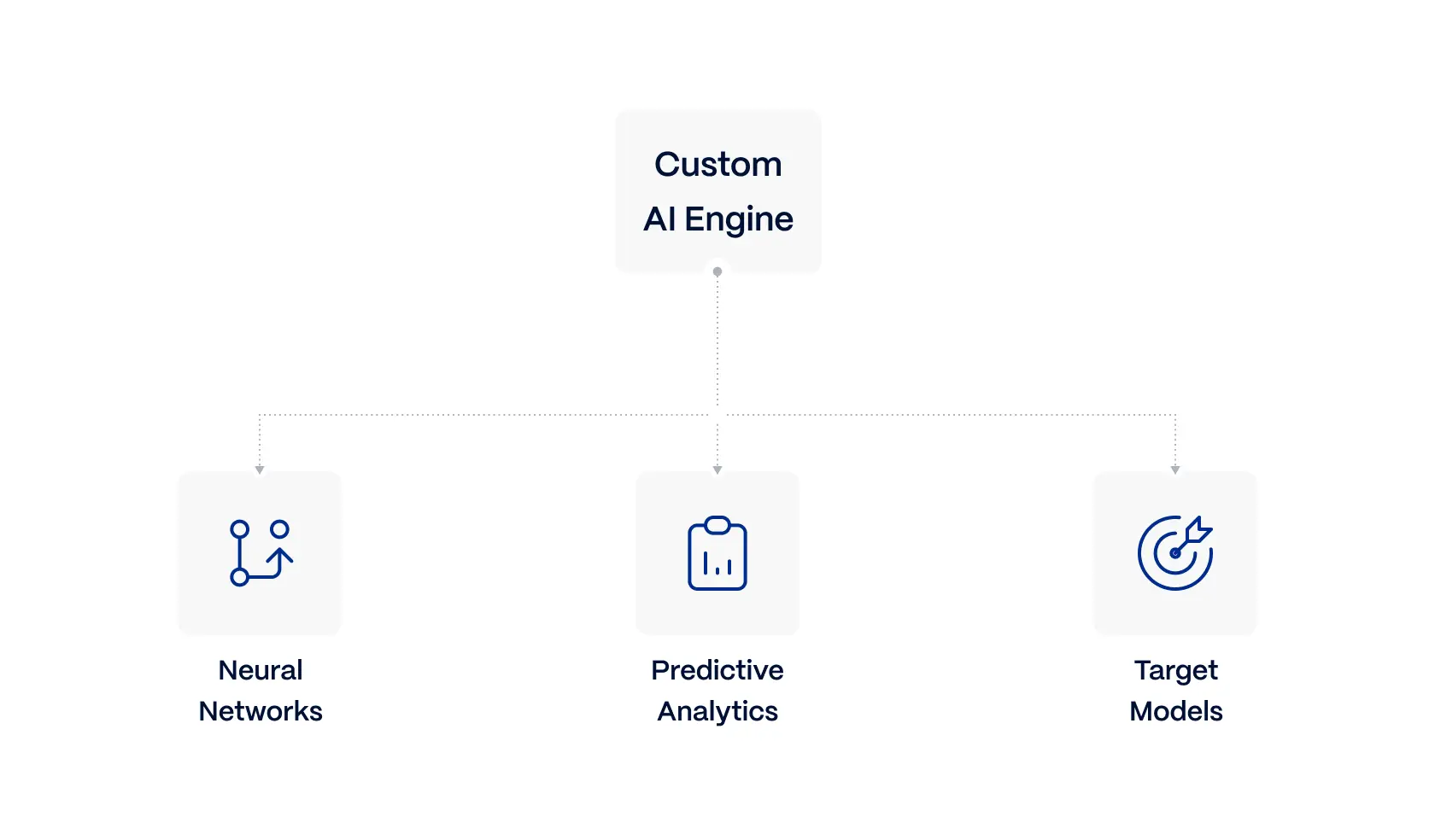

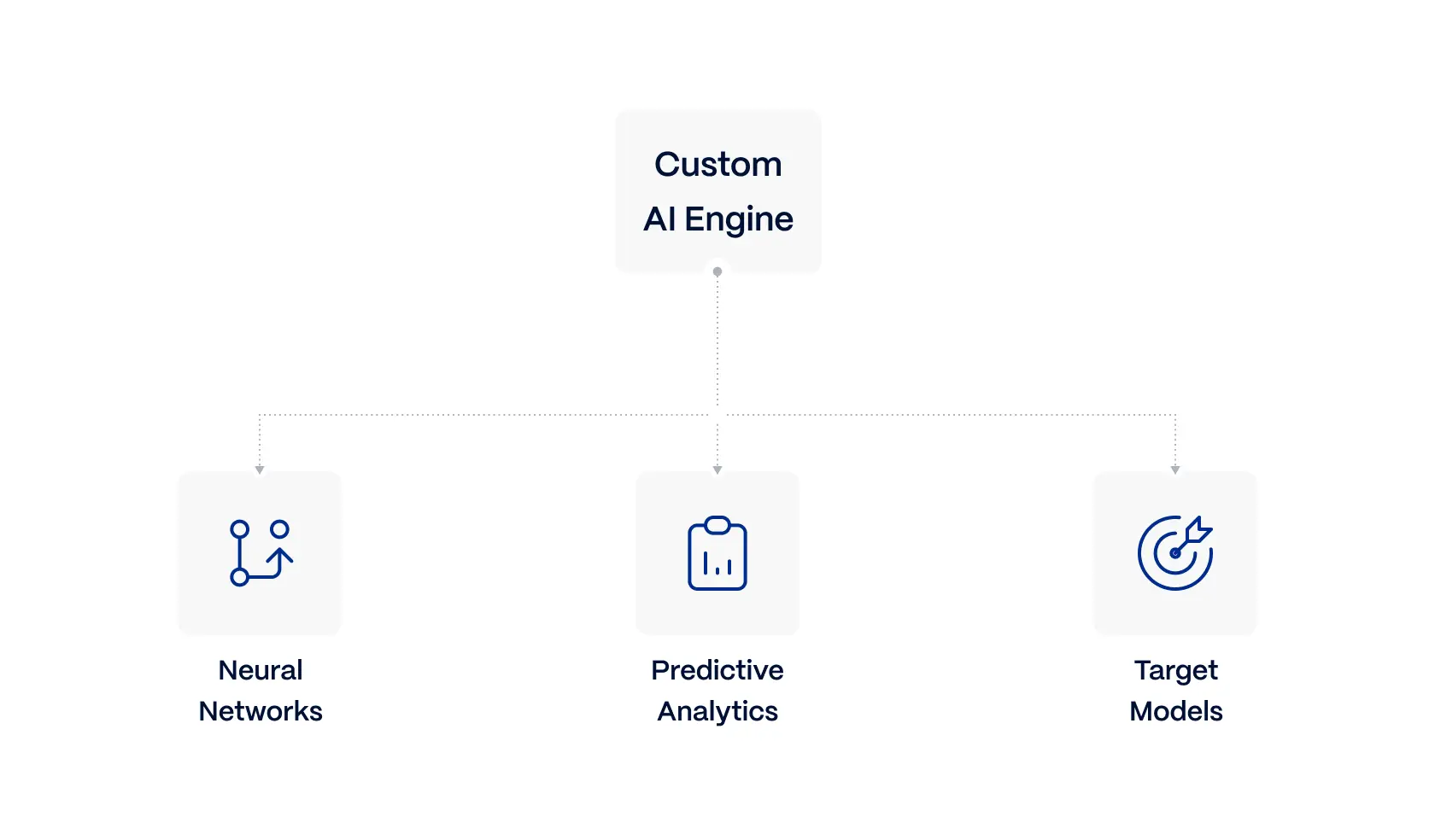

Custom AI models

Our team trained proprietary data into predictive models tailored to retail products such as loans, cards, and deposits. These models provided insights that competitors could not easily replicate.

Custom model developed

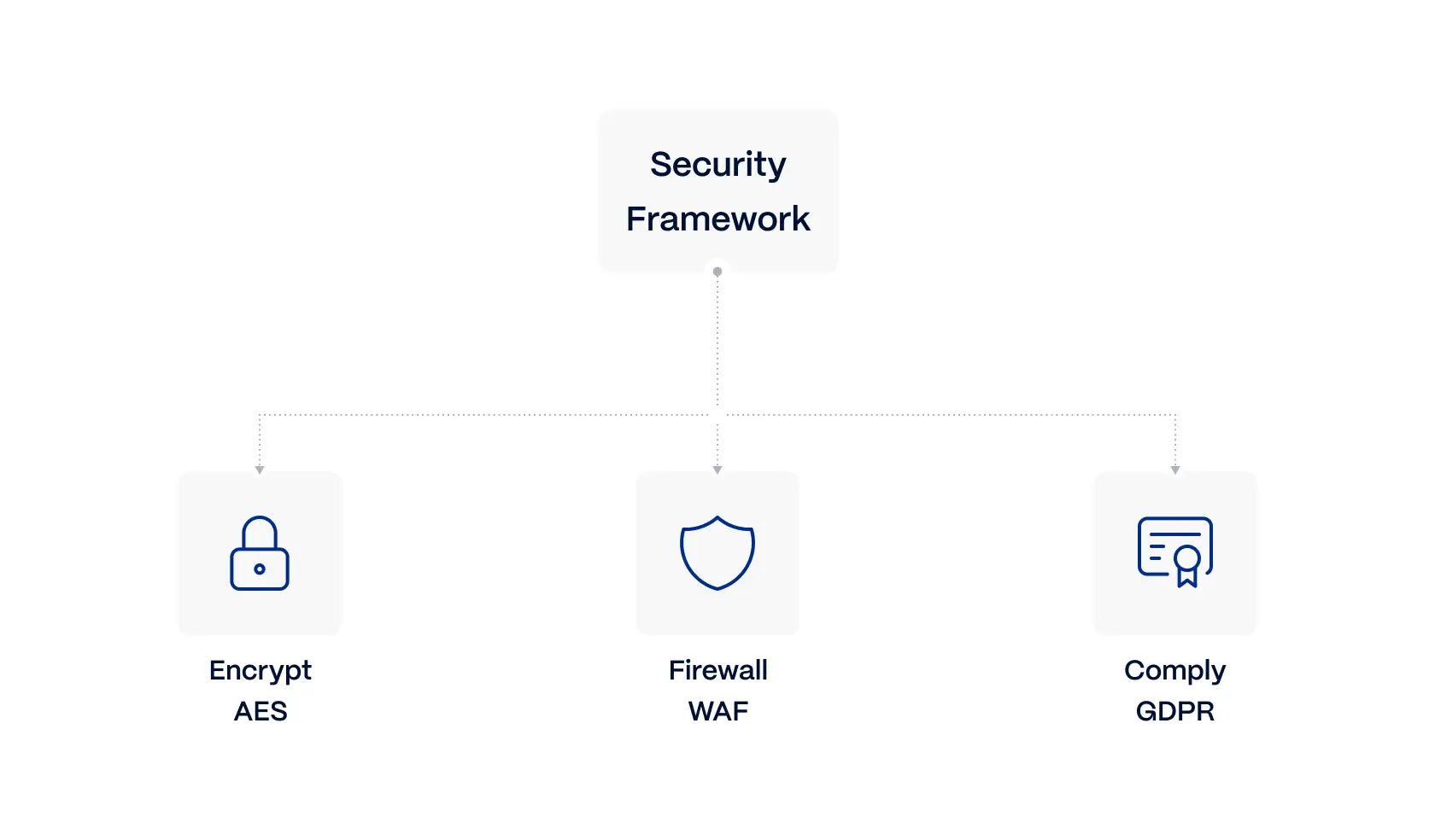

1GDPR and PSD2 compliance

100%Reduction in analyst workload

35%The client is one of the largest banks, serving millions of individuals and small businesses across multiple countries. With more than a century of history, it has amassed a proprietary dataset of transactions, customer behavior, and product usage. Core retail products, such as savings, credit cards, consumer loans, and insurance bundles, remain both a major revenue source and a highly competitive segment.

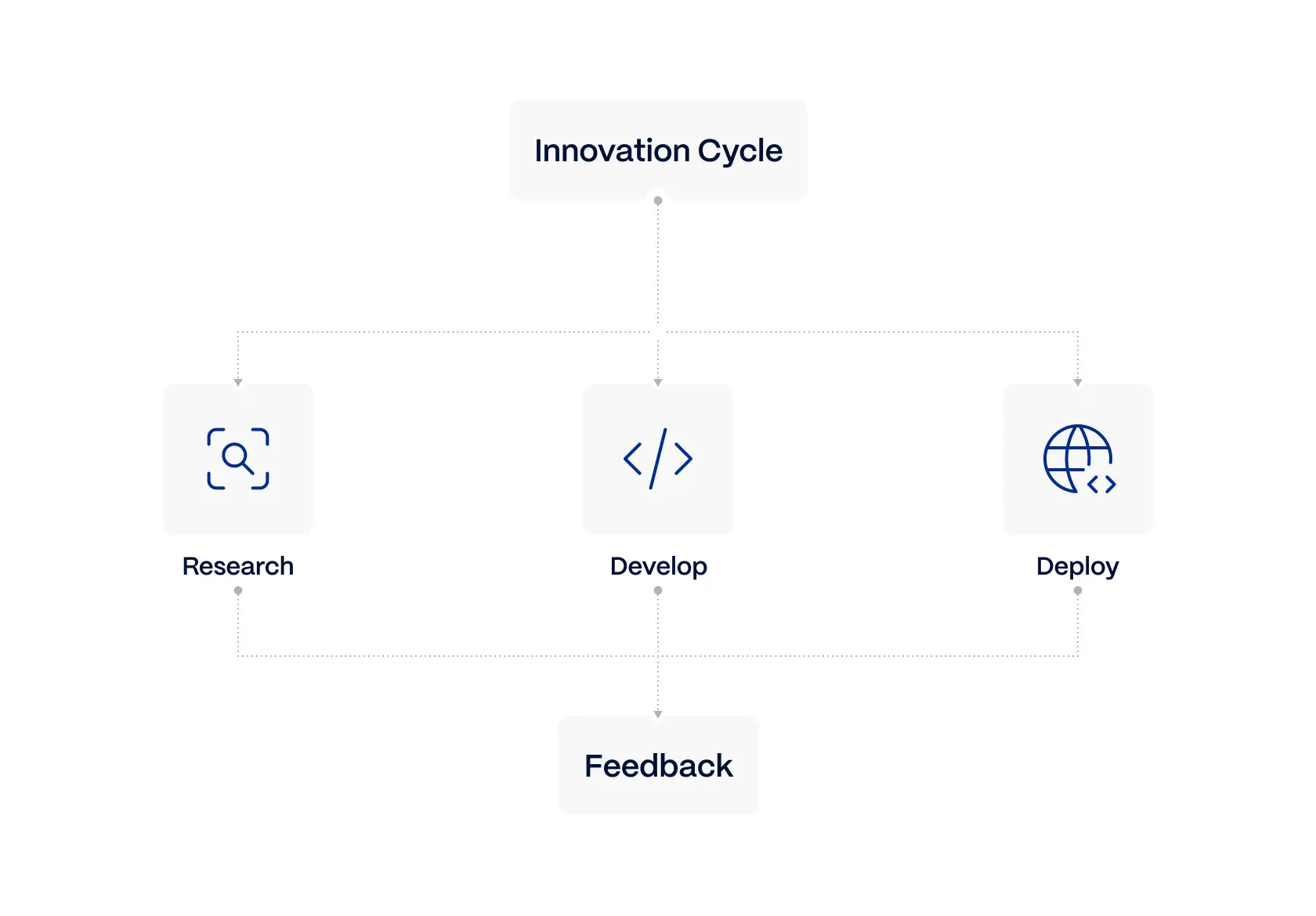

As new fintechs and digital banks attracted customers with personalized, data-driven services, the bank decided to build a clear AI strategy to get more value from its data. The goals were to create predictive models, establish data as a strategic asset, foster product innovation, elevate customer experience, and maintain full regulatory compliance.

Relevant Software, in partnership with CX Design, began with consulting and was engaged to design and implement the AI strategy. The collaboration combined deep technical expertise with strong knowledge of compliance and banking operations, ensuring the AI platform delivered measurable business value while protecting trust and security.

Our team trained proprietary data into predictive models tailored to retail products such as loans, cards, and deposits. These models provided insights that competitors could not easily replicate.

We engineered pipelines to collect, clean, and prepare millions of records daily. This ensured accuracy, speed, and scalability for AI training and reporting.

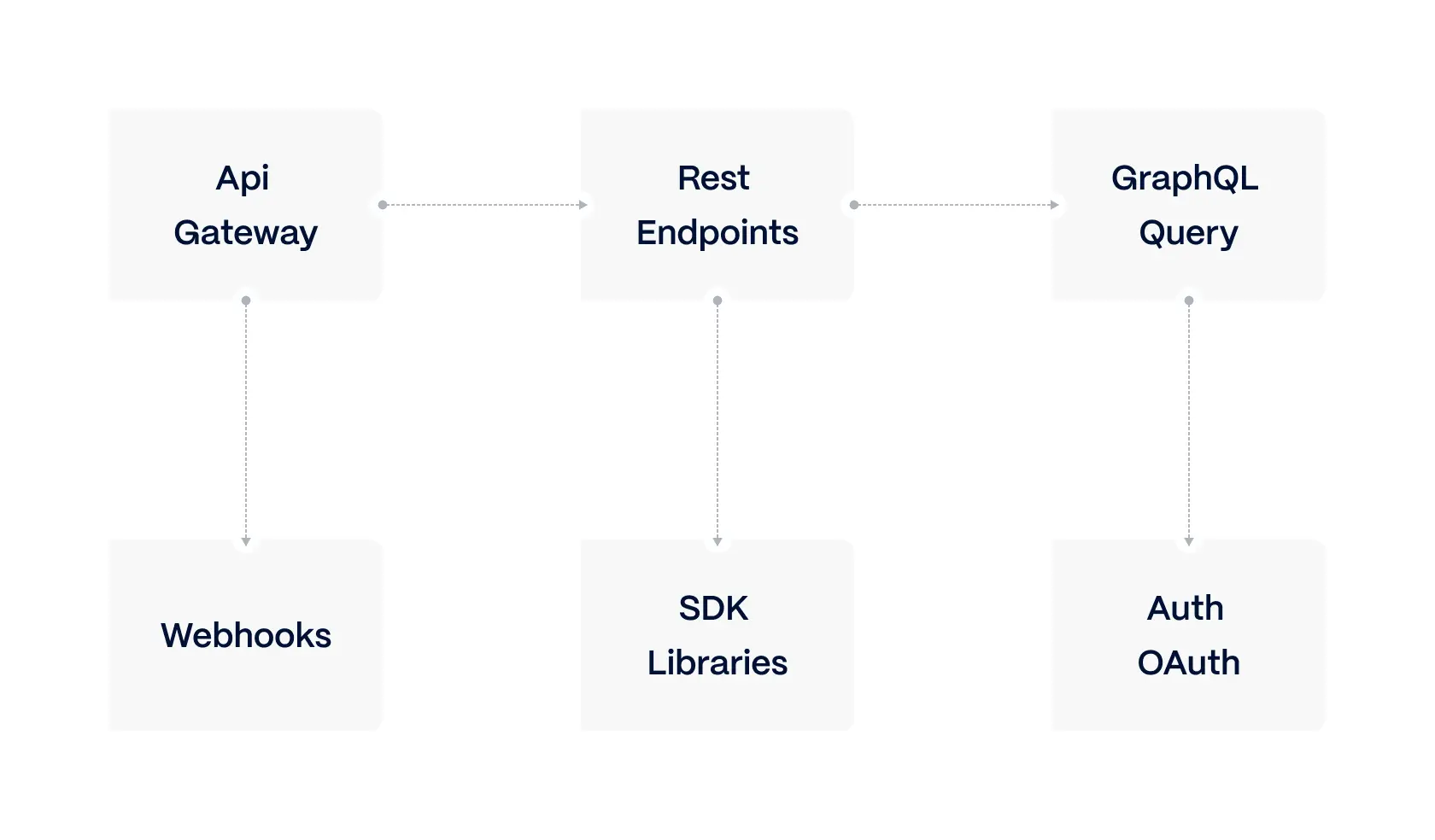

Our developers created secure APIs to deploy models directly into the bank’s IT systems. This enabled AI capabilities without disrupting existing infrastructure.

We integrated GDPR-ready monitoring, encryption, and access controls. Every action is logged, giving compliance teams full oversight.

Our AI team delivered dashboards that visualise model performance and outcomes. Managers use them to track predictions and make data-driven decisions in real time.

We built automated pipelines for retraining and fine-tuning models. This ensures the AI strategy adapts to market changes and regulatory updates.

40% faster decision-making

Executives and managers act on live predictions instead of manual reports.

650+ self-service reports generated monthly

Business users query the system directly through BI dashboards without writing SQL.

0.8 seconds average query response

Dashboards and APIs deliver insights instantly, without overnight batch jobs.

✓ Built pipelines for millions of daily records and BI dashboards that surfaced actionable insights

✓ Developed custom models with TensorFlow and PyTorch that improved demand and pricing forecasts

✓ Embedded compliance and audit controls across data flows and model lifecycles

✓Delivered secure APIs that plugged into core systems without disruption

✓ Set up CI/CD for continuous model improvement

Founder & CEOThey had the talent to keep positive momentum with both to-the-point communication and humor when necessary.

Share details about your project and book a free call with us

to discuss your development strategy