Insurance Claims Management Software Explained: Features, Benefits, and Custom Development

Most insurance claims teams hit the same point sooner or later: claim volumes grow, but so do processing time and costs. Data lives in too many systems, manual checks increase, and reports no longer reflect what’s actually happening. Problems that once felt minor are now slowing teams down, frustrating customers, and increasing loss ratios.

Many insurers cope by patching things together. Emails replace real workflows. Spreadsheets fill reporting gaps. A few experienced adjusters handle every exception. This can work for a while, but it breaks down when volumes jump, regulations shift, or a core system fails.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

Insurance claims management software resolves the root issue by turning claims handling into a controlled, observable flow. It captures first notice of loss in one place, routes work using defined rules and ownership, keeps all documents attached to the claim, and records decisions in a way compliance teams can rely on. With insurance software development services, insurers can extend that discipline across the wider platform, from portals to integrations, and keep outcomes predictable as the business scales.

What is insurance claims management software?

At its core, insurance claims management software keeps a claim moving from first notice to financial resolution without relying on memory, workarounds, or side chats. It assigns ownership, shows the next step, and applies rules at the right moments, so the file stays structured instead of “mostly tracked.” Claims tracking software can tell you where a claim sits; a real platform helps the team move it forward.

In modern insurance operations, the claims system works as a coordination layer. It pulls policy context, customer communication, document management, and payment workflows into one flow, so updates stay connected to decisions. Each action leaves a trace that supports cost control, regulatory review, and customer trust when questions arise months later.

Strong claims management systems for insurance also handle product variation without turning the platform into three separate worlds. Health insurance quoting software, auto claims management software, and property insurance claims management software share the same lifecycle, but the validation logic, evidence requirements, and settlement rules change. Well-designed software handles these differences cleanly, allowing insurers to expand their portfolios without adding complexity or fragmentation.

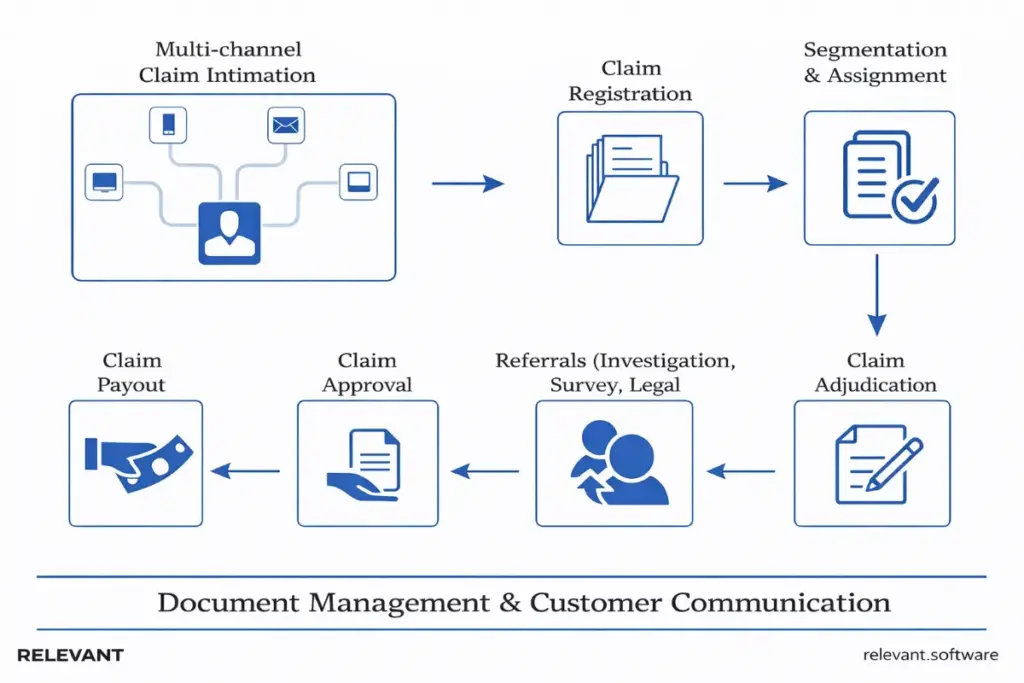

How insurance claims management software works

Insurance claims software orchestrates multiple steps across the claims lifecycle. Each stage contributes to speed, accuracy, and operational control.

Claim intake and first notice of loss (FNOL)

FNOL looks simple until the same claim arrives multiple times from different digital channels, with slightly different details. A strong claims management solution collects the same core fields no matter where the claim starts, then runs quick checks early so adjusters spend time on decisions, not cleanup.

What this step typically includes:

- Guided intake forms with required fields and basic validations

- Identity checks and contact confirmation

- Automatic claim creation with triage tags and severity hints

- Immediate acknowledgment messages with clear next steps

Claims validation and documentation handling

After FNOL, delays often come from document ping-pong. Someone requests evidence, the customer uploads the wrong file, an adjuster stores attachments in an email, and the record starts to look like a scrapbook. Claims processing software fixes that by keeping evidence in one place and tying each item to a purpose: medical reports, repair estimates, photos, police reports, and correspondence.

A solid system also supports version control, so teams stop debating which estimate counts as “final.” In health insurance claims processing software, this matters even more because codes, provider notes, and eligibility checks create extra edge cases.

Common capabilities here:

- Central document management with templates and checklists

- Digital evidence capture with timestamps and source tracking.

- Automated extraction for repeatable documents

- Clear audit history for uploads, edits, and access

Workflow automation and task routing

Rules-based automation works best when it mirrors real operations. The best claim management software routes work based on claim type, jurisdiction, severity, customer segment, and risk signals. It also prevents silent stalls with timers and escalation paths, so claims do not sit in a queue forever while everyone assumes someone else owns it.

At this point, claims management systems for insurance stop behaving like tracking tools. Each claim has an owner and an explicit following action, or the system flags it as incomplete.

Typical automation workflows include:

- Assignment rules by skill, authority level, and workload

- SLA timers with escalation to supervisors

- Exception routing for missing data or coverage conflicts

- Approval chains that match authority thresholds

Claims assessment, approval, and settlement

Assessment rarely comes down to one decision. Evidence arrives in waves, and conclusions evolve as the file becomes clearer. For auto claims management software, this may include estimate review, liability notes, and fraud signals. For property insurance claims management software, catastrophe rules, contractor validation, and coverage interpretation often drive complexity.

Strong claims processing systems keep this phase structured. Checklists and required fields capture rationale, approvals follow clear thresholds, and payments trigger only when conditions are met. The goal is simple: settlement should feel routine, not like a last-minute scramble.

What “good” looks like here:

- Standardized decision records with captured rationale

- Threshold-based approvals with complete visibility

- Payment triggers tied to confirmed conditions

- Settlement letters generated from structured data

Reporting, analytics, and audit trails

Reporting breaks down when important details live in free-text notes. Dashboards turn into estimates, and reviews become arguments. The claims system in insurance produces reliable reporting by requiring structured inputs at the points that matter most — intake completeness, decision rationale, vendor actions, and settlement results.

This gives claims leaders a clear view of operations and lets compliance teams answer audit questions without digging through emails and notes. It also creates transparency with claims software vendors, since every metric can be traced back to a real workflow event.

Operational reporting usually focuses on:

- Cycle time by claim type, region, and adjuster group

- Leakage indicators and exception reasons

- Reopen rates, dispute rates, and customer satisfaction signals.

- Audit trails that show who did what, and when

When these metrics stay trustworthy, teams stop arguing over numbers and start fixing root causes. That is when a claims platform becomes a real claims management solution, not only a system of record.

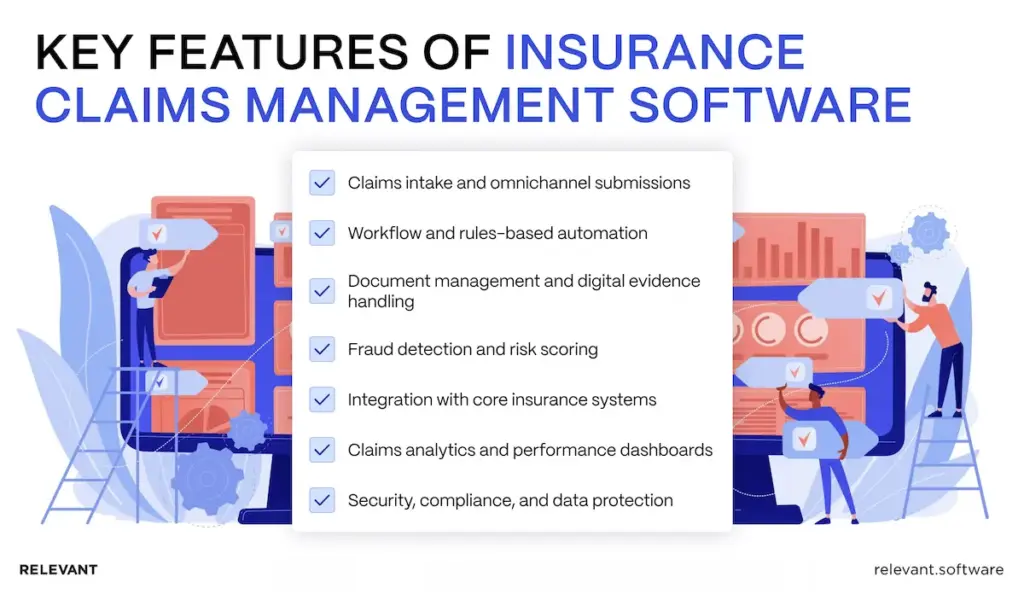

Key features of insurance claims management software

A modern claims platform earns its place by removing friction from day-to-day work. The best feature sets focus on two things at once: they make claims teams faster, and they make decisions easier to audit. Below are the capabilities most insurers look for when evaluating insurance software, particularly when the roadmap includes automation, integrations, and future expansion, such as AI-enabled insurance platforms.

Claims intake and omnichannel submissions

Modern insurance claim management software supports submissions from multiple channels. Policyholders can file claims digitally, upload evidence, and track progress without repeated follow-ups, creating a consistent front door for insurance claims processing software across portals, mobile apps, and call centers.

Workflow and rules-based automation

Automation enforces consistent claims processes. Business rules define routing, approvals, and thresholds, reducing dependence on manual judgment for routine cases and stabilizing insurance claim processing software under volume pressure.

Document management and digital evidence handling

Centralized document management securely stores claim files and supports insurance claims administration software requirements around retention, version control, and audit readiness. Integration with intelligent document processing improves extraction accuracy and reduces review time.

Fraud detection and risk scoring

Advanced claims management solutions apply risk scoring and pattern detection. These features flag suspicious claims early and support consistent investigation workflows without disrupting standard processing paths.

Integration with core insurance systems

Claims management systems for insurance connect with policy management, billing, CRM, and data analytics services. This integration keeps data consistent across the organization and prevents downstream reconciliation work.

Claims analytics and performance dashboards

Dashboards track cycle times, settlement ratios, leakage, and operational bottlenecks. Claims processing software healthcare teams often rely on these insights for regulatory reporting and operational oversight.

Security, compliance, and data protection

Insurance claims systems enforce access controls, encryption, audit logs, and retention policies. These controls support regulatory requirements and internal governance standards.

Benefits of insurance claims management software

Insurance organizations invest in software solutions to solve specific, measurable problems in claims operations. The goal is not to digitize existing habits, but to improve speed, cost control, accuracy, and customer experience across the entire claims lifecycle. When claims move through structured workflows instead of manual workarounds, teams gain visibility, consistency, and control as volumes grow.

That shift delivers tangible benefits:

- Faster claim processing and settlement through automation and consistent workflows

- Lower operating costs by reducing manual work and reprocessing

- Higher accuracy with fewer data entry mistakes and inconsistent decisions

- Better customer experience through transparency and self-service access

- Stronger compliance supported by full audit trails and controlled claims handling

For many insurers, these benefits directly support efficiency targets, risk reduction, and long-term scalability.

Common challenges in claims management without automation

Without dedicated claims processing software, insurers run into the same structural problems again and again. As claim volumes grow, these issues become harder to manage and start to limit both control and scalability.

- Manual workflows built on emails, spreadsheets, and disconnected tools

- Slow claim resolution and growing backlogs during peak periods

- Limited visibility into claim status across teams and departments

- Higher fraud risk caused by inconsistent evaluation and review criteria

- Compliance and regulatory exposure due to missing documentation and audit gaps

Over time, these challenges push insurers to seek claims management platforms or invest in custom insurance management software that brings structure, visibility, and control back into the process.

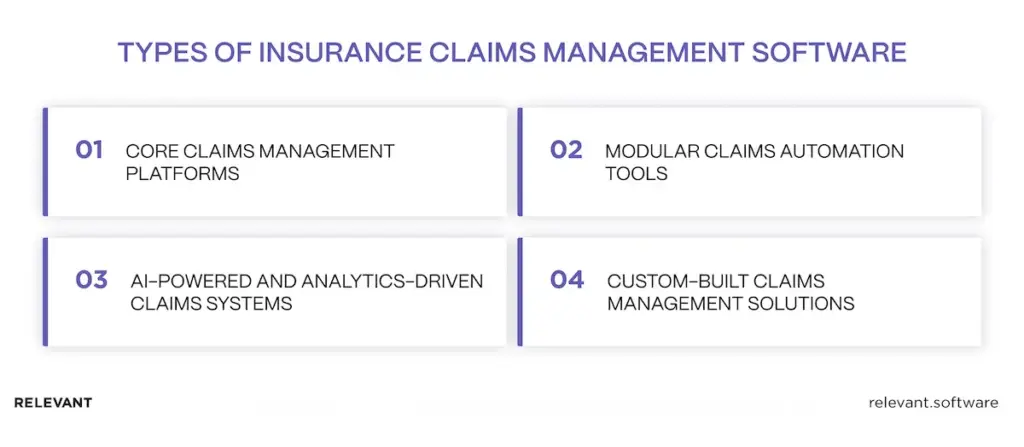

Types of insurance claims management software

These solutions can mean different things depending on what an insurer needs to fix. Some teams want one system for the full claims lifecycle. Others already have a core platform and only need stronger claims-tracking software, document handling, or analytics. A third group needs more control because products, regulations, and integrations keep changing. These categories help match the market to your operating reality.

Core claims management platforms

These platforms run claims end-to-end inside one product. They fit insurers that prefer standardized workflows, faster rollout, and a vendor roadmap, with customization mostly limited to configuration.

Modular claims automation tools

Modular tools solve a specific pain point without replacing the core, such as document management, workflow add-ons, fraud modules, or reporting layers. Many teams add intelligent document processing and tighter data management to reduce manual work and keep records consistent.

AI-powered and analytics-driven claims systems

AI in insurance software supports risk assessment, fraud detection, and predictive insights. These systems rely on strong data quality and governance, often paired with data analytics services for operational visibility. If your claims workflow touches payer or medical documentation, align requirements early with healthcare software development services.

Custom-built claims management solutions

Custom insurance claims management software fits complex workflows, unique products, and strict regulatory requirements, especially when legacy integrations drive delivery risk. It provides complete control over architecture and scalability.

These types often overlap. An insurer might run a core platform, add modular tooling for documents and analytics, then build custom components when configuration limits appear. That leads to the next decision: whether off-the-shelf software can support the operating model long term, or whether custom development becomes the safer path as complexity grows.

Custom vs. off-the-shelf insurance claims management software

The choice usually comes down to speed versus control. Off-the-shelf software can launch faster for standardized products, while custom claims management systems fit insurers that need flexibility across lines, integrations, and regulatory change over time.

When off-the-shelf solutions make sense

Off-the-shelf software fits insurers with standardized products, stable volumes, and limited integration complexity. It offers faster deployment and predictable licensing costs.

When custom claims management software is the better option

Custom solutions suit insurers with complex claims processes, multiple lines, and long-term scalability needs. Custom development allows alignment with internal data models and evolving regulatory requirements.

Cost, scalability, and long-term flexibility considerations

While off-the-shelf systems may appear cheaper initially, customization limits and integration constraints often increase the total cost of ownership. Custom claims management systems support controlled evolution without vendor lock-in. The table below shows how those trade-offs usually play out over time.

| Decision factor | Off-the-shelf claims management software | Custom claims management software |

| Best fit | Insurers with standardized products, predictable volumes, and minimal process variation | Insurers with complex claims processes, multiple lines of business, or frequent exceptions |

| Time to launch | Faster initial deployment using prebuilt workflows and templates | Slower start, but aligned to real operating workflows from day one |

| Workflow flexibility | Limited to vendor configuration options | Fully aligned with internal claims logic, approval paths, and exception handling |

| Integration complexity | Works best when policy, billing, and CRM systems match vendor assumptions | Designed around existing legacy cores, third-party providers, and data constraints |

| Scalability | Scales within predefined boundaries set by the vendor | Scales with business growth, new products, and regulatory change |

| Customization limits | Profound changes are often restricted or costly | No functional limits beyond the agreed scope and architecture |

| Regulatory adaptability | Depends on vendor release cycles and roadmap priorities | Changes are implemented when regulations or internal rules change |

| Total cost of ownership | Lower upfront cost, higher long-term cost as customization and workarounds grow | Higher upfront investment, lower long-term cost through controlled evolution |

| Vendor lock-in risk | High, due to proprietary models and licensing | Low, with full ownership of architecture and data |

| Long-term control | Vendor controls the roadmap and upgrade timing | Insurer controls roadmap, releases, and operating model |

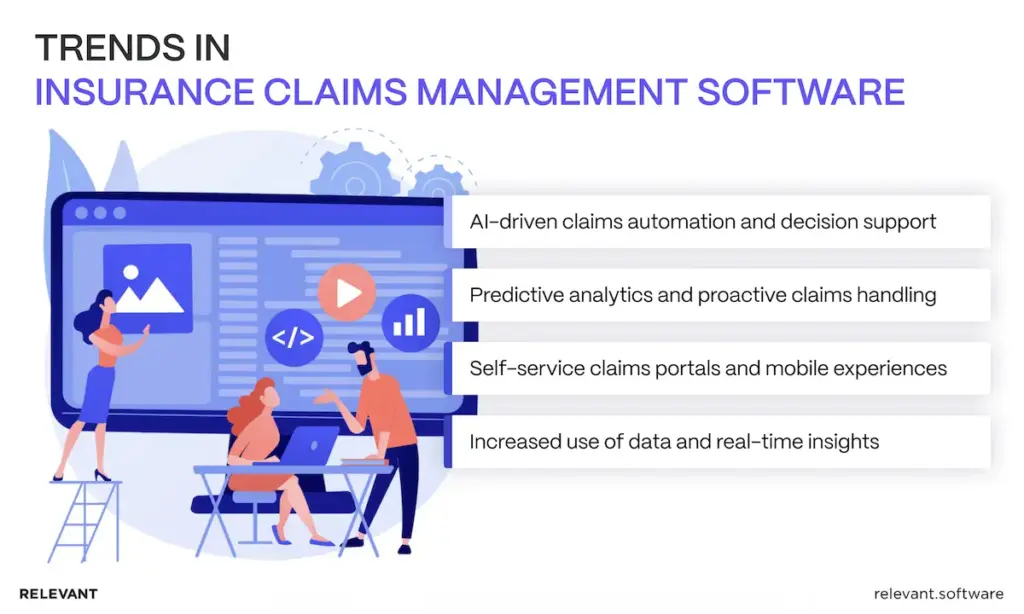

Future trends in insurance claims management software

Claims technology evolves when operational pressure builds, not when a new tool appears. Rising claim volumes, higher customer expectations, and tighter regulatory scrutiny push insurers to look beyond basic automation and toward systems that enable better real-time decisions. The trends below reflect where claims platforms are headed, based on how insurers actually operate today.

AI-driven claims automation and decision support

AI increasingly supports adjusters where volume and time pressure are highest. Triage models help sort claims by complexity and risk at intake, while decision support tools surface relevant policy clauses, similar past cases, and likely outcomes. The focus moves away from full automation and toward consistency, auditability, and controlled human override.

Predictive analytics and proactive claims handling

Predictive models help insurers anticipate delays, cost overruns, and dispute risk before they appear in reports. By combining historical claim data with real-time signals, teams can intervene early, reassign work, request missing evidence sooner, or adjust settlement paths while options remain open.

Self-service claims portals and mobile experiences

Self service continues to expand beyond simple claim submission. Modern portals support document exchange, status tracking, appointment coordination, and two-way messaging. Mobile access becomes the default for policyholders, while internal teams benefit from fewer inbound calls and clearer customer expectations.

Increased use of data and real-time insights

Claims decisions increasingly rely on live operational data rather than retrospective reports. Integrated analytics surfaces queue health, exception rates, and leakage indicators as work happens. This shift allows claims leaders to manage performance continuously instead of reacting after the month closes.

Build custom claims management software with Relevant

A custom claims platform makes sense when the business can no longer “configure its way out” of bottlenecks. If every new product line adds a new exception path, if integrations turn releases into a risk event, or if audits depend on manual reconstruction, the software starts to dictate the operating model. Custom development flips that relationship back, so claims teams run the workflow and the system follows.

Relevant builds delivery programs around the realities insurers live with: legacy cores, strict data controls, and process changes that happen mid-year. The work usually starts with a thin slice of the lifecycle, then expands through stable integrations, clear data ownership, and reporting that traces metrics back to real workflow events. AI follows the same rule: it ships only when teams can monitor it, override it, and explain it.

If you want a clear plan for a custom claims platform, contact us.

FAQ

What are the top-rated insurance claims management software solutions available?

“Top-rated” depends on what you insure, where you operate, and what the ranking actually measures. Many shortlists still start with Duck Creek Claims, then reality takes over: can the platform match your operating model without turning every exception into a workaround? The strongest candidates stay calm under messy intake, heavy third-party traffic, and reporting pressure, then prove it in a pilot that uses your data patterns and your edge cases.How do cloud-based claims management systems differ from on-premises options?

Cloud options usually ship updates faster and scale more smoothly when volume jumps, which means fewer late-night patch cycles for the IT team. On-premises can offer tighter control over data residency and internal network boundaries. The real difference shows up after go-live: monitoring, upgrades, backups, and incident response either remain your daily workload or shift toward the vendor. Contracts, SLAs, and exit terms decide more than architecture diagrams.How long does it take to implement insurance claims management solutions?

Timelines depend on scope, integration complexity, and how much of the claims-handling process you want to standardize in the first release. A configured rollout for a narrow line can take a few months, while programs that include core integrations, data migration, and new portals often take longer. Many insurers reduce risk by launching one end-to-end workflow first, then expanding in planned waves.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.