What can Fintech offer to the financial sector?

Consumers and businesses are looking for faster and safer ways to conduct financial transactions, pay bills, raise investments and manage debts, and more, through technology.

Due to finance’s specialized and highly regulated nature, established banks and other large financial institutions had to take the lead. But while their wheels have been spinning, modern technologies have blurred industry boundaries and created new business players.

200+ companies from 25 countries outsourced software development to Relevant

We provide companies with senior tech talent and product development expertise to build world-class software. Let's talk about how we can help you.

Contact usWe are talking about financial technology (fintech) startups that have entered markets with specific services and have come to dominate. Actually, startups not only indicate where innovation is needed. They identify or spotlight new consumer needs and, lastly, identify new business opportunities. In other words, startups define a “white space” and illustrate solutions and ways to raise money.

We at Relevant end-up our 2022 season of interview stories with two influential entrepreneurs from the financial services space. Read on to find out how they paved their way to success.

Table of Contents

Introducing our guest-speakers

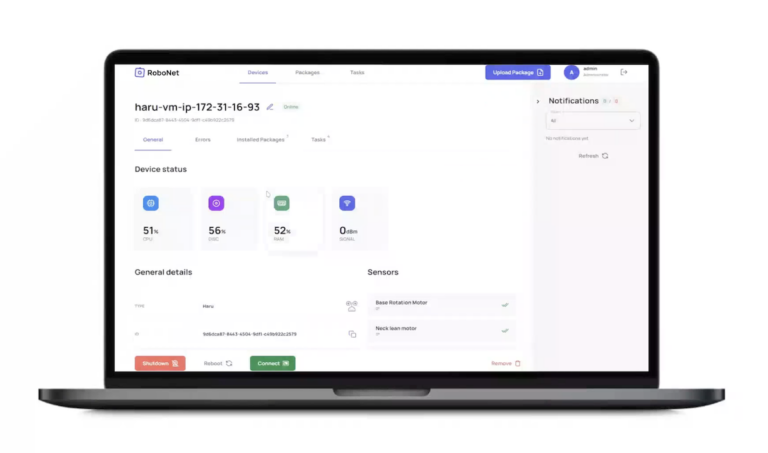

Kevin Ruthen – Chief Technology Officer at Fora Financial. Founded in 2008, Fora Financial is a leading business financing lender that has provided over $2 billion to more than 25,000 business owners nationwide. They provide fast, flexible financing for small to mid-sized businesses leveraging its state-of-the-art proprietary technology, industry-leading sales capabilities, and dedicated customer service.

Richard Healey – Product Development Director at Paylink Solutions – a part of a bigger group of financial service companies delivering services to predominantly UK consumers. This high-volume software development company builds multi-award-winning digital affordability solutions for the lending, mortgage, and debt management sectors. Their software has been adopted by major UK lenders and utility providers and assists thousands of customers daily.

How startups strive to fill the product gaps

A market gap is a business opportunity that may involve solving an unresolved problem or delivering a product or service in a different way. This is called creative flipping, where you take an idea and tweak it to improve it or develop something new. And most often, finding the gaps in a market happens purely by accident rather than intentionally. Let’s find out what gaps our guest speakers tried to close with their startups.

Customer experience first

Kevin Ruthen

“At Fora Financial, we provide a customized funding approach, listening to customers and understanding their needs in an ever-changing financial market. Our two main products are short-term small business loans or merchant cash advances (MCAs). Also, we offer more specific financing options, including equipment financing, inventory loans, SBA loans, and bridge financing. This makes Fora a viable solution for a wide variety of small business expenses.

And if you’re a small or medium-sized business owner with less-than-perfect credit history, you might find you’ll have an easier time getting approved with Fora Financial compared to other options. The approval process for Fora Financial financing occurs in less than 24 hours, and once funding is approved and terms accepted, capital is available in 72 hours.”

Richard Healey

“We’re business to business, and we sell our product predominantly to lenders within the UK. The actual end user is the consumer at home but has to go through the building of a budget. And we make that process as simple as possible.

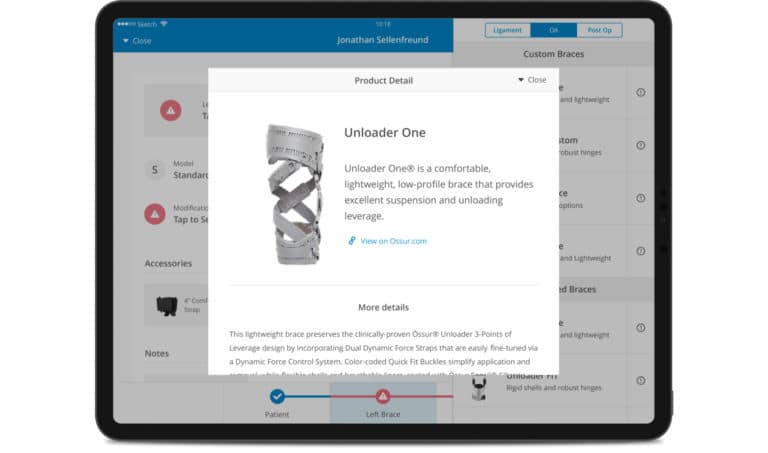

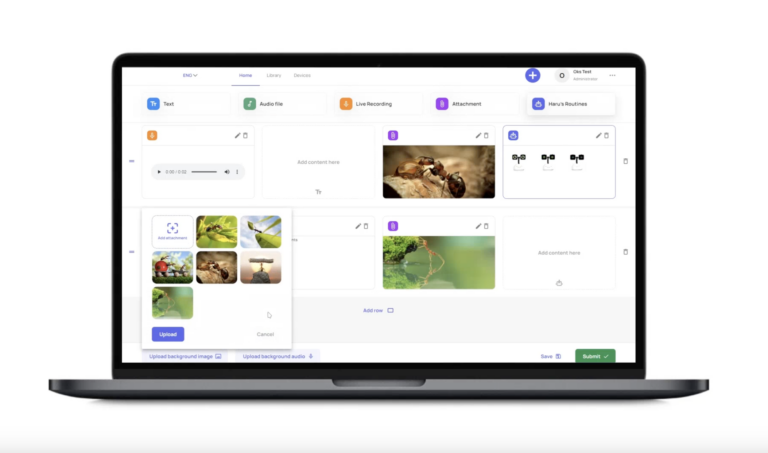

Our flagship product, Embark, helps our clients create intuitive and automated customer journeys – from lending to collections. At the heart of Embark’s platform is our customer affordability assessment tool. The initial information entered by a customer or agent generates an income and expenditure questionnaire tailored to their specific circumstances. Boasting intelligent wrap-around features such as Open Banking, Chatbot, access to credit reference data, and a Benefits Calculator, we attract high customer engagement rates and reduce drop-off.

It’s a big-time saver. We’re also seeing an improvement in the accuracy of the data because we’re using bank data rather than the consumer trying to remember figures.”

Agile methodology: How does it work in Fintech?

The Fintech industry moves quickly and constantly evolving. So to keep up, you need to be able to move just as fast. This is where agile methods of work based on lean principles come in handy.

Kevin Ruthen

“The way we approach MVP comes down to engaging with key stakeholders to understand why and how it affects the business because it often gets lost. And then, it’s about making the hard decisions to determine the absolute minimum in terms of the critical requirements that need to be met.

It is also important to reinforce a culture of agile, iterative delivery, reach, and ease of use—this must happen for an MVP to succeed. Bill Gates famously discussed how if he had followed traditional delivery and not MVP, Windows would never have launched, and we would have a very different environment these days. ”

Richard Healey

“We have recently renovated our ways of working. We had three groups: an integration team, an internal group companies team, and a flagship product team. In addition, we also have a DevOps team and a product team. We recently combined them all into one pool, with the aim of giving people as much knowledge as possible about our different applications and reducing the number of single points of failure. And then, we can work off one prioritised backlog, rather than three separate backlogs.”

Agile methodology allows you to quickly and efficiently respond to market changes while keeping your costs low. It also helps you prioritize and focus on the most critical tasks. This is essential in a fast-paced industry like financial technology. Read in our blog why Fintech needs DevOps.

Key to attracting good employees or tech vendors

Not every startup has the technical expertise, technical skills, IT and physical infrastructure, and, most importantly, the team to turn an idea into a product that actually works. It is difficult to find the necessary talent, given the limited budget, time, and geographical constraints. So, like any other company, a startup also finds itself at a crossroads before choosing between building an in-house team or outsourcing product development.

The problem with relying on hiring is that often there is a significant lag time before someone becomes productive and a general shortfall of qualified talent. Similarly, core capabilities must remain in-house to enable the business to move quickly, so outsourcing can’t be the main answer.

We asked our speakers which of these approaches they chose for the maximum performance of their startups.

Kevin Ruthen

“We look to see where there are the right opportunities to outsource for specific initiatives. We target projects that don’t necessarily require extensive expertise in our business and can easily be transitioned.

We’re not just interested in “bodies” or “body shops” but rather a partner that embraces and exhibits a true partnership that can be trusted. Do they have the right skilled resources, a decent bench, a decent track record of retention, and track record of success? Security is also paramount, especially when dealing with sensitive financial data. They must demonstrate a commitment to ensure joint success, providing the right management oversight, accessibility to critical folks on their side, and collaboration at the most senior levels with us.”

Richard Healey

“The results of our new approach have been positive. It’s about giving more responsibility for a flatter structure but allowing us to try and grow people within the team, as opposed to bringing in too many people at a senior level. This enables us to grow that experience from the inside and try to bring the current team and pull them through the progression framework.

It’s really important to get this model where we work with graduates, we can give them that knowledge as it comes through, and then we grow from the bottom down. And for me, if we can get that through our culture, that’s crucial that people understand the value of the work that they are doing. We know exactly what we need to do to be at certain stages of our development lifecycle, whether that’s a graduate or a technical lead”.

Challenges and Opportunities

Although there are many challenges and opportunities in fintech startups, we asked our spikers to highlight the most significant. As it is said, forewarned is forearmed.

Richard Healey

“If we’re talking about development / engineering resource; one big challenge was that we are a small software company based in Grantham in Lincolnshire. When COVID struck in 2020, many big companies went to a remote model almost overnight. It opened up challenges across the UK regarding what the natural salary might look like for a particular role. It bought around what you would get in terms of benefits. From a product perspective, our big challenge number two is getting someone to engage with our product in the first place.

Kevin Ruthen

“Those obstacles come down to making sure we get to eliciting those right level of details of requirements. And then getting into rapid iterative deployments and feedback and ensuring decent prioritization. There are often contentions with other critical initiatives, and we must be able to address that. Also crucial is looking at other opportunities for addressing resourcing contentions, including outsourcing and contracting with the right vendors to help with the scalability and flexibility.”

What would be the further steps?

Richard Healey

“We’re one of those rare companies where regulation helps us. Our application gives a transparent view of a consumer’s affordability; it allows them to connect with various data sources for verification.

So we work with what’s known as SFS guidelines, which are standard financial statement guidelines. This gives the customer brackets on certain levels of what they’re allowed to spend in certain areas based on their household size, vehicles, and jobs. So they outsource some of the risks of getting it wrong to us because we ensure that their income and expenditure are also an industry standard. And we keep that updated in terms of SFS.

We’re b2b, so we will sell our product to predominantly lenders within the UK. But we have had an office in Lisbon for many years, so we will likely step into Portugal before looking at the rest of Europe.”

Kevin Ruthen

“FinTech is a very exciting, always evolving, and dynamic industry. And it’s one of the things that I love about it. One of the big things I see now in the industry is opportunities to leverage new alternatives – sources of customer data, which is about providing additional context for underwriting decisions for funding.

Most funders typically rely on credit agency risk reports, scores, and banking statements. But there are a lot of other additional sources of information, especially as it relates to SMBs, that can be leveraged, where you can gain additional insights. Using public websites with information to get a sense of what successes SMBs are having, what challenges are facing, more insight into the business operations, and several additional variables and factors that can be taken into consideration as part of underwriting decisions and funding.

Another key trend is embedded finance and opportunities with non-financial companies or marketplaces of brokers. There’s an opportunity for us to be directly integrated or embedded with their website, especially at the point of sale, where they might sell a non-financial product or service. And there’s an opportunity for an SMB business that’s going to that partnership site that would benefit from funding, especially rapid funding availability, and would allow them to purchase either that much more services or products from that partner.

So for us, there are opportunities to integrate with that partner and provide that sort of funding. Point of sale is another key trend and an opportunity I see growing”.

Looking for a software development vendor? We at Relevant have over nine years of experience and have helped many budding startups get a product that appeals to their target audience

Tips and insights: Scale from the beginning and customize your communication to the target audience

When you’re thinking about starting a startup in the financial industry, any nugget of advice from someone who’s already succeeded is worth its weight in gold. And some of these tips are more relevant to your business than others. Let’s read what our guests have prepared for you.

Richard Healey

“The main thing is understanding how to scale your product – that’s the biggest thing you can do. Try and think past the first couple of customers you will bring on and look at, ultimately, where you want to be able to get to and whether your product is set up from scale from the beginning.

It’s easier to set up for scale at the beginning, even though you think it may be unnecessary for the first five customers.

But when you reach greater numbers, does your product scale allow you to do that? Will it have to interrupt the growth period? So the first tip starts with the basics of having a scale that allows you to keep growing.

The second tip concerns bringing people into the company when you are very small. Look beyond technical skills, which are essential to do what you want. A look at the culture they work with and their mentality in the spirit they hold is also very important. Because you need people to develop that culture the same way you create a business.”

Kevin Ruthen

“The big one is adjusting your communication with the audience and being aware of who your audience is. So try to customize your communication, especially if you’re talking to a technician, resource developer, or engineer rather than a business stakeholder, board member, or external customer.

We tend to get into our comfort zone and talk about technical or business matters; of course, we get bogged down in using much jargon. So I advise as far as possible to stay away from jargon. Keep things simple. I believe in using analogies and painting a picture. And again, once you know your target audience and whom you’re communicating with, be able to adapt to be the most effective for that particular audience or person.

The perspective of the financial technology market seems extremely bright, so you shouldn’t be afraid to claim your piece of this global pie. There is a place for everyone, and the success of a fintech business is wholly dependent upon your ability to zero in on the certain pain points of your target audience and deliver high-quality services that people will trust and love.

Our core services:

Do you want a price estimate for your project?

Do you know that we helped 200+ companies build web/mobile apps and scale dev teams?

Let's talk about your engineering needs.

Write to us