AI in Insurance: Its Benefits, Key Technologies, and Use Cases

What if every insurer could turn raw data into a true competitive edge? That is exactly what AI in insurance is beginning to deliver. Insurers that once depended on slow, manual underwriting and weeks-long claims processing now use AI to detect fraud patterns hidden in vast datasets. It speeds up risk assessment and enables more personalized policies that strengthen customer trust.

At Relevant Software, we’ve been part of this transformation for over a decade. By combining insurance software development services with proven AI expertise, we’ve helped insurers move beyond one-off pilot projects to create enterprise platforms that truly scale. We’ve seen firsthand how AI can make a measurable difference when it’s built on a strong foundation and tied to real business outcomes.

from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software.

In this article, we will unpack the full range of benefits of AI in insurance, explore the technologies driving change, and highlight the use cases already reshaping underwriting, claims management, and customer experience across the insurance industry.

AI in insurance at a glance

Not long ago, policyholders had to wait for weeks while insurers manually reviewed paperwork and verified claims. Times have changed. Clients want decisions in minutes, regulators expect clear oversight, and insurers can no longer afford inefficiency. Against this pressure, AI in the insurance sector is more than innovation; it is the engine of competitive advantage, allowing insurers to adapt and thrive in a shifting market.

What sets this shift apart from earlier waves of automation is the scale. Machine learning models, trained on decades of historical data, now refine the underwriting process with far greater accuracy. Generative AI and large language models cut weeks of claims management to hours by analyzing unstructured data — from photos of car damage to medical records. Virtual assistants now manage policy questions, assist with claims, and provide 24/7 customer support.

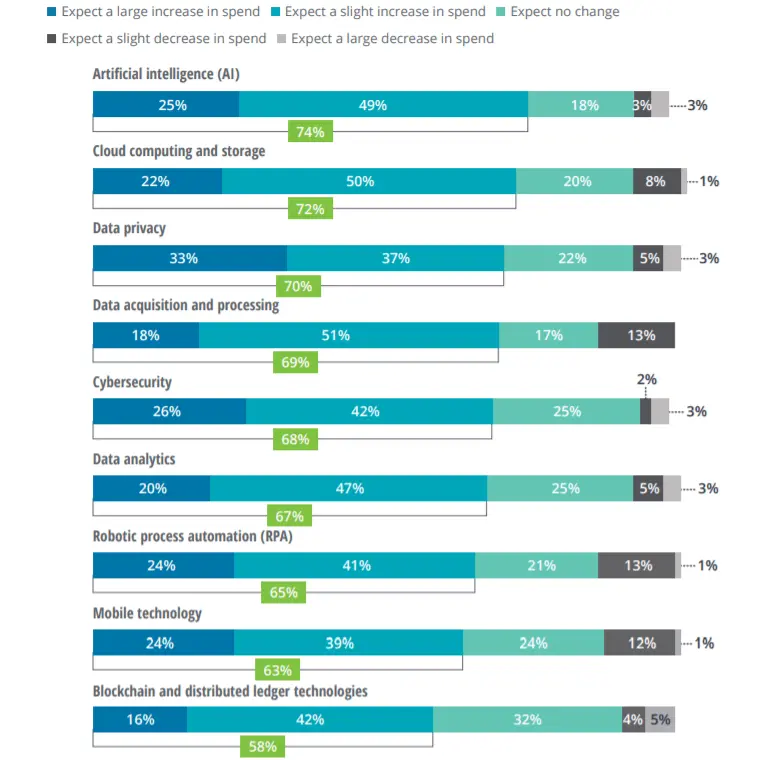

Source: Deloitte

Benefits of AI in insurance software

AI now supports every step from quote to claim. It reads data fast, finds patterns, and either recommends the next step or takes it with controls. Read further to see how AI creates each benefit and why the effect holds up in real operations.

Sharper underwriting and pricing

AI pulls application records, telematics, and third-party data into one view, compares those signals with established risk patterns, and assigns a score that reflects real exposure, which allows straightforward files to pass straight through while complex submissions reach an underwriter with the decisive factors already highlighted, so pricing becomes consistent and explanations stay clear.

24/7 customer service

Virtual assistants can now handle routine requests anytime. They understand what a customer needs, check policy details, and make secure updates. If a situation is more complex, they pass it to a human agent along with all the details. This shortens wait times while keeping service quality high.

Faster claims decisions

During intake, AI reviews coverage, pulls details from photos and forms, spots missing information, and sends the file to the right specialist with a clear checklist. This speeds up claim processing, reduces errors and losses, and keeps customers updated with accurate status notifications instead of irregular calls or emails.

Fraud detection at scale

By linking people, providers, devices, and accounts across many claims, AI exposes patterns that a record-by-record review cannot reveal, ranks the level of suspicion with evidence, and guides special investigation units to the cases that matter most, which reduces losses while improving case quality and closure rates.

Personalized offers and retention

Prediction models estimate who will buy, renew, or lapse, then time outreach and select bundles or discounts that align with risk, regulation, and margin targets, so customers receive offers that feel fair and relevant while conversion rises, churn falls, and loss ratios remain under control.

Lower operating cost

AI eliminates duplicate data entry and messy handoffs by matching information across systems, filling in verified details automatically, and organizing task queues so each item goes to the right person at the right time. This lets teams focus on real decisions and deliver faster service, without adding more staff.

Compliance and audit readiness

Every automated decision carries its inputs, model version, features used, and reason codes, while bias tests and drift monitors run behind approval gates, so auditors move faster because lineage stays complete and consistent, and reviewers can see exactly what happened, when it happened, and why it made sense.

Faster product innovation

Agent workflows assemble new journeys for quotes, endorsements, and claims without heavy rebuilds by reusing skills and connectors to core systems, and teams can test ideas safely in sandboxes before rollout; if you plan this path, learn how to build an AI agent that fits your stack and governance.

Scalable AI foundations

Modern data platforms, feature stores, and MLOps keep models accurate and secure. Data contracts and PII controls protect customer information, while a model registry manages every change from training to deployment. Together, these tools ensure reliable AI operations today and create a solid foundation for future growth.

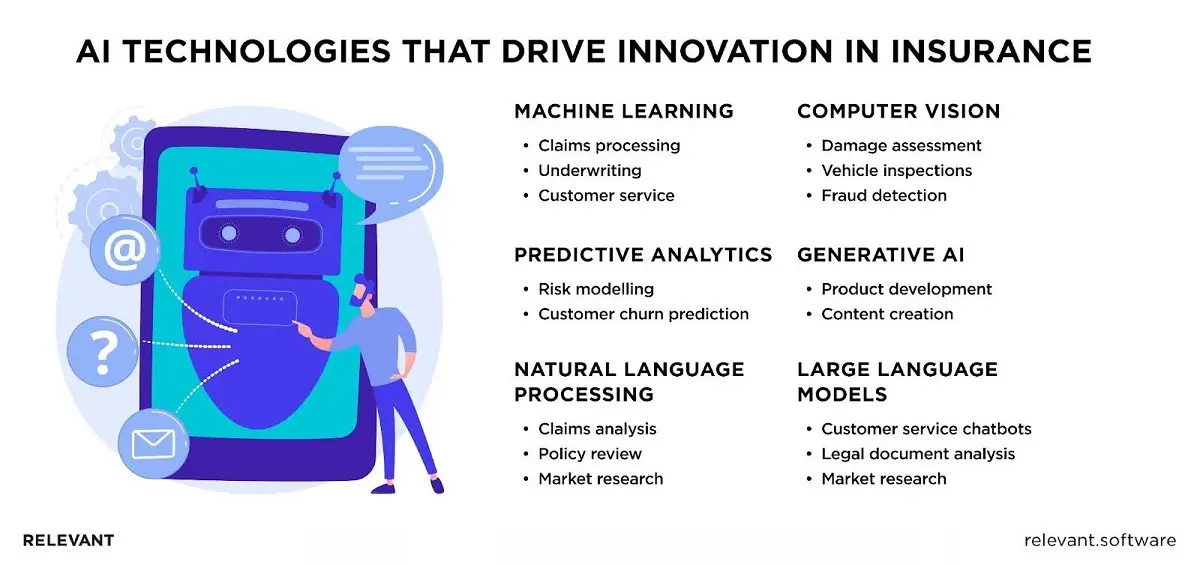

AI in insurance and its core technologies

Insurance technology has always depended on data, but artificial intelligence in insurance sector has transformed the scale and speed of what’s possible. What once meant simple automation now extends to systems that read documents, analyze risk factors, flag potential fraud, and interact with customers in real-time. Below are the core AI technologies in insurance that are defining the industry’s next phase and help to create modern AI systems:

Machine learning (ML)

Machine learning drives many of the most effective solutions in insurance. Instead of relying on fixed rules, ML models adapt by learning from millions of past claims and customer interactions. They help insurers spot anomalies that could signal fraud, sharpen risk assessment, and adjust pricing in ways that reflect actual exposure.

Predictive analytics

If ML learns from the past, this kind of data analytics helps insurers peek into the future. By blending historical claims with live data feeds, it predicts not just when a loss might happen, but how severe it could be. That foresight means premiums that reflect reality, stronger portfolios, and fewer nasty surprises in risk pools. Deloitte notes that predictive models are already central to digital transformation in insurance, and companies that have adopted them early are now outperforming their peers in profitability.

Natural language processing (NLP)

Few industries deal with as much text as insurance: policies, claims notes, endless customer emails. AI insurance software with NLP now processes that flood of information at speed, extracts what matters, and routes it where it belongs. On the front line, NLP powers chatbots, AI agents, and virtual assistants that provide customers with quick and accurate answers, while human agents focus on more complex cases. The payoff is easy to measure — higher efficiency and noticeable improvements in customer satisfaction.

Computer vision

When customers upload photos of a car accident or a damaged home, computer vision turns those images into evidence. Algorithms can estimate damage, flag inconsistencies, and speed up the claims process. Zurich Insurance Group has already reported multimillion-dollar savings from AI tools that tagged catastrophe claims with greater accuracy. It’s a clear example of how insurance companies using AI achieve faster settlements and more consistent outcomes.

Robotic process automation (RPA)

RPA may not grab headlines like generative AI, but it remains one of the most practical AI solutions for insurance. It takes over repetitive back-office tasks such as policy updates, payments, and data transfers between systems. Combined with ML, RPA enables the straight-through processing of claims and policies, reduces costs, and minimizes errors. For many insurance providers, this step marks the point at which AI pilots begin to deliver sustainable gains.

Generative AI in insurance

Generative AI is still new, but it advances rapidly. Insurers now draft policy documents, summarize long claim files, and produce more empathetic customer communications with its help. Deloitte reports that three out of four U.S. insurers have already deployed gen AI in at least one function, often in claims or service. The value is clear: fewer bottlenecks, faster workflows, and sharper fraud detection.

Large language models (LLMs)

LLMs take on the heavy reading that slows insurers down. They can condense a 40-page medical report into key points or categorize hundreds of claims for routing. By reducing manual review, they speed up settlements and free underwriters to focus on judgment calls. For insurers, LLMs represent one of the most practical AI use cases in insurance, turning information overload into actionable insight.

Key applications of artificial intelligence in insurance

Insurance runs on data — policies, claims, medical records, accident reports, customer interactions. Artificial intelligence in insurance turns this complexity into insight, helping insurers improve accuracy, speed, and customer trust. McKinsey estimates advanced AI could unlock $1.1 trillion in annual value worldwide, proving its impact is already too big to ignore. So, here are the areas where AI applications in insurance deliver the most immediate results.

Risk assessment and underwriting

Underwriting remains one of the most important AI in insurance use cases. Traditional methods relied heavily on historical claims and financial data, but today AI insurance software combines structured and unstructured data sources, from driving habits and IoT devices to environmental factors and even social signals.

- Benefit: More precise risk models, tailored premiums, and quicker policy approvals.

- Case in point: Aviva, one of the UK’s largest insurers, cut liability assessment time for complex cases by 23 days after embedding AI into underwriting and claims, while improving routing accuracy by 30%.

Fraud detection and prevention

Insurance fraud costs exceed $308 billion annually in the U.S. alone. Detecting it through manual investigations is slow and expensive. AI solutions for insurance use predictive modeling to spot anomalies in claims and expose fraud patterns that humans miss.

- Benefit: Higher accuracy, fewer false positives, and significant cost savings.

- Case in point: McKinsey reports that insurers using AI in the insurance industry for fraud detection have reduced customer complaints by 65% in certain domains, resulting in annual savings of millions.

This is one of the most critical AI applications in insurance, as fraud drives up premiums for honest customers.

Personalized customer experiences

In a customer-driven market, insurers lose business if they fail to personalize. AI for insurance companies enables dynamic segmentation based on risk profiles, demographics, and behaviors. Recommendation engines, much like Netflix’s, suggest policies or add-ons tailored to individual needs.

- Benefit: Higher retention and conversion rates.

- Case in point: Deloitte found that 76% of U.S. insurers have already implemented generative AI in one or more functions, with customer service being one of the top three.

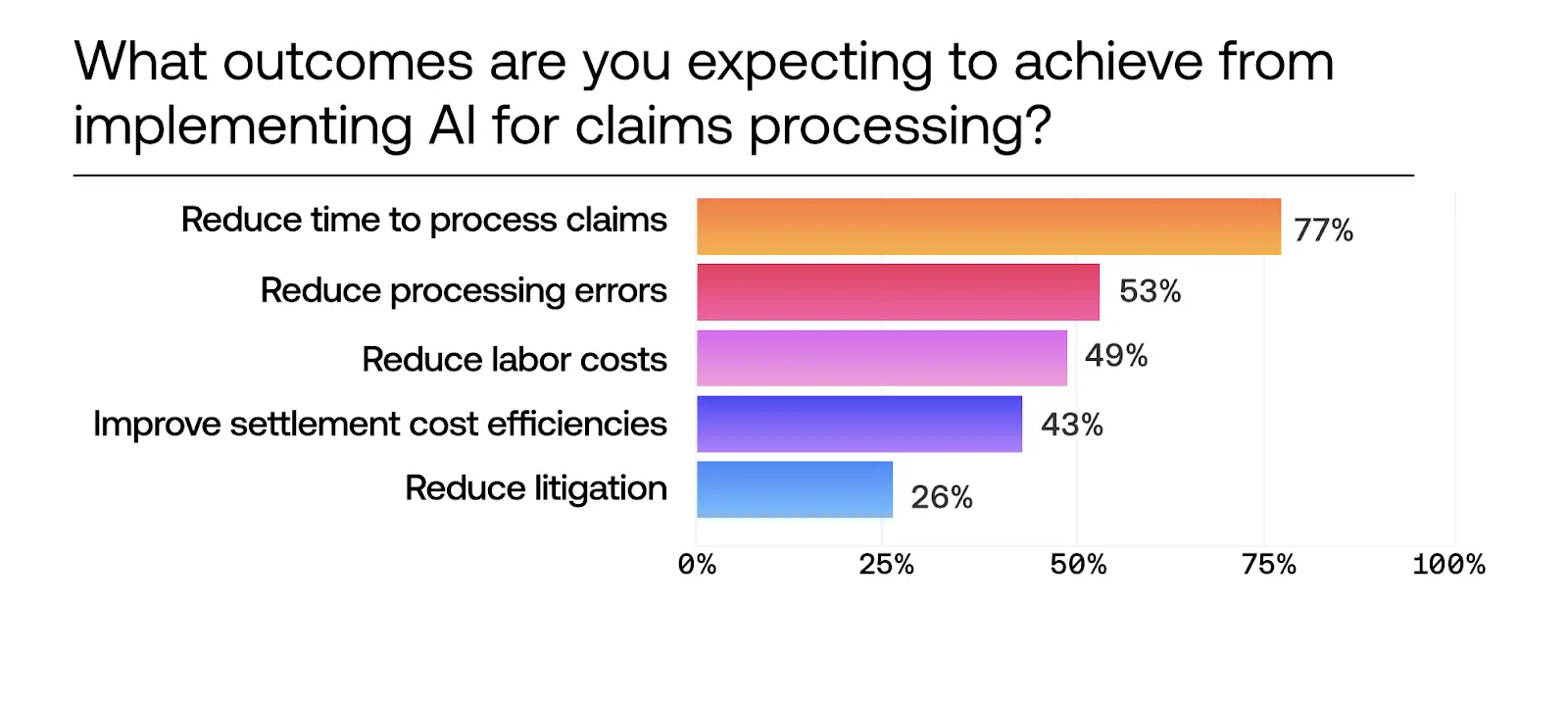

Claims processing and management

If there’s one area where AI’s impact on insurance is unmistakable, it’s claims. Customers judge insurers by how quickly and fairly claims are handled. Manual processes can take days or weeks, while AI reduces this to hours or even minutes.

- How it works: Computer vision analyzes accident photos, NLP validates policy details, and machine learning models assess severity while also checking for fraud.

- Case in point: Zurich Insurance Group piloted an AI claims tagging tool that identified 500 additional catastrophe claims across five events. The initiative generated $1.4 million in savings and increased validation speed, demonstrating how the targeted use of AI can enhance both accuracy and efficiency.

Source: Scale

Chatbots and customer service

Round-the-clock service is now an expectation. Many insurers now rely on AI chatbots and virtual assistants to answer questions, help customers with policies, and process claims — anytime, day or night.

- Benefit: Lower workloads for agents, reduced costs, and faster resolutions for customers.

- Case in point: Forbes notes that insurers adopting conversational AI saw a 95% boost in customer experience metrics thanks to faster, always-available support.

For many insurers, chatbots are the most visible AI applications in insurance and often the entry point for broader AI adoption. If you want a partner to build and scale this capability, see our AI chatbot development services.

AI and insurtech startups

The new wave of insurtech isn’t just about digitizing paper forms. It’s changing how insurance itself is designed, sold, and experienced. Startups are using artificial intelligence in insurance to refine risk models, automate claims, and create products that traditional insurers often struggle to deliver. For an industry built on data, these innovators show just how far intelligence and automation can reach.

Key trends among insurtech startups

Instead of bolting technology onto legacy workflows, startups now design their models around AI from day one. Predictive analytics, computer vision, and generative AI no longer look exotic. They already serve as core tools that deliver efficiency and personalization.

One area advancing rapidly is AI in underwriting. With IoT data, credit behavior, and satellite imagery, insurtechs build risk assessments that exceed what traditional models can achieve. At the same time, other firms tackle claims with AI-driven tools that evaluate accident photos or property damage and recommend payouts in hours rather than weeks.

Distribution is changing fast. With API-based platforms, insurers can plug coverage directly into online shops, travel apps, or ride-sharing services, reaching more customers without increasing acquisition costs. At the same time, startups are exploring parametric insurance that pays out automatically when certain conditions, such as storms or flight delays, occur. These simpler, more scalable models are shaping the next chapter of the industry.

Notable players

Among the flood of insurtech startups, a few names have already shown what AI can really do when it’s put to work. Each tackles a different headache for insurers, from slow claims to hard-to-price risks.

- Tractable applies computer vision to vehicle and property damage, helping insurers settle claims in days instead of weeks.

- Kin Insurance leverages data analytics to underwrite homes in disaster-prone regions where traditional insurers often retreat.

- Hippo combines IoT sensors with AI insurance software to monitor properties and prevent losses before they happen.

An increasing number of API-first startups now provide the infrastructure that enables established insurers to connect with this emerging ecosystem.

Opportunities and challenges

When AI first entered the insurance industry, many assumed it would be a quick fix: automate paperwork, trim expenses, and make customers happier overnight. Reality looked different. Startups that jumped in too quickly encountered the tough challenges — raising capital in a risk-averse market, navigating regulatory reviews, and convincing policyholders to trust decisions made by algorithms.

Meanwhile, regulators raised the bar. AI in underwriting can no longer rely on speed alone; it must also demonstrate fairness. A new conversation has emerged around insurance for AI risks, with accountability climbing to the top of the agenda. The rules are being rewritten in real time.

This is where contrasts appear. Some insurtechs burned through funding because they raced ahead without governance. Others slowed down just enough to build transparent data pipelines, audit trails, and communication that customers could trust. That balance of bold ideas backed by discipline is what separated the survivors from those who never scaled.

Relevant Software experts took these lessons to heart. Our engineers design AI insurance solutions that pass regulatory scrutiny, while our consultants ensure systems meet customer expectations.

AI in insurance: Final thoughts

Years ago, we sat across the table from a CIO who admitted, “We know we’re drowning in data, but we don’t trust machines to make the calls.” Today, that same company resolves routine claims in hours, not weeks, and earns higher marks from customers for fairness and speed. That is the role of AI in insurance: help teams build systems that scale, prove value, and keep trust with regulators and policyholders.

Our job is to make this path yours. We combine AI development services with digital transformation consulting so models leave the lab and improve daily work.

The gap between leaders and laggards is growing. Move with clarity and discipline, and you will set the pace. Wait, and you will chase. If you’re ready to see what AI can do for your business, contact us.

Hand-selected developers to fit your needs at scale! Let’s build a first-class custom product together.