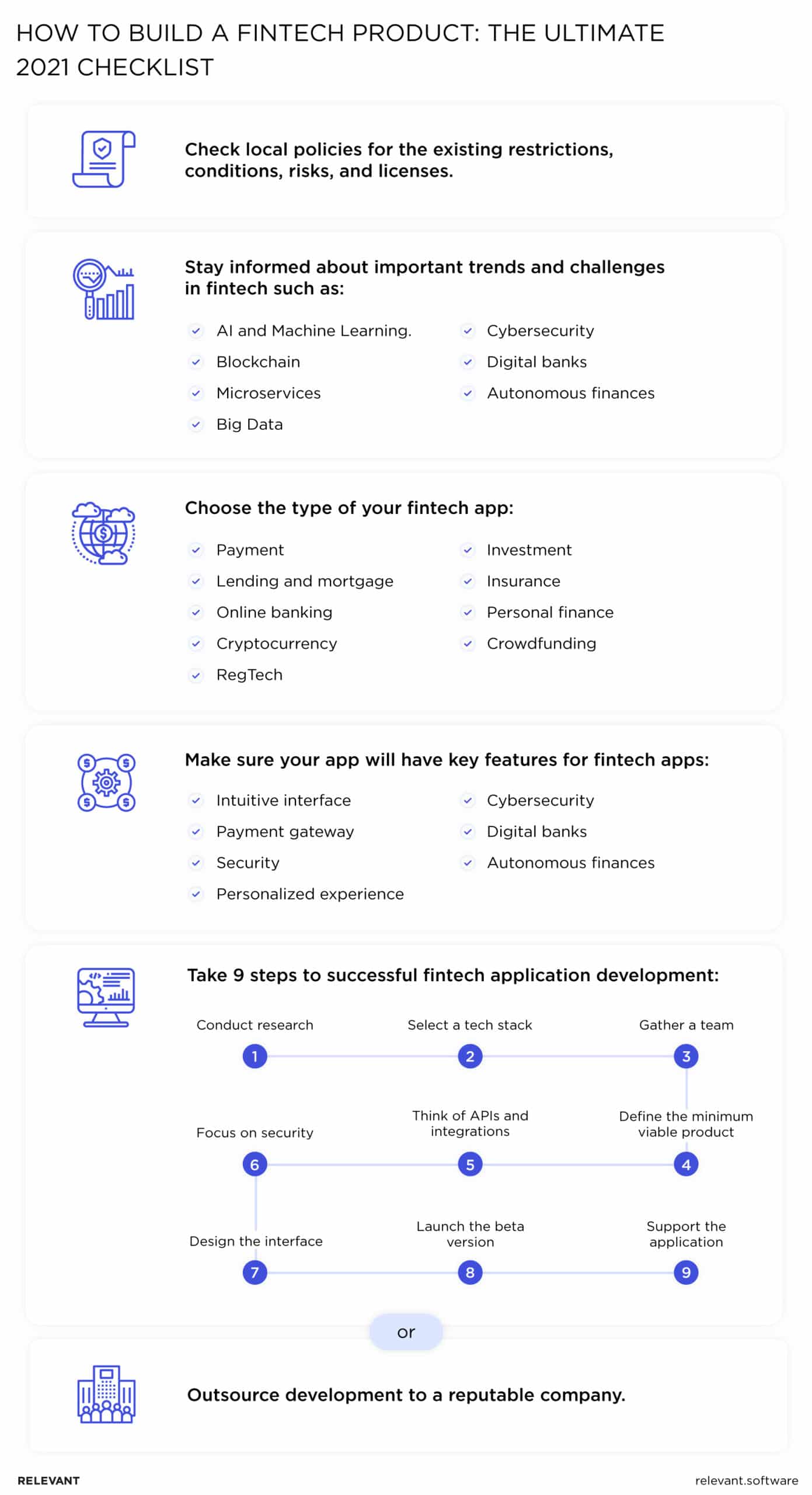

9 steps to successful fintech application development

We recommend following our proven methodology to combine your unique offerings and basic features into your product.

Step 1: Conduct research

Here’s the deal: the more complex the software project, the more time you should dedicate to research. In such a multi-faceted industry as fintech, the research phase should be your top priority.

Before you start a fintech product development, you need to study:

- Target region. Governmental institutions regulate all financial services, with many considering how to handle cryptocurrencies. Therefore, you should study the existing laws and legislative initiatives.

- End-consumer. Figure out who your customers are and what their needs are. Will they be desktop or mobile users? Why do they need your app? What makes your solution stand out from the competition?

- Scope of work. You don’t want to delay your release just as you don’t want to run out of money half-way through development. That’s why you need to start your project with a realistic budget and time estimates.

Calculating expenses and time-planning won’t be precise without a team.

Step 2: Select a tech stack

The finance industry is about adapting to evolving customer needs. Your technology stack should reflect these ideas and allow for flexibility during development. But what programming languages should you choose?

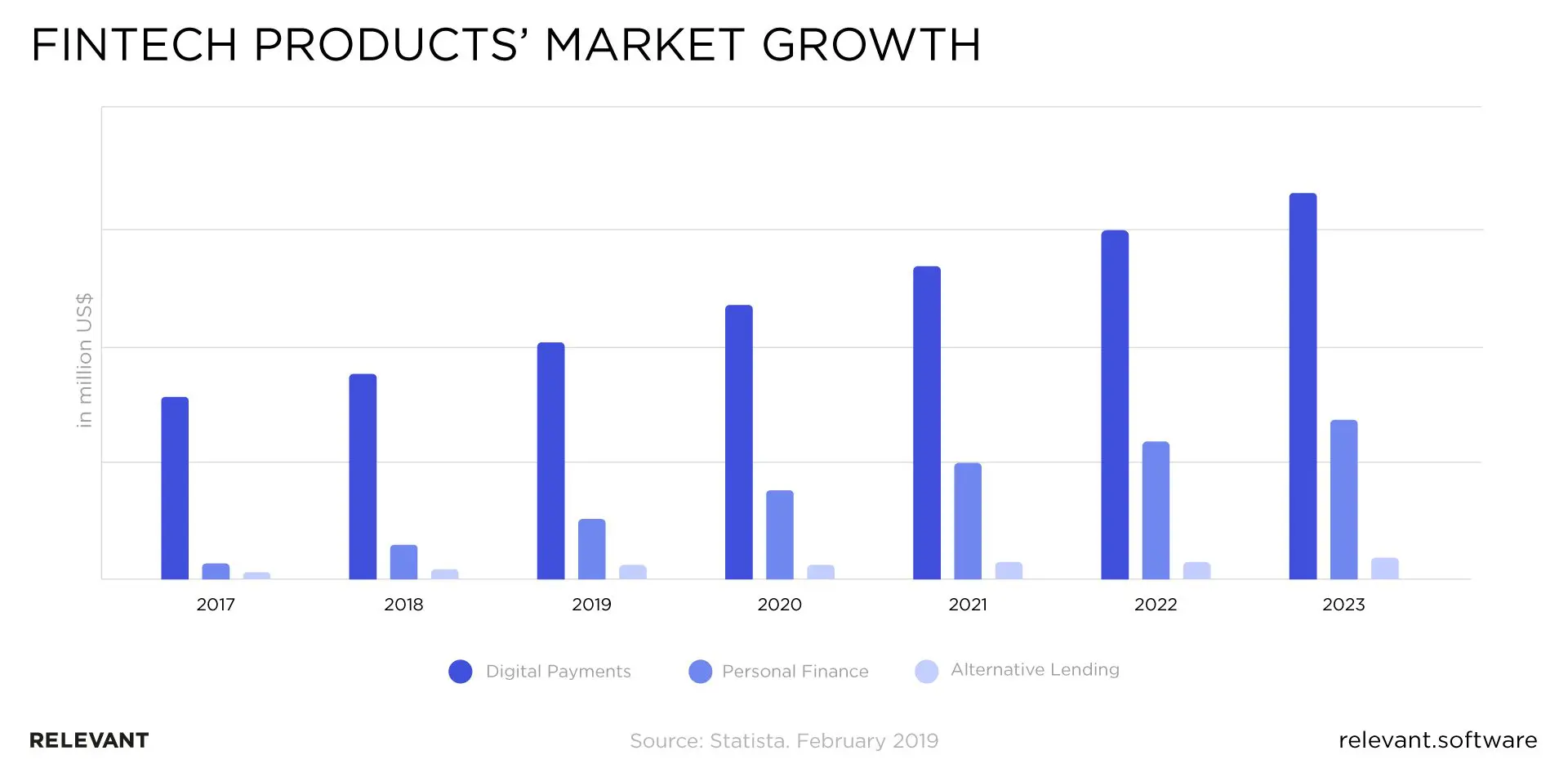

According to the 2018 HackerRank’s Developer Skills Report, Java is the most sought-after programming language for the financial services industry. It’s followed by JavaScript and Python, with C# and C++ languages close behind.

The cost of development will immediately rise when you decide to build apps for several platforms at once. If you have doubts about the tech stack, hire tech consultants or outsource the development to a dedicated team with experience using the right tools for cross-platform financial app development.

Step 3: Gather a team

Find professionals that can build a successful fintech product. Ideally, your developers should have experience with fintech apps, an appropriate tech stack, and communication tools.

How can you find a team that has the necessary skills and expertise? There are several approaches you can take.

First of all, you can assemble an in-house team. However, you’ll have to do the headhunting, interviewing, and vetting.

Secondly, you can outsource a remote team. This option gives you access to a large pool of talents and allows you to save operating costs. But the communication and management can become a bottleneck if you haven’t worked with remote teams before.

Finally, you can hire dedicated software development teams. This option allows you to enhance your software team with business analysts, UX/UI designers, front-end and back-end developers, testers, a project manager, and a product owner. It’s the most flexible option for long-term projects (fintech apps certainly fit the description).

A reputable software development vendor can assemble a committed team of vetted professionals to complement your crew. With Relevant, you can start building a fintech product with a dedicated team in just two weeks.

Step 4: Define the minimum viable product

You need to check if your potential customers are interested in your fintech app before you start full-scale development.

An MVP (Minimum Viable Product) is a prototype version of your product with barebone functionality. Putting together, MVP development services will help you test your software at the early stages of production. As a result, you’ll have more analytical data to get rid of the unnecessary features and focus on what your customers really want.

Step 5: Think of APIs and integrations

People expect fintech apps to include features like basic transactions, budgeting, bill tracking, chat support, and integrations. Even if you choose to build your features from scratch, you still need to make sure your app supports third-party APIs (Application Programming Interfaces).

After all, financial services are built around user experience, and your customers want your app to work with their favorite SaaS solutions. It’s equally important to make the integration seamless and secure.

Step 6: Focus on security

Your app will collect financial, personal, and other information about customers. As such, data leaks can have severe financial and reputational implications for your company.

It’s therefore necessary for your team to understand data protection regulations, policies, and best practices for secure fintech product development. Some of the most effective solutions include:

- Data encryption (RSA, 3DES, Twofish algorithms)

- Dynamic password change

- Multi-factor and adaptive authentication

- RBAC (role-based access control to reduce internal threats)

You can adopt the DevSecOps methodology to make cybersecurity a part of the software development process from the start. But here’s the deal: this approach requires expertise and appropriate tools. So, it might be better to seek an experienced vendor that leverages the latest fintech app security solutions.

Step 7: Design the interface

User experience and design are the core elements of a fintech app. You need to make sure every feature and interface element provides value.

If you want to maximize revenue, you should target all users, including the service provider and end-customers. For example, if you’re making a money lending app, there will be two parties: a loaner and a loanee. You’ll get more customers by creating interfaces for different user categories (like Upwork did). And even if you’re focusing on B2C services, it’s important to build the app with the possibility of a B2B interface in the future.

Step 8: Launch the beta version

Continuous testing is mandatory for software development, but it’s not enough for a successful launch. That said, there’s a proven way to improve your product before delivery.

It’s easy — start a close Beta test for backers or potential test groups. Actual feedback from customers can help you smooth out the rough edges in your app. Of course, you should take measures to secure your private data. So, make your legal team prepare legal documentation and NDA (Non-Disclosure Agreement) for testers.

Step 9: Support the application

Product release is just the beginning. As you know, fintech is a constantly changing market, so you should be prepared to maintain and upgrade your app throughout its life cycle.

As you can see, navigating through fintech development is challenging. However, you can streamline the process with the right person at the helm.

Product owner and end-customer

Communication is the defining factor for a project’s success. And we don’t mean just your team — it’s also about the link between your app and the customers.

The financial technology sector has many pitfalls. However, you can avoid them if you hire a product owner who knows how to start a fintech company and lead it to success.

An experienced product owner will understand governmental regulations, help outline the target audience, and allow engineering and testing teams to maximize their productivity. In other words, they will define the product’s goal and manage the development process.

Do you want to reduce the risks and speed up the production even further? You can achieve this by outsourcing development to a reputable company.

Our custom mortgage app for a UK fintech company

FirstHomeCoach is a UK-based firm that helps people acquire new real estate property. And it was Relevant that took on the development of the mortgage app for this company.

Our team had thoroughly researched the market to find out what customers wanted. The project manager helped find and vet the right talent for the team and picked the appropriate development methodology to speed up the production. The result was value-driven software that guides users on every step of the buyer’s journey.

The app works as several independent modules:

- Mortgage calculator. Allows estimating interest rate and monthly payments.

- Property buying plan. Guides buyers on how to save money while sticking to the timeframe.

- Deposit builder. Helps users save money for future deposits.

- Integrations. The app works with credit reporting agencies, banks, and real estate vendors.

- Security. Multi-layered testing helped us eliminate security bottlenecks and prevent data backdoors.

This is just one example proving that Relevant provides professional fintech software development services for companies all over the globe. We have the necessary tools and expertise to create a custom platform for your business needs.

How much does it cost to build a fintech app?

An average fintech app can cost from $20,000 to $150,000. Several factors affect the final price, primarily:

- Complexity (number of features you want to implement)

- Type of an application

- Tech stack

- Development team

As we discussed, starting a fintech company with an in-house team is the most expensive and time-consuming option. Outsourcing is a more cost-effective solution, but the price will depend on the developer’s location. For example, an hourly rate for developers in the USA ranges from $120 to $150. In contrast, companies in Asia charge under $30 per hour.

If you want to access one of the world’s biggest IT hubs, consider hiring a Ukrainian software development company. World-renowned platforms like SkillValue and HackerRank rank Ukraine’s outsourcing market among the world’s best.

And here’s the kicker. An innovative fintech app developed by a Ukrainian team will cost you about $40,000, while the US company might deliver the same quality for nearly thrice as much.

Conclusion

The adoption of fintech keeps rising along with the demand for easy-to-use online services. What do you need to make your project successful? First, understand policies, requirements, and the user’s expectations, and second, know how to build a fintech product around your idea.

Relevant has the necessary resources and experience to craft a proprietary app that will meet your needs. Get in touch with us to learn more about app development and regional regulations.

FAQ

What are the best FinTech app ideas to consider?

We recommend focusing on recent trends and apps that simplify traditional processes. Some of the fresher ideas for fintech include: – Mortgage u0026amp; lending software – Digital-only banks – Cryptocurrency servicesPlus, you should consider what features customers expect to see in the app.How is FinTech regulated?

Governmental entities control and oversee the financial technology sector. The policies and requirements differ based on the region, service type, scale, and revenue business.What technology aspects should be considered before developing an online banking platform?

Your team has to define the programming languages, technical requirements, security measures, and the development methodology. Afterward, you’ll have to define the scope of the MVP.Where to hire fintech consultants?

We recommend hiring consultants from software firms in Ukraine. It’s one of the best markets for vetted talents with experience in fintech software development.How to choose a fintech software development company?

You should consider the following: – Company’s experience in the financial technology services field – Case studies of successful software products – Relevant tech stack – Prices – Communication tools – Software development modelHaving a hard time choosing between promising vendors? Ask for a free consultation or a sample of their work.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.