Integrating Finance and Supply Chain Management: Benefits & Best Practices

Updated: October 31, 2021

The supply chain is the backbone of any business, and as a result, takes up a significant share of your budget. However, if your supply chain costs are too high, they constitute a danger to your financial health and can ultimately destroy your business. But here’s the rub: if your finance department and supply chain executives operate separately, these costs are uncontrolled. So, how can you align these functions?

At Relevant, we have vast experience building tech solutions to address financial issues in supply chain management. Read on to learn the basics of integrating finance and the supply chain into one system.

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usTable of Contents

Finance and the supply chain: where’s the link?

At first glance, there might seem to be no connection between finance and supply chain management. While the former is concerned with budgeting and risk management, the latter takes care of purchasing materials, manufacturing products, and selling them to end customers.

But in fact, these two processes are inseparable: the way your supply chain performs affects your financial condition and vice versa. Let’s look at several examples:

- If you, say, decide to pay your suppliers less in return for early payment, it may undermine their stability and reliability. So, you may end up looking for other procurement options because your current suppliers can’t provide the goods in time.

- If there’s an unexpected spike in demand, you might need to spend more than planned to manufacture more products. However, you won’t be able to do that if you have too many outstanding invoices, which ultimately results in lost revenue.

- At the same time, an unexpected drop in demand can lead to increased inventory overheads, which also means that you are losing money.

Considering this, it’s clear that for effective cash flow management, financial executives need to base their decisions on what’s happening in the supply chain. This can be made possible with an integrated system for finance and supply chain management—a real-time platform for sharing information, reporting, and forecasting.

Advantages of integrating finance and supply chain operations

Aligning finance and supply chain operations is the key to the sustainable growth of any business. But how exactly will an integrated solution help your company thrive? Let’s look at the main benefits of such an integration.

Cost reduction

More often than not, finance departments know the total overhead expenses of the supply chain but fail to associate them with particular processes. When supply chain data is visible, financial executives can take the guesswork out of overhead analysis and allocate funds in a more informed manner. This allows businesses to reduce overheads to a minimum while responding to spikes and drops in demand.

Accurate forecasting

In traditional accounting, the budgeting process usually relies on what happened in past years and has no connection to what the supply chain executives actually forecast. Reconciling supply chain and finance allows firms to take into account a larger number of variables, such as sales forecasts, procurement expenses, manufacturing costs, risks, and cash flows. Access to this data, in turn, enables organizations to make more accurate financial forecasts and maintain the company’s financial health more effectively.

Adaptability

Adapting to fluctuations in supply and demand is a challenging process, especially in the wake of COVID-19. For example, Peloton—an American exercise equipment provider—couldn’t respond to the sudden spike in demand for indoor bikes when all fitness centers were closed due to the pandemic. As a result, some of their customers had to wait months for their equipment to be delivered.

If the finance and supply chain operations had been aligned, the company could have avoided this. An integrated system allows businesses to monitor market fluctuations in real-time and to make adjustments on the go. With the right software in place, it takes mere minutes to react to almost any change.

Best practices to integrate finance and supply chain management

Since supply chain and finance departments typically work on two different systems, it might be challenging to make data accessible and consumable to both sides. Here’s what you should keep in mind to implement integration properly:

- Find connections. Talk to your supply chain and financial executives and find connections in how they understand and approach the business.

- Break down your supply chain costs. Associate particular finance processes with corresponding supply chain operations. This will help you understand the nature of supply chain costs.

- Ensure mutual understanding. Both departments use different KPIs and terminologies to carry out their functions. That’s why it’s critical to find a common taxonomy to enable collaboration between the two. Otherwise, they simply won’t be able to make sense of the data they receive.

- Train your staff. No integrated system will ever optimize your finance and supply chain processes if executives in the different departments continue to operate separately. Given that, the integration should be followed by training your employees to work together while using the system in a proper way.

These are the basics of how you should approach the integration. But what about the technical side of things? Read on to learn about finance and supply chain management software development below.

Nothing functions without technology today

The top integrated solutions for supply chain and finance can aggregate terabytes of data, allowing executives from both departments to collaborate on the same platform and make informed decisions in real-time. This, however, isn’t possible without cloud computing, machine learning, and visualization tools:

- Machine learning (ML). It takes minutes for ML algorithms to identify trends in large amounts of data, which will enable you to spot the slightest fluctuations in demand, identify less profitable areas, and make accurate adjustments immediately. Besides, your reports will grow in accuracy with time due to the ability of ML to learn.

- IoT. Mixing supply chain management with IoT provides a number of benefits, including improved traceability, risk management, and decision-making. IoT-enabled workflows are ready to give your company a competitive edge in today’s crowded market.

- Data visualization. Data visualization tools will transform algorithmic findings into color-coded graphs, charts, and maps. These will help you to actually see all those trends and patterns without having to interpret countless spreadsheets and numbers.

- Cloud computing. With cloud computing, you can securely store as much information as you need. Besides, the technology makes collaboration easy and effective. Instead of tossing files back and forth, your employees can work on the same file in real-time.

These technologies are the key components of a reliable solution for integrated finance and supply chain management. If you want to develop custom software, it’s essential that your developers are proficient in these areas. But what if you don’t have the relevant talent in-house? Well, you can hire remote software developers from Relevant.

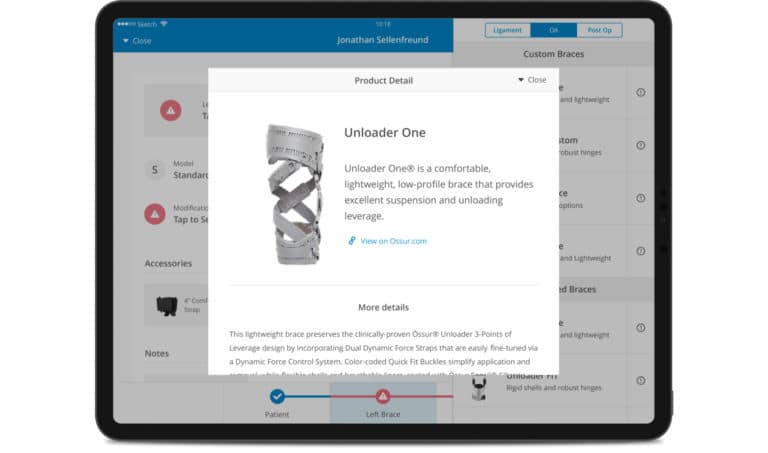

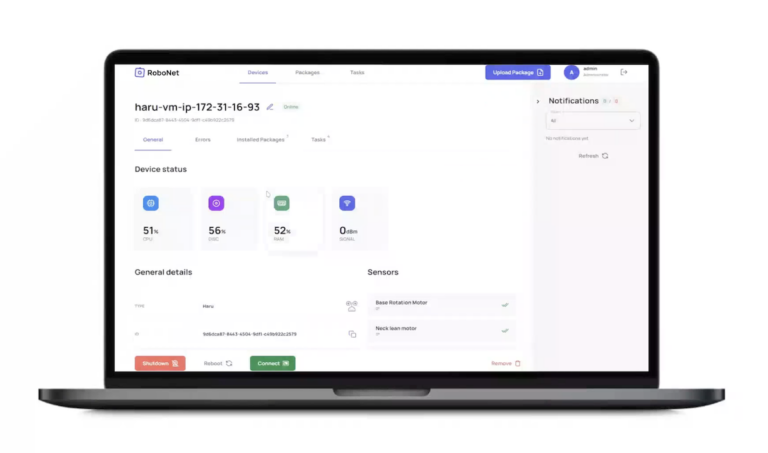

Relevant’s data visualization dashboards

If you are looking for reliable сustom web development services to build a finance and supply chain management system, look no further. At Relevant, we are well-versed in the latest technologies, such as artificial intelligence and machine learning, cloud computing, and data visualization. And we keep on honing our expertise to meet our clients’ needs, which translates into successful projects and happy clients. Let’s take Spindy, one of our latest projects, for example.

What is Spindy?

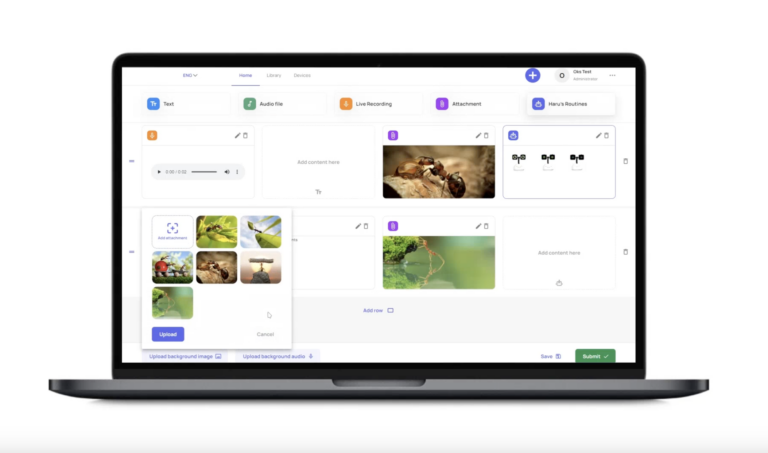

Spindy is a gamification platform for customer engagement and retention. Instead of traditional bonuses and gifts, the app allows users to win a cashback of up to 100% by spinning a wheel with different reward options. The system integrates with a bank and is based on an algorithm that balances payouts: though users have a chance to win an amount that covers the full cost of a purchased product, the average reward will remain below the threshold set by the store owner.

How we built Spindy

We built the solution from scratch. One of the biggest challenges was to make the platform easy to use for everyone. Our solution is a comprehensive online dashboard, which allows store owners to edit their listing information, set the odds for winning, change the average reward, manage payouts, and so on. The system can also visualize data on customer activity and payouts into comprehensive charts and graphs, so merchants can get more insights on their cashback campaigns and make adjustments.

The app has already been downloaded more than 10,000 times on Google Play. But still, it’s possible to take it to an entirely new level with machine learning. And our experts can handle this as a part of our AI development services.

Conclusion

In times of economic uncertainty, bridging finance and supply chain management systems is vital for businesses to survive. An integrated system will cut your overhead costs, make your forecasts more accurate, and streamline budget planning.

However, keep in mind that the integration process is complex from the business side and also in terms of tech: you’ll need expertise in artificial intelligence and machine learning, cloud computing, and data visualization. Luckily, Relevant is here to help you with the custom development of a finance and supply chain management system. Whether you are planning an integration system for your company or just willing to learn more on the topic, contact us—and we’ll get back to you soon!

Your Next Read

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us