Insurance Software Development Companies: Leading Options for Carriers & Insurtechs

If insurance software development companies are on your 2026 roadmap, it helps to start with the reality of insurance work. This industry runs on regulated data, complex edge cases, and legacy core systems that don’t respond well to “move fast and break things.”

That reality shapes every part of delivery, from policy administration and issuance rules to claims systems, customer service tools, and CRM integrations. It also changes what “good delivery” means for insurers. Success is not speed alone, but stable releases, decisions you can audit, and real efficiency gains that lower operating costs while staying fully compliant.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

This guide supports carriers modernizing claims, underwriting, and policy administration systems, as well as insurtech teams building custom insurance products for specific needs. It also helps brokers, MGAs, and TPAs seeking insurance software development services to build digital solutions that increase customer satisfaction through better customer experiences and tighter customer engagement.

Comparison table: top insurance software companies

A table helps you quickly scan the market, but it should not replace due diligence. This list of insurance software companies uses Clutch profile ratings and pricing as a snapshot, so expect changes as reviews, scope, and vendor positioning evolve.

| Company | Core insurance-adjacent delivery | Locations | Clutch reviews | Notable clients | Pricing range |

| Relevant Software | Claims and policy portals, workflow automation, data, and integrations | Lviv, Warsaw, Valencia | 4.9 | AstraZeneca, Volkswagen Genser, First Home Coach. | $50–$99/hr |

| Simpalm | Mobile and web apps, portals, integrations | USA (Tysons, VA) | 4.9 | Bamboo, Pepsi, AudiobooksNow | Min $10k; $50–$99/hr |

| Dualboot Partners | Product development, portals, automation | USA (Charlotte, NC), LatAm | 4.9 | Continental Tire, PrizePicks | Min $75k; $50–$99/hr |

| Sapphire Software Solutions | Web, mobile, platform delivery | USA, India | 4.9 | American Express, Bayer, Adani | Min $10k; $25-$50/hr |

| Itexus | Custom platforms, insurance | Poland (Warsaw) | 4.9 | Chick-fil-A, Unilever, McDonald’s | Min $10k; $25–$49/hr |

| Avenga | Enterprise modernization, regulated programs | Czech Republic (Prague) | 4.8 | HDI, Klarna, Arthur D. Little | Min $50k; $50–$99/hr |

| Velvetech | Custom platforms, mobile, data workflows | USA (FL, IL) | 5.0 | Insureon, Novo Nordisk, Hyatt | Min $25k; $50–$99/hr |

| Appinventiv | Enterprise apps, mobile-first delivery | USA (NY), global | 4.6 | KFC, IKEA, Adidas | Min $50k; $25–$49/hr |

| Iflexion | Enterprise systems, portals, BI | Global delivery | 4.9 | PayPal, Philips. | Min $10k; $25–$49/hr |

| NaNLABS | Cloud, data engineering, product builds | Argentina, France | 4.9 | Delos Insurance Solutions | Min $25k; $50–$99/hr |

The table helps you narrow the field, but to make the shortlist useful, the next step is to understand why insurance delivery requires a different skill set than a typical enterprise build.

Why insurance companies need specialized software development partners

In the insurance sector, delivery quality depends on how well a team handles regulated workflows, legacy software, and exception-heavy business processes. Specialized partners bring years of experience, a track record in the insurance domain, and a proven track record of meeting industry regulations and compliance requirements without slowing business growth in the insurance business.

Complexity of insurance processes (claims, underwriting, policy admin)

Policy management rarely follows a straight line. Policy issuance changes mid-term, claims reopen, and underwriting rules shift by risk appetite and geography. Teams that build custom insurance software treat this volatility as a design constraint and deliver claims management systems and risk management software that fit specific needs through custom insurance software development and custom solutions.

A quick maturity test is whether they can explain how they handle exceptions, audit trails, and versioned rules across underwriting and claims.

Rising customer expectations for digital experiences

Customer experience now directly affects retention, cost to serve, and overall satisfaction. Customers expect consistent journeys across mobile apps and web portals, while support teams rely on CRM context to respond quickly and accurately. Strong partners design mobile apps around real workflows, so business teams spend less time re-entering data, fixing handoffs, or switching between systems.

Compliance, data privacy, and security requirements (HIPAA, GDPR, SOC 2)

Security has to show up in real controls, not in a PDF that no one reads after procurement. In health insurance and other regulated lines, a vendor should prove repeatable practices for access management, encryption, audit logs, retention, and incident response. If machine learning supports triage or decision support, governance becomes essential because risk assessment must stay explainable during audits and disputes.

Integration with legacy core systems and third-party data providers

Most insurers depend on core platforms plus third-party data for identity checks, fraud signals, payments, and property or vehicle details. A vendor needs disciplined integrations that remain stable during releases in tight change windows. Software technology choices and big data pipelines matter here because data often comes from several systems, and each system may claim a different “source of truth.”

Need for automation, AI, and analytics in modern insurance operations

Automation matters because it removes repetitive work from routing, document handling, and routine checks, then feeds analytics that teams can act on. AI is most effective when it runs within controlled workflows with clear ownership and audit trails. McKinsey links “rewiring” around digital and AI to a 3–5% improvement in claims accuracy when data, controls, and operating model stay aligned. If AI sits on your roadmap, this overview of AI in insurance helps set realistic use cases and control points.

Top insurance software development companies

This section highlights insurance software developers and delivery partners that often make the shortlist for modernization, customer portals, automation, and data initiatives. Even so, each option should be assessed against your specific reality — your product mix, regulatory scope, legacy systems, and the capacity of your internal teams.

Relevant Software

Relevant Software is one of the insurance software development companies that fits carriers and insurtechs that need stable delivery around core systems. The team supports software solutions for insurance industry programs, including policy and claims workflows, customer portals, and data layers that deliver actionable insights through AI and business intelligence.

- Insurance focus and examples: Policy and claims workflows from intake through settlement, built to handle peak volume and exceptions. Customer and agent portals for self-service submission, document exchange, and status tracking, with internal workspaces for task queues and escalations.

- Technologies: Web and mobile delivery, integrations, and data layers that support business intelligence and AI-driven decision support.

- Notable clients (public): AstraZeneca; Volkswagen Genser; FirstHomeCoach.

- Why this company stands out: Small senior-led teams set the architecture early, and consistent QA keeps each release stable as the platform evolves. This delivery discipline supports long-term partnerships and helps explain the 97% client retention.

Simpalm

Simpalm is one of the insurance software companies in the USA, often chosen by carriers and insurtechs building customer and agent experiences that must remain reliable after go-live. The team focuses on portals and workflow tools that support claims intake, policy servicing, and integration with core systems.

- Insurance focus and examples: Digital touchpoints such as customer onboarding, agent portals, and internal workflow tools that replace email-heavy processing in regulated environments.

- Technologies: Mobile and web application builds with integration work scoped during discovery, then delivered through iterative releases.

- Notable clients (public): Bamboo; Window Nation; Pepsi.

- Why this company stands out: The company provides a clear multi-office US footprint and a product-oriented setup that fits cross-role applications and long roadmaps. For buyers screening insurance software companies, this footprint also supports workshops and stakeholder access.

Dualboot Partners

Dualboot Partners is a solid choice for teams evaluating insurance software vendors that value a product-first approach and predictable execution. The company fits well with underwriting workbenches, agent tools, and automation programs where scope discipline and release cadence are critical.

- Insurance focus and examples: Platforms that sit close to operational risk and claims-adjacent workflows, where audit trails and role-based access shape daily use.

- Technologies: Full product delivery with modern web stacks; confirm security controls, observability, and integration standards early for core-system adjacency.

- Notable clients (public): Continental Tire; PrizePicks; Burnett Risk Control International.

- Why this company stands out: The team runs a structured delivery model with clear ownership, helping insurance software vendors stay predictable as requirements shift across product, legal, and operations.

Sapphire Software Solutions

Sapphire Software Solutions is often included on lists of insurance software companies when organizations need parallel delivery across multiple workstreams. It supports portal builds, servicing apps, and integration-heavy systems that require consistent throughput across releases.

- Insurance focus and examples: AI in insurance use cases, such as smart claims processing, policy recommendations, and insurance data analytics themes that target actionable insights for underwriting and claims teams.

- Technologies: Application development plus AI-oriented capabilities positioned for insurance workflows and analytics layers.

- Notable clients (public): Bright Day School CBSE Harni; Vidyalaya product deployments.

- What stands out: Sapphire scales delivery across parallel workstreams, which can suit insurers that need steady throughput from insurance software providers across portals, internal tools, and integrations.

Itexus

Itexus stands out among insurance software providers for data-heavy insurance programs where audit trails, rules, and evidence shape delivery. It supports underwriting automation, claims workflow systems, and analytics layers that produce actionable insights, grounded in business intelligence.

- Insurance focus and examples: Insurance software development services framed around workflow automation, smart document processing, and analytics patterns that support claims and underwriting operations.

- Technologies: Web and mobile delivery, AI, and automation components positioned for document pipelines and decision support.

- Notable clients (public): Public client names are not consistently published in the sources above; request named references tied to a carrier, MGA, or TPA context during due diligence.

- Why this company stands out: The company leans into data-heavy workflow design and integration discipline, which fits insurance industry programs where rules, evidence, and audit trails drive the build.

Avenga

Avenga is frequently shortlisted by enterprises worldwide seeking top insurance software development companies for modernization programs spanning multiple systems and business units. It fits digital layers around cores, regulated data platforms, and broader digital transformation initiatives.

- Insurance focus and examples: Commercial insurance digitization around contracting and broker-supported flows, with delivery designed for complex products and regulated decision points.

- Technologies: Enterprise-grade delivery across modern platforms; confirm cloud deployment standards, integration governance, and release controls during early workshops.

- Notable clients (public): HDI; Mazda; a360inc.

- Why this company stands out: Avenga brings enterprise governance and cross-team coordination that fits regulated programs tied to digital transformation, especially when modernization spans multiple systems and business units.

Velvetech

Velvetech fits carriers seeking software solutions for insurance operations, with strong integration discipline and practical reporting. It often supports policy servicing tools, claims workflows, and dashboards that turn operational data into actionable insights.

- Insurance focus and examples: Insurance platform work delivered in a long-running partnership model, with multiple initiatives completed over time for an insurance-focused business.

- Technologies: Custom software development across web, mobile, cloud, and data analytics, with partner ecosystems that support enterprise delivery.

- Notable clients (public): Insureon; Microsoft (partner ecosystem); Salesforce (partner ecosystem).

- Why this company stands out: Velvetech combines integration work with analytics foundations, which helps carriers turn operational data into business intelligence and practical reporting for claims and servicing.

Appinventiv

Appinventiv is often considered among the top insurance app development companies for mobile-led rollouts that still depend on stable backend connections. It fits omnichannel customer apps, self-service journeys, and workflow-driven mobile experiences.

- Insurance focus and examples: Insurance product delivery framed around customer self-service, policy servicing flows, and claims journeys that require stable UX under load.

- Technologies: Mobile and web delivery with cloud and AI capabilities promoted for digital product builds; validate SDLC controls for regulated data and production support models.

- Notable clients (public): KFC; IKEA; Domino’s.

- Why this company stands out: Appinventiv fits mobile-led rollouts with a large delivery capacity, which can help when insurance application development companies must ship fast while still aligning with backend constraints.

Iflexion

Iflexion tends to appear in comparisons of the top insurance software development companies worldwide when buyers seek enterprise-grade delivery for long-lived platforms. It fits portals, internal operations systems, and modernization work where governance and maintainability decide total cost.

- Insurance focus and examples: Insurance software development positioned around underwriting, policy administration, and claims management, supported by analytics and reporting layers.

- Technologies: Full-cycle delivery across web and enterprise systems, with integration work that supports insurance operations and data flows.

- Notable clients (public): PayPal; Xerox; Philips.

- Why this company stands out: Iflexion offers a long operating history and enterprise delivery experience, making it a stable choice among insurance software companies when governance and longevity matter.

NaNLABS

NaNLABS leans into cloud-native, data-heavy systems that often align with insurance use cases, such as risk analytics, portfolio monitoring, and event-driven claims workflows. It suits insurtech teams that want modern architecture choices and rapid iteration without fragile delivery.

- Insurance focus and examples: Data and platform work for insurtechs and cyber insurance contexts, with emphasis on third-party data integration and modernization patterns.

- Technologies: Cloud-native architecture plus data engineering foundations, observability, and governed AI delivery patterns promoted for production environments.

- Notable clients (public): Delos Insurance Solutions; CyberCube; HyreCar.

- Why this company stands out: NaNLABS suits cloud-first platforms where artificial intelligence and data pipelines support automation, monitoring, and decision support without fragile architecture.

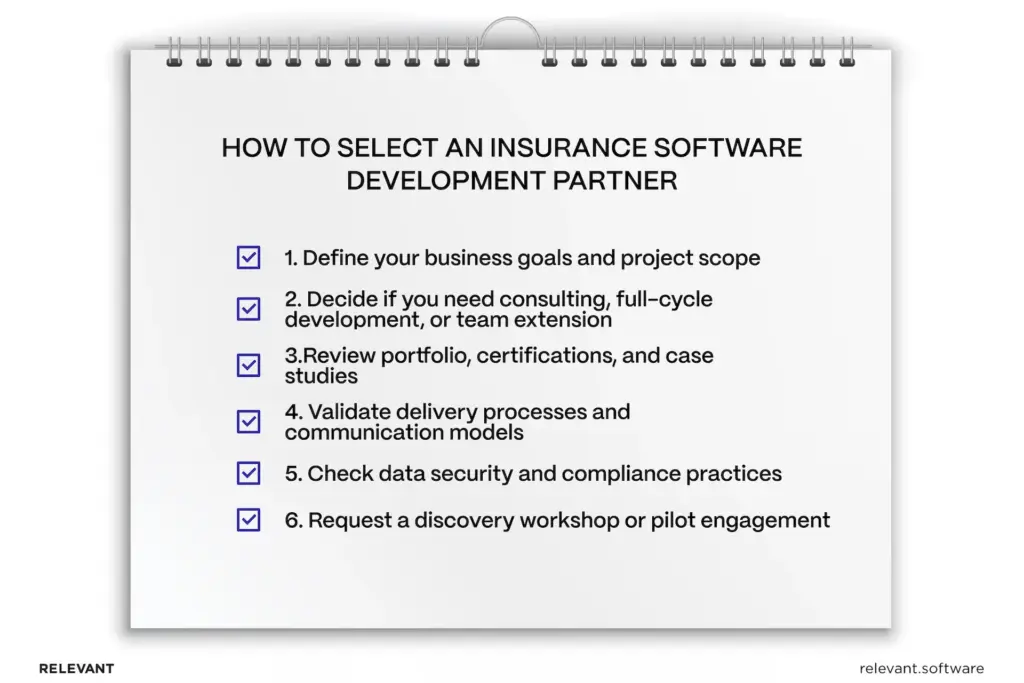

How to choose the right insurance software development company

Vendor selection works best when it feels like a delivery rehearsal. The goal is to confirm fit for your insurance business, your compliance requirements, your legacy constraints, and your operating rhythm.

Define your business goals and project scope

Start with outcomes that match how the business runs, then define the boundaries that keep estimates honest. Scope becomes easier to control when each goal maps to a workflow, an owner, and a measurable result tied to claims management software or underwriting operations.

A simple scope card usually covers:

- Target workflow and KPI (cycle time, leakage, conversion, service cost)

- System map (policy admin, claims, billing, CRM, document store, data providers

- Data classes, including PII and payment data, plus PHI, where health data appears

- Required reporting and actionable insights, often delivered through business intelligence foundations

Decide if you need consulting, full-cycle development, or team extension

The engagement model decides delivery risk more than most teams expect. Consulting fits when rules, data quality, and approvals remain unclear. Full-cycle delivery is appropriate when product ownership can hold scope steady and expects a single accountable team across build, QA, and release readiness. Team extension is appropriate when internal architecture remains strong and capacity limits progress, especially when multiple business employees must review requirements and edge cases.

Review portfolio, certifications, and case studies

Portfolios rarely reveal what happens under pressure, so ask for proof that mirrors your environment. The best case studies explain constraints, trade-offs, and production outcomes, including the impact on customers and operations.

Prioritize evidence that matches your context:

- Comparable lines of business insurance or personal lines, with similar regulatory exposure

- Security and compliance readiness that fits vendor risk reviews.

Examples that show how teams handle exceptions, rule changes, and integration limits without quality erosion

Validate delivery processes and communication models

A team can ship features and still miss delivery if execution lacks structure. Look for an operating cadence that supports predictable releases, clear ownership, and fast issue resolution when integrations fail.

Ask for concrete artifacts rather than promises:

- Weekly status format that highlights risks, blockers, and decisions

- QA gates and release checklist that fit your environments and audit needs

- Escalation path that stays clear across product, engineering, and compliance

Check data security and compliance practices

Security must be a daily engineering practice: access control, encryption, audit logs, and incident-handling routines. This becomes even more important when artificial intelligence influences triage, fraud signals, or decision support, where governance and traceability protect both customers and the organization.

Validate how the team handles:

- Secrets, environment separation, and safe test data

- Log retention and auditability aligned to your compliance expectations

- AI monitoring, overrides, and explainability where applicable

- Confirm experience with legacy integrations

Legacy cores and third-party providers decide the critical path. A credible approach covers data mapping, reconciliation, and rollback, not only API connectivity. This is also where architecture must match your cloud deployment model and the broader software technology stack across the enterprise.

If analytics becomes central, align early on reporting governance and the operating model behind dashboards. A short scan of business intelligence consulting services can help teams frame the right vendor questions.

Request a discovery workshop or pilot engagement

A short paid pilot replaces assumptions with evidence. Choose a thin slice that still touches risk, so comparisons remain fair across insurance software vendors.

A high-signal pilot usually includes:

- One end-to-end workflow (for example, FNOL to assignment)

- One legacy integration (policy lookup or coverage verification)

- Production-ready logging and error handling.

In short, treat vendor selection like a delivery rehearsal. If the shortlist includes broader engineering partners beyond insurance, compare delivery models, governance, and ownership expectations on equal terms. When customer or agent portals sit at the center of the roadmap, review front-end quality, accessibility, and performance budgets early, and use web development services criteria to keep that evaluation concrete.

Common challenges in insurance software development and how vendors solve them

Insurance platforms tend to break in predictable places. Data arrives in messy formats, core systems enforce rigid constraints, and regulators expect traceability even when processes evolve mid-year. This section highlights the delivery problems that slow claims and underwriting work, as well as the practical solution patterns that top insurance software development companies in the world apply to keep programs stable.

Legacy modernization and system interoperability

Most carriers cannot replace a policy admin or claims core in one step, so modernization becomes a coexistence problem. The safest vendors design an integration layer that protects new services from legacy quirks, then replace capabilities in slices that the business can absorb.

What strong vendors typically do:

- Wrap legacy systems with stable APIs and versioned contracts

- Introduce event-driven patterns where they reduce coupling and support replay

- Build integration test harnesses that simulate third-party behavior and batch windows

- Plan dual-run and reconciliation so cutovers stay reversible

Data privacy and regulatory compliance

Insurance systems handle sensitive data such as personal details, financial records, and sometimes health information. Compliance works best when it shows up as clear, repeatable controls within everyday engineering work, not as a policy document that sits on the sidelines.

Strong vendors usually take a practical approach:

- Use role-based access with least-privilege by default and logged access changes

- Encrypt data in transit and at rest, with clear rules for key access and rotation

- Generate audit logs that support investigations, audits, and customer disputes

- Keep test and production environments separate, using masked or synthetic data for testing

Achieving end-to-end automation

Automation often looks straightforward on paper until edge cases take over. Claims and underwriting processes are full of exceptions, handoffs, and judgment calls. Without clear escalation paths, automation can introduce risk rather than reduce it.

Strong vendors handle this by:

- Define clear “straight-through processing” rules for each workflow and track how often they actually apply

- Send exceptions to human review with full context, not just a generic failure status

- Record structured reasons for overrides so rules and models improve over time

Design retries and idempotent actions so system failures don’t trigger duplicate claims, payments, or decisions.

Managing large volumes of structured and unstructured data

Insurance operations generate structured transactions plus a constant stream of documents and communications. If vendors treat documents as “attachments,” search, analytics, and case work slow down.

What strong vendors typically do:

- Normalize metadata for documents, images, notes, and emails at ingestion

- Create a searchable index with access controls aligned to roles

- Track lineage so analytics teams can trust the numbers and explain changes

- Monitor pipelines for drift, backlogs, and processing failures

Ensuring accuracy and transparency in AI-driven decisions

AI can improve triage, fraud detection, document classification, and summarization, yet it also introduces governance needs. The question is not whether the model performs in a demo, but whether outcomes stay explainable and stable in production.

What strong vendors typically do:

- Set acceptance thresholds and confidence bands, then route low-confidence cases to humans

- Log model inputs, outputs, and decision context for audit and dispute handling

- Monitor drift and performance by segment, then schedule retraining responsibly

- Provide explanation surfaces that help adjusters and underwriters trust outcomes

Balancing customization with long-term scalability

Insurance products evolve, and organizations often accumulate “special cases” that become expensive to maintain. The best vendors separate what should be configurable from what should remain standardized, so change stays safe.

What strong vendors typically do:

- Keep product rules and templates configurable through versioned configuration

- Isolate client-specific logic behind well-defined interfaces

- Use modular services and clear ownership boundaries to limit blast radius

- Set upgrade paths early so the platform can evolve without rework cycles

Bottomline

If this guide helped you compare vendors and spot delivery risks early, it’s done its job. We regularly share comparisons, practical checklists, and lessons from real projects to help teams move from a long list of options to a shortlist they can confidently justify. If your next step is to evaluate partners for digital transformation, this list of top digital transformation companies can help you set clear expectations for governance, delivery, and long-term support.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.